(Bloomberg) — SK Hynix Inc. outlined plans to speed up spending on advanced memory production equipment after reporting record earnings, reflecting surging AI demand.

Most Read from Bloomberg

The South Korean company notched a bigger-than-expected 68% jump in operating income in the June quarter. It now aims to accelerate planned investments after gauging potential demand from initial negotiations with customers seeking high-bandwidth memory (HBM) in 2026, according to executives.

Demand for advanced memory is expected to continue to grow with customers launching new products in the second half of the year. The emergence of ChatGPT is prompting nations around the world to build their own AI infrastructure to secure data independence, the company said in a statement. SK Hynix shares remained largely unchanged after climbing as much as 3.7% earlier.

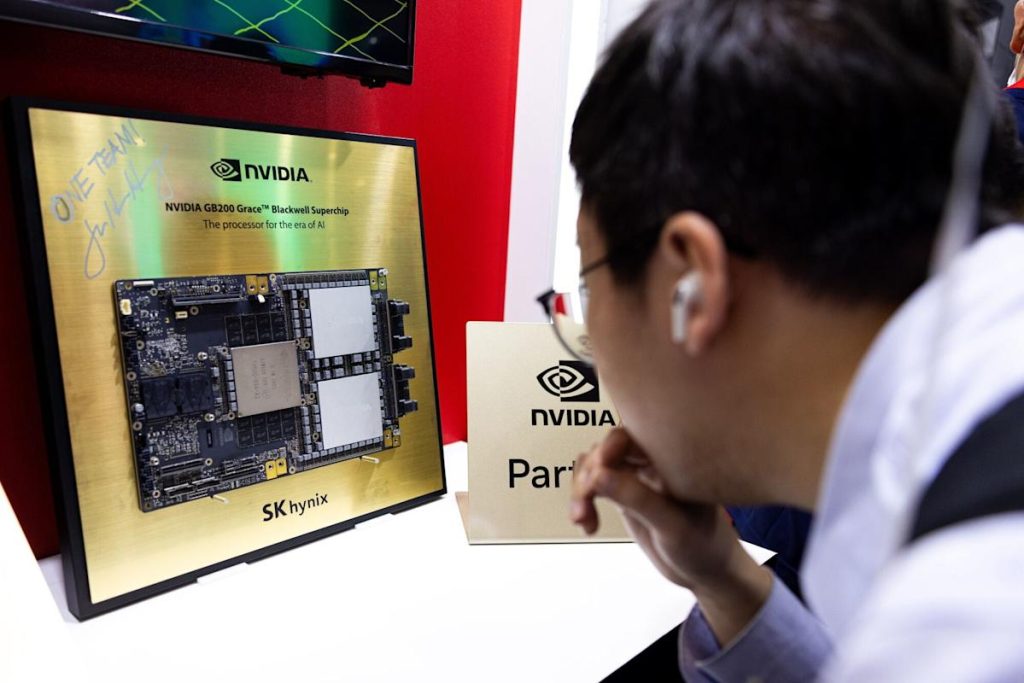

The stock has shed about 10% of its value since peaking in July on concerns about growing competition in 2026. Investors are worried about rivals like Samsung Electronics Co. eating into SK Hynix’s lead in HBM essential to Nvidia Corp.’s processors. The US company buys up the bulk of SK Hynix’s most advanced chips, but other tech providers are eager to join the fray and build out new data centers.

“The record performance was driven by HBM,” said MS Hwang, research director at Counterpoint. “Yet it also underscores SK Hynix’s growing leadership in the overall memory market,” which includes DRAM and NAND. After the chipmaker claimed the top spot in the global DRAM market by revenue in the first quarter, it is now competing head-to-head with Samsung for leadership in the overall memory market, he said.

Second-quarter operating income at SK Hynix hit 9.21 trillion won ($6.7 billion) on a 35% rise to record quarterly revenue. A recovery in NAND prices also bolstered earnings, although profit was largely driven by the lucrative HBM market, which capitalizes on low-latency architecture built from stacks of advanced DRAM.

“There is no doubt about growth potential of HBM demand,” an SK Hynix official said during a conference call. DRAM, or dynamic random access memory, is a type of memory most commonly used to process data in computers and servers. NAND is a type of memory used to store data.

SK Hynix has benefited from Samsung’s delay in obtaining Nvidia’s certification for its most advanced product, 12-layer HBM3E. That’s given SK Hynix an unusually long lead time in the highly lucrative segment.

But now, SK Hynix is racing to stay ahead of deeper-pocketed Samsung. Some investors expect the chips-to-smartphone company — which this month reported its first quarterly profit decline since 2023 — to have hit bottom over the summer. Nvidia is shifting toward a new generation of memory chips, offering Samsung an opening.

Goldman Sachs downgraded SK Hynix for the first time in more than three years on expectations of competitors encroaching on its market share.

SK Hynix is proceeding with the construction of facilities such as a new M15X memory chip factory and a new fabrication plant in Yongin, South Korea, as well as an advanced packaging plant in Indiana. The majority of the additional spending this year will be allocated to HBM-related equipment, Chief Financial Officer Kim Woo Hyun said.

In March, the company supplied the industry’s first next-generation HBM4 samples to Nvidia. Price negotiations around HBM4 — which will be more expensive to produce — are ongoing, company officials said, adding SK Hynix aims to keep current levels of HBM profitability.

Nvidia, which controls more than 90% of the market for chips needed to build AI systems, became the first publicly traded company to hit a valuation of $4 trillion earlier this month. Investor expectations about the company resuming sales of its H20 AI chips to China helped the stock, after US President Donald Trump’s administration reversed its earlier stance on measures to limit Beijing’s AI ambitions.

SK Hynix was a key supplier of those AI chips designed for the Chinese market prior to the implementation of export controls, and the company is “well positioned to respond swiftly” to Nvidia’s request, an official said. The company is trying to assess concrete information, he added.

The Korean chipmaker also said the 2023 waivers remain in place allowing it to ship US chipmaking equipment to SK Hynix’s factories in China without US license approval, addressing concerns raised by media reports in June.

China remains an important production base for SK Hynix’s legacy chips, particularly as the company reallocates more of its DRAM capacity to ramp up HBM output. As memory manufacturers like SK Hynix and Samsung shift their focus toward higher-margin HBM products, supply of legacy chips — such as DDR4 and LPDDR4 — has tightened, driving up prices in recent months.

“Our fabrication plants in China are not only critical to our operations but also play a key role in the global memory semiconductor supply chain,” an executive said, adding that SK Hynix will strive to provide uninterrupted supply while remaining in line with regulations.

What Bloomberg Intelligence Says

SK Hynix could keep a strong operating-profit margin in 3Q as it expects bit shipments of both DRAM and NAND chips to grow further sequentially, according to just-released guidance, after it achieved robust sequential growth in 2Q. Its factory-utilization rate might improve in 3Q after its inventory decreased sequentially in 2Q. The strong sales increase in 2Q might lead to a robust operating-profit margin in 4Q as well as 3Q.

-Masahiro Wakasugi and Takumi Okano, analysts

Click here for the research.

Long-term prospects for advanced memory makers may depend on expanding beyond Nvidia, given the incentives for the US company to diversify its vendors and negotiate lower prices.

SK Hynix is looking to strengthen ties with the likes of OpenAI Inc. and deepen ties by building AI infrastructure. OpenAI Chief Executive Officer Sam Altman said in a post on X on July 21 that his company will bring online 1 million graphics processing units (GPUs) by the end of the year and is trying to figure out how to scale that a hundredfold.

–With assistance from Shinhye Kang, Edwin Chan and Vlad Savov.

(Updates with details on capex investment and executive comments from eighth paragraph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.