Large cyber players are scrambling to own AI security, as demonstrated by their 7 recent acquisitions, including 4 in September alone. This includes Check Point’s acquisition of Lakera, CrowdStrike acquiring Pangea, F5 snapping up Calypso AI, and Cato Networks grabbing Aim Security.

GenAI and agentic AI are expanding attack surfaces and fueling a booming AI security market. While companies are actively hiring for AI and security talent, as revealed by CB Insights’ Hiring Insights Agent, they have also opted for M&A as a faster way to seize the opportunity and integrate AI security features into existing offerings.

Most of these acquisitions are early-stage end-to-end platforms that combine offensive capabilities (red teaming, vulnerability management) with defensive features (incident response, alerts). Half of the targets were Series A or earlier, 70% raised under $60M, and only one was generating revenue.

This points to a future where AI security becomes a table-stakes feature embedded in broader cyber offerings, rather than a standalone platform — driving large players to continue their acquisition spree.

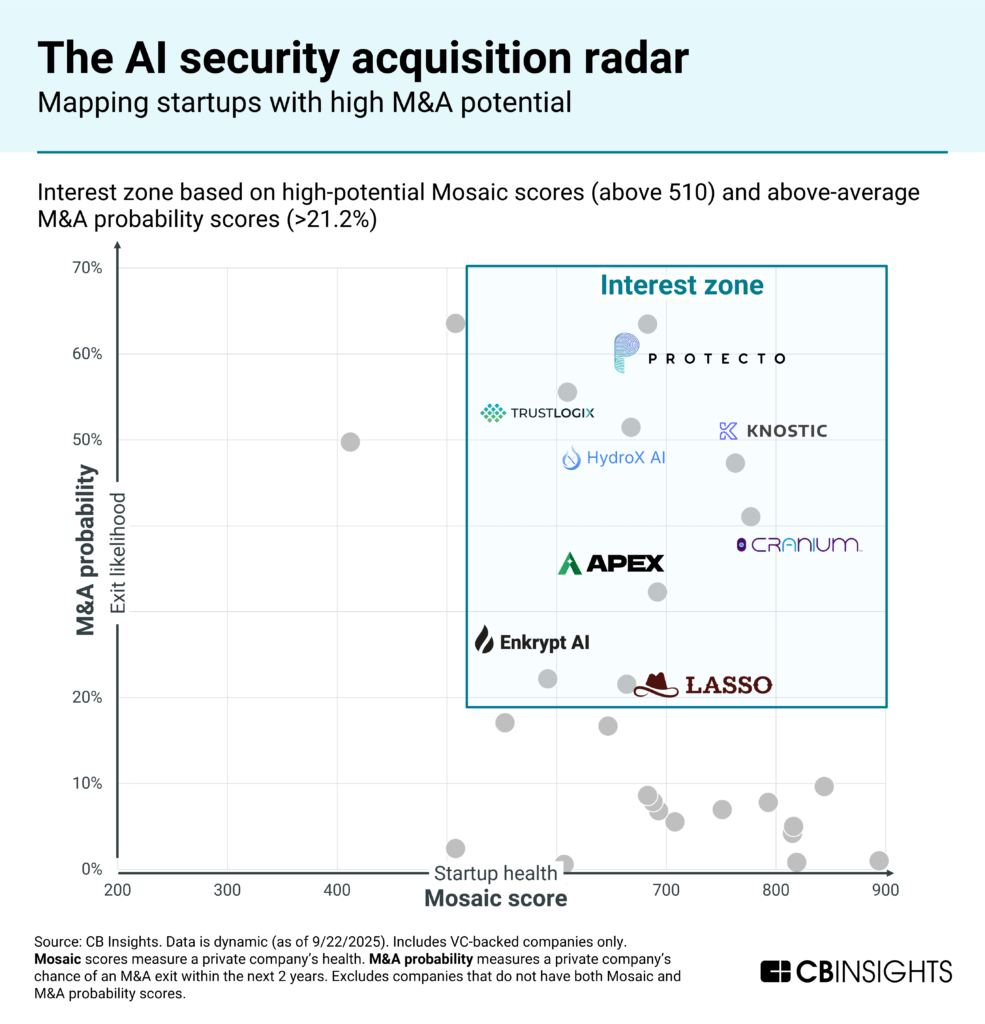

Using CB Insights’ predictive signals, including Mosaic company health scores and M&A probability, we’ve identified the AI security startups that are ripe for acquisition next.

![]() See the top AI security startups ranked by M&A probability here

See the top AI security startups ranked by M&A probability here

Key takeaways

Securing the data pipeline will be a new frontier in AI security. Companies with the highest M&A probability in this group focus on securing AI data pipelines, including TrustLogix (with a 56% chance of being acquired in the next 2 years) and Protecto (with a 64% chance). Both are early-stage and have not received funding past Seed. Their combination of strong Mosaic (more than 1.5X the overall average of 370) and low funding positions these companies as low-cost acquisition targets that could add value in industries with highly sensitive data.

Partnerships with large tech firms signal product validation, with 5 out of the 8 interest zone companies having partnered with large tech or cyber firms. 2 companies partnered with Snowflake for data privacy, 2 partner with Amazon, 1 integrates with OpenAI ChatGPT, and 1 has an ex-Google CISO on board. This market is nascent, with all companies either validating or deploying solutions and having raised at most Series A funding. In a market that’s so early-stage, partnerships are a proxy for market validation to potential acquirers.

C-suite tech expertise is a talent acquisition opportunity: 50% of founding teams come from large tech companies. The CEO of HydroX AI spent time at Meta, HP, and LinkedIn, the C-suite of Protecto comes from Microsoft, Apple, and Oracle, and the founding team at Lasso Security comes from SAP and Check Point. This expertise at the highest levels makes these companies potential targets for acquirers looking to bring AI talent in-house. As Check Point CEO Nadav Zafrir noted in a recent earnings call, “in this AI world, it’s all about talent and the critical mass of talent that you can bring into the organization.”

Want to submit your company’s profile data? Please reach out to researchanalyst@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.