AI funding in the first half of 2025 has already surpassed 2024’s record full-year total. Deals are flowing to companies across the landscape, from AI infrastructure to defense tech to humanoid robots.

The fastest-growing startups and tech markets signal what’s next: the proliferation of agents and voice AI.

Below, we break down the top stories from this quarter’s report, including:

Massive deals continue to drive the AI funding boom

Consolidation is in full force in the AI market

AI revenue multiples reflect investor confidence in startups’ growth potential

Tech market deals signal a shift from infrastructure to applications

The fastest-growing genAI startups highlight the rise of voice AI

Download the full report to access comprehensive CB Insights data and charts on the evolving state of AI.

Massive deals continue to drive the AI funding boom

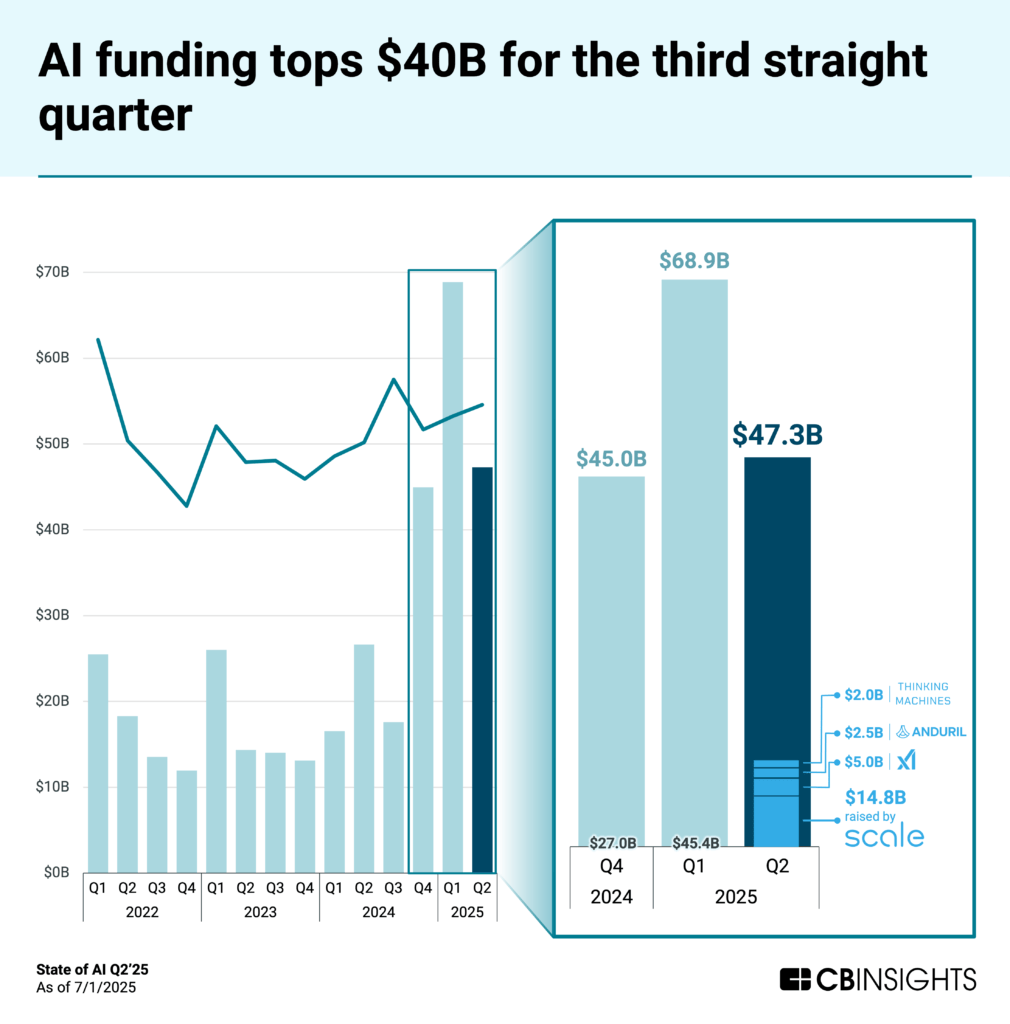

Funding to private AI companies across the globe reached $47.3B across 1,403 deals in Q2’25.

Combined with the record total for Q1’25 (inflated by OpenAI’s $40B raise), funding in 2025 ($116.1B) has already blown past 2024’s full-year total ($105.7B).

Together, the top 10 rounds accounted for 60% of the quarter’s funding total.

AI development players continue to lead the surge, with Scale (AI training data provider), xAI (model developer), and Thinking Machines Lab (model developer) raising some of the quarter’s largest rounds. Other notable raises went to defense tech startups Anduril ($2.5B) and Helsing ($693M) as geopolitical tensions drive interest in the sector.

The largest round of the quarter — Meta’s $14.8B investment in Scale for a 49% stake (with CEO Alexandr Wang joining Meta) — highlights big tech’s recent “quasi-acquisition” spree.

This trend sees tech leaders hiring away the teams and licensing the tech of promising startups — this allows big tech to avoid antitrust scrutiny while giving startups a way to return capital to investors. These deals enable them to move more quickly and be more selective with the talent they bring on than traditional M&A allows.

Deals in this pattern include:

Inflection AI (March 2024): Microsoft paid $650M in a licensing deal to Inflection AI while poaching its founders and key employees

Adept (June 2024): Amazon hired away Adept’s founders and many employees, with $330M+ going to licensing its tech

Character.AI (August 2024): Google poached the company’s founders and 20% of its team in a $3B licensing deal

Covariant (August 2024): Amazon hired robotics startup Covariant’s founders and a quarter of its staff while licensing the company’s models

Windsurf (July 2025): Google hired Windsurf executives and R&D employees in a $2.4B licensing deal

This activity reinforces the premium placed on AI talent in the current landscape.

Consolidation is in full force in the AI market

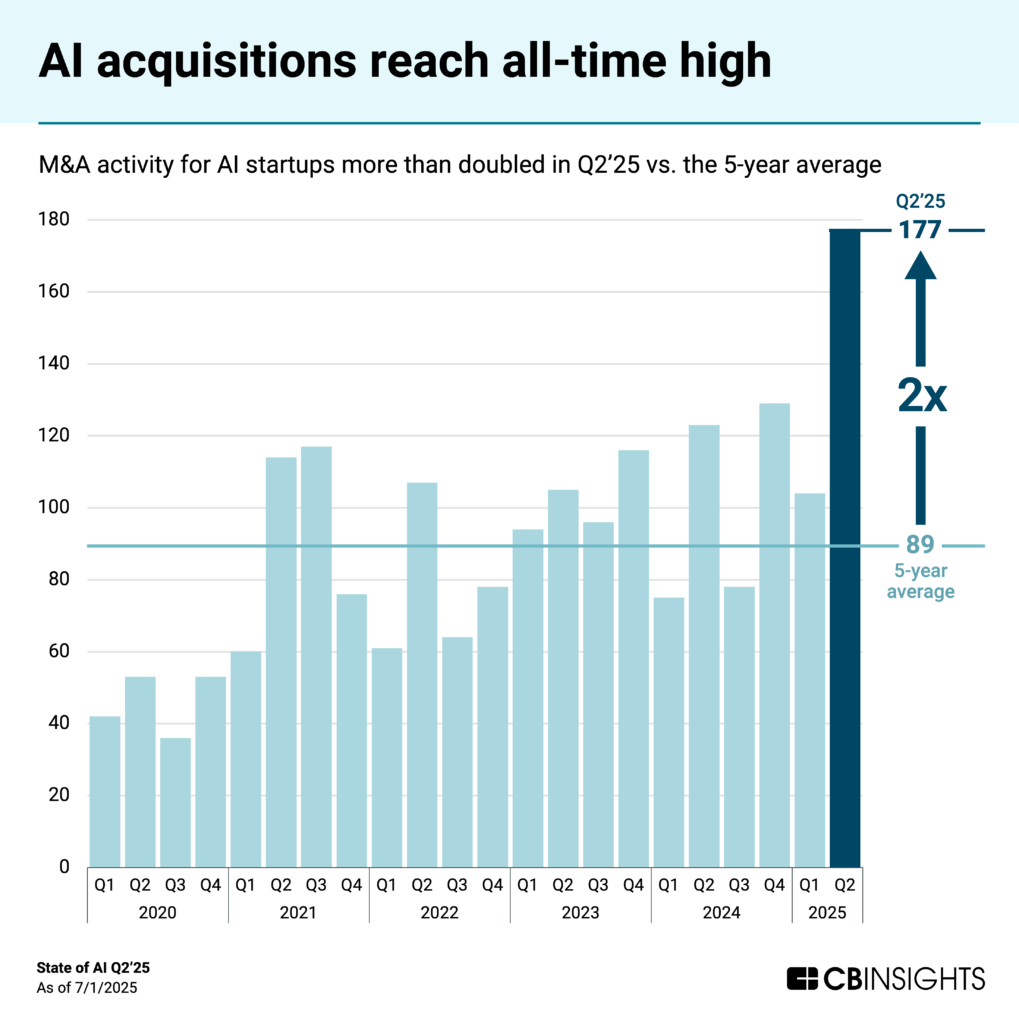

Despite broader M&A weakness across the venture market, AI is a bright spot.

M&A activity in AI reached record levels in Q2’25 at 177 deals — almost double the quarterly average of 89 since 2020.

The US was largely responsible for the jump, with acquisitions of US-based AI startups nearly doubling from 59 in Q1’25 to 104 in Q2’25. Europe followed with 46 M&A deals in the quarter.

Major US enterprise tech companies led activity as they embed AI across their offerings. Among the top 10 most active in the quarter were IBM (3 AI acquisitions), followed by Intuit, Nvidia, Databricks, and Salesforce (tied with 2 AI acquisitions each).

Earlier this year, we predicted enterprise tech heavyweights would compete for AI infrastructure dominance. AI optimization company CentML, acquired by Nvidia in Q2’25, was on our AI infrastructure acquisition target list.

Dive into 7 AI-related areas where we expect to see M&A activity this year, as well as high-potential acquisition targets for each, in the free report.

AI revenue multiples reflect investor confidence in startups’ growth potential

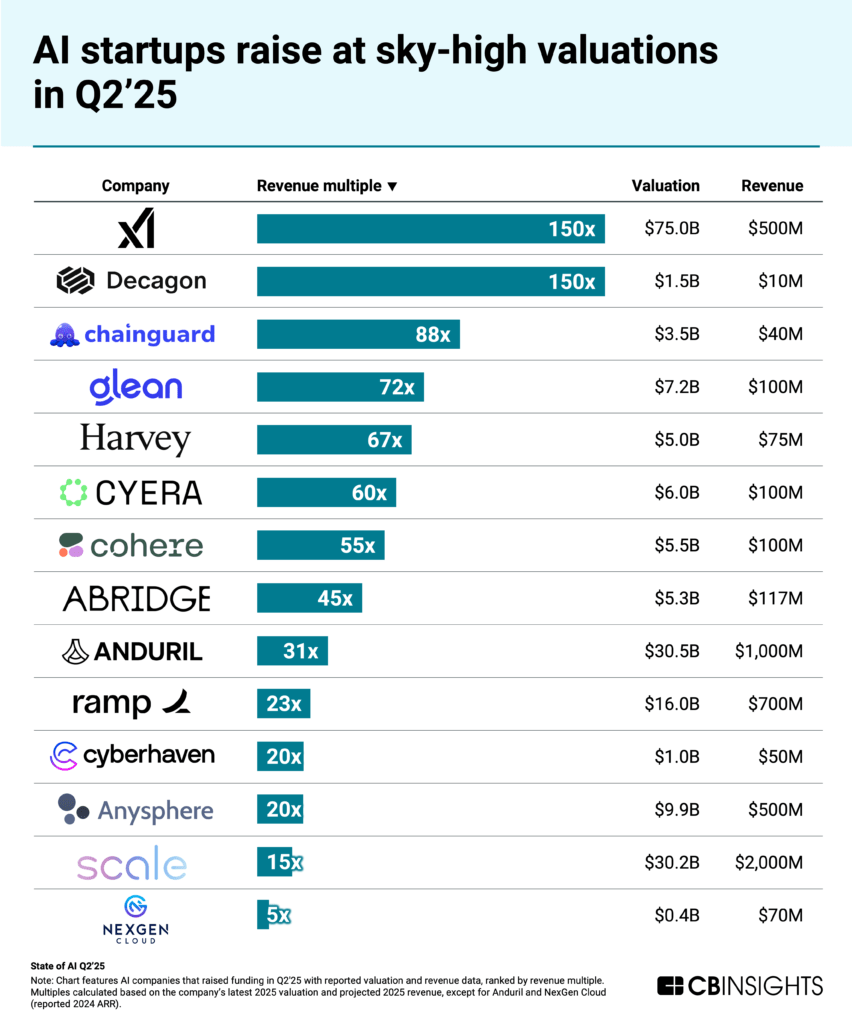

Leading AI companies that raised funding in Q2’25 did so at sky-high valuations — even by AI standards.

Model developer xAI raised $5B at a $75B valuation in June 2025, up from its $50B valuation in November 2024. With a projected $500M in 2025 revenue, that’s a 150x forward-looking multiple. Similarly, customer service AI agent startup Decagon raised $131M at a $1.5B valuation on just $10M in ARR.

AI startups are commanding a median 17.1x revenue multiple (based on FY 2024 revenue), but some far exceed that. Companies in the chart below command a median 50.1x multiple.

This indicates investor confidence and competition for the hottest startups. The big multiples are also a reflection of these companies’ growth potential: xAI projects $2B in revenue next year, while others on the list, like Glean, hit $100M ARR in 3 years.

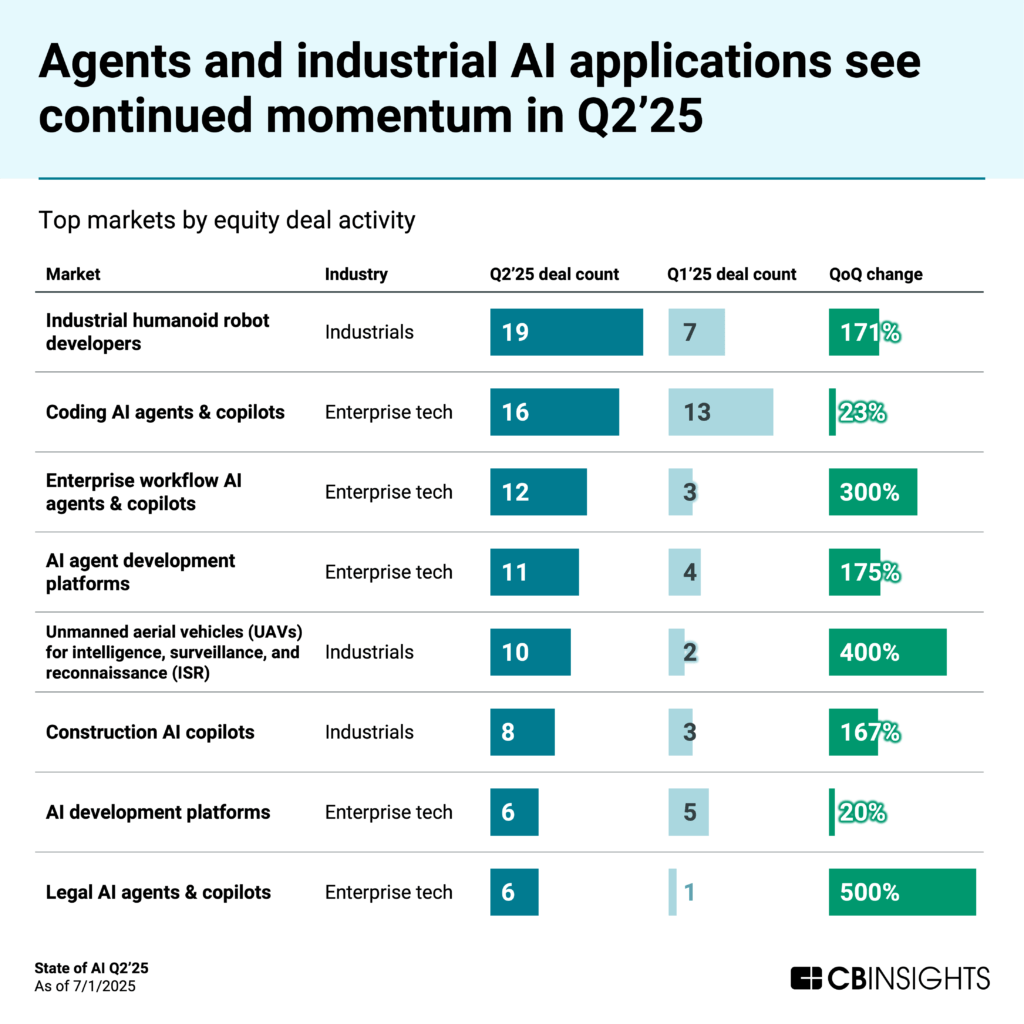

Tech market deals signal a shift from infrastructure to applications

Among the 1,500+ tech markets that CB Insights tracks, those in the chart below saw the greatest number of AI deals in Q2’25.

Leading markets focus on specific industry or technical challenges — like industrial humanoid robots and coding AI agents — not general-purpose AI models.

In fact, LLM developers tied for 9th place with 11 other markets at 5 deals during the quarter.

This suggests investors increasingly expect greater value creation to come from applications than from infrastructure.

![]() See how markets stack up in the CBI Market Index

See how markets stack up in the CBI Market Index

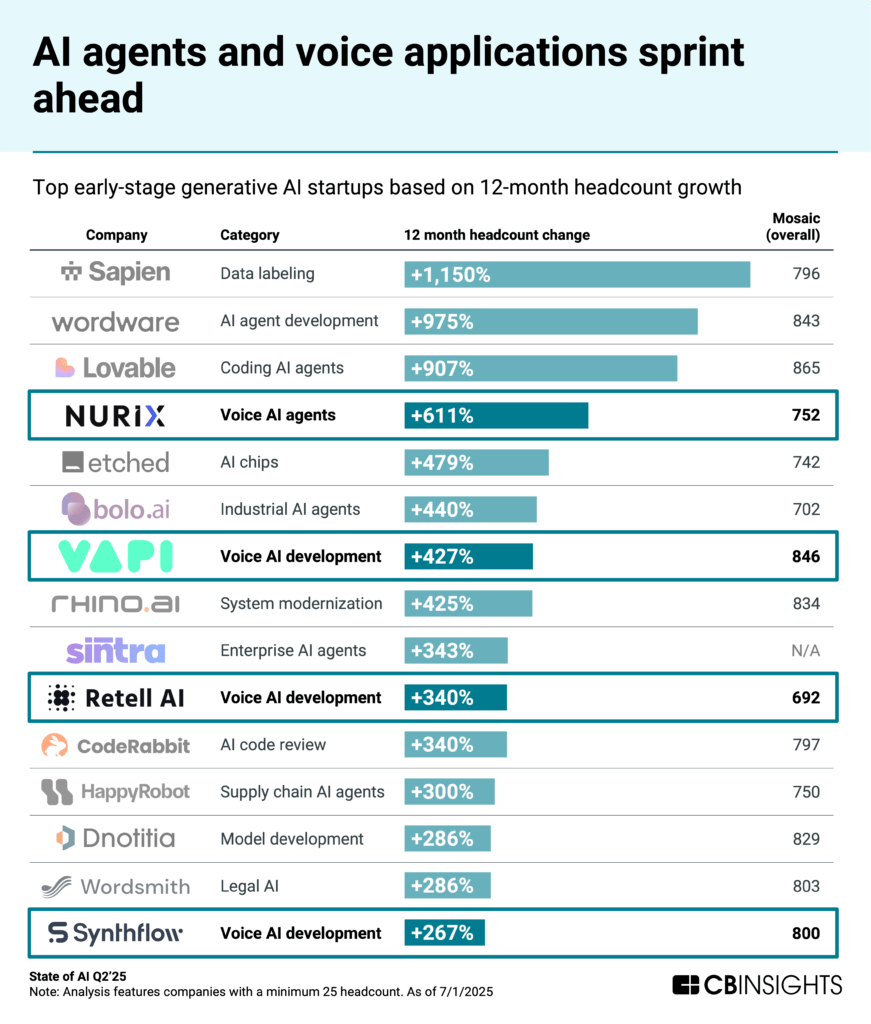

The fastest-growing genAI startups highlight the rise of voice AI

While funding may be concentrated among the largest players, opportunities in AI aren’t limited to those companies. Nearly 3 in 4 AI deals (72%) in 2025 so far still involved early-stage startups.

Early-stage genAI companies with the fastest-growing headcounts are concentrated in AI agent applications — and more specifically in voice AI development.

Advancements in voice AI models in 2024 — including the launch of OpenAI’s Realtime API for speech-to-speech applications — jumpstarted voice applications across use cases.

Companies are now positioning themselves for a future where humans interact with AI via conversation rather than text interfaces.

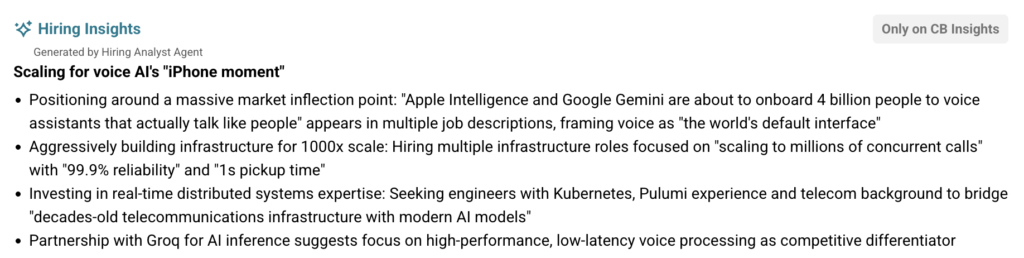

Job postings from Vapi — one of the fastest-growing voice startups based on headcount — highlight its positioning around this inflection point, as noted by CB Insights Hiring Insights.

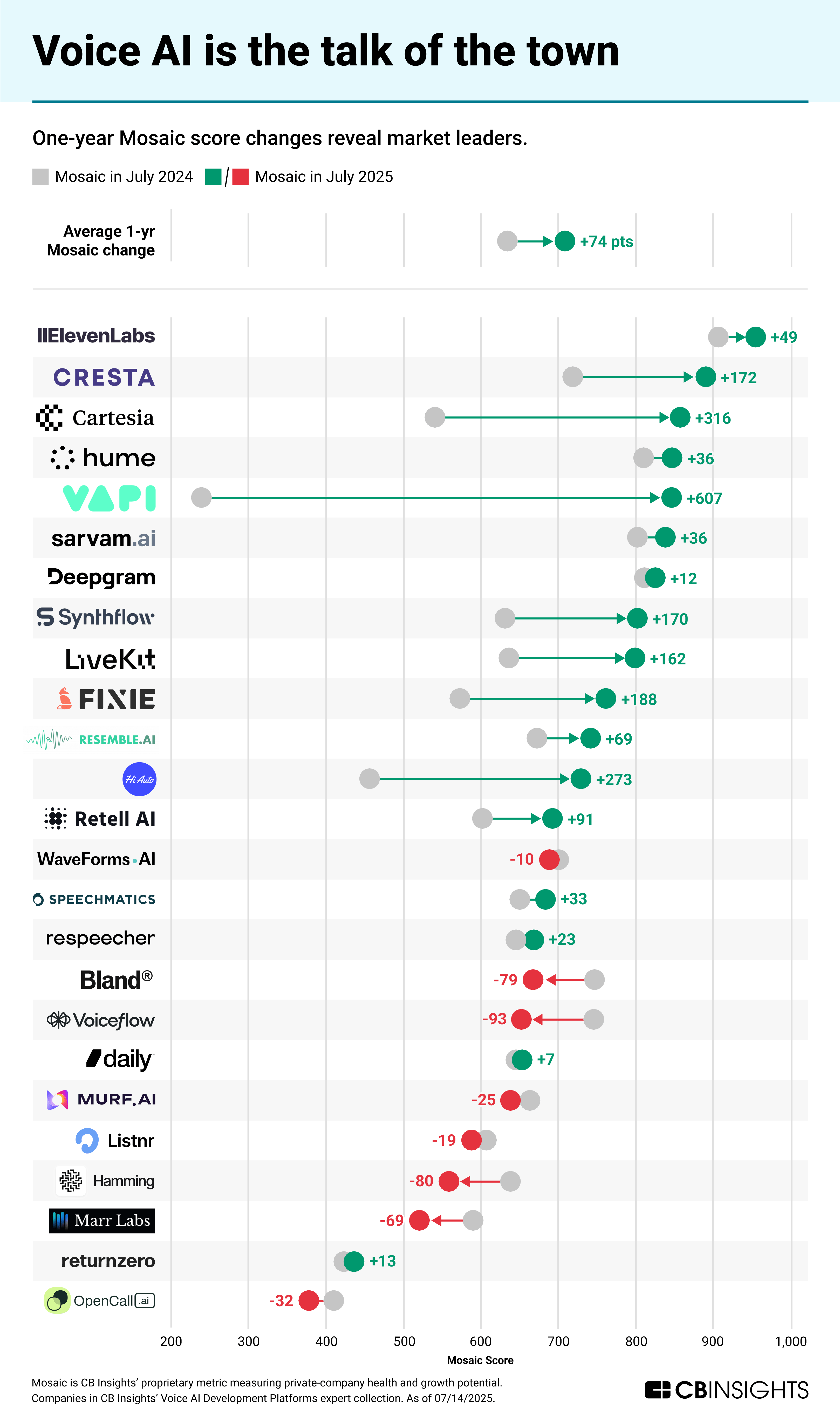

Vapi has also seen the greatest jump in its Mosaic health score among voice development companies, as shown in the chart below.

Watch these startups for partnership, investment, and acquisition opportunities. Signaling the potential for increasing consolidation, Meta acquired voice startup Play AI, which uses AI to generate human-like voices, in July 2025.

MORE AI RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.