CVCs are prioritizing quality over quantity, with deal volume hitting a 7-year low even as deal sizes grow. We break down the trends shaping corporate venture capital using CB Insights data.

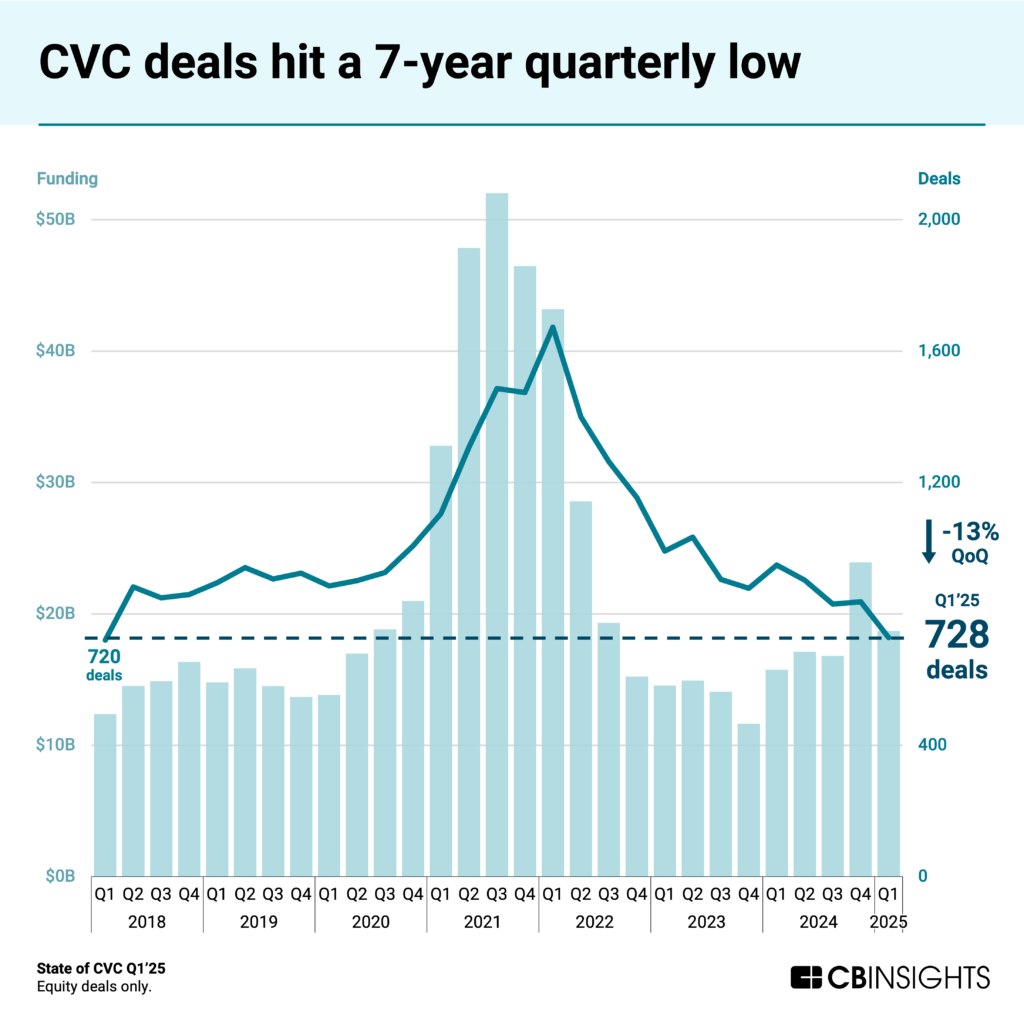

In Q1’25, corporate venture capital hit its lowest deal volume in 7 years, with transactions plummeting to 728 deals and CVC-backed funding dropping 22% QoQ to $18.7B.

Despite this contraction, median deal size has climbed to $10M this year (up from $8.9M in full-year 2024), revealing that CVCs are making fewer but larger investments as economic uncertainty persists.

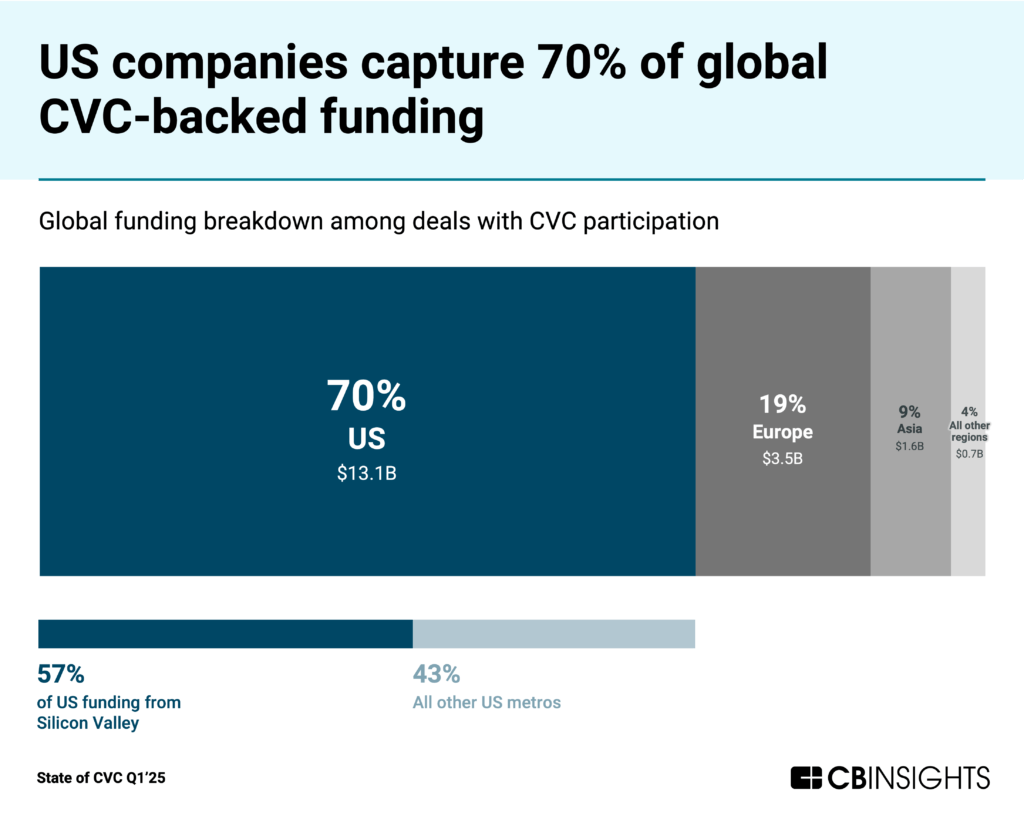

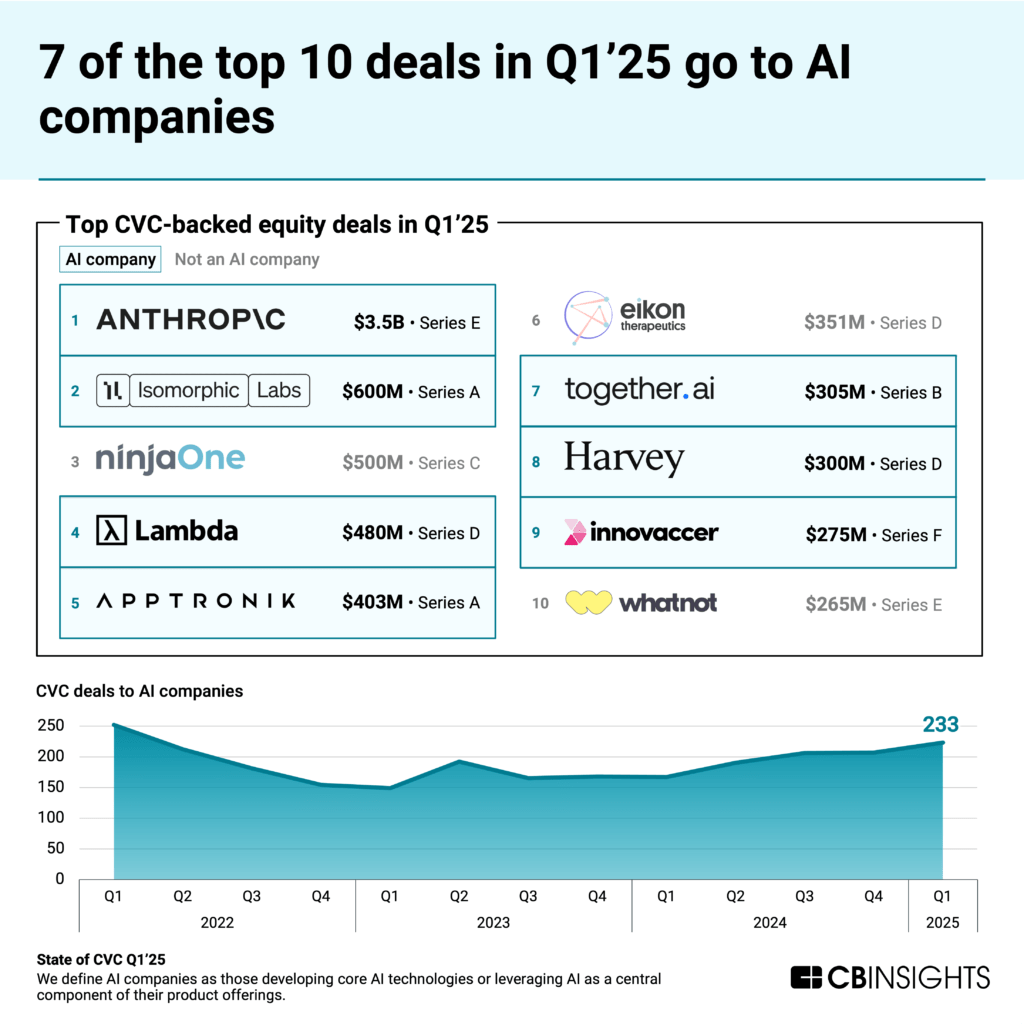

The quarter highlighted 2 other dominant forces reshaping the CVC landscape: US startups captured 70% of global CVC-backed funding — the 2nd straight quarter at 70%+ — while AI startups secured 7 of the top 10 CVC deals worldwide. This reflects an intensifying race among CVCs to secure competitive footholds in leading technologies before rivals gain the upper hand.

Download the full report to access comprehensive data and charts on the evolving state of CVC across sectors, geographies, and more.

Key takeaways from the report include:

Deals continue their downward trend as investors remain selective. Global CVC deal volume fell 13% QoQ to 728 deals in Q1’25, reaching the lowest quarterly total since Q1’18. Mega-rounds ($100M+) accounted for 59% of the $18.7B in total funding, showing that CVCs are still making substantial bets in a more selective environment.

US companies dominate CVC investment dollars. In Q1’25, US startups captured $13.1B (or 70%) of global funding from deals with CVC participation. Within the US, Silicon Valley maintained its leading position with $7.5B across 97 deals, underscoring its continued importance as a strategic hub for corporate investment.

AI continues to command CVC attention and dollars. AI startups secured 7 of the 10 largest CVC-backed deals in Q1’25, with these deals representing 31% of all quarterly funding among CVC-backed deals. The biggest deal was Anthropic‘s massive $3.5B Series E round, backed by the venture arms of Cisco and Salesforce.

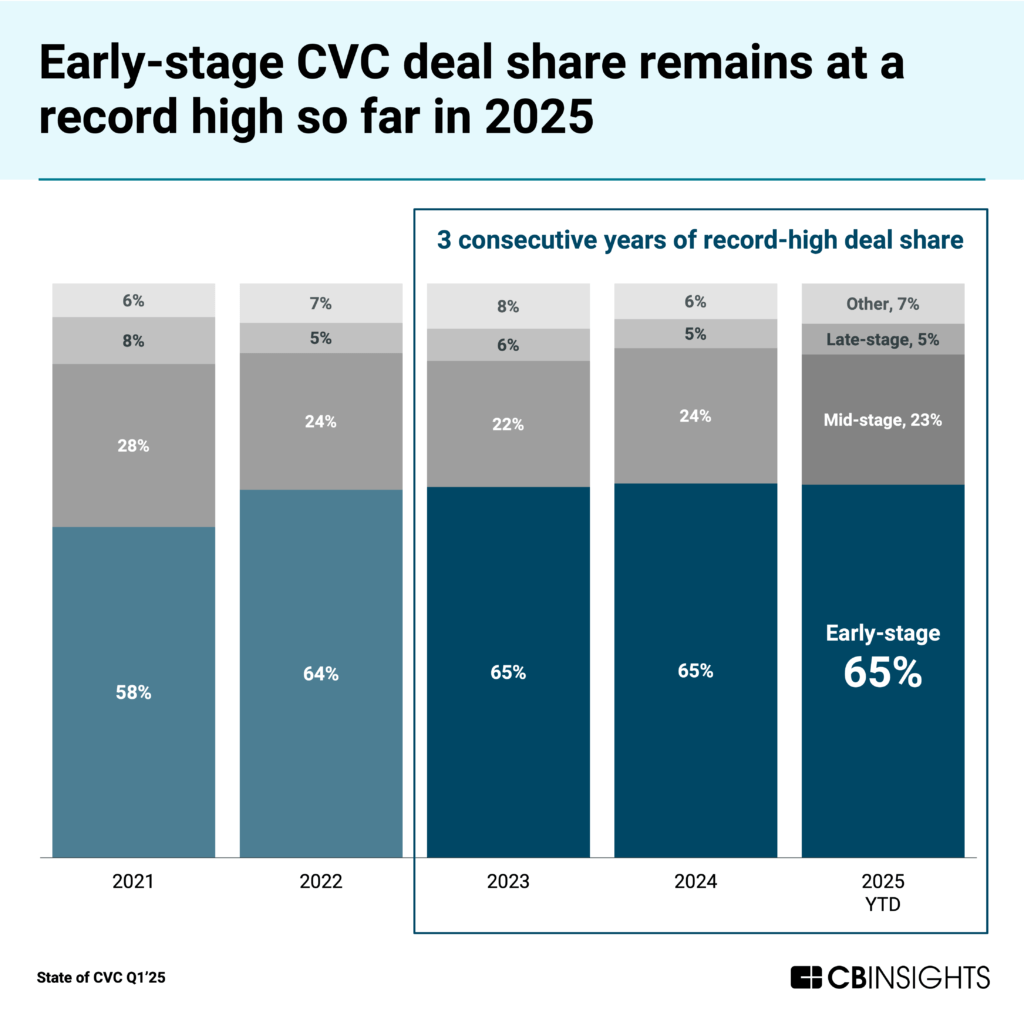

Early-stage deal share holds steady at the highest level in over a decade. Early-stage investments made up 65% of all CVC deal activity in Q1’25, matching the high-water mark sustained annually since 2023. With the median early-stage deal size growing to $5.8M this year so far, CVCs are placing larger bets on nascent companies that have long-term growth potential.

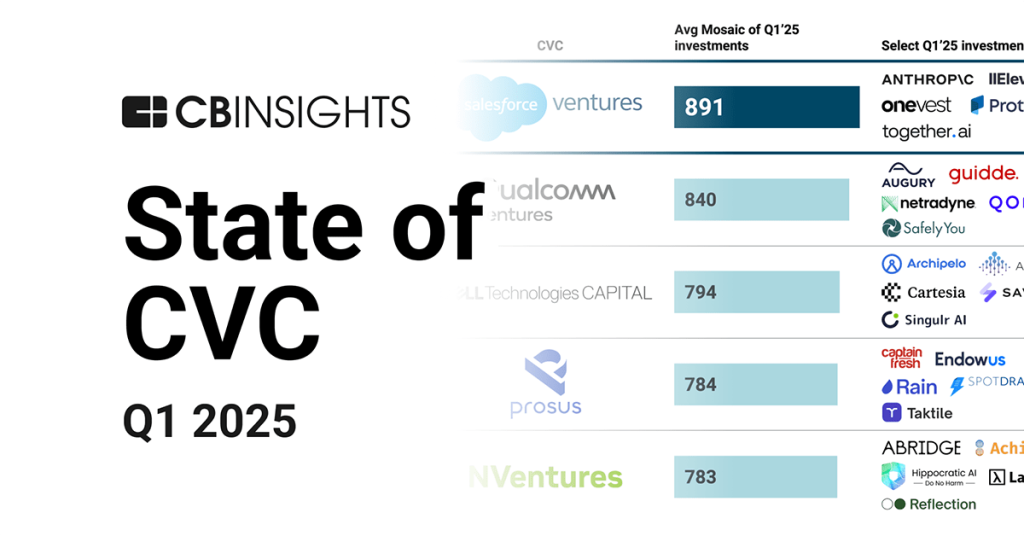

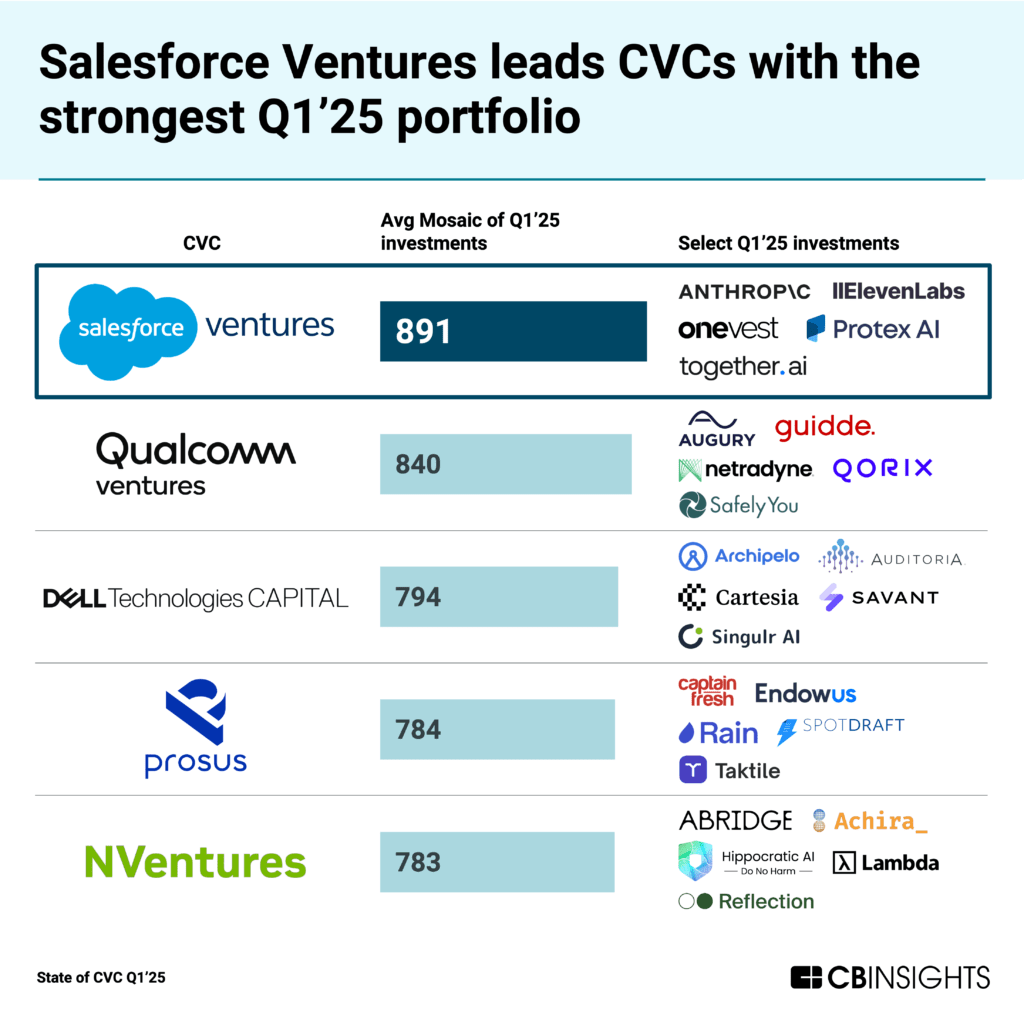

Salesforce Ventures leads with the strongest Q1 portfolio. Among CVCs with 5+ investments in Q1’25, Salesforce Ventures leads the way with the highest average Mosaic score, followed by Qualcomm Ventures. Salesforce Ventures’ Q1’25 investments include 2 of the largest rounds this quarter — Anthropic ($3.5B) and Together AI ($305M) — signaling the importance of AI in its growth strategy.

We dive into the trends below.

Deals continue their downward trend as investors remain selective

Global CVC deals fell 13% QoQ to 728, the lowest quarterly total since Q1’18. CVC-backed funding also declined 22% to $18.7B.

Despite the pullback, $100M+ mega-rounds accounted for 59% of total funding, indicating that CVCs are still making large, strategic bets but in a more selective environment.

While the number of deals decreased, the median size of CVC-backed deals increased to $10M — up from $8.9M last year — as CVCs write larger checks for companies they believe will deliver long-term strategic value.

The shift toward fewer but larger deals reflects a broader flight to quality across venture capital. Notable mega-rounds in Q1’25 included Anthropic’s massive $3.5B Series E round, which represented nearly 19% of all Q1 CVC-backed funding globally and showcased the concentration of capital in market-leading companies.

US companies dominate CVC investment dollars

US companies captured 70% of global CVC-backed funding in Q1’25, securing $13.1B despite macroeconomic volatility. The US funding share represents the 2nd quarter in a row at 70% or above, up significantly from the historical norm of ~50% before 2023.

Silicon Valley maintained its position as the epicenter of CVC investment, attracting $7.5B across 97 deals — more than half the total US funding.

Several unicorn rounds powered the US’ strong funding quarter, including those from Anthropic, NinjaOne, Lambda, and Apptronik.

The capital concentration is striking given that US companies represented just 37% of global deal volume (269 of 728 deals). The substantial gap between deal share and funding share highlights a key regional difference in investment approach, with US deals ballooning in size. The median US deal reached $17M in Q1’25 — over 50% more than Europe, the next highest region, at $10.9M.

However, as corporate uncertainty grows due to shifting tariff policies, the US’ funding dominance will be a critical trend to monitor in the coming quarters.

![]() Hear from CBI analysts on the global impact of tariffs

Hear from CBI analysts on the global impact of tariffs

AI continues to command CVC attention and dollars

AI dominated the biggest CVC investments in Q1’25 — securing 7 of the top 10 deals — as CVCs place massive bets on startups with the potential to reshape industries.

CVCs are investing in AI companies across diverse areas. These range from general-purpose AI agents & copilots to hardware applications like Apptronik’s AI-powered industrial humanoid robots.

Other leading CVC-backed AI deals in Q1’25 include:

For parent corporations, these investments go well beyond financial returns. They provide strategic access to technologies that could determine competitive advantage in the AI era.

![]() Track the latest CVC-backed AI deals

Track the latest CVC-backed AI deals

Early-stage deals hold at the highest levels in over a decade

Early-stage investments remain at a record share of CVC activity, accounting for 65% of all deals in Q1’25 — matching the same level seen over the past 2 years and up 7 percentage points from where it was in 2021.

The strategic shift comes with increasing commitment levels, as the median early-stage deal size grew to $5.8M in Q1’25. Rather than spreading smaller amounts across many startups, CVCs are making substantial, focused bets on promising early-stage companies.

Regional strategies show notable differences: Asia leads with 39% of early-stage CVC deals, compared to 33% in the US and 21% in Europe. This suggests that corporate investors in Asia are particularly aggressive in securing access to emerging technologies at the earliest possible stage.

Across all markets, this pronounced shift toward early-stage investing reflects a fundamental change in CVC strategy: corporate investors are prioritizing gaining early access to innovation rather than supplying later-stage growth capital, positioning themselves to shape technological development from the beginning rather than joining after validation.

Salesforce Ventures leads with the strongest Q1 portfolio

Among CVCs with 5+ investments in Q1’25, Salesforce Ventures leads with the highest average Mosaic score for its Q1’25 bets (891 out of 1,000), followed by Qualcomm Ventures (840). Salesforce Ventures’ Q1’25 investments include 2 of the largest rounds this quarter: Anthropic ($3.5B) and Together AI ($305M).

Meanwhile, Google Ventures was the most active CVC in Q1’25 with 17 companies backed, followed by Japan-based investors Mitsubishi UFJ Capital and SMBC Venture Capital with 15 companies each. With 11 companies each, In-Q-Tel and Mizuho Capital rounded out the top five, highlighting the dominance of US- and Japan-based corporate investors.

![]() Track top CVC-backed companies by Mosaic score

Track top CVC-backed companies by Mosaic score

MORE VENTURE RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.