In a robust display of investor confidence in artificial intelligence technologies, the past week has seen significant capital inflows exceeding $130 million across diverse AI applications. From productivity tools to entertainment, to financial technologies and automation solutions, venture capital continues to fuel innovation in the rapidly evolving AI sector.

Productivity & CRM: Streamlining the Enterprise Engine

The perennial quest for efficiency is a powerful driver for AI adoption, and the recent investments in this space highlight its critical role in modern businesses.

Sola Solutions

New York City-based AI-powered productivity and CRM innovator, Sora Solutions has been a magnet for investor attention. The company wants to use AI agents to automate businesses’ repetitive, manual back-office tasks, and initially secured $3.5 million through the prestigious Y Combinator Summer 2023 cohort, alongside Y Combinator themselves and one other undisclosed investor. Sola Solutions quickly demonstrated its potential and traction spurring a follow-on raise of $17.5 million from venture capital giant Andreessen Horowitz. This follow-on investment from a top-tier firm like Andreessen Horowitz, known for its keen eye on disruptive technologies, is a strong endorsement for Sola Solutions.

Topline Pro

Another New York City AI startup, Topline Pro, secured a significant $27 million in Series B funding from a syndicate including BBG Ventures, Bonfire Ventures, and six other investors. The company provides long-tail field service pros with generative AI in marketing and sales. Instead of “do it yourself,” Topline Pro offers “done for you,” autonomously managing pros’ websites, SEO, social media, ad spend, and reviews. The global home services market size is estimated to grow by $1.03 trillion from 2025-2029. As generative AI models become more sophisticated, their application in marketing, customer support, and sales is expected to expand exponentially.

Source: Technavio

AI-Native & Web Agents: Building the Next Digital Frontier

The foundational AI layer, particularly AI-native solutions and AI web agents, is attracting substantial capital, signifying a belief in the emergence of truly intelligent digital ecosystems. Two San Francisco startups received investments in the past two weeks.

Dealops

With a $7 million investment spearheaded by 20SALES, Allison Pickens Ventures, and six other investors, Dealops is positioning itself in the AI-native space. This category denotes companies where AI is not just a feature but the core architecture of their product. This approach often leads to higher performance, greater adaptability, and unique capabilities not achievable through traditional software.

Refold AI

Raising $6.5 million from investors like Ahead VC, Better Capital, and four others, Refold AI is tapping into a critical emerging trend: AI web agents. These autonomous agents, capable of navigating the web, interacting with applications, and performing complex tasks, represent a significant leap in AI’s utility.

Specialized AI: Deepening Impact Across Industries

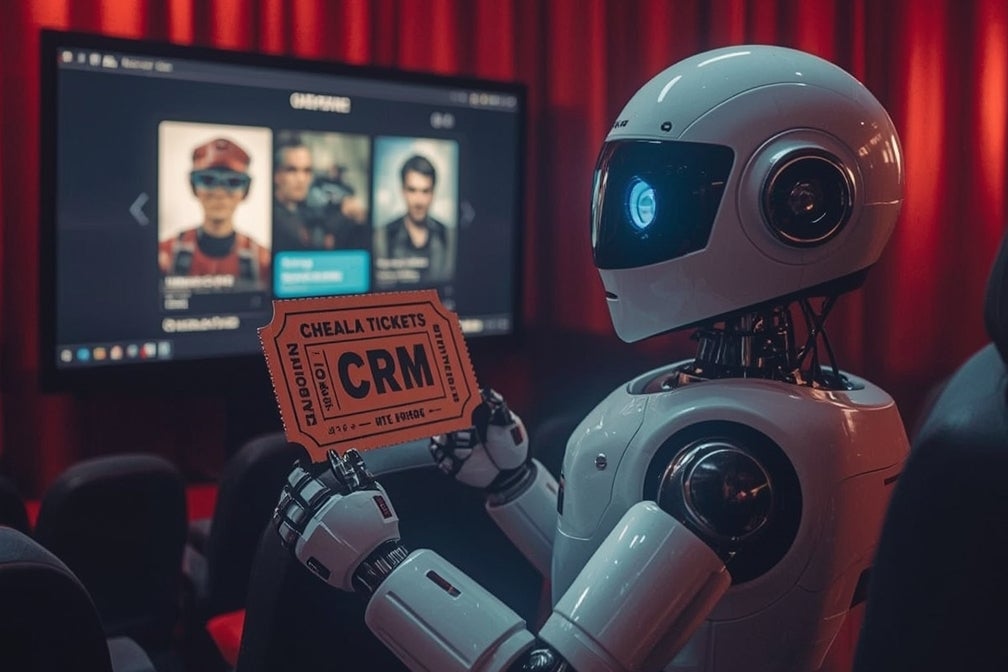

Source: AI-Generated by Andre Bourque

Beyond general productivity, AI is making profound impacts in specialized sectors, attracting targeted investments from industry-specific funds and strategic corporate partners.

LawPro AI

Funded by Scopus Ventures and The LegalTech Fund, Los Angeles-based LawPro AI is applying AI to the complex and data-rich legal industry. The company received an undisclosed Seed Round investment. From automating document review to powering predictive analytics for legal outcomes, AI is poised to drastically improve efficiency and access to justice. The involvement of a dedicated LegalTech fund underscores the growing specialization of venture capital in the AI domain.

Permian Labs

Securing $13.4 million from a diverse group including Arbitrum, Big Brain Holdings, and seven other investors, Boston-based Permian Labs represents AI’s critical role in the evolving financial landscape. Their product, USD.AI issues loans to AI firms using GPU hardware as collateral, reducing approval times by over 90% compared to traditional lenders. The presence of blockchain-focused investors like Arbitrum hints at the convergence of AI with decentralized finance (DeFi) and Web3 technologies.

Protege

New York City-based Protege received a substantial $25 million Series A investment from Bloomberg Beta, CRV – Charles River Ventures, and four other investors. Protege is focused on delivering advanced AI-driven analytics. Since its $10 million seed round in 2024, Protege has partnered with leading foundational models and AI companies across healthcare and media and boasts an expansive catalog of AI training data.

SoftWear Automation

A significant $20 million Series B1 investment from CTW Venture Partners, Lear Corporation, and five others went into Georgia-based SoftWear Automation. The company’s patented SEWBOT technology delivers a fully autonomous sewing solution, enabling sewn products to be made closer to the consumer, with radically reduced fashion waste, faster cycle times, and superior cost-efficiency. As an established company, Lear Corporation’s participation as a strategic investor is particularly noteworthy.

Dashverse

A $13 million Series A investment led by Peak XV Partners, Stellaris Venture Partners, and one other investor, into San Francisco-based Dashverse demonstrates the creative applications of AI extending into the entertainment sector. The company that originated as an AI-powered digital comics platform has since expanded its offerings, and now includes Frameo.AI, a generative video studio, and DashReels, a microdrama app.

Strategic Acquisitions: The Need for Speed

Beyond investments, the M&A landscape in AI reveals a strategic consolidation of talent and technology. Established companies are increasingly recognizing the value of acquiring innovative AI startups to accelerate their product roadmaps, gain market share, or integrate specialized capabilities.

In a noteworthy acquisition, Nimble Gravity has acquired Fog Solutions, an AI App Development company. Fog Solutions’ capabilities span the full data value chain, from strategy and governance to architecture and AI product delivery, strengthening Nimble Gravity’s ability to serve clients across industries, and creating the combined capabilities to deliver across Microsoft’s Cloud and AI Platforms. Acquisitions like this are growing popular for companies looking to quickly gain access to specialized AI talent, proprietary algorithms, and established customer bases to shorten their time to market and gain a competitive edge.

Feature image AI-generated by Andre Bourque

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.