Venture capital is changing how militaries develop new technology, with an increasing reliance on startups that can deliver solutions in months rather than years.

The catalyst was not a technological breakthrough. It was a war.

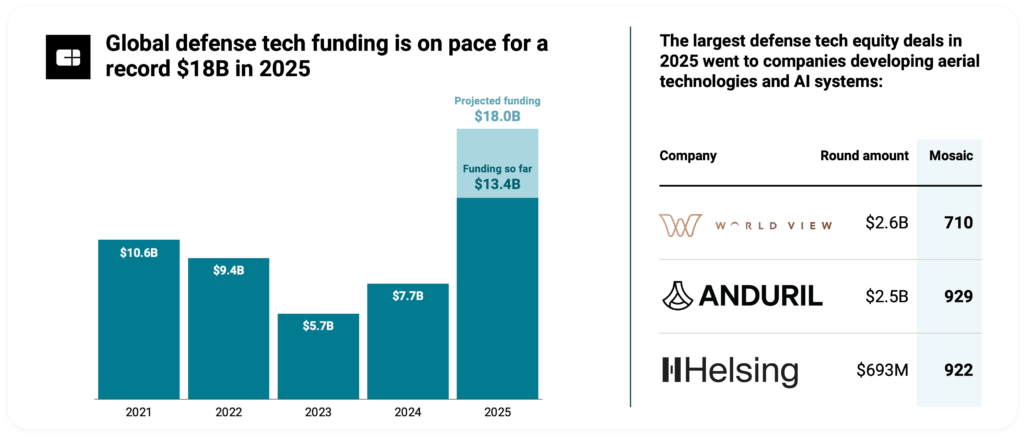

When consumer drones started destroying $5M tanks across Ukrainian battlefields, global militaries realized the need to revamp their defense strategies. Silicon Valley noticed too, sparking a defense tech gold rush. Now, Anduril commands a $30.5B valuation, Palantir skyrocketed to become one of the most valuable companies in the world, and hundreds of investors are chasing deals in a market they once ignored.

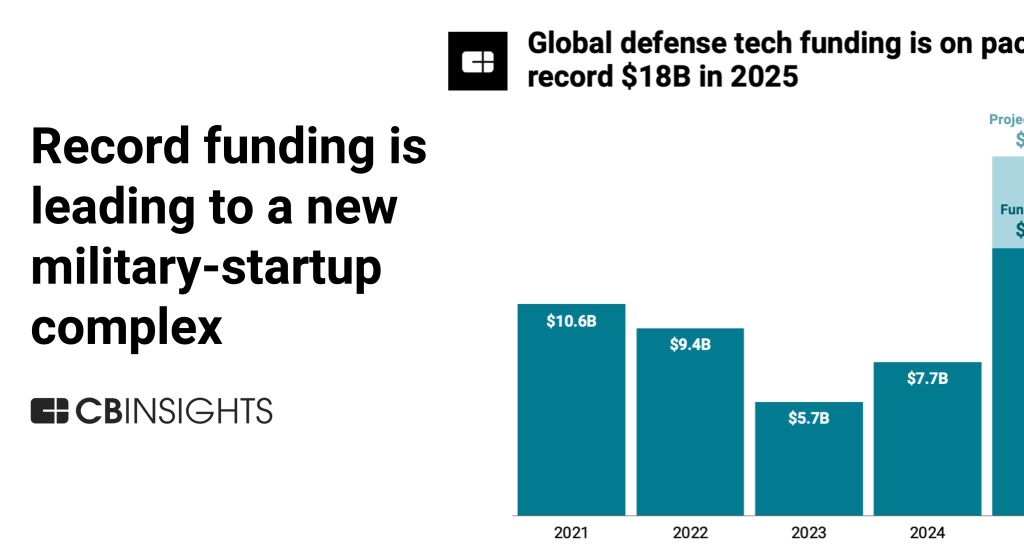

We project that defense tech funding will reach a record $18B in 2025 — a 134% increase from 2024 — leading to a new “military-startup complex” where Silicon Valley holds greater influence over how the US develops its military capabilities.

Below, we analyzed defense tech investments using CB Insights data to identify 3 key trends reshaping the global defense landscape. We define defense tech as technologies where defense is a primary application area.