Oncology tech is back. After three years of declining investment, the sector has already raised $1.3B YTD, exceeding the full-year totals for both 2023 and 2024. At this pace, funding will exceed $2B by year-end.

Several factors are driving this recovery. Recent cuts to public cancer research funding are leaving startups to drive innovation, while AI advances are accelerating precision medicine’s transition from development to standard care. Precision medicine customizes treatments based on individual genetic, molecular, and biological factors rather than applying uniform therapies, unlocking market opportunities for tech-enabled diagnostics and treatment selection.

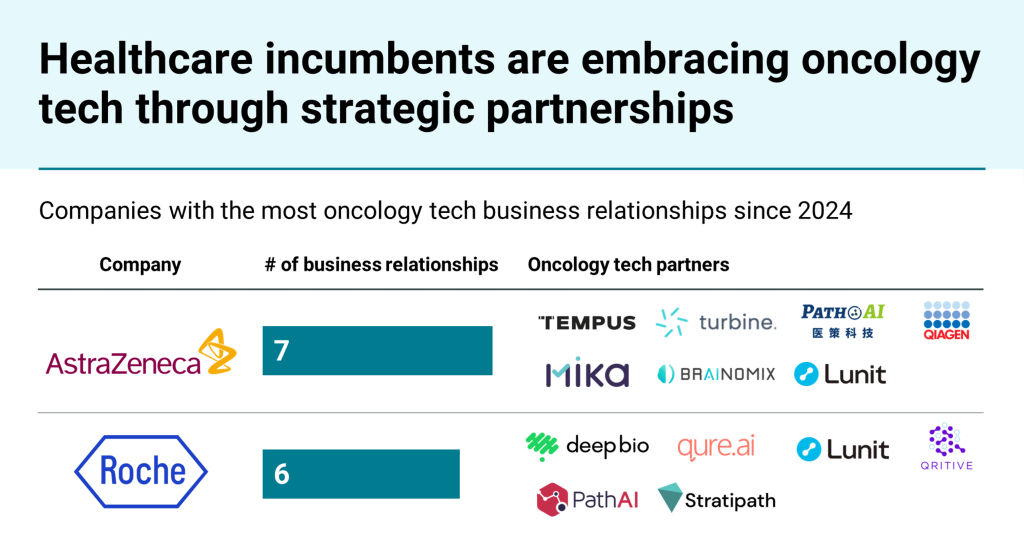

Companies that can harness these technologies are attracting attention from healthcare incumbents, both through investments and strategic partnerships. With cancer rates continuing to rise and treatment revenues growing substantially over the past decade, this momentum seems likely to continue.

We assessed the oncology tech landscape using CB Insights data. Below, we cover:

The funding rebound seen in 2025 so far

How early-stage investments are driving deal volume

The top sectors by deal count

Incumbents that are leading partnership activity

We define oncology tech as companies that develop tech-enabled products in cancer care, diagnosis, and treatment. This includes diagnostic tools, AI-powered drug discovery, and clinical decision support platforms (e.g., real-world data analytics and digital therapeutics).

![]() Explore the oncology tech expert collection

Explore the oncology tech expert collection