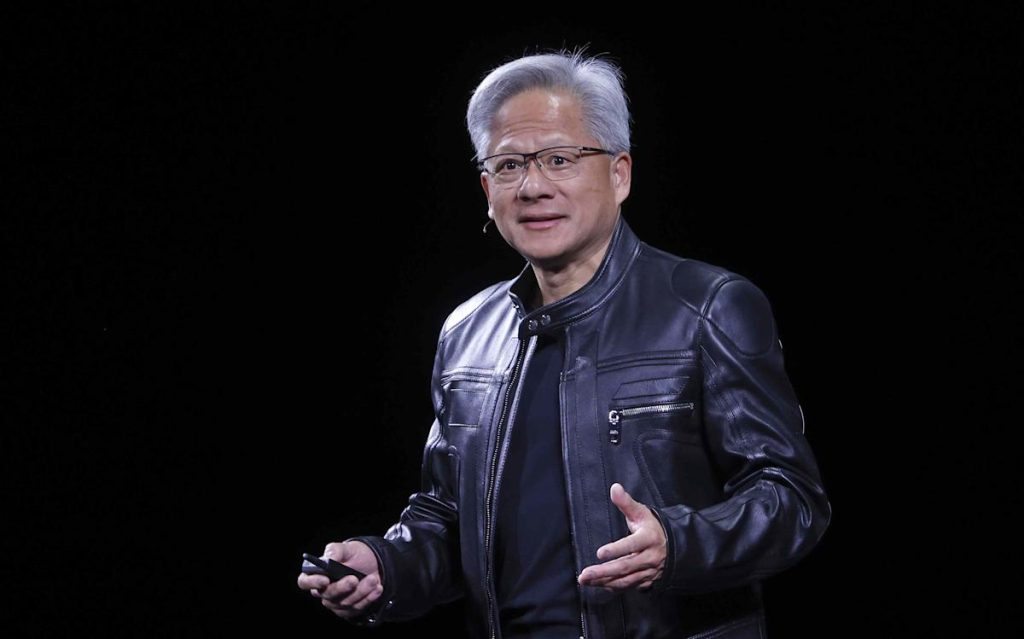

Chesnot / Getty Images

Citi analysts raised their share price target on Nvidia, led by CEO Jensen Huang, to $190.

Citi analysts raised their price target for Nvidia stock to $190 from $180, citing growing demand for sovereign AI.

Nvidia is “involved in essentially every sovereign deal,” the bank said, as governments and other organizations invest heavily in AI.

Last month, Nvidia CEO Jensen Huang announced multiple sovereign AI partnerships during a European tour.

Nvidia (NVDA) is poised to take advantage of growing demand for sovereign artificial intelligence, Citi analysts wrote Monday, as governments and other organizations invest heavily in AI.

The bank raised its price target for Nvidia stock to $190 from $180, lifting it further above the Visible Alpha analyst consensus of $174. Citi expects the AI data center market to reach $563 billion in 2028, up from a prior estimate of $500 billion, based on higher-than-expected sovereign AI demand. That benefits Nvidia, which is “involved in essentially every sovereign deal,” Citi said.

Sovereign AI refers to artificial intelligence capabilities developed for a single entity, often a national government, run on systems under that entity’s control. Nvidia CEO Jensen Huang last month announced multiple sovereign AI partnerships during a European tour that included stops in the United Kingdom, France and Germany. The semiconductor titan also recently partnered with Humain, an AI subsidiary of Saudi Arabia’s sovereign wealth fund.

Bank of America analysts have said they expect “every major country” to invest in sovereign AI, “generating high-tech employment, and serving critical healthcare, defense, industrial, financial and cyber needs.” Oppenheimer said the global sovereign AI market could be $1.5 trillion, including $120 billion in Europe.

Shares of Nvidia were less than 1% lower in recent trading Monday. They ended last week at a record high.

Read the original article on Investopedia