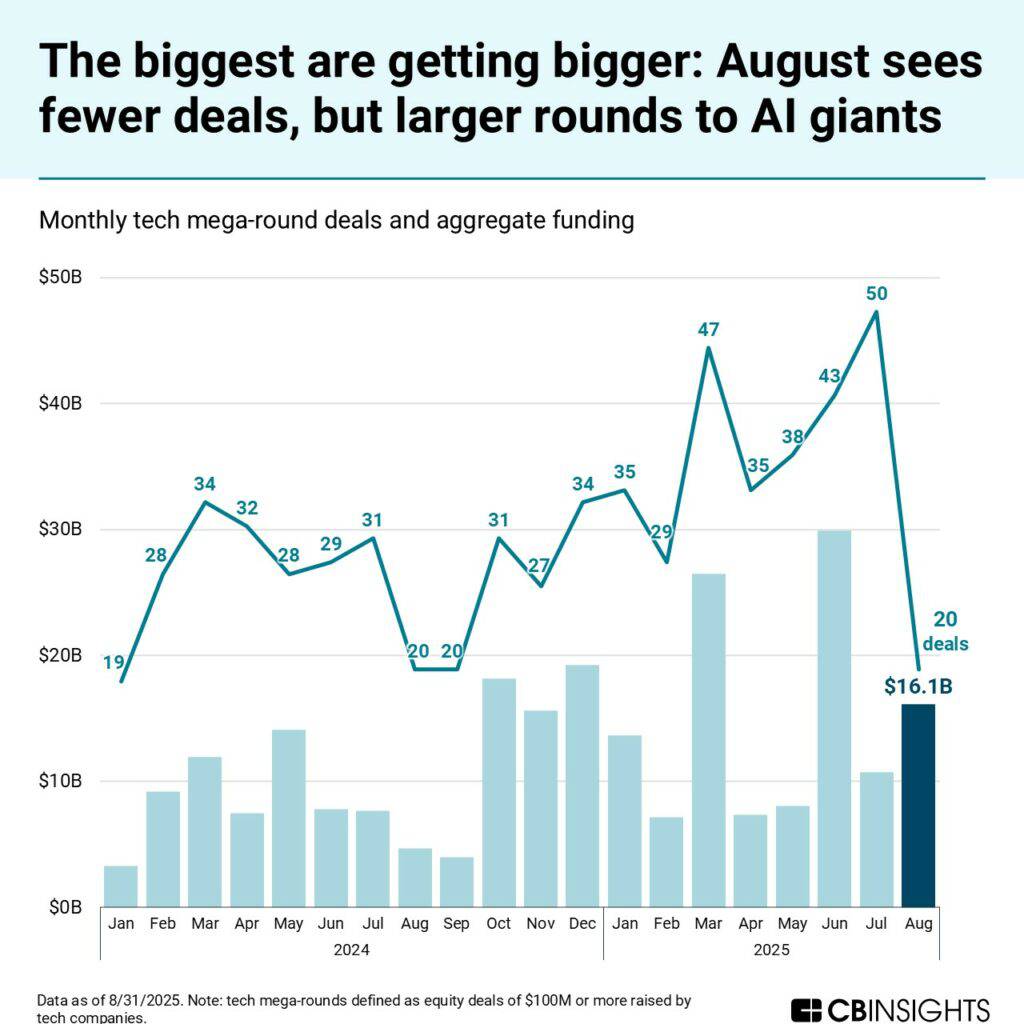

Despite a dip in deal count, the August mega-round tracker confirmed the private-for-longer trend, with the ever-larger, ever-later rounds raised by emerging AI giants Databricks and OpenAI.

These 2 companies alone accounted for over 50% of the funds raised last month, with valuations in the hundreds of billions of dollars, demonstrating that private markets are increasingly capturing value creation in tech.

These companies are also growing their own influence and reshaping the AI landscape. OpenAI’s alumni founded Periodic Labs and at least five other mega-round recipients in 2025. Databricks is making agentic AI a core part of its business through product development and its recent acquisition of Tecton, positioning itself as another SaaS player in the AI agent battleground.

Using CB Insights’ Business Graph, our monthly Book of Scouting Reports offers an in-depth analysis of every private tech company that has raised a funding round of $100M or more. It spotlights where private capital is concentrating, startups gaining momentum, and which companies are becoming tomorrow’s disruptors.

Download the book to see all 20 scouting reports.

Key takeaways from August’s mega-rounds include:

Tech giants get bigger as late-stage private market funding becomes the new norm: OpenAI accounted for over half of all mega-round funding dollars this month with an oversubscribed $8.3B raise. Databricks received a Series K — 1 of only 16 in history — of $1B. Continuing the trend of tech companies staying private for longer, Databricks and OpenAI show that an IPO isn’t the only path to growth, signaling a shift in the financing model for late-stage startups. This is also illustrated by a rise in secondary transactions and tender offers meant to provide liquidity for early employees and investors, with OpenAI is in talks for a secondary share sale of $500B. Databricks is using its latest funds to grow its product set, expanding into AI agent development and agentic databases.

Early-stage unicorns show investor confidence in specialized AI: August minted 3 new AI unicorns. All are early-stage, and all are developing specialized AI. Decart is building real-time generative AI like talk-to-video models and reached $3.1B valuation following a Sequoia-led Series B, a 6x valuation jump. Materials science AI company Periodic Labs, despite no live product, is now valued at $1B after its first and only raise, led by Andreessen Horowitz. Field AI secured a $2B valuation after a Series A from Bezos Expeditions for its robotics AI. These companies all have lower-end Commercial Maturity Scores of 2 or 3, indicating they are emerging or deploying solutions. Yet their significant valuations signal that high-profile investors remain comfortable placing bets on earlier-stage companies, and that specialized applications beyond LLMs have entered the AI boom.

Over 60% of AI mega-round recipients are generating 8-figure revenue and above: Two-thirds of the AI companies receiving mega-rounds in August have a 2025 projected revenue of $40M or above, a signal that AI continues to generate not just investor interest, but actual commercial success. With an average Commercial Maturity Score of 4 (scaling solutions) and Mosaic health score of 892 (vs. 802 average for all August mega-round recipients), these companies are producing revenue while still in growth mode. Some, like Framer, are expected to produce $100M in revenue by 2026. Others are achieving exceptional capital efficiency today: EliseAI is projected at $100M in 2025 revenue and $670K per employee, more than double the revenue-per-employee of Databricks.

Want to submit your company’s funding data? Please reach out to researchanalyst@cbinsights.com.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.