Recently, Tesla’s official website in China was updated, announcing a partnership with ByteDance’s Volcano Engine. The new Model Y L will feature the Doubao large model and the DeepSeek model, both integrated through Volcano Engine. The Doubao model will handle voice command functions such as navigation settings, media playback control, and air conditioning temperature adjustments, while also providing a vehicle owner’s manual query function; the DeepSeek model will offer AI voice chat services. This collaboration directly addresses Tesla’s pain point regarding the lack of localization in its vehicle system.

Unlike the North American models that use Grok from Musk’s xAI, the Chinese version opts for a local technology combination, demonstrating Tesla’s pragmatic compromise for regional competition. DeepSeek has recently gained favor with brands such as Zeekr and Dongfeng Nissan, excelling in scenarios like Chinese idiom games and dialect comprehension. Notably, the flexible computing power support from Volcano Engine allows Tesla to achieve millisecond-level responses without needing to build its own data centers, showcasing a new paradigm of competition and cooperation among tech giants.

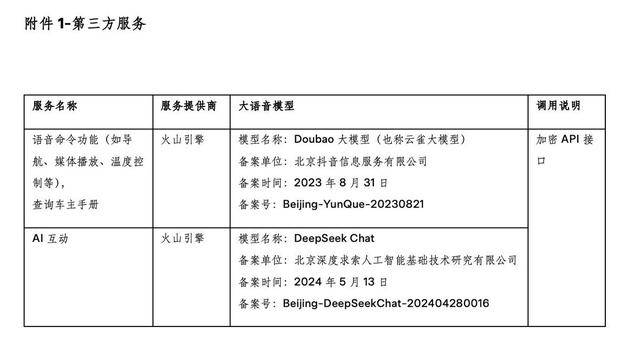

This partnership marks a significant upgrade in Tesla’s localization strategy in the Chinese market. It also means that Tesla has officially joined the race among Chinese automakers to integrate large models into their vehicles. According to Tesla’s official terms of use for the vehicle voice assistant, the assistant will integrate the Doubao (Cloud Sparrow large model) and DeepSeek Chat services provided by ByteDance’s Volcano Engine. It’s worth noting that Tesla does not directly call the DeepSeek official API but accesses it through the Volcano Engine API. In the future, Tesla vehicles equipped with AI interaction capabilities in China will allow users to control vehicle functions and engage in human-vehicle interactions through voice commands, enhancing the smart cockpit experience.

Currently, Volcano Engine has served dozens of automakers including Mercedes-Benz, BMW, and BYD, and has a deep understanding of the intelligent needs of the Chinese automotive market.

The collaboration between Tesla China and Volcano Engine is another typical event reflecting multinational automakers deepening their localization strategies. This partnership not only reflects the unique demands of the Chinese market for intelligent technology implementation but also reveals the restructuring logic of the global automotive industry.

· Multinational Automakers Accelerate Restructuring of Their Chinese Strategies

Not just Tesla, in recent years, an increasing number of multinational automakers have turned their attention to restructuring their localization strategies in China. From the transformation outcomes of these giants, BMW’s “new generation models” have become one of the most notable representatives of this shift. The new generation models, designed by the BMW Shanghai R&D team, are set to go into production in Shenyang in 2026, equipped with the sixth-generation eDrive system and utilizing an 800V high-voltage platform. These technological breakthroughs serve not only the Chinese market but also provide feedback to European factories.

The Volkswagen Group has invested 2.5 billion euros in building an intelligent connected R&D center in China, focusing around 3,000 local engineers on the development of next-generation models. Its two electric vehicle models developed in collaboration with XPeng are set to go into production in 2026, with the first mid-size SUV equipped with the XPeng XNGP intelligent driving system. Through deep cooperation with local companies, Volkswagen’s new company in Anhui has become a crucial support point in the group’s global electrification transformation.

Mercedes-Benz is also undergoing a transformation, with the R&D outcomes from its Beijing center beginning to change global technology flows: the MBUX vehicle system, developed based on Chinese user preferences, is gradually being applied to Mercedes-Benz models worldwide; the next-generation infotainment system created by the Chinese team not only meets Chinese users’ unique demands for “watching movies, playing games, or holding video conferences in the back seat,” but is also expected to extend to other markets’ Mercedes-Benz products; and the L2++ advanced driving assistance system, developed by the Chinese team, is being utilized in various models.

China is transforming from a purely market consumption end to a source of technological innovation and a global supply chain hub. Not only vehicle manufacturers but also major suppliers in the industry chain are continuously laying out plans. Valeo, a global leader in automotive parts supply, has expanded production in China three times, establishing its global software technology center and the largest R&D center in the world in China.

Under the dual pressures of electrification and intelligentization, multinational automakers and their joint ventures are experiencing unprecedented strategic differentiation. In this round of transformation among multinational automakers, deep integration of the supply chain has become crucial, especially in key areas like battery technology and intelligent driving systems, where multinational companies need to address their shortcomings through strategic collaborations. Current practices indicate that foreign automakers that actively integrate into the Chinese industrial ecosystem have shown significant advantages in product iteration speed and cost control capabilities. Toyota adopts a strategy of “technological reserves + localized production,” establishing a hydrogen energy R&D center in Changshu, Jiangsu, while exploring collaboration with BYD to develop electric vehicle models; BMW, Mercedes-Benz, and Nissan have formed strategic partnerships with Huawei and Alibaba to develop smart cockpits based on the HarmonyOS and utilize Tongyi large models for localized optimization of voice interactions, satisfying Chinese regulatory requirements while building a differentiated intelligent ecosystem.

It is noteworthy that the technological routes of automakers are showing a trend of differentiation: Tesla and BMW choose to collaborate with third-party large model manufacturers to quickly implement mature solutions; while Li Auto is pursuing a self-research path, with its Mind GPT cognitive large model already applied in the “Li Xiang Classmate” intelligent assistant, building a technological moat. Regardless of the path taken, the core goal remains the same—upgrading the vehicle system from a “command executor” to a “scene interpreter,” truly achieving an interactive revolution where “what is said is what is obtained.”

· The Future Competitive Landscape of Smart Vehicles

Tesla’s recent upgrade signifies the broad application trend of large model technology in the automotive field. As technology continues to advance, the functions of smart cockpits will become richer, and user experiences will further improve. For the industry, as more automakers embrace large models, avoiding “interaction homogenization” and truly binding large model capabilities with real user scenarios and vehicle hardware characteristics will become the core proposition for realizing the value of smart cockpits. Today, intelligent driving and smart cockpits have gradually become the battleground for automakers to shape brand premium, win user choices, and capture market share, with their technological depth, iteration speed, and implementation scale profoundly affecting the formation of future competitive landscapes and determining how automakers build sustainable moats in the “software-defined vehicle” arena, as well as influencing whether business models can steadily transition into new economic forms. Therefore, deeply analyzing the real situation and evolution paths of intelligent driving and smart cockpits is crucial for predicting future competitive dynamics and commercialization trends.

In the future, the competition for smart vehicles will no longer be limited to power performance and range; it will also be a competition of intelligent experiences and ecosystems. Tesla’s recent upgrade is merely a new starting point in this competition. Today, intelligentization has undoubtedly become the core link for ecosystem co-construction. Some institutions predict that by 2025, the penetration rate of NOA in passenger vehicles will reach 20%, and by 2030, the penetration rate of L2+ smart vehicles will exceed 90%. Looking at the industry, achievements such as NIO’s self-developed 5nm intelligent driving chip, Li Auto’s open-source Xinghuan OS system, and XPeng’s flying car mass production plan fully demonstrate the underlying technological breakthroughs of Chinese automakers in the smart electric field.

The cooperation between Tesla and Volcano Engine is essentially a microcosm of “China’s market defining technological standards”—when multinational automakers hand over the R&D leadership and core supply chain elements to China, it signifies that the global automotive industry has entered a new era centered around China’s innovation chain. As Tesla’s vice president Tao Lin stated, “Tesla’s success is the success of the Chinese supply chain.” In the future, those who better understand the digital needs of Chinese consumers will gain an advantage in the second half of electrification.

(Images sourced from the internet)

Editor: Zhang Tao返回搜狐,查看更多