From a new breed of AI unicorns to the M&A wave, we look at key changes in the AI landscape using CB Insights data.

2024 was a transformative year for the AI landscape.

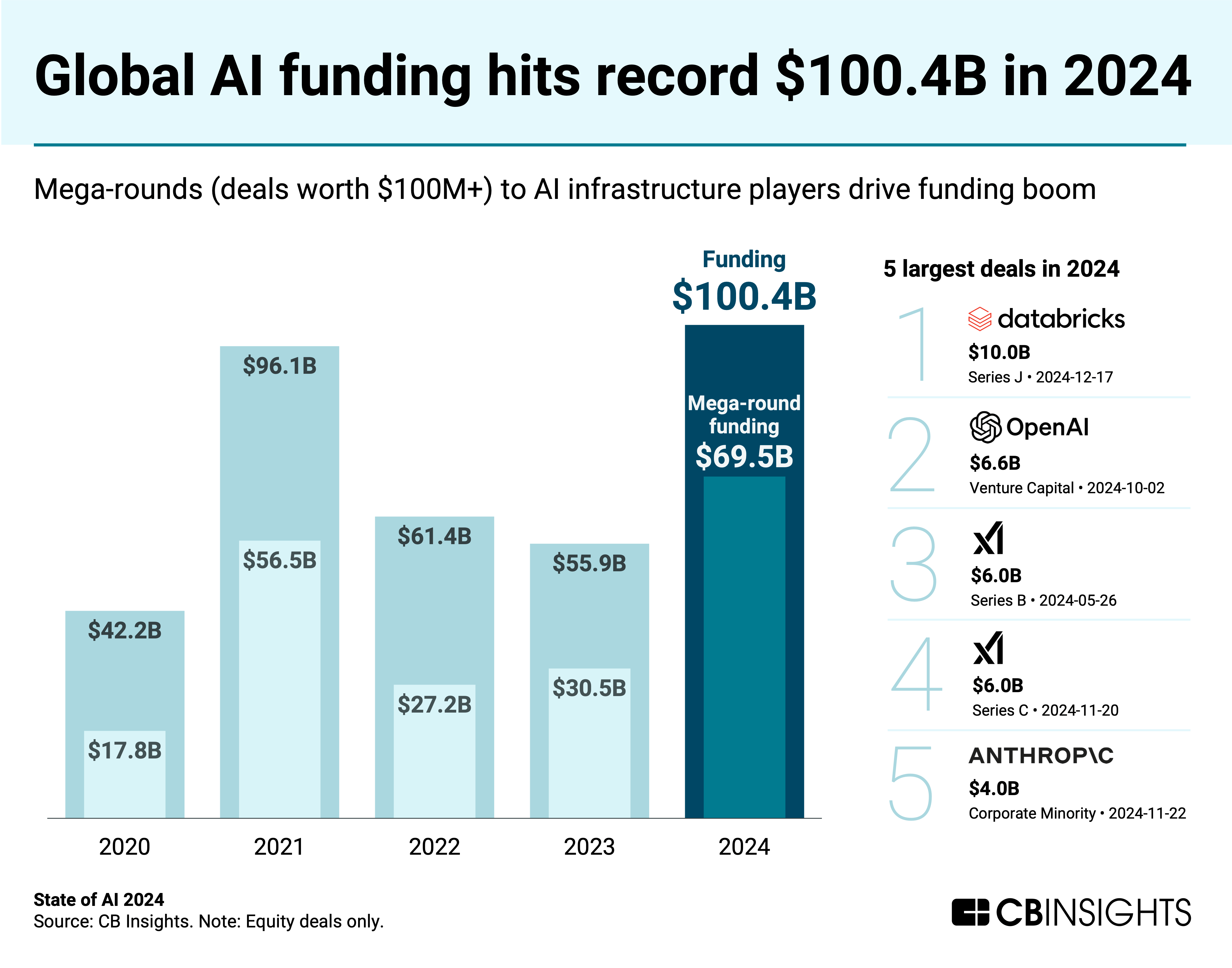

Venture funding surged past the $100B mark for the first time as AI infrastructure players pulled in billion-dollar investments. A wave of M&A deals and rapidly scaling AI unicorns further underscored the tech’s momentum.

Download the full report to access comprehensive data and charts on the evolving state of AI across exits, top investors, geographies, and more.

Key takeaways include:

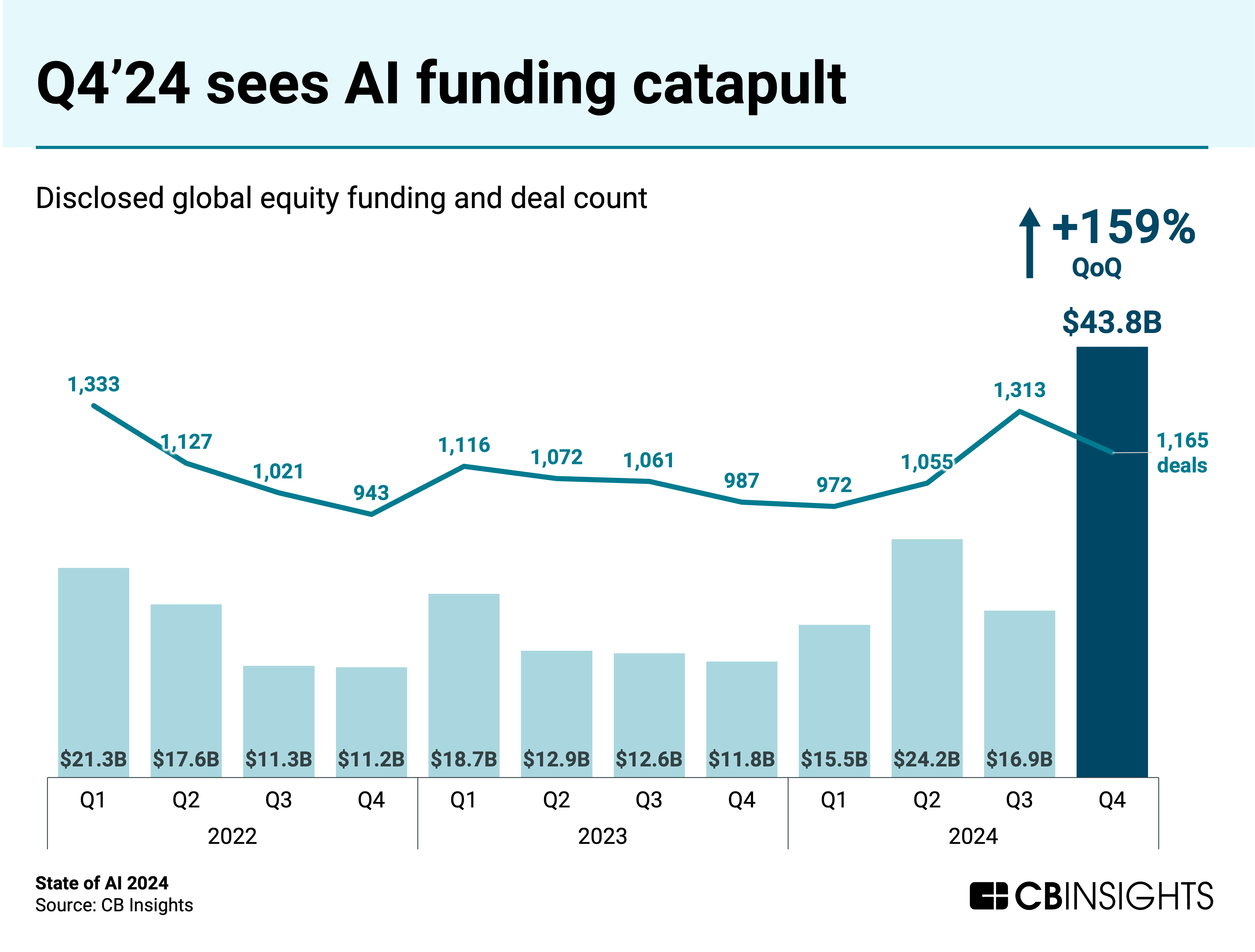

Massive deals drive AI funding boom. AI funding hit a record $100.4B in 2024, with mega-rounds accounting for the largest share of funding we’ve tracked to date (69%) — reflecting the high costs of AI development. Quarterly funding surged to $43.8B in Q4’24, driven by billion-dollar investments in model and infrastructure players. At the same time, nearly 3 in 4 AI deals (74%) remain early-stage as investors look to get in on the ground floor of the AI opportunity.

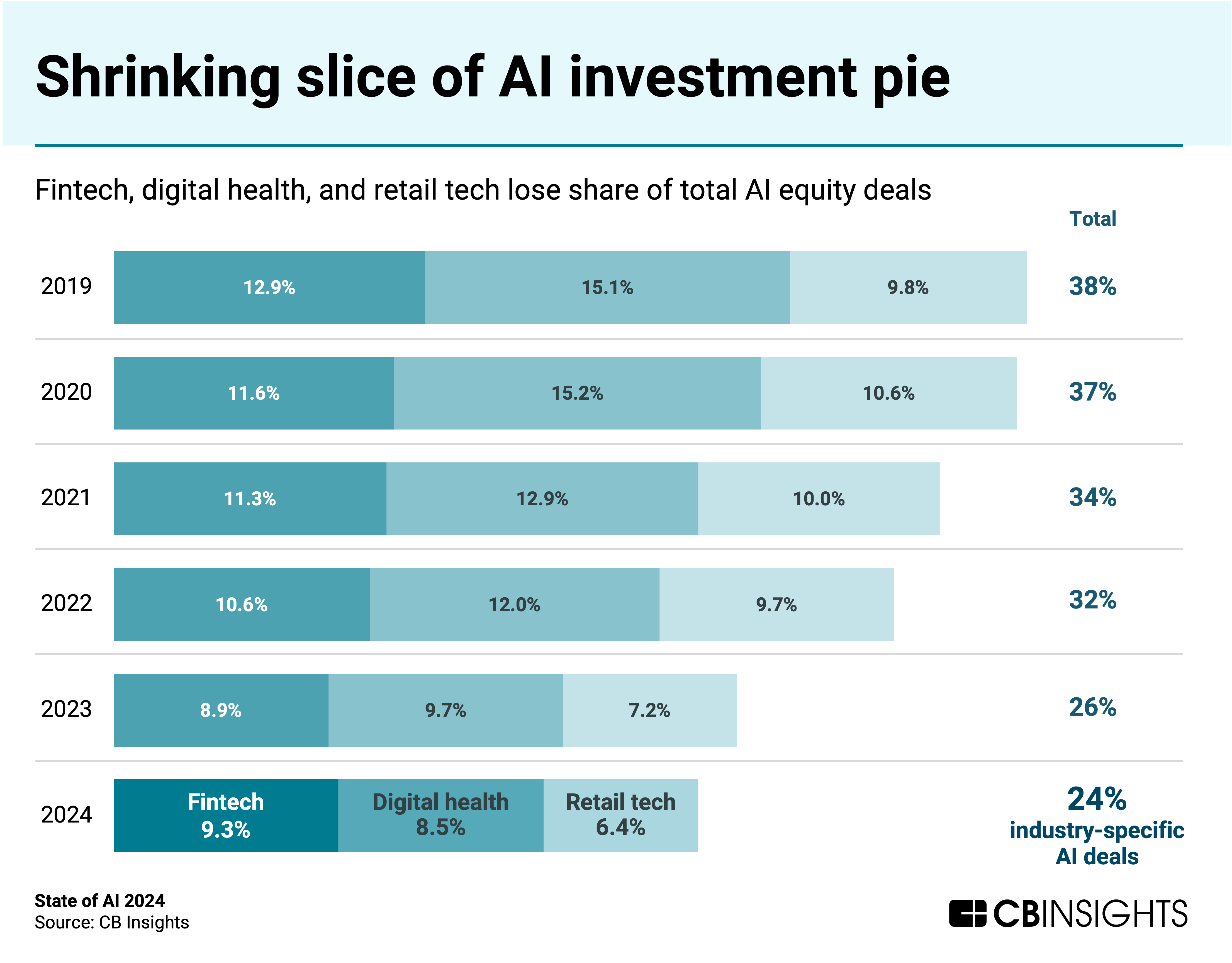

Industry tech sectors lose ground in AI deals. Vertical tech areas like fintech, digital health, and retail tech are securing a smaller percentage of overall AI deals (declining from a collective 38% in 2019 to 24% in 2024). The data suggests that companies focused on infrastructure and horizontal AI applications are drawing greater investor interest amid generative AI’s rise.

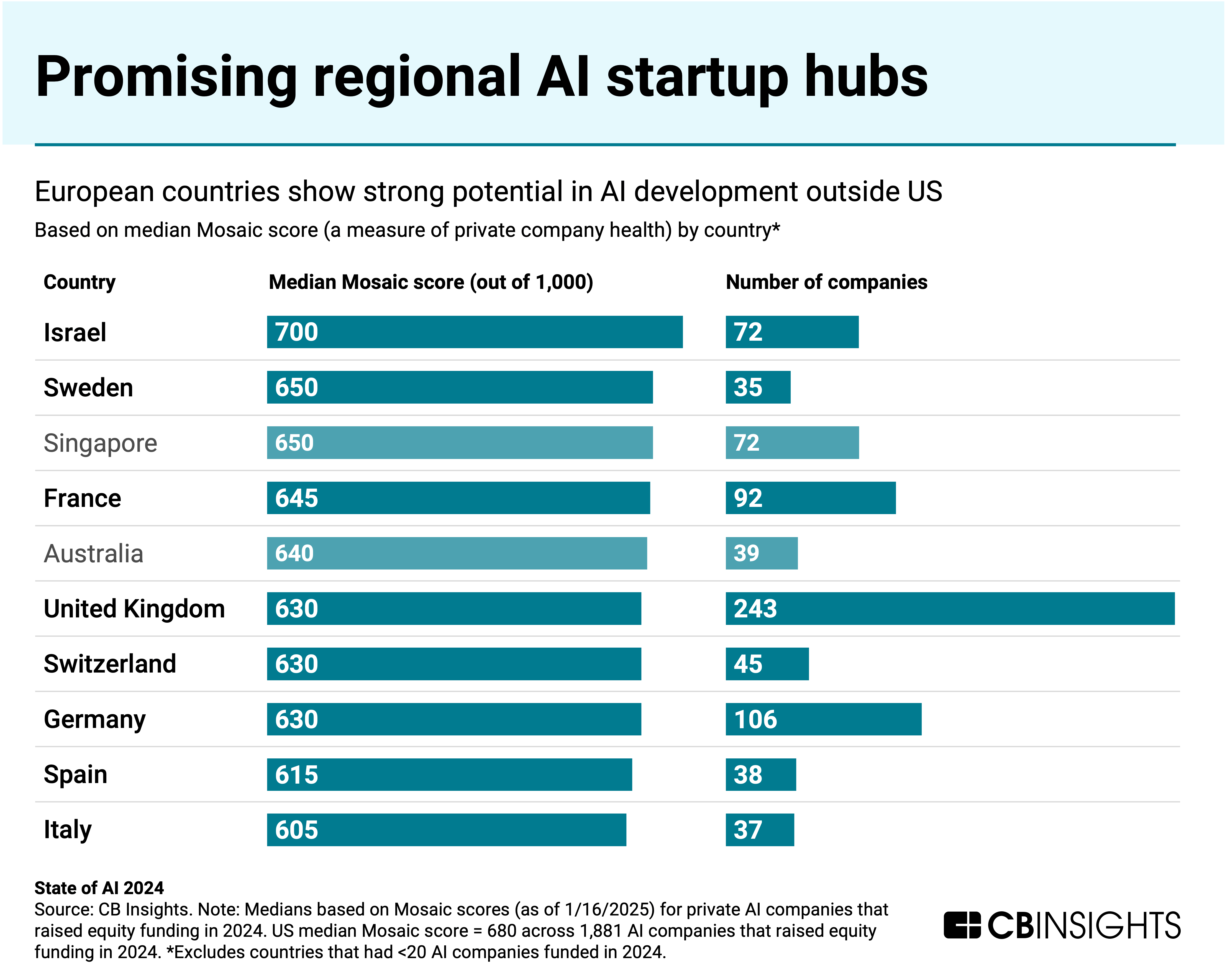

Outside of the US, Europe fields high-potential AI startup regions. While the US dominated AI funding (76%) and deals (49%) in 2024, countries in Europe show strong potential in AI development based on CB Insights Mosaic startup health scores. Israel leads with the highest median Mosaic score (700) among AI companies raising funding.

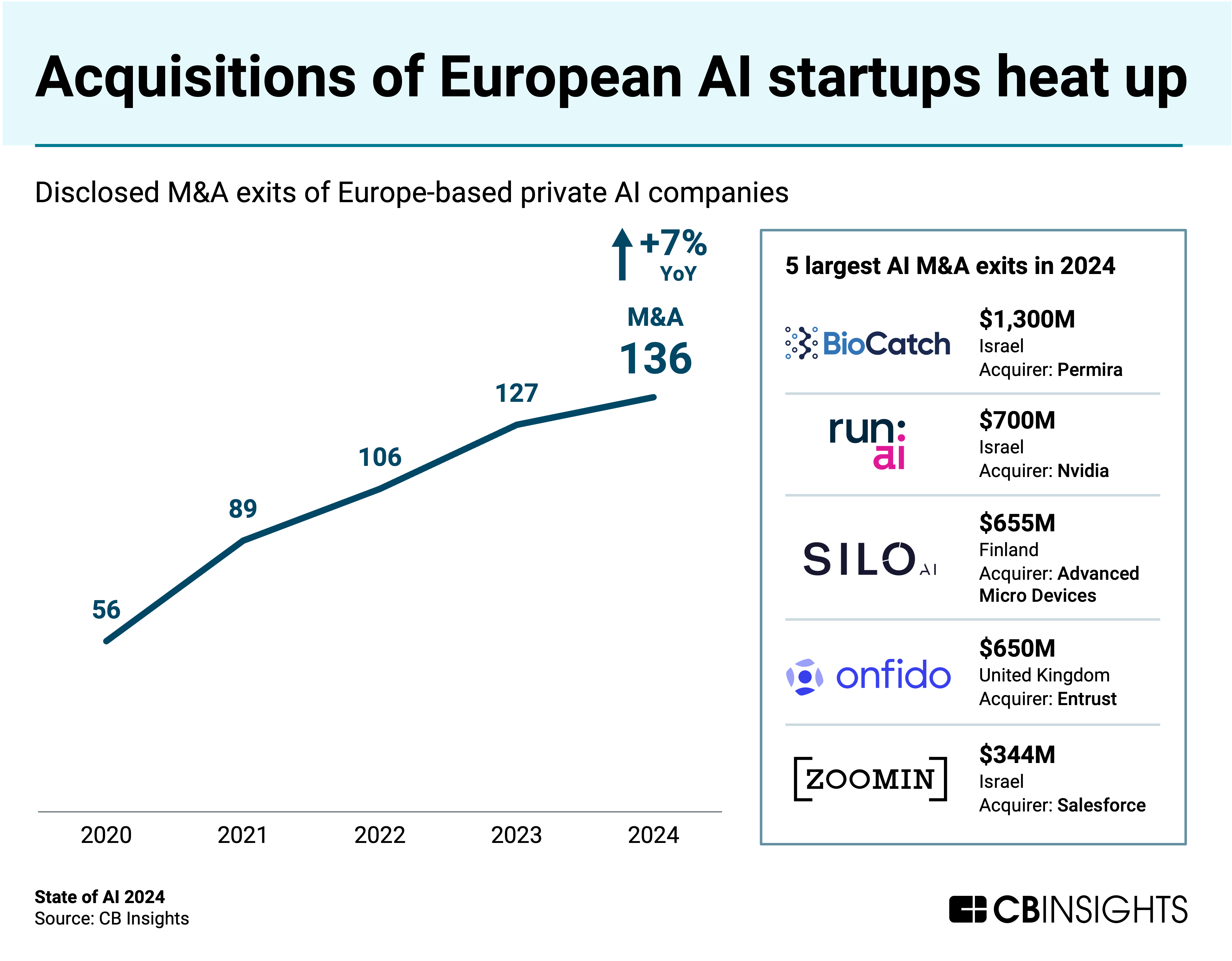

AI M&A activity maintains momentum. The AI acquisition wave remained strong in 2024, with 384 exits nearly matching 2023’s record of 397. Europe-based startups represented over a third of M&A activity, cementing a 4-year streak of rising acquisitions among the region’s startups.

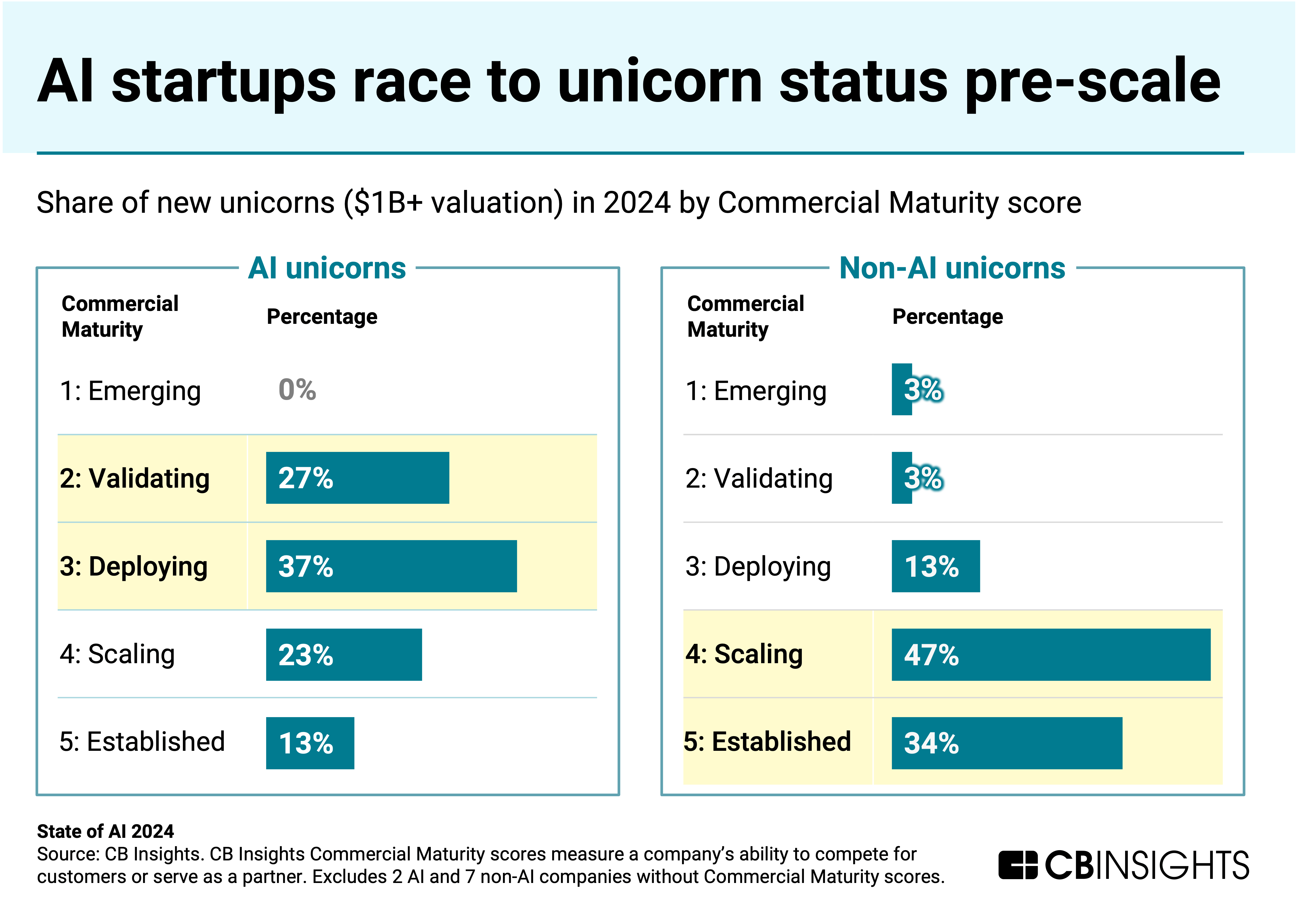

AI startups race to $1B+ valuations despite early market maturity. The 32 new AI unicorns in 2024 represented nearly half of all new unicorns. However, AI unicorns haven’t built as robust of a commercial network as non-AI unicorns, per CB Insights Commercial Maturity scores, indicating their valuations are based more on potential than proven business models at this stage.

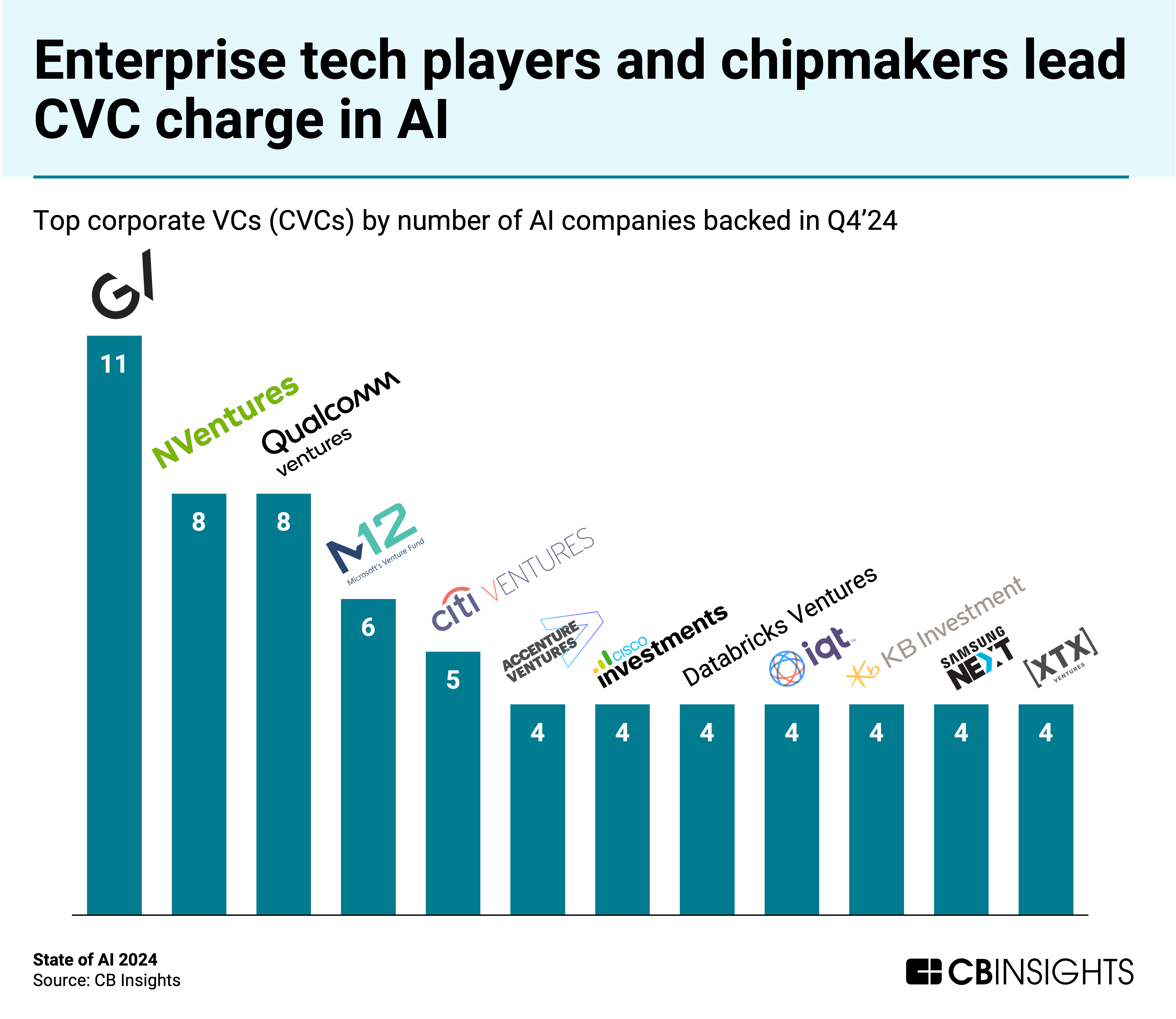

Tech leaders embed themselves deeper in the AI ecosystem. Major tech companies and chipmakers led corporate VC activity in AI during Q4’24, with Google (GV), Nvidia (NVentures), Qualcomm (Qualcomm Ventures), and Microsoft (M12) being the most active investors. This reflects the strategic importance of securing access to promising startups while providing them with essential technical infrastructure.

We dive into the trends below.

For more on key shifts in the AI landscape in 2025, check out this report on the implications of DeepSeek’s rise.

Massive deals drive AI funding boom

Globally, private AI companies raised a record $100.4B in 2024. At the quarterly level, funding soared to a record $43.8B in Q4’24, or over 2.5x the prior quarter’s total.

The funding increase is largely explained by a wave of massive deals: mega-rounds ($100M+ deals) accounted for 80% of Q4’24 dollars and 69% of AI funding in 2024 overall.

The year featured 13 $1B+ deals, the majority of which went to AI model and infrastructure players. OpenAI, xAI, and Anthropic raised 4 out of the 5 largest rounds in 2024 as they burned through cash to fund the development of frontier models.

Overall, the concentration of funding in mega-rounds reflects the high costs of AI development across hardware, staffing, and energy needs — and widespread investor enthusiasm around the AI opportunity.

But that opportunity isn’t limited to the largest players: nearly 3 in 4 AI deals (74%) were early-stage in 2024. The share of early-stage AI deals has trended upward since 2021 (67%) as investors look to ride the next major wave of value creation in tech.

![]() CBI Customers: Track 15,000+ AI companies

CBI Customers: Track 15,000+ AI companies

Industry tech sectors lose ground in AI deals

Major tech sectors — fintech, digital health, and retail tech — are making up a smaller percentage of AI deals.

While the overall annual AI deal count has stayed steady above 4,000 since 2021, dealmaking in sectors like digital health and fintech has declined to multi-year lows. So, even as AI companies make up a greater share of the deals that do happen in these industries, the gains haven’t been enough to register in the broader AI landscape.

The data suggests that, amid generative AI’s ascendancy, AI companies targeting infrastructure and horizontal applications are drawing a greater share of deals.

With billions of dollars flowing to the model/infra layer as well, investors appear to be betting that the economic benefits of the latest AI boom will accrue to the builders.

Outside of the US, Europe fields high-potential AI startup regions

Although US-based companies captured 76% of AI funding in 2024, deal activity was more distributed across the globe. US AI startups accounted for 49% of deals, followed by Asia (23.2%) and Europe (22.9%).

Comparing median CB Insights Mosaic scores (a measure of private tech company health and growth potential on a 0–1,000 scale) for AI companies that raised equity funding in 2024 highlights promising regional hubs.

![]() Explore 500+ high-potential AI startups

Explore 500+ high-potential AI startups

European countries dominate the top 10 countries by Mosaic score (outside of the US). Israel, which has a strong technical talent pool and established startup culture, leads the pack with a median Mosaic score of 700.

Overall activity on the continent is dominated by early-stage deals, which accounted for 81% of deals to Europe-based startups in 2024, a 7-year high.

The European Union indicated in November that scaling startups is a top priority, pointing to the importance of increased late-stage private investment in remaining competitive on the global stage.

AI M&A activity maintains momentum

The AI M&A wave is in full force, with 2024’s 384 exits nearly reaching the previous year’s record-high 397.

Acquisitions of Europe-based startups accounted for over a third of AI M&A activity in 2024. Among the global regions we track, Europe is the only one that has seen annual AI acquisitions climb for 4 consecutive years. Although the US did see a bigger uptick YoY (16%) in 2024, posting 188 deals.

In Europe, UK-based AI startups led activity in 2024, with 32 M&A deals, followed by Germany (18), France (16), and Israel (12).

Major US tech companies, including Nvidia, Advanced Micro Devices, and Salesforce, participated in some of the largest M&A deals of the year as they embedded AI across their offerings.

![]() Search for recently funded AI companies with high M&A probabilities

Search for recently funded AI companies with high M&A probabilities

AI startups race to $1B+ valuations despite early market maturity

AI now dominates new unicorn creation. The 32 new AI unicorns in 2024 accounted for nearly half of all companies passing the $1B+ valuation threshold during the year.

These AI startups are hitting unicorn status with much smaller teams and at much faster rates than non-AI startups: 203 vs. 414 employees at the median, and 2 years vs. 9 years at the median.

![]() CBI Customers: Dive into data on every unicorn

CBI Customers: Dive into data on every unicorn

These trends reflect the current AI hype — investors are placing big early bets on AI potential. Many of these unicorns are still proving out sustainable revenue models. We can see this clearly in CB Insights Commercial Maturity scores. More than half of the AI unicorns born in 2024 are at the validating/deploying stages of development, while non-AI new unicorns mostly had to get to at least the scaling stage before earning their unicorn status.

Tech leaders embed themselves deeper in the AI ecosystem

In Q4’24, the top corporate VCs in AI (by number of companies backed) were led by a string of notable names: Google (GV), Nvidia (NVentures), Qualcomm (Qualcomm Ventures), and Microsoft (M12).

As enterprises rush to harness AI’s potential, big tech, chipmakers, and other enterprise tech players are building their exposure to promising companies along the AI value chain.

Meanwhile, startups are linking up with these players to not only secure funding for capital-intensive AI development but also access critical cloud infrastructure and chips.

MORE AI RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.