While 2025 isn’t shaping up to be the year that tech exits fully rebound, it’s offering a clear preview of where private markets are headed.

M&A volume stayed flat in the first half of the year, and the IPO market remained muted, though there are early signs of a potential second-half recovery. In the meantime, capital continues to flow into private tech companies at record levels, including a surge in secondary transactions. This is giving private tech companies more runway (and more reason) to delay public listings.

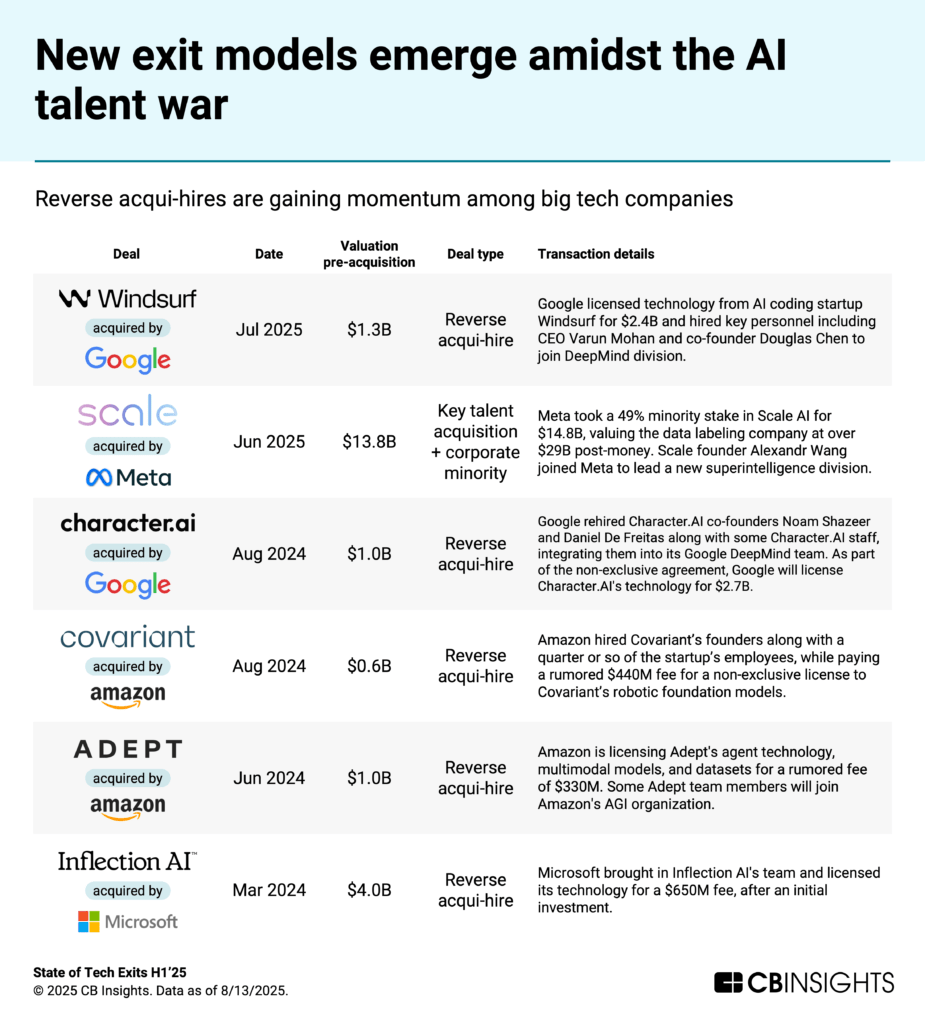

New exit models are also gaining traction. From large minority stakes to reverse acqui-hires, big tech companies are finding ways to access talent and technology without triggering regulatory review. These deal structures are starting to reshape how value is created, captured, and distributed across the ecosystem — for founders, investors, and employees alike.

Taken together, these trends point to a broader shift: private markets are becoming the dominant venue for value creation and capture in tech. With that comes the need for better private market investing infrastructure, including real-time data and context, turning private company intelligence into a new competitive advantage.

Below, we break down the top stories from this first half of the year and our projections for the rest of the year, including:

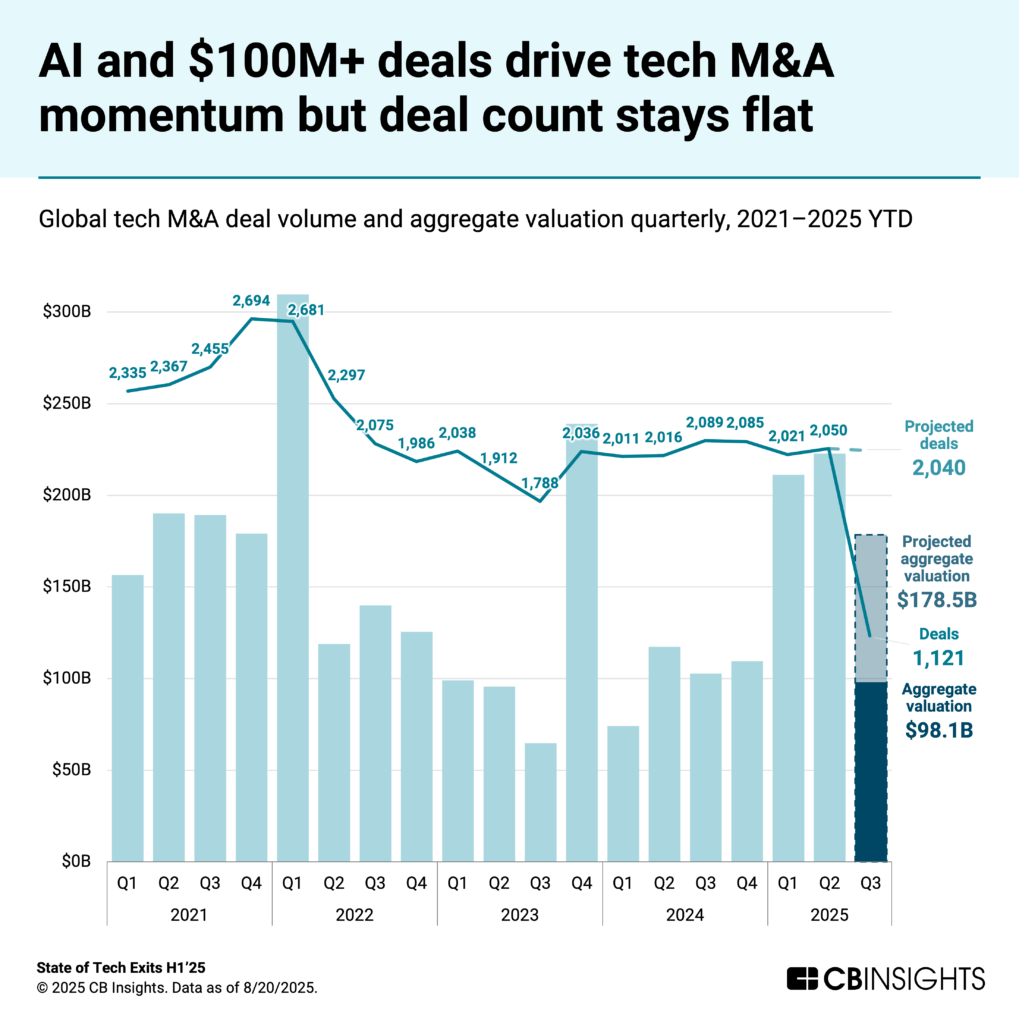

AI and $100M+ deals drive tech M&A momentum

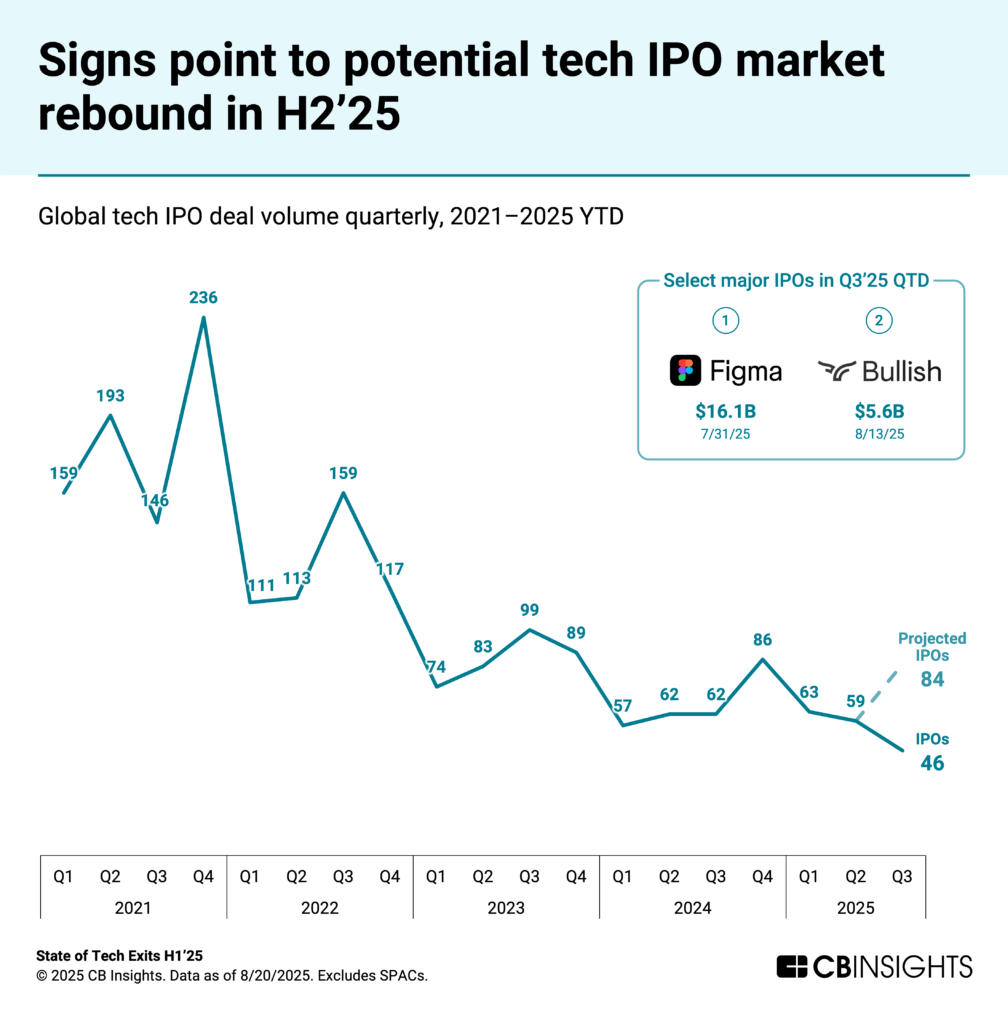

Signs point to tech IPO market rebound in H2’25

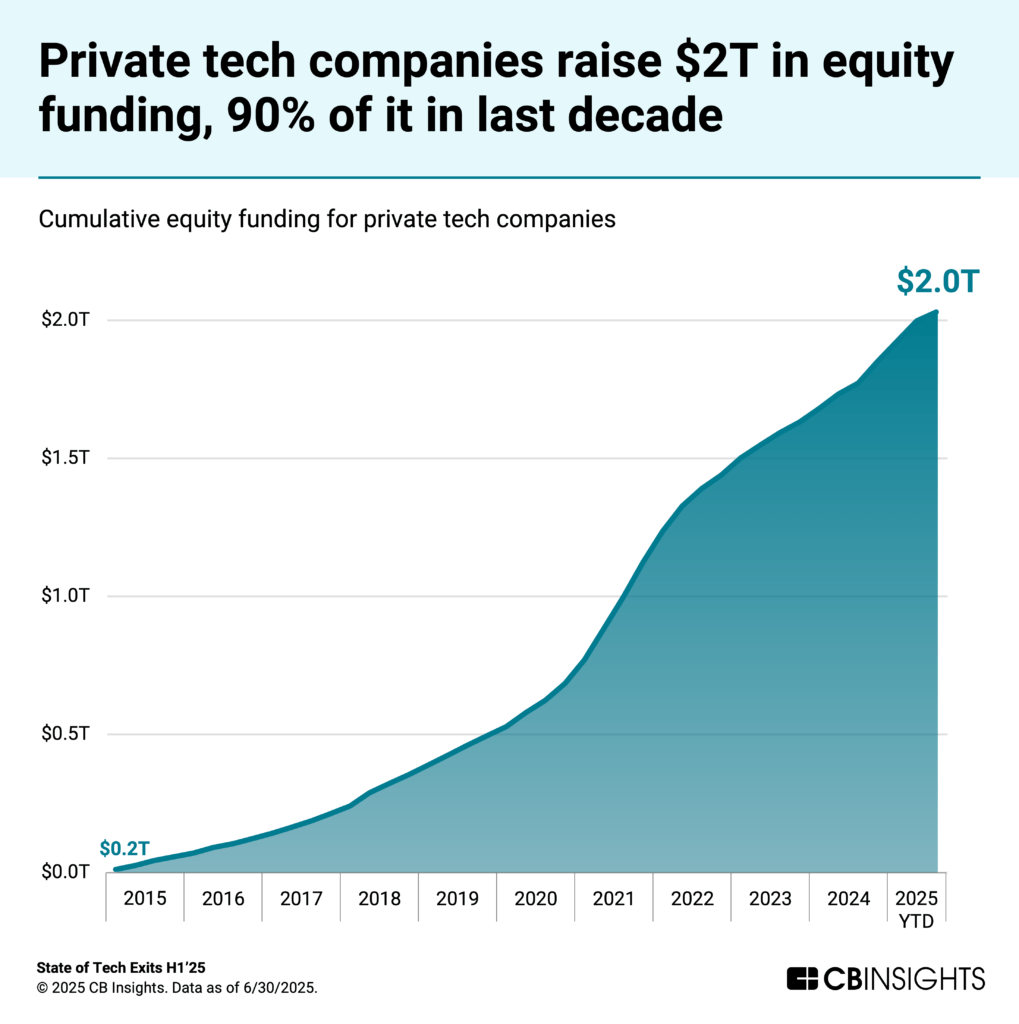

Private tech markets top $2T in equity funding

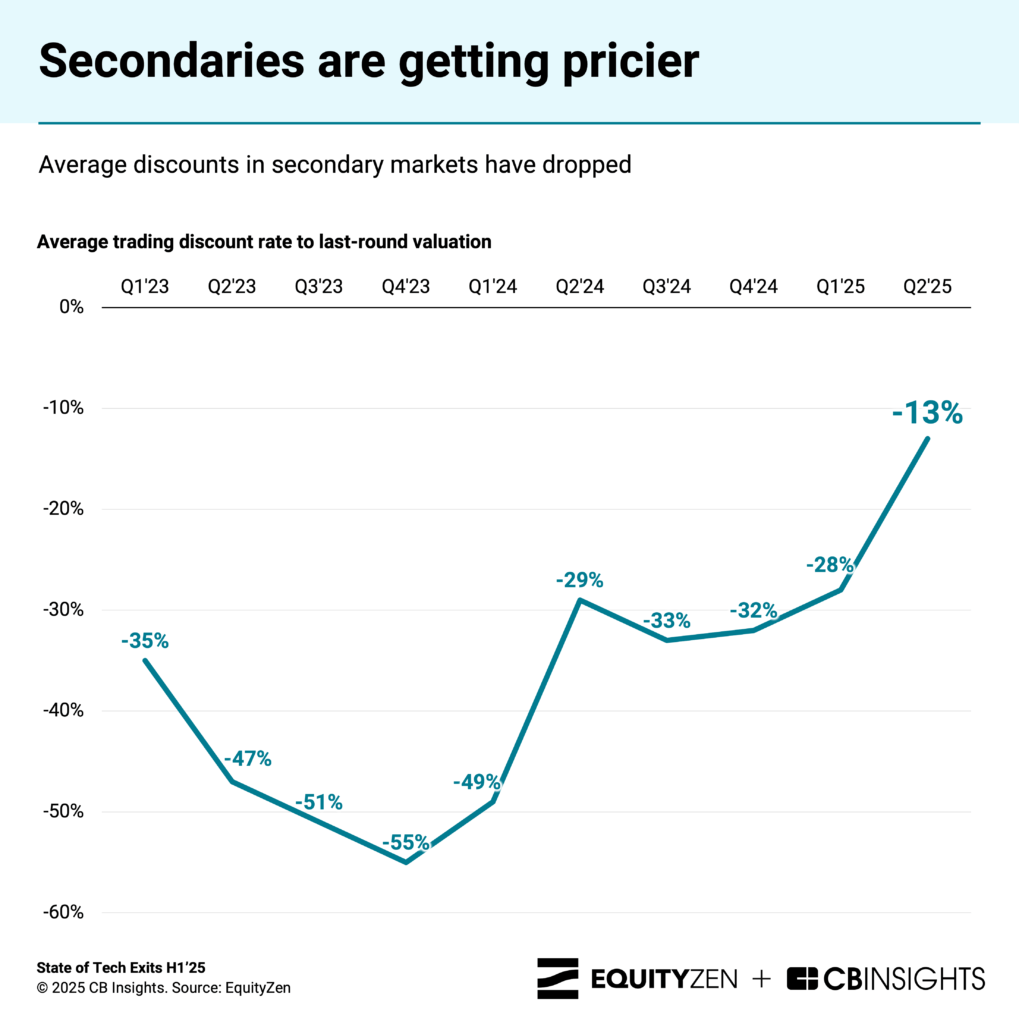

Secondaries get bigger and pricier

New exit models emerge amidst the AI talent war

Download the full report to access comprehensive CB Insights data and charts on the evolving state of tech exits, in partnership with EquityZen.

Top stories in H1’25

1. AI and $100M+ deals drive tech M&A momentum

Tech M&A activity has remained stubbornly flat since Q4’23, stagnating at just over 2,000 transactions per quarter. We project Q3’25 to follow the same trajectory, with 2,040 deals.

Despite flat volume, this year is shaping up to be a record year in terms of M&A deal value, driven by an increase in the number of $100M+ acquisitions. These large transactions represent 4.7% of deal share so far this year, up from 3.8% from all of 2024, and a level not seen since 2021.

AI has also emerged as a bright spot, as corporations race to grab AI tech & talent.

M&A activity in AI reached record levels in Q2’25 at 192 deals, pushing AI’s share of tech M&A to 7.5% so far this year — almost double its share in 2021. Private companies have notably led some of the largest AI acquisitions in the first half of 2025, with OpenAI acquiring Io for $6.5B and Databricks spending $1B to buy Neon.

The AI race is also pushing big tech companies to rethink their M&A strategy, after years of muted activity.

Meta scooped up voice AI startups PlayAI and WaveForms this summer — marking its first acquisition since 2022 — in a bid to win the race to build the future of human-machine interactions. The company is betting that voice will become the dominant interface for interacting with AI.

During the company’s Q3’25 earnings call, Apple’s CEO mentioned being open to larger M&A deals to help accelerate its roadmap. This marks a significant move away from Apple’s historical focus on smaller acquisitions.

Dive into 7 AI-related areas where we expect to see M&A activity this year, as well as high-potential acquisition targets for each, in the free report.

2. Signs point to tech IPO market rebound in H2’25

The global tech IPO market has remained muted during the first half of 2025, with 122 tech companies going public, in line with the numbers from 2024. But recent activity signals things may be picking up.

Figma successfully went public last month, in an IPO often referred to as a test of the public market’s appetite for tech companies. The company was valued at just over $16B at IPO and now boasts a market cap of $39B (as of 8/20/2025).

A few weeks later, crypto exchange platform Bullish followed a similar path, raising $1.1B in at a $5.4B valuation. The company is now trading at a 60%+ premium to its IPO price.

These recent examples have pushed several tech companies (crypto in particular) to announce they had filed to go public, reviving hopes of a tech IPO market rebound. Based on current trends, we project 84 tech IPOs for Q3 ’25 — above the 2-year quarterly average of 72.

![]() Find 40+ blockchain companies with a high probability of going public in the next 2 years

Find 40+ blockchain companies with a high probability of going public in the next 2 years

But any rebound is likely to be modest, with private tech companies expected to remain private for longer and the role of IPOs potentially shifting to becoming a clearinghouse rather than a capital-raising mechanism, as predicted by Jared Carmel, Managing Partner, Manhattan Venture Partners:

“We’re witnessing a fundamental shift in how tech companies approach public markets. The average age at IPO has increased dramatically, from under 4 years in 2000 to 12 years in 2015 and nearly 16 years today. I expect this trend to accelerate, with companies staying private for 20+ years becoming the new norm.

The aggressive IPO pops we’ve historically seen are fundamentally unfair to founders and long-term investors who actually built these companies. Over the next several years, you’re going to see VCs, private equity, and sovereign wealth funds step in to extract maximum value before these companies ever go public. When they eventually do an IPO, they’ll go public at fair market value without the pop — essentially using public markets as a clearinghouse rather than a capital-raising mechanism.

This shift is already playing out in the data. We’re seeing record levels of private funding, exceeding $2 trillion in cumulative investment, and explosive growth in secondary transactions. The real value creation and liquidity will increasingly occur in private markets, rather than public ones. With companies staying private for two decades, secondary liquidity becomes absolutely critical — employees, early investors, and founders can’t wait 20 years for an exit.”

3. Private tech markets top $2T in equity funding

Private tech companies are staying private longer and now have more capital than ever to do so.

Over $2T in cumulative equity funding has poured into private tech markets to date, with 90% raised in just the last decade. That funding has enabled companies to keep scaling before tapping the public markets. Today, startups are going public an average of 16 years after being founded, 4 years later than just a decade ago.

Late-stage rounds have also reached new extremes, with Databricks joining the exclusive “Series K” club in July. Just 16 Series K rounds have ever been raised — half in the last 5 years — signaling the growing normalization of ultra-late-stage private fundraising.

Private market check sizes have also grown dramatically. The past 18 months alone account for the largest Seed, Series A, Series B, Series D, and Series E+ rounds on record. And more dry powder is on the way: a recent executive order in the US is opening the door for 401(k) retirement accounts to invest in private markets, potentially unlocking a new wave of capital for private tech companies.

As regulatory barriers fall and new investment vehicles emerge, private tech company investments will increasingly define institutional — and eventually retail — portfolios.

But there’s a catch.

Private companies operate in information shadows, beyond public view. Institutions will increasingly need real-time data and context on companies not subject to quarterly reporting, turning private company intelligence into a new competitive advantage.

4. Secondaries get bigger and pricier

The last 7 quarters have seen YoY growth in secondary transaction activity among VC-backed companies, with no signs of slowing down. As tech companies stay private longer and valuations continue to climb, secondaries are playing a growing role in providing liquidity.

In August 2025, OpenAI reportedly launched a tender offer at a $500B valuation, a sharp jump from its last reported $300B. The offer gives current and former employees a chance to cash out while attracting new capital from institutional buyers. Canva followed a similar playbook, recently conducting a secondary sale at $42B. That’s $10B higher than its October 2024 valuation, which was also set during a prior secondary transaction.

These moves are helping long-time employees and early investors realize returns, while giving latecomers a shot at high-growth companies.

Investor demand is heating up too. According to EquityZen, average discounts in secondary markets have compressed to just 13% below last-round valuations — the lowest level observed between Q1’23 and Q2’25. That pricing shift reflects growing competition and perceived upside, even in companies potentially years from IPO.

While large players like SpaceX, Ripple, and OpenAI continue to dominate transaction volume, interest is expanding to smaller unicorns and breakout startups. In Q2’25, 7 of EquityZen’s top 10 secondary movers had Mosaic scores over 800 and valuations north of $1B, including names like Axiom Space, Brex, and Skild AI.

![]() Explore 500+ private tech companies with strong secondary potential

Explore 500+ private tech companies with strong secondary potential

As secondary markets mature, they’re reshaping liquidity expectations — and giving investors new ways to get exposure to private tech winners without waiting for the IPO window to reopen.

5. New exit models emerge amidst the AI talent war

The intensifying race for AI talent is driving a new wave of unconventional exits in the tech ecosystem, bypassing traditional M&A while still delivering strategic value to acquirers.

Tight regulation has pushed big tech companies to shift away from full takeovers and toward deal structures that offer access to technology and, more importantly, talent, without triggering antitrust alarms.

Large minority stakes have emerged as one such mechanism. In Q2’25, Meta invested $14.8B for a 49% stake in Scale, marking the largest private funding round of the quarter. As part of the deal, Meta hired Scale’s CEO and founder, Alexandr Wang. At their current pace, big tech companies are on track to complete 14 corporate minority deals in 2025.

Reverse acqui-hires — where acquirers buy the team (fully or partially) and license the technology — are also gaining momentum. These hybrid transactions often include lucrative licensing fees that serve as a partial liquidity event for investors.

Notable examples include:

Google hiring key personnel from Windsurf to join its DeepMind division, including CEO Varun Mohan and co-founder Douglas Chen

Amazon hiring key members of Adept

Microsoft bringing in employees from Inflection AI

These transactions let acquirers cherry-pick talent and assets without facing regulatory hurdles or needing to buy out entire cap tables.

But it’s not just big tech adapting; major LLM developers are adopting similar tactics. OpenAI and Anthropic have collectively made 3 acqui-hires so far in 2025 — Context.ai, Crossing Minds, and Humanloop.

These nontraditional exits may complicate fundraising and hiring for AI startups, as investors and employees weigh the risk of being bypassed in partial team acquisitions. In response, both groups may begin negotiating protective terms to ensure they aren’t left behind.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.