AI agent startups are showing no signs of slowing down.

Since we published our first agent revenue ranking in July, the sector has continued to gain significant momentum: Harvey reached the $100M revenue threshold, category leaders like Sana Labs are exiting (Workday’s $1.1B acquisition), and startups like Sierra are raising mega-rounds ($350M Series D at a $10B valuation).

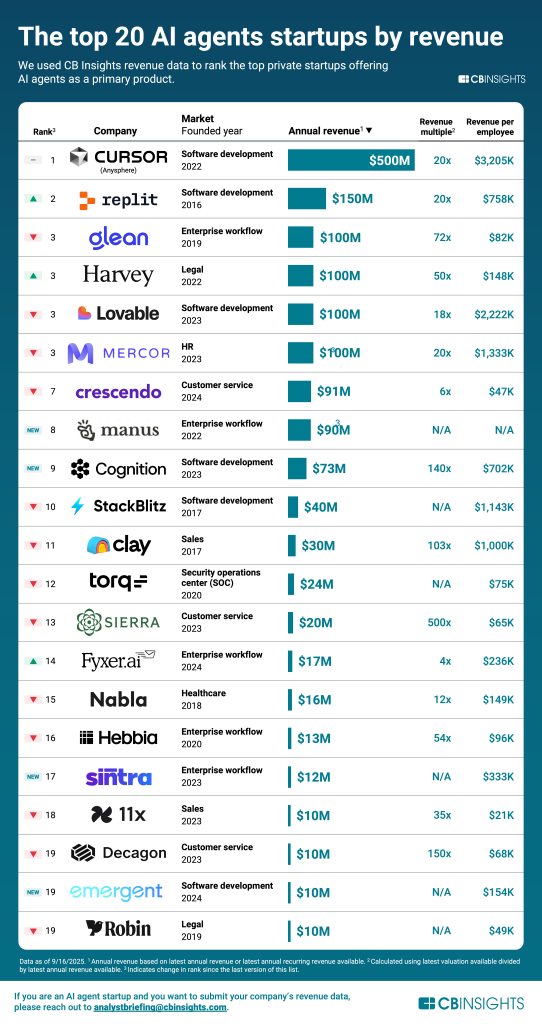

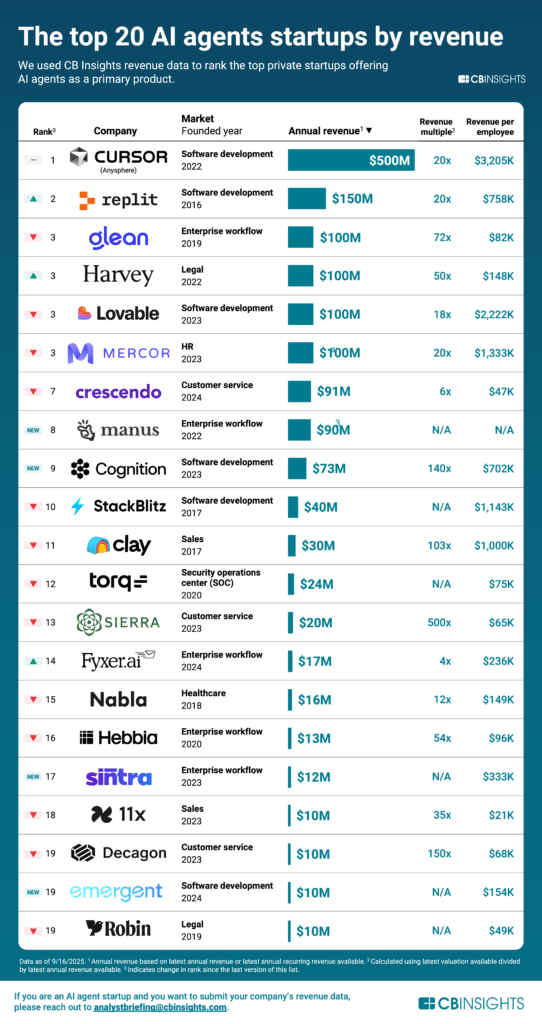

Using CB Insights revenue data, we identified the top private startups generating $10M+ in revenue that offer AI agents as their primary offering and analyzed their revenue performance across categories (see the graphic below).

If you are an AI agent startup and want to submit your company’s revenue data, please reach out to analyst@cbinsights.com.

![]() See the top AI agent startups ranked by revenue here

See the top AI agent startups ranked by revenue here

Key takeaways

Coding AI agents are racing ahead in commercialization, with 6 software development agents making the top rankings, including market leaders like Anysphere’s Cursor ($500M in ARR) and Replit ($150M). These startups have demonstrated that they’re the most capital-efficient category, averaging $1.4M revenue per employee (compared to $594K per employee across all top agent categories). We recently identified the leaders of coding AI by market share — read more here.

Customer service AI agents command the highest valuation premiums, averaging 219x revenue multiples (compared to 80x across all top revenue-generating AI agents). This valuation gap reflects investor confidence in the sector’s applicability and the expectation that businesses will rapidly replace human support teams with AI agents.

These revenue leaders average just 3.8 years old. Despite their youth, CB Insights’ Commercial Maturity data shows the majority are already deploying or scaling their products, demonstrating the industry’s compressed timelines from startup to commercial success.

If you aren’t already a client, sign up for a free trial to learn more about our platform.