Nvidia’s $100 billion commitment to OpenAI over a few years is one of several circular deals Nvidia is making. Upstream chip sales fuel downstream infrastructure bets, creating a self-reinforcing loop that has propelled Nvidia’s market cap to $4.6 trillion.

Nvidia Q2 operating cash flow hit $15.4 billion and a growing $56.8 billion war chest. Projections show Nvidia free cash flow (FCF) exploding to over $100B+ annually in 2026. This will enable $100B+ yearly investments for 3+ years while preserving a $50B+ liquidity moat.

Nvidia can deploy $100B+ per year for years and this could grow to $200 billion per year by 2029. They can use phased via equity stakes, offtake guarantees, and SPVs to de-risk. This can scale the AI ecosystem into a self-sustaining loop. Investments in xAI/CoreWeave/OpenAI will generate hyperscaler orders. Nvidia’s 90% GPU share and ecosystem TAM can go from $200B today to $1T+ inference markets by 2030.

It is variation of share buybacks. Nvidia is big owner of the AI Ecosystem and they can become a bigger investor and owner of the ecosystem.

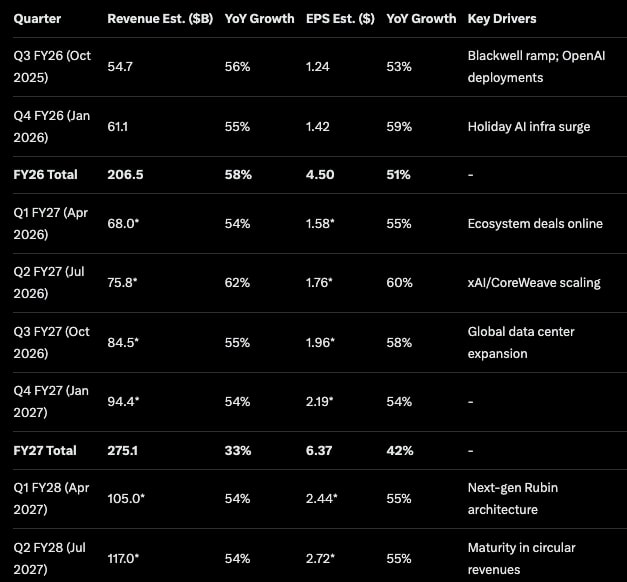

Nvidia annual revenue will grow from $206.5 billion, (+33%) $275.1 billion in 2026 and then beyond $300 billion, $400 billion and $500 billion.

Nvidia as AI’s Central Iron Banker

These investments aren’t charity but are a sustainable feedback loop. $100B OpenAI bet secures 10GW GPU exclusivity, recycling into $50B+ annual sales. Nvidia $2 billion investment locks in sales.

AI Ecosystem scales 5x by 2030 and Nvidia captures 40%+ of $1T inference flows.

CoreWeave IPO on Nvidia backing, hyperscalers (Oracle’s $300B OpenAI tie) amplify, birthing a $7T global data center race .

Bubble watch: If ROI lags (delayed cash positivity) then there can be problems.

Tesla, Google, Broadcom, AMD : Cash Printers Searching for Investment Flywheels

Microsoft, Amazon and Oracle have a lot or growing cashflow $40B+ annual and investments into other companies in an ecosystem can stimulate cloud and AI cloud revenue. Semiconductors companies like AMD/Broadcom could try to replicate the Nvidia model.

Tesla and SpaceX could become a cash printing machine with robotaxi, humanoid bot and Starlink/Direct to Cellphone. Tesla could create an investment flywheel once the humanoid bot systems are scaled. SpaceX could be restricted by the anti-monopoly global regulations in telecommunications.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.