A survey by Skills of which legal AI tools law firms are actually using provides multiple insights into where we are today. For example, Kira – which is part of Litera – remains by far the most popular tool for due diligence review. But, it’s followed by Harvey’s Vault feature – a relatively new AI kid on the block.

So, let’s have a look at some of the key data and what it means, then hear from Oz Benamram, who leads Skills. The sample of data was from a group of 100 firms, with a majority from major US law firms, along with some in the UK and Canada. It was collected earlier this year, but is now published in full – see here.

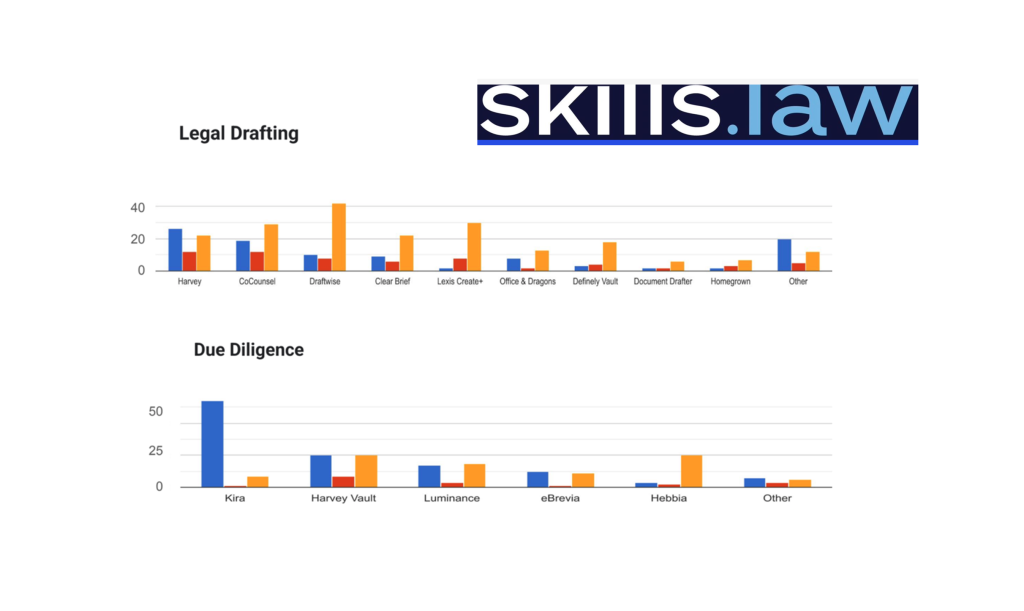

OK, let’s dig in. As noted, due diligence was intriguing – especially as it was the area where the first wave of legal AI tools in the 2010s were heavily focused. (Note: in all the charts blue = live, red = pilot, and orange = considering)

Kira, a pioneer in this area, and largely operating via NLP/ML approaches, is the clear leader. This shows that years of ML training and also familiarity among lawyers with the tool has sustained its popularity. This also shows that earlier AI tools can live alongside more recent genAI approaches.

Third and fourth were two other early legal AI ‘OGs’ – Luminance and eBrevia, although both also now use genAI as well, as does Kira for certain aspects.

The surprise though is that Harvey has come in second, with Vault, even though the company only came to market a couple of years ago. That’s quite an impressive move.

Harvey also did well with legal drafting, coming in first, closely followed by CoCounsel from Thomson Reuters. Then came Draftwise, ClearBrief, Lexis Create+, Office & Dragons (which Litera also recently bought), and several more including Definely.

However, the main message here is that no single company has dominance for drafting. As you can see, about 20 firms were in the ‘Other’ category. The additional message is that despite the massive size of TR and LexisNexis, far smaller companies are doing well too here.

In terms of future outlook, Draftwise is the company with the highest likelihood of future use, with 40 firms ‘considering’ it, with Lexis Create+ in second for future potential use.

When it came to search and retrieval – and especially with an AI aspect that digs into a DMS or other document store – good old Microsoft and its Copilot came first – which was a surprise. But, perhaps this is the case because all lawyers use Word, and so it’s simply ‘at hand’?

However, it’s clear which tools are soon to be trialled, with just under half the firms saying they are considering Swiss company DeepJudge for AI-driven search (which was also voted the most popular AI tool in a related Skills survey), followed by iManage and its Insight+ product. In short, although Copilot is ahead now, that picture could change a lot by the end of the year.

And, time for one last one: contract negotiation and redlining. Harvey and TR’s CoCounsel came out as the leaders here. But, with once again, Draftwise and Lexis Create + showing high levels of interest.

The survey also found most firms had on average 18 live AI solutions – which is a lot, but that actual adoption rates are low – only ~20% of lawyers at the largest firms are using their AI legal assistants regularly, for example.

But, that isn’t a surprise, and compared to uptake of some AI tools in the past this is actually a good result. Moreover, as genAI tools become normalised then usage levels will naturally grow.

One other thing that is good to see is that Innovation Departments now lead AI strategy at most firms: ‘Innovation departments (59%) have overtaken IT (43%) as the primary drivers of AI strategy – a dramatic shift from last year when IT led at 74%,’ Benamram noted.

AL would add that this is a really important step, as at least in theory, innovation teams have the role of bringing in new tech, testing it, doing POCs with the lawyers, co-developing tools with vendors, or doing DIY projects, i.e. their job is to pioneer, to explore, to go to the frontiers of where legal tech is – and is heading.

And if firms are giving such teams more say in AI deployment then this is a very good thing. Of course, it doesn’t really matter what a team is called, it could still be ‘IT’ or ‘KM’. As long as they’ve been given the task of exploring and testing the boundaries of what’s possible, then all is going in the right direction.

Overall, the picture is varied, but positive: a mix of old and new companies, large and small, with few segments having any dominant leaders – or leaders where there are also not signs that this could change in the next 18 months or so. It’s all in flux still, that’s for sure.

In short, the legal AI market is relatively open with everything to play for. Good luck to all the participants and the buyers!

—

Some thoughts from Oz:

‘Rather than one AI tool ruling all, firms are deploying highly specialized solutions across 22 different use cases. Many categories still show 30-50+ firms saying ‘No’ to entire use case categories. This also explains the higher representation of newer players in the Most Recommended Legal AI Report you already published, where none of the big names in the legal vendor space came in the top 15 spots.

Yet, I predict that we will see soon a winning platform emerge to enable RAS (Retrieval Augmented Services) and everyone else will offer agents to interact with that system, to allow firms to compete based on their own knowledge.

Despite the explosion of generative AI tools, legacy solutions like Contract Companion (used by 61%) and Intapp Time (used by 58%) remain widely adopted, suggesting firms are not rushing to replace established products with newer AI-driven alternatives.

High Abandonment Rate for Certain AI Tools – Some firms have stopped using tools like Harvey (4 firms) and CoCounsel (9 firms), citing cost concerns and a lack of ROI. This suggests an ongoing reassessment of which AI solutions truly deliver value.

Low Adoption of Client-Facing AI Products – Only 13% have built revenue-generating AI products, showing that while AI is transforming internal workflows, firms remain cautious about rolling it out to clients in ways that directly impact their business models.

Most Firms Haven’t Replaced Legacy Tools – While some firms have replaced legacy systems with generative AI – especially in legal research, contract review, and due diligence—many report merely “augmenting” rather than fully swapping out older solutions.

Chief AI Officers Are Already a Thing – 2/3 of firms have hired a dedicated AI leadership role, signaling that the industry is moving toward formalizing AI governance at high levels.

Taken together, these trends suggest that while legal AI adoption is accelerating, firms are still grappling with strategy, education, and balancing the cost-effectiveness of different tools.

Which is why they should get help with building their long-term AI Strategy.’

—

Legal Innovators California conference, San Francisco, June 11 + 12

If you’re interested in the cutting edge of legal AI and innovation – and where we are all heading – then come along to Legal Innovators California, in San Francisco, June 11 and 12, where speakers from the leading law firms, inhouse teams, and tech companies will be sharing their insights and experiences as to what is really happening.

We already have an incredible roster of companies to hear from. This includes: &AI, Legora, Harvey, StructureFlow, Ivo, Flatiron Law Group, PointOne, Centari, LexisNexis, eBrevia, Legatics, Knowable, Draftwise, newcode.AI, Riskaway, Aracor, SimpleClosure and more.

Cooley, Wilson Sonsini, Baker McKenzie, Gunderson, Ropes & Grey, A&O Shearman and many other leading law firms will also be taking part.

See you all there!

More information and tickets here.

P.S. there will also be a Legal Innovators New York conference this November…! See here.

Discover more from Artificial Lawyer

Subscribe to get the latest posts sent to your email.