Digital health roared into 2025, with funding, M&A, and unicorn births all hitting multi-year highs. We break down the data and trends driving this rebound — from AI’s growing dominance in dealmaking to the return of billion-dollar exits — using CB Insights data.

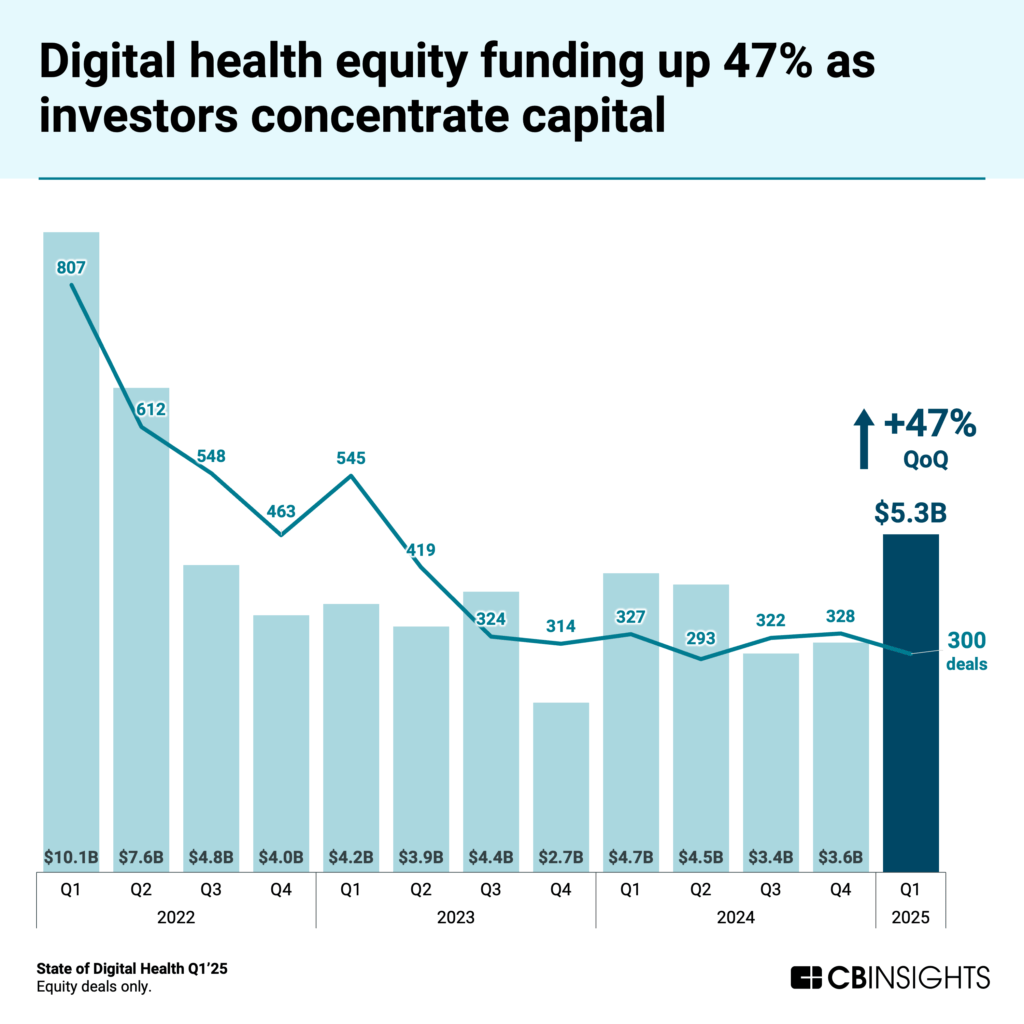

Digital health funding rebounded sharply in Q1’25, reaching levels not seen since mid-2022 despite continued contraction in deal volume. This divergence points to a more selective funding environment, with capital concentrating around established companies, particularly those leveraging AI for specialized healthcare applications.

The sector also showed renewed vitality through the return of billion-dollar M&A deals and the highest quarterly addition of new unicorns in nearly three years. These developments further confirm that the digital health landscape is prioritizing specialized market leaders over broader capital distribution.

Key takeaways from the report include:

Investors are concentrating capital in fewer, higher-quality bets. Equity funding jumped 47% QoQ to reach the highest level since Q2’22, even as deal count dropped 9%. Startups with strong clinical validation, demonstrable ROI, and scalable business models are leading the pack.

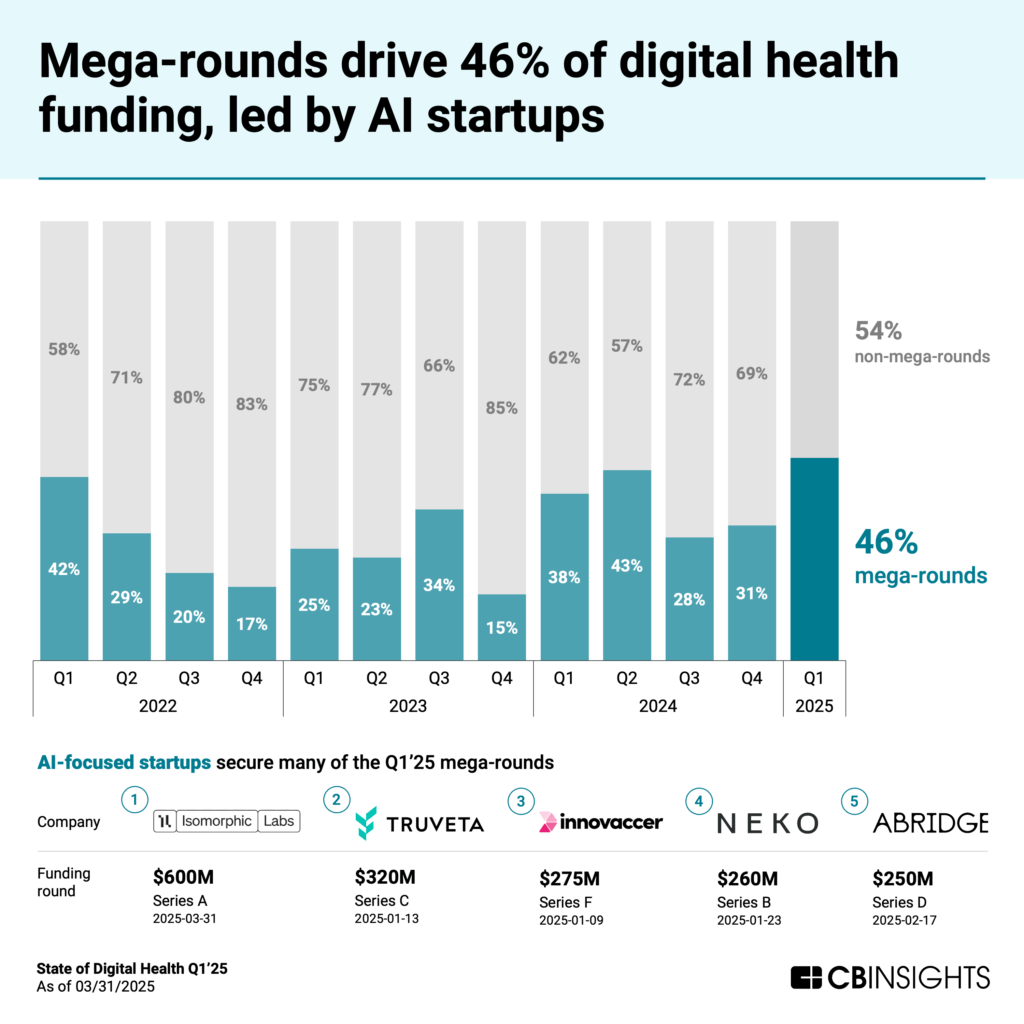

Mega-rounds are back, and AI is claiming most of them. Funding from mega-rounds ($100M+ deals) surged to $2.5B across 11 deals in Q1, capturing 46% of all digital health funding — the highest share since Q4’21. AI-focused startups secured 8 of these 11 mega-rounds, signaling where investors expect outsized returns.

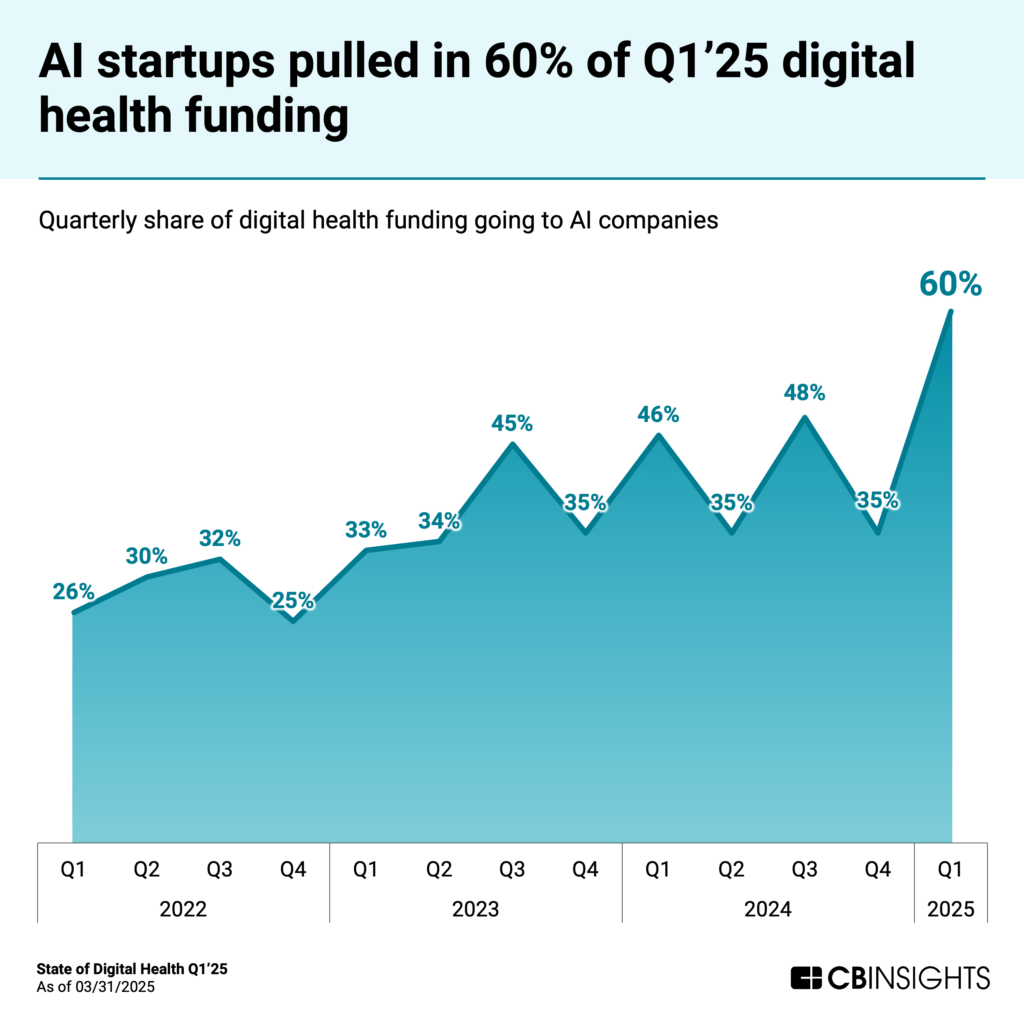

AI companies are capturing more than half of digital health funding. AI startups raised $3.2B in Q1, or 60% of all digital health funding — up from 41% in 2024. Top-funded segments included AI-derived small molecule drug discovery and clinical documentation tools, underscoring the shift toward targeted, high-impact applications.

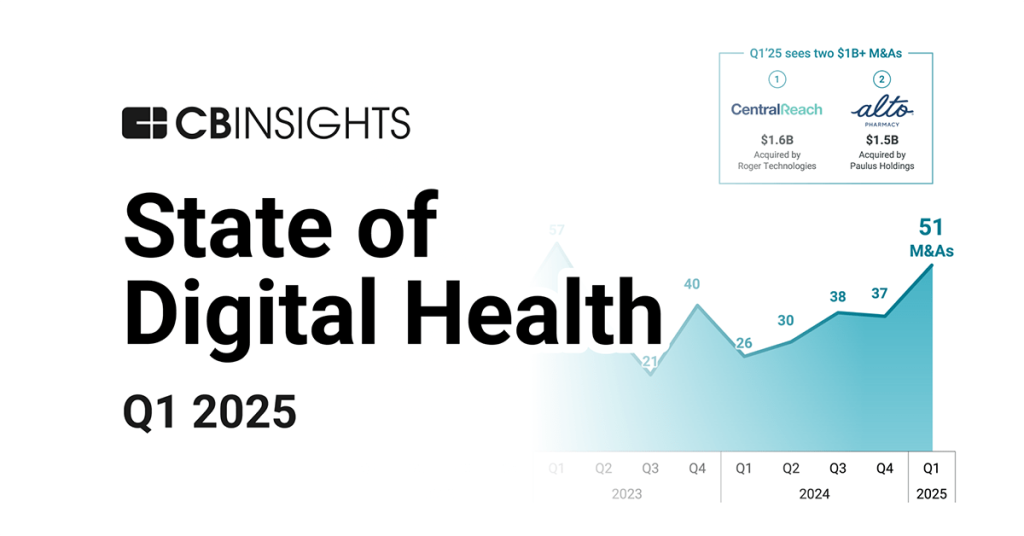

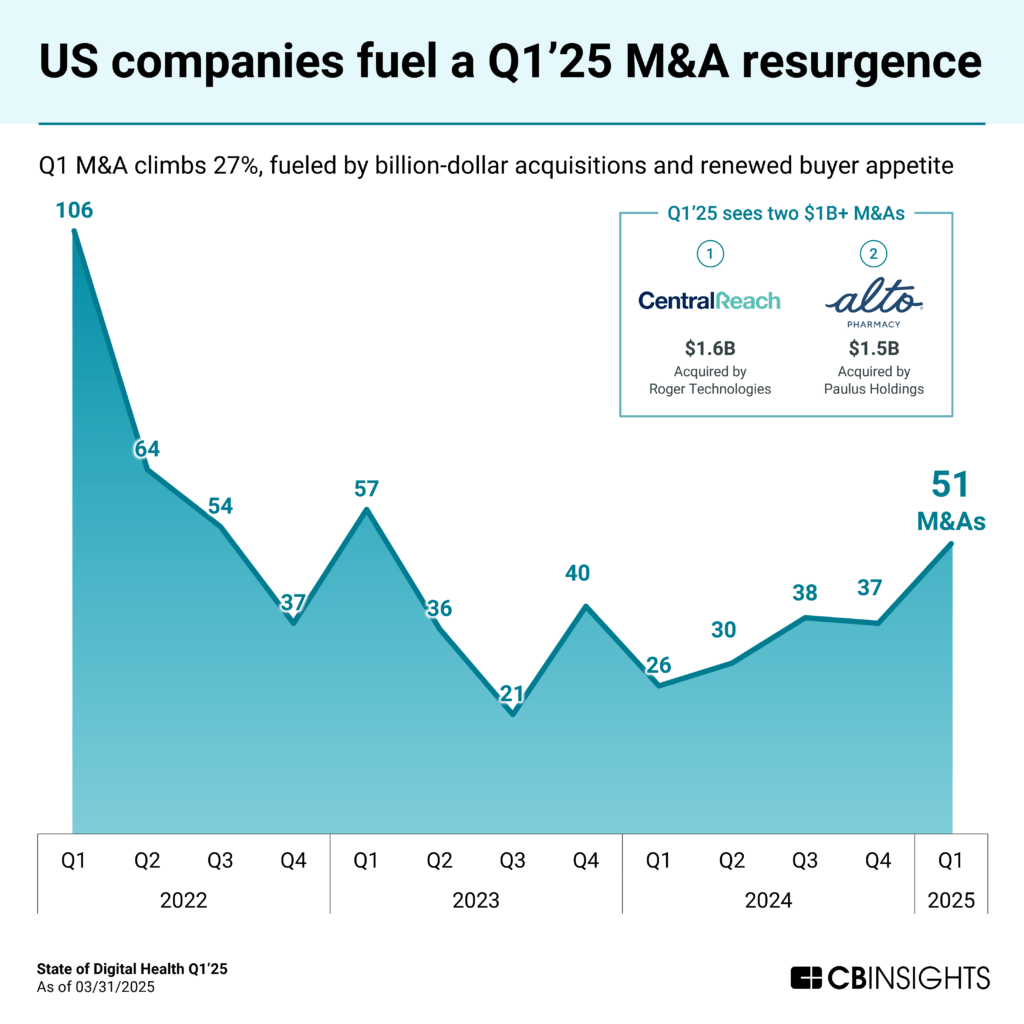

Billion-dollar deals mark a digital health M&A revival. M&A activity surged 27% QoQ to 51 deals in Q1, with the US driving growth and two $1B+ acquisitions (CentralReach and Alto Pharmacy) demonstrating renewed market confidence in high-value digital health platforms.

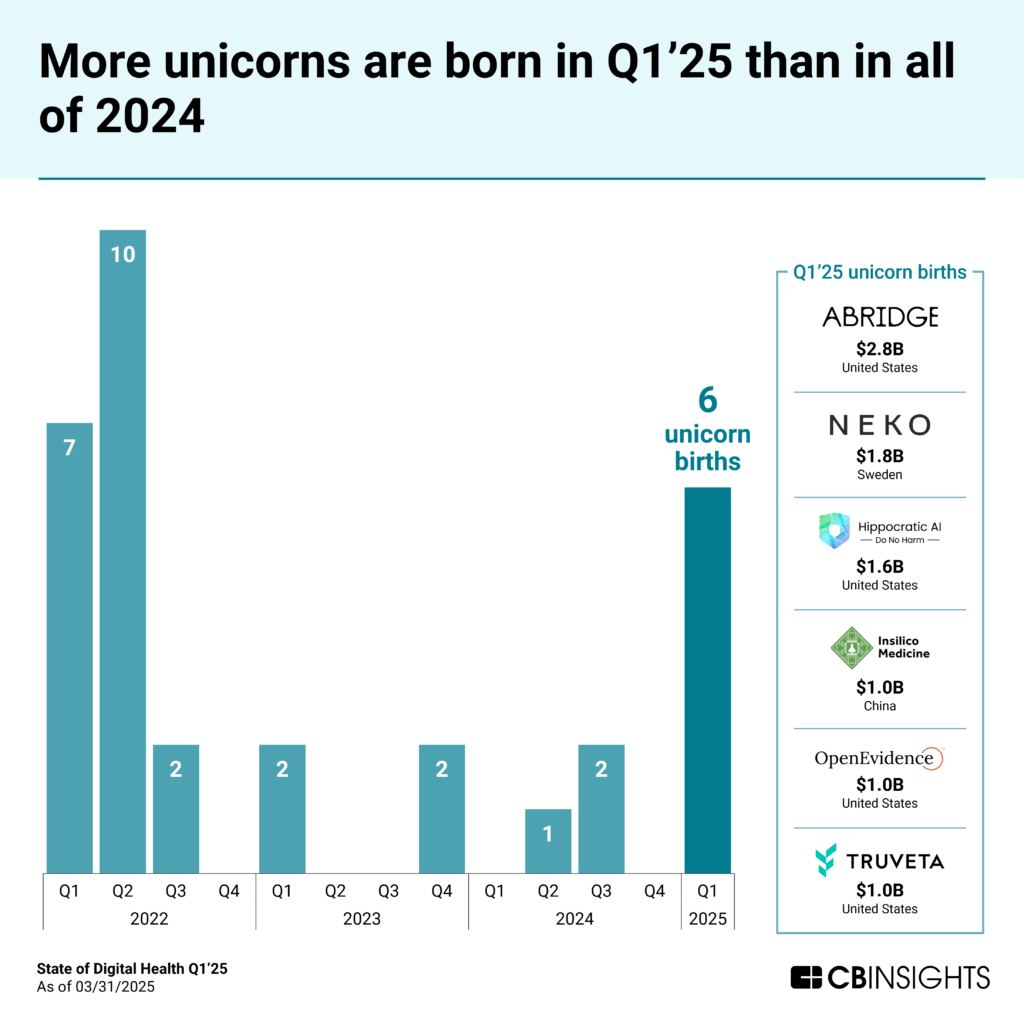

Unicorn creation rebounds, driven by AI-native platforms. Digital health saw 6 new unicorns in Q1’25 — more than in all of 2024 — and the highest quarterly total since Q2’22. With half focused on AI for provider workflows, the data suggests investor conviction is highest where AI directly supports care delivery.

We dive into the trends below.

Investors are concentrating capital in fewer, higher-quality bets

Digital health equity funding surged 47% QoQ, making it the strongest quarter since Q2’22. But while capital surged, deal volume slipped 9%, underscoring a broader VC trend: fewer bets, bigger checks.. This consolidation pushed the global median deal size from $5.4M to $6.4M.

This growth was powered by a handful of major raises, most notably Isomorphic Labs‘ record-breaking $600M Series A on the final day of Q1. This investment — the largest ever for AI in drug discovery — will support the company’s evolution from an AI molecular design platform to a comprehensive therapeutic discovery engine.

Deal stage distribution also shifted. Early-stage deal share declined from 60% of total volume in 2024 to 51% in 2025 YTD, while mid and late-stage deal shares increased slightly. But the most striking change was in deal size: median late-stage deal size grew 96% QoQ, compared to 41% for mid-stage and 25% for early-stage rounds.

This late-stage surge reflects investor preference for companies with regulatory milestones and scalable AI platforms. Examples include Saluda Medical, which received FDA approval for its Evoke System; Insilico Medicine, advancing drug candidates to clinical trials; and Innovaccer, now serving 6 of the top 10 US healthcare systems.

![]() Track 11K+ digital health companies

Track 11K+ digital health companies

Mega-rounds are back, and AI is claiming most of them

Mega-rounds made a strong comeback in Q1’25, totaling $2.5B across 11 deals — more than double Q4’24’s funding, despite only a modest uptick in volume. These $100M+ investments captured 46% of all digital health funding, marking the highest concentration of capital in mega-rounds since Q4’21 and signaling renewed investor confidence in mature digital health companies.

AI-focused startups dominated these large investments, securing 8 of the 11 mega-rounds in Q1. Standout deals include Isomorphic Labs’ $600M Series A for therapeutic development, Truveta‘s $320M Series C for electronic health record (EHR) data analytics, and Innovaccer’s $275M Series F for its clinical decision support platform.

![]() Explore this quarter’s mega-rounds

Explore this quarter’s mega-rounds

AI companies are capturing more than half of digital health funding

AI now accounts for the majority of digital health funding, pulling in 60% of Q1’25 investment — up from 41% in 2024 and 37% in 2023. This quarter marks the first time AI companies have captured more than half of all digital health dollars, signaling a structural shift likely to continue as the sector matures.

Despite an overall decline in digital health deals, AI digital health deal volume rose 6% QoQ — from 109 in Q4’24 to 116 in Q1’25 — underscoring sustained investor appetite for AI-driven solutions. The top-funded AI markets were AI-derived small molecule drugs ($204M across 5 deals) and clinical documentation solutions ($372M across 4 deals).

The surge reflects not just hype, but real traction: AI is evolving from general-purpose tools to vertical-specific, regulatory-compliant platforms that address provider burnout, accelerate R&D, and improve diagnostics.

High-momentum startups in Q1’25 — according to CB Insights’ Mosaic score — include Ubie (Mosaic score: 922), which offers an AI-powered symptom tracker, and Suki (Mosaic score: 913), a voice assistant for clinical documentation. These use cases show how AI is delivering measurable clinical and operational value across the ecosystem.

![]() See 370+ high-potential AI startups in digital health

See 370+ high-potential AI startups in digital health

Billion-dollar deals mark a digital health M&A revival

M&A activity surged 27% QoQ to 51 deals in Q1, reaching its highest level since Q1’23. This growth was driven entirely by US companies, where deal volume increased 85% QoQ to 37, while Europe dipped slightly (12 to 10 deals) and Asia saw just 1 deal, down from 3.

The quarter featured two $1B+ acquisitions — the first such deals since Q2’22 — signaling the return of strategic buyers to the market. Roper Technologies‘ acquired CentralReach, an autism and IDD care software provider, for $1.6B and Paulus Holdings purchased digital pharmacy platform Alto Pharmacy for $1.5B.

These acquisitions highlight a strategic shift toward platforms with market dominance and proprietary data. Alto Pharmacy serves more than 500,000 patients and captures deep insights into medication use and patient behavior. CentralReach supports 200,000 users with rich clinical and behavioral datasets for autism and IDD care. Strategic buyers are showing a clear willingness to pay premium valuations for scaled operations paired with hard-to-replicate data ecosystems.

Unicorn creation rebounds, driven by AI-native platforms

6 new unicorns were minted in Q1’25 – the most in a single quarter since Q2’22 – but with a striking difference in scale. Today’s unicorns are leaner, averaging just 196 employees compared to 408 during the 2021-2022 boom. OpenEvidence reached the milestone with a team of just 21.

They’re also reaching unicorn status faster. The average time to unicorn this year has fallen to 6 years from 7 in 2022, with Hippocratic AI setting the pace — hitting a $1B+ valuation just two years after its founding in 2023.

Regionally, the US led the charge with 4 new unicorns, while Europe contributed 1 and Asia celebrated its first digital health unicorn birth since 2021.

Half of these newly minted unicorns apply AI to support provider workflows: Hippocratic AI (patient follow-up), Abridge (clinical documentation), and OpenEvidence (healthcare decision-making). This trend highlights both growing demand for clinician-support tools — and strong investor conviction in AI’s ability to deliver venture-scale returns.

With M&A activity surging and $1B+ acquisitions returning to the market, these companies are prime candidates for notable future exits. Based on CB Insights’ M&A probability metrics, OpenEvidence stands out as the frontrunner with a 35% likelihood of acquisition in the next 2 years, while Neko Health follows with 22% — both exceeding the market average of 20%. follows with 22% – both exceeding the market average of 20%.

![]() See all of digital health’s current 120+ unicorns

See all of digital health’s current 120+ unicorns

MORE DIGITAL HEALTH RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.