On May 20, Suffolk Technologies, a venture capital arm of Boston-based Suffolk Construction, announced it had invested an unspecified amount of money in Sublime and pre-purchased some of the cement that will be made in Holyoke. Two days later, Sublime announced an agreement with Microsoft in which the software giant will buy more than 620,000 metric tons of Sublime cement over up to nine years. Last fall, two of the world’s largest cement suppliers, Holcim and CRH, together invested $75 million in the company. The company has also raised $45 million in venture capital funding, including from Lowercarbon Capital and Engine Ventures.

And on Thursday, Sublime disclosed a roster of nine construction companies, including Suffolk, that have agreed to act as sales partners to pitch Sublime’s low-carbon cement for their clients’ future projects.

The Holyoke factory is expected to be completed in 2027 and provide jobs for at least 70 people after it opens. The plant will still get some subsidies, including $47 million in federal tax credits that remain in place, $1.05 million in state tax credits, and $351,000 in local property tax breaks.

Site work has begun in Holyoke, but not construction of the actual building. Joe Hicken, senior vice president of business development at Sublime, declined to say what kind of impact, if any, the Department of Energy’s action will have on the project’s timing. He noted that Sublime’s mission dovetails with the Trump administration’s goal of boosting American manufacturing.

“If anything, that termination letter is one data point,” Hicken said. “We have many other data points associated with commercial movement [and] for every plan that we talk about publicly, we have 10 backup plans waiting for their day to shine.”

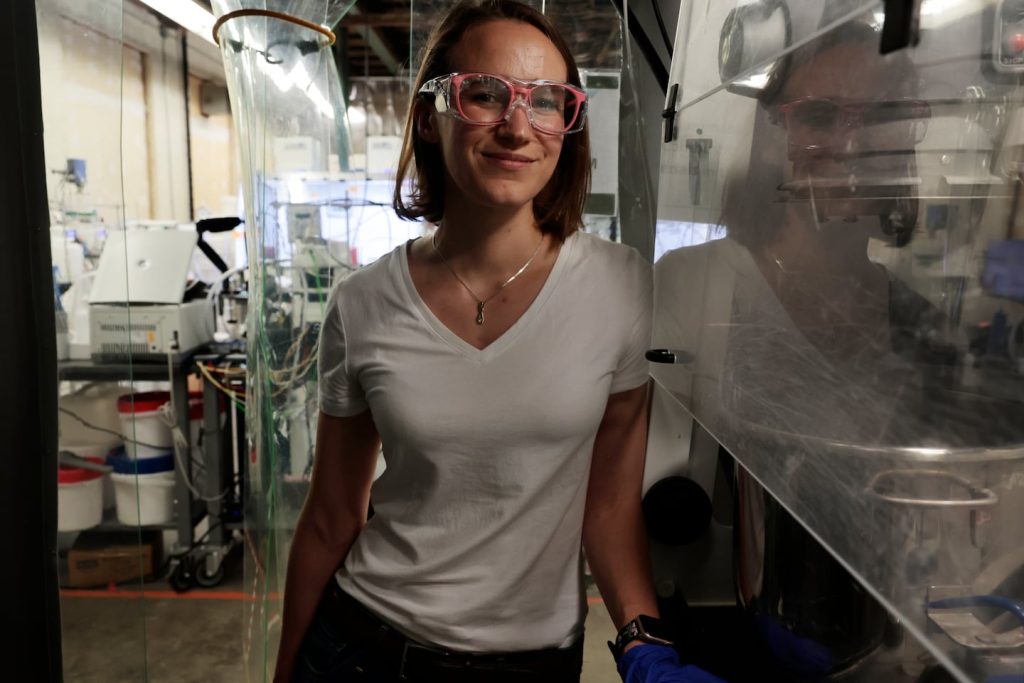

Builders such as those at Suffolk and Consigli Construction in Milford have come to appreciate the technology developed by Sublime cofounders Leah Ellis and Yet-Ming Chiang. The process they developed replaces traditional kilns with electrolysers that make cement from calcium sources, avoiding the intense release of carbon dioxide from the super-heating of limestone used to make most cement. So far, Sublime’s production has been limited to small test batches, including a foundation section included in the new building WS Development finished for Amazon in the Seaport.

Consigli vice president Todd McCabe said his company signed up to sell Sublime cement because its executives are always looking for ways to build more sustainably and efficiently, and Sublime’s clean cement will help with that.

At Suffolk, executives decided to buy equity in Sublime. Suffolk followed the startup soon after its 2020 inception. As Sublime moved closer to commercialization, Suffolk chief technology officer Jit Kee Chin decided it was the right time to invest.

“They’re getting to the point where it’s about to go to market,” Chin said. “Really, it’s no longer a science experiment. … This is the right time for us to go in and really support them.”

Chin said many of Suffolk’s clients are keenly interested in Sublime’s goal of creating a cost-effective, low-carbon cement that’s just as effective as traditional cement, known as portland cement.

The news about Sublime losing the federal award came as a disappointment to Ben Downing, the chief strategist at the Engine, a nonprofit startup accelerator affiliated with MIT and with VC firm Engine Ventures. Although it’s a significant amount of money, Downing has confidence that Sublime will be able to finish the Holyoke factory.

“We know there’s a lot of chaos in Washington but we believe in the science and we believe in the team,” Downing said. “It’s bad news, but if any team is going to be able to respond to it and grow and scale it, they’re going to find a way [and] I know Holyoke and Massachusetts will be better for it.”

Jon Chesto can be reached at jon.chesto@globe.com. Follow him @jonchesto.