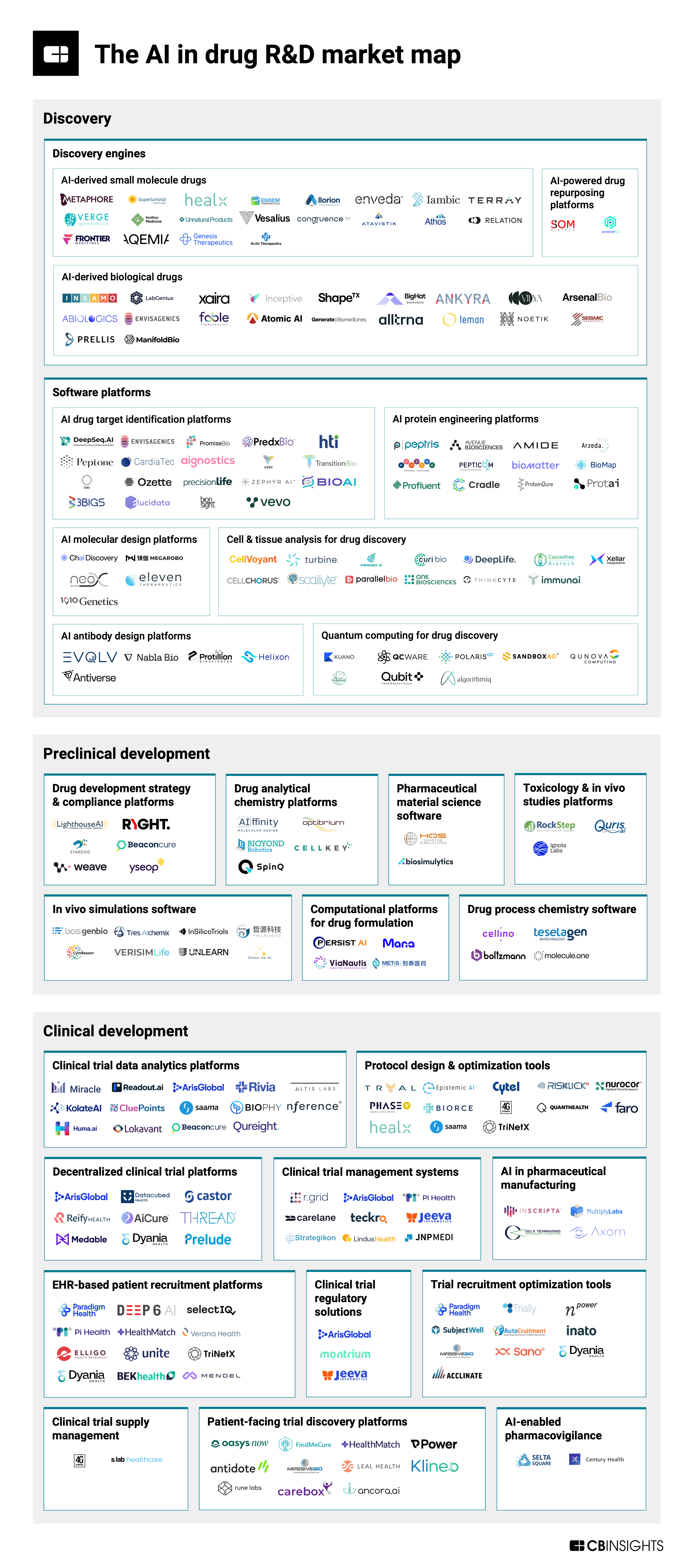

We map out 200+ companies applying AI to discover and develop new therapeutics, from project inception through commercialization.

Billion-dollar drug development costs are redefining pharmaceutical priorities. R&D expenses have increased tenfold since the 1980s (after adjusting for inflation), and pharmaceutical companies now allocate approximately 25% of their revenue to R&D – nearly double the share seen in the early 2000s.

In response to these cost pressures, pharma companies are using AI to make R&D more efficient. These capabilities enable organizations to quickly identify and evaluate promising drug candidates, influencing the selection of therapeutic approaches that advance to development.

AI could potentially cut years off the discovery process and compress clinical trial times by up to 30%. This would accelerate the delivery of new treatments to patients, unlock novel treatment approaches, and enable more personalized medicine. Companies that effectively leverage these AI capabilities will gain crucial advantages in speed, precision, and breakthrough discoveries.

Our analysis maps 225 AI-driven drug R&D companies across 27 markets. Below the map, we break down several trends shaping the future of pharmaceutical innovation, as well as share the methodology we used to select and categorize companies.

Please click to enlarge.

Note: This market map is not intended to be exhaustive, and categories are not mutually exclusive. For more, see the detailed methodology at the bottom of this report.

Key takeaways

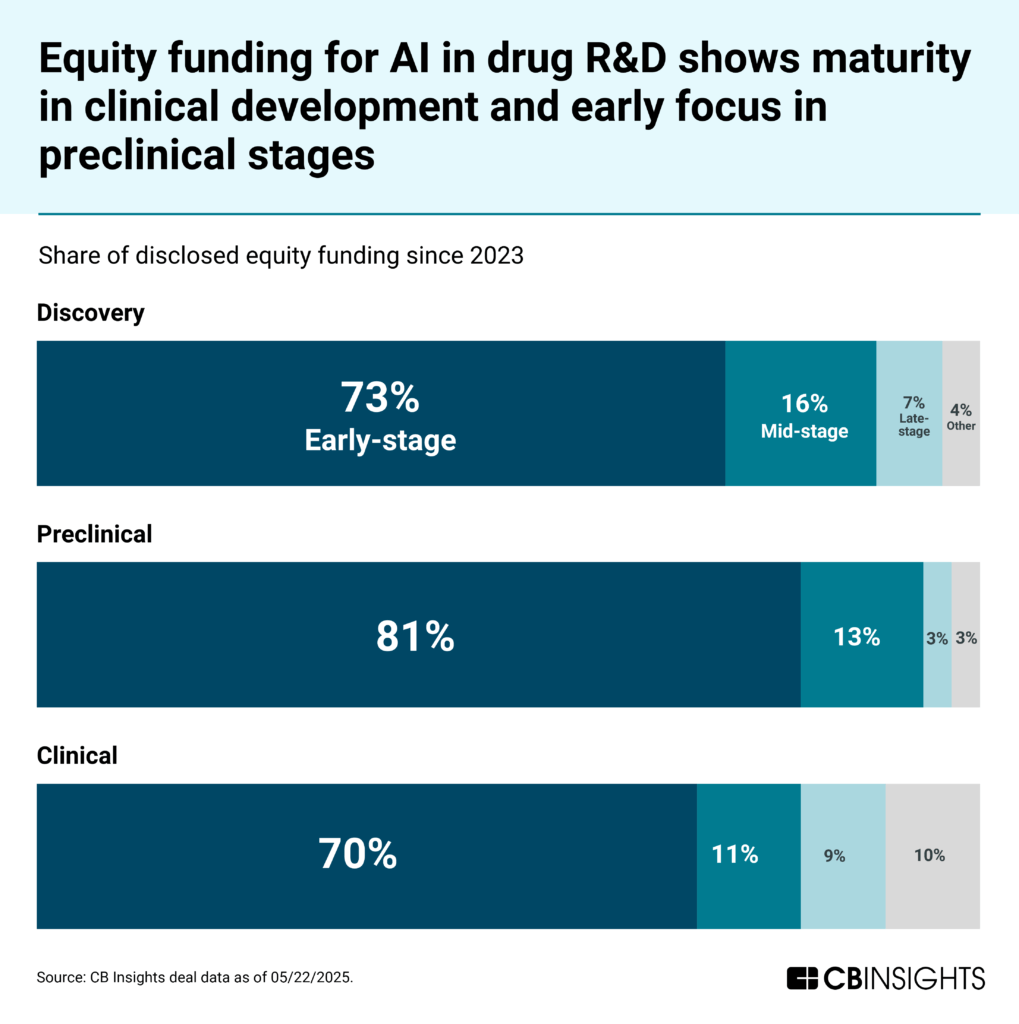

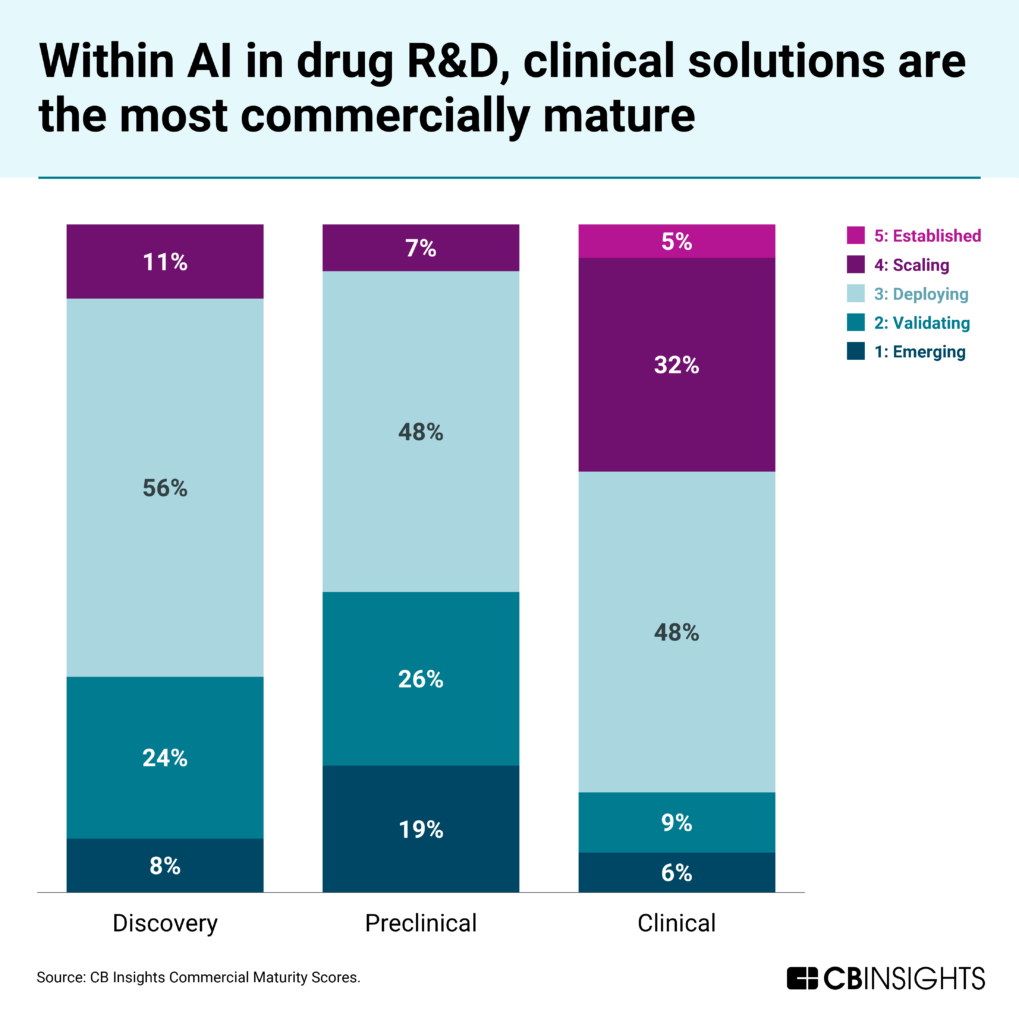

AI tools for clinical development are more commercially mature than the emerging field of preclinical applications. According to CB Insights’ Commercial Maturity scores, 37% of clinical development companies have reached the most mature commercial stages (4: Scaling or 5: Established) compared to just 7% of preclinical companies. Late-stage funding follows a similar pattern — 9% of clinical development funding since 2023 has gone to late-stage companies, compared to just 3% for preclinical tools.

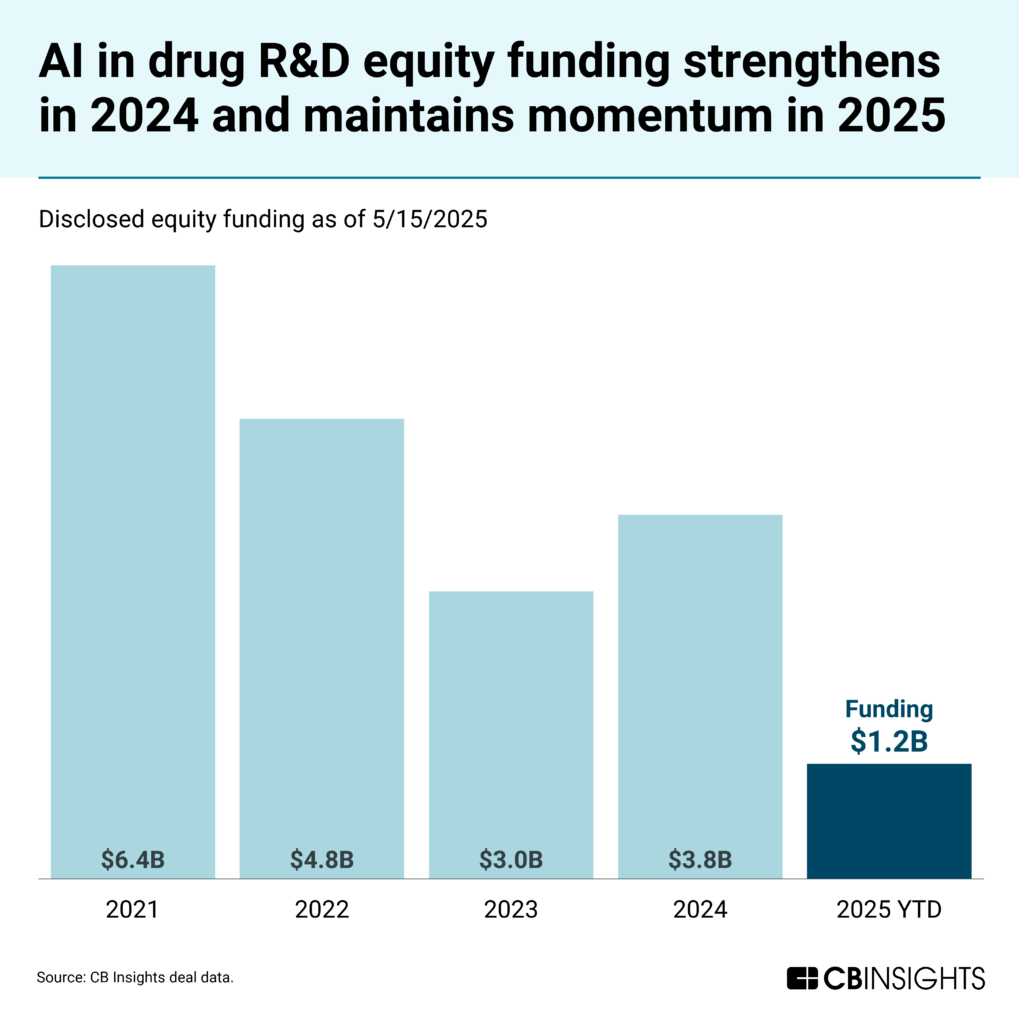

AI funding in drug R&D rebounded in 2024, with discovery engines capturing the majority of investments amid consolidation in the clinical trial sector. In 2024, equity funding grew to $3.8B (up from $3B in 2023), with AI-derived biologics and small molecules attracting $1.1B and $1B, respectively. Early 2025 momentum suggests the sector is on track to match last year’s strong performance.

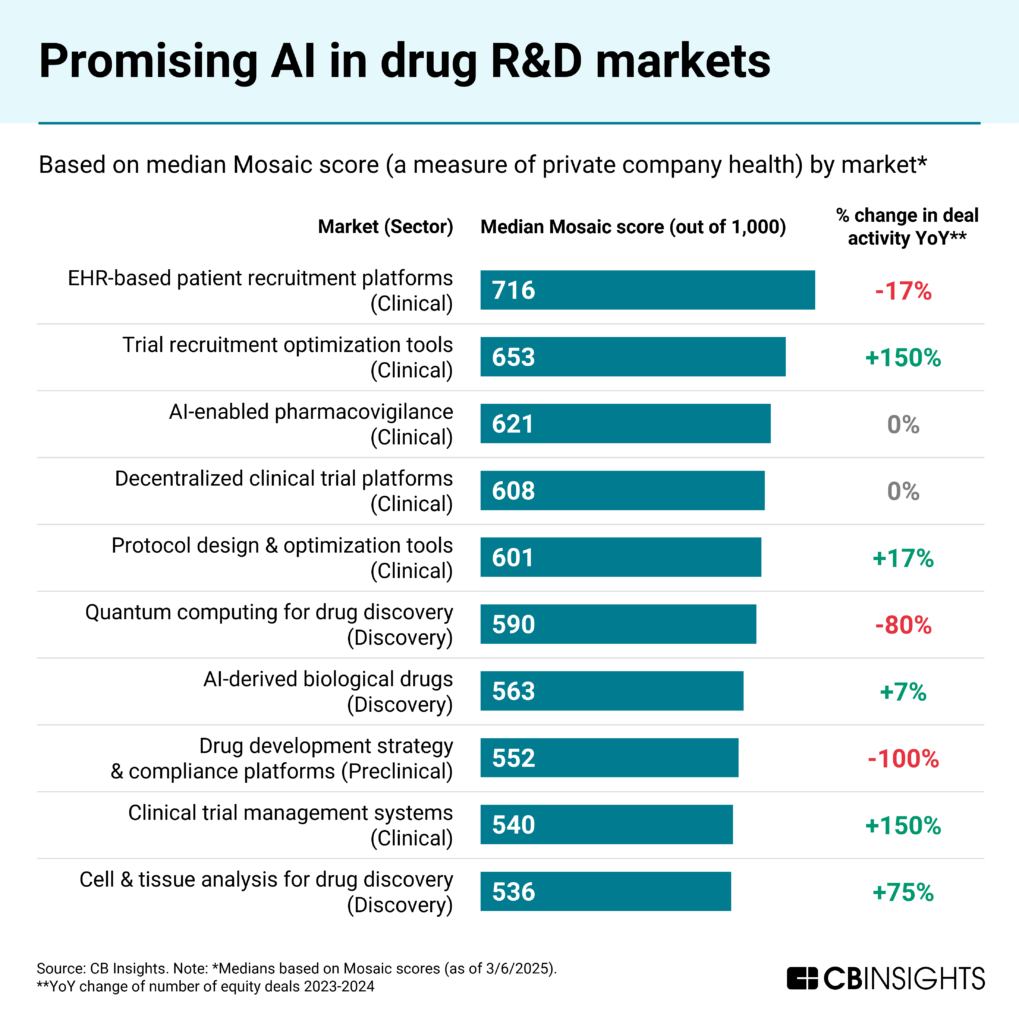

Patient recruitment platforms and clinical trial management systems demonstrate the strongest momentum. Examining market performance through average CB Insights Mosaic scores (a proprietary measure of private-company health and growth), EHR-based recruitment platforms lead (716 out of 1,000), while trial management systems show highest deal growth (+150% YoY). Look to these markets as high-growth areas to track within the AI drug R&D space.

Clinical development AI tools have achieved commercial maturity, while preclinical applications offer emerging investor opportunities

The adoption of AI in drug R&D is still emerging, and its pace varies across different sectors.

While early-stage funding dominates all sectors, preclinical development remains the most nascent, with 81% of funding since 2023 directed to early-stage deals and only 3% to late-stage deals.

Clinical development shows greater maturity — still led by early-stage deals, but with a more established cohort of companies in later stages (70% early-stage, 9% late-stage funding).

CB Insights’ Commercial Maturity metrics further highlight this disparity.

In preclinical development, 45% of companies are in the earliest commercial stages (1: Emerging and 2: Validating) compared to 32% in discovery and just 15% in clinical development.

Conversely, only 7% of preclinical companies have reached the most mature stages (4: Scaling or 5: Established) vs. 11% in discovery and a substantial 37% in clinical development.

The disparities in maturity stem from each sector’s unique characteristics:

Clinical development AI solutions often build upon existing healthcare technology infrastructure, facilitating faster adoption.

The use of AI in discovery carries higher investment risks as companies develop unproven molecules from scratch.

Preclinical development, positioned mid-pipeline, offers more specialized solutions and faces stricter regulatory scrutiny, explaining its slower advancement despite growing momentum.

For investors, this creates a clear distinction: Clinical development companies provide stronger near-term return potential, while the emerging preclinical space offers better opportunities to establish early market advantages.

![]() Explore all 700+ AI in drug R&D companies

Explore all 700+ AI in drug R&D companies

Drug R&D AI funding recovers as discovery engines lead investments amid clinical trial sector consolidation

After declining YoY between 2021 and 2023, equity funding across AI in drug R&D rebounded in 2024, growing from $3B to $3.8B and significantly surpassing pre-pandemic levels ($2.7B in 2019). The momentum continues in 2025, which, after Q1, is on pace to match 2024’s performance, bolstered by Isomorphic Labs‘ $600M Series A round in March 2025.

Among markets, discovery engines led funding in 2024, with AI-derived biologics securing $1.6B in equity funding and AI-derived small molecules attracting $1B. This aligns with these companies’ higher funding requirements for developing therapeutics and conducting clinical trials. It also demonstrates investors’ strategic bets on AI’s potential to slash drug discovery timelines — with discovery engines serving as the primary vehicles to prove this capability.

Enveda stands out here, having raised a $130M Series C in November 2024, followed by an additional $20M investment from Sanofi in February 2025 — a strong endorsement of its platform, which combines machine learning, metabolomics, and robotics to identify novel compounds from medicinal plants. The company’s recent collaboration with Microsoft Azure (May 2024) further positions it to scale its generative AI capabilities.

Beyond discovery engines, quantum computing platforms had an exceptional 2024, raising $376M, while decentralized clinical trial platforms followed, securing $129M. Huma led the latter group with an $80M Series D round in July 2024, while the market simultaneously underwent a wave of consolidation, with 5 acquisitions in 2024 alone, doubling all exits since 2020.

However, among these acquisitions, only Aparito (purchased by Eli Lilly in July 2024) leverages AI in its offerings through its Atom5 platform, which enables comprehensive remote data collection and AI-powered data analysis.

![]() Analyze AI in drug R&D deals

Analyze AI in drug R&D deals

Patient recruitment and quantum computing lead commercial momentum in AI-driven R&D

According to CB Insights’ Mosaic scores, the highest-momentum AI markets across phases of drug R&D are:

Among these high-potential sectors, several companies are making significant advances.

SandboxAQ (Mosaic score: 843) leads in the quantum computing space; its 2023 release of the AQBioSim technology stack combines AI and quantum algorithms to predict molecular behavior and accelerate drug discovery. This expansion into biotech applications attracted Sanofi, resulting in a partnership in October 2024.

In the regulatory domain, Weave (Mosaic score: 575) has positioned itself as an early mover in AI-driven regulatory automation for life sciences. Its AutoIND platform, launched in 2024, claims to reduce IND application timelines by up to 70%.

Among these top 10 markets, trial recruitment optimization tools and clinical trial management systems showed the most growth in deals from 2023 to 2024. This illustrates increasing investor confidence in technologies that address critical bottlenecks in clinical trial efficiency and challenges related to patient enrollment.

In these markets, the companies with the highest Mosaic scores demonstrate rapid advancement and growing investment appeal:

In the clinical trial management space, Lindus Health (Mosaic score: 874) secured a $55M Series B round in January 2025 and established a partnership with the Clinical Data Interchange Standards Consortium (CDISC) in February 2025. This collaboration with CDISC — a nonprofit that sets standards mandatory for FDA submissions — focuses on automating data standardization using Lindus Health’s AI platform for trial protocol generation and analysis.

Paradigm Health (Mosaic score: 822) leads in trial recruitment optimization with its AI-driven platform for patient recruitment and trial management. Its deployment across 400 research sites and 1,000 healthcare provider locations in 3 countries helped it secure a $203M Series A in January 2023. In November 2024, Japan’s National Cancer Center selected Paradigm for its nationwide clinical trial network to advance precision medicine initiatives, expanding the company’s footprint in the Asian oncology research market.

These market signals suggest AI’s most immediate and transformative impact on drug development will come not from scientific breakthroughs alone, but from technologies that systematically eliminate the operational inefficiencies that have historically extended development timelines and inflated costs.

![]() Dive into all drug R&D tech markets

Dive into all drug R&D tech markets

Methodology

To identify players for this market map, we reviewed AI companies in drug R&D markets and included startups with a Mosaic score of 400+ that have raised funds within the last 5 years. For markets where these criteria identified more than 20 companies (AI-derived small molecule drugs, AI-derived biological drugs, and molecular design platforms), we selected those that had raised at least $20M in funding. If further reduction was needed, only companies in the top 20 Mosaic scores are shown.

Categories on the market map align with our recent 3-part series on AI in drug R&D:

Discovery encompasses workflows from project inception through lead selection, where discovery platforms are companies whose products are AI software systems, while discovery engines are companies whose products are therapeutics discovered using proprietary AI systems.

Pre-clinical development covers lead development to the first regulatory filing (an Investigational New Drug (IND) application in the United States)

Clinical development spans from the start of clinical trials through commercialization.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.