As tech giants race to monetize AI, startups that make shipping AI products faster are coming into focus.

OpenAI’s recent $1.1B purchase of A/B testing & experimentation platform Statsig at a 27.5x revenue multiple — one of its largest acquisitions to date — highlights this shift as model performance gains become increasingly expensive and incremental. Statsig’s CEO Vijaye Raji will also join OpenAI as CTO of Applications to accelerate development of its consumer and enterprise products.

The trend is taking shape across the AI landscape this year. In August, Databricks acquired feature store company Tecton to support its AI agent business, while DataDog snatched up A/B testing company Eppo to strengthen its application development suite in May.

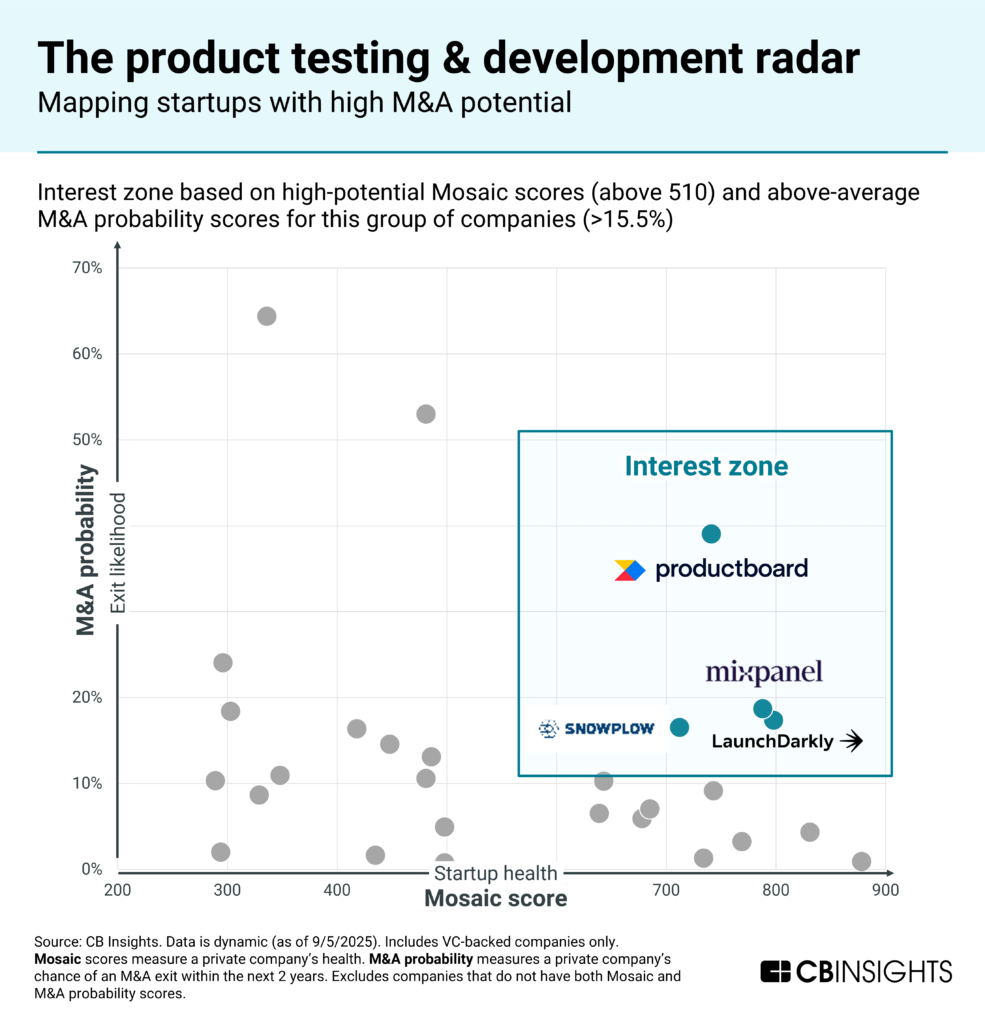

Using CB Insights’ predictive signals, including Mosaic company health scores and M&A probability, we’ve identified the product testing and development platforms that tech giants could acquire next.

Companies sourced from CB Insights markets covering feature stores & management, product management, product analytics, and A/B testing & experimentation platforms.

Key takeaways

AI-focused companies with proven revenue are prime targets: Almost all of the companies in the interest zone enable AI product development. Mixpanel and Snowplow provide product analytics for AI applications, and LaunchDarkly offers AI product feature management. Both Mixpanel and LaunchDarkly have crossed $100M in revenue, indicating product-market validation and traction.

C-level teams feature tech and data expertise that potential acquirers can bring in-house: 3 out of the 4 executive teams in the interest zone come from large tech and SaaS companies. The CEO of LaunchDarkly is ex-Salesforce, AWS, and Microsoft, and the CEO of Productboard spent time at HP and GoodData. Like Statsig, tech talent at the executive level is a ripe target for tech companies seeking this expertise. Based on CBI Funding Insights, LaunchDarkly, and Productboard used their most recent funding rounds to go after new talent and grow their teams, indicating technical expertise across levels.

Partnerships with larger tech and professional services companies signal validation and reach: Established tech and AI companies have business relationships with nearly all of the companies in the interest zone. Databricks partnered with and invested in Snowplow for AI-driven user analytics, Salesforce is a customer of Productboard, and LaunchDarkly integrates with AWS to reduce data transfer costs. Similarly, Productboard partnered with consulting firms like Boston Consulting Group and Slalom to expand reach, and Mixpanel grew its international presence with Seven Peaks and Altudo. These companies have grown not only their own platform capabilities but also their market presence, networks that potential acquirers may want to leverage for reach.

Want to submit your company’s profile data? Please reach out to researchanalyst@cbinsights.com.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.