Nvidia weathered a storm of tariff uncertainty and export controls to exceed Wall Street’s lofty expectations for sales when the AI chip behemoth reported quarterly earnings Wednesday. The hit to profits and margins came in worse than expected, however.

Revenue increased 69% from the same period last year to $44.1 billion, surpassing the Street’s projection of $43.3 billion, per Visible Alpha. Profits came in at $18.8 billion, though, falling from $22 billion last quarter and missing the $19.5 billion mark analysts expected. That meant Nvidia posted diluted earnings per share of $0.76, down from $0.89 last quarter and below the projected $0.79.

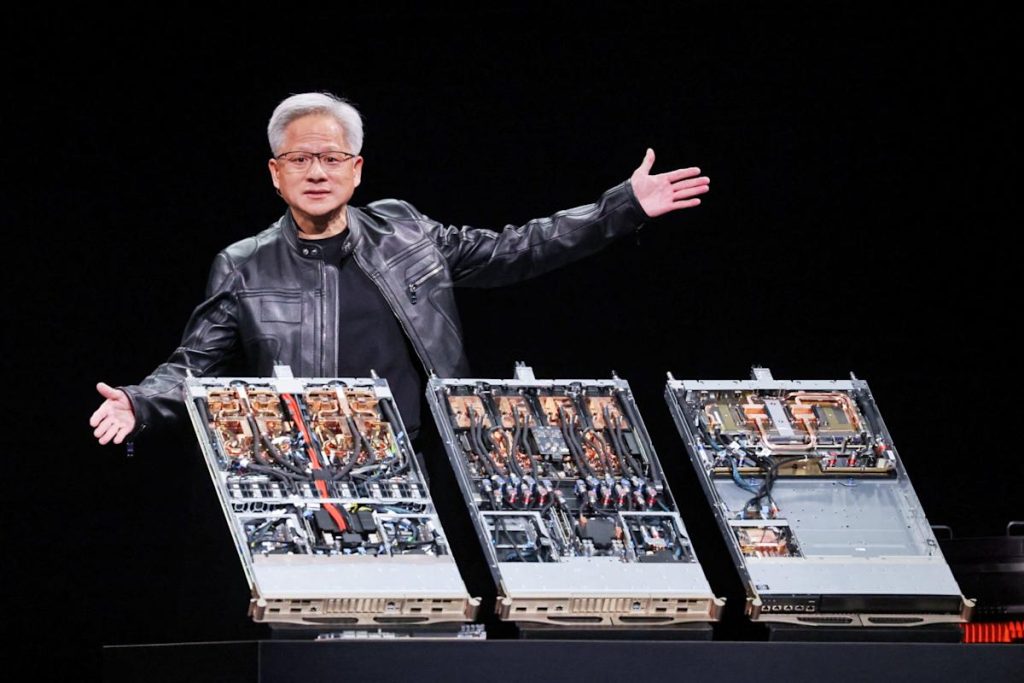

“Global demand for Nvidia’s AI infrastructure is incredibly strong,” CEO Jensen Huang said in the earnings release.

“Countries around the world are recognizing AI as essential infrastructure—just like electricity and the internet—and Nvidia stands at the center of this profound transformation,” he added.

The top-line results allowed investors to breathe a sigh of relief. Shares jumped over 4% to hit the $140 mark in extended trading Wednesday evening.

Will Rhind, founder and CEO of ETF issuer GraniteShares, told Fortune the results assured traders that the AI trade remains intact.

“And I think that’s, at the end of the day, what the bulls wanted to see,” said Rhind, whose firm manages leveraged and inverse ETFs for Nvidia and other companies.

Nonetheless, gross margins dipped to 60%, falling below the 66% figure Wall Street had feared. Last quarter, CFO Colette Kress said the company expected margins to be in the low 70s to start the year as Nvidia continues to ramp up its next-generation Blackwell offering.

Meanwhile, new restrictions on China chip sales will continue to hit revenue going forward. The company said it expects sales in the current quarter to come in at $45 billion, below the Street’s $46 billion projection.

Dave Wagner, portfolio manager at Aptus Capital Advisors, told Fortune he thought revenue guidance of $45 billion or higher would keep most investors in the stock. For the first time since the company stormed to prominence, he said before the call, it felt like Nvidia had a relatively low bar to clear.

“Sentiment seems a little bit lower,” he said.

Scott Acheychek, the chief operating officer of Rex Financial, agreed that investors entered Wednesday’s print guarded.

“I feel like nobody wanted to believe that it could be good,” he told Fortune after the earnings release.

As Nvidia emerged as the first major darling of the AI boom—competing with Apple and Microsoft for the title of the world’s largest company by market capitalization—the company’s earnings calls became highly anticipated events for institutional and retail investors alike.

Story Continues