Key Takeaways

IBM is gaining from hybrid cloud and AI demand, aided by acquisitions like HashiCorp and StreamSets. ORCL saw 51% IaaS revenue growth and expects cloud infrastructure revenue to rise 70% in fiscal 2026. IBM outperformed ORCL in share price gains over the past year and trades at a lower forward P/E ratio.

International Business Machines Corporation (IBM Quick QuoteIBM – Free Report) and Oracle Corporation (ORCL Quick QuoteORCL – Free Report) are two leading players in the hybrid cloud infrastructure and database services.

IBM offers cloud and data solutions that aid enterprises in digital transformation. In addition to hybrid cloud services, the company provides advanced information technology solutions, computer systems, quantum computing and supercomputing solutions, enterprise software, storage systems and microelectronics.

Oracle is one of the largest enterprise-grade database, middleware and application software providers. The company has expanded its cloud computing operations over the last couple of years. It offers cloud solutions and services that can be used to build and manage various cloud deployment models. Built upon open industry standards such as SQL, Java and HTML5, Oracle Cloud provides access to application services, platform services and infrastructure services for a subscription. Through its Oracle Enterprise Manager offering, the company manages cloud environments.

With a focus on hybrid cloud and AI (artificial intelligence), both IBM and Oracle are strategically positioned in the cloud infrastructure market and have the wherewithal to cater to the evolving demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

The Case for IBM

IBM is poised to benefit from healthy demand trends for hybrid cloud and AI, which drive the Software and Consulting segments. The company’s growth is expected to be aided by analytics, cloud computing and security in the long term. A combination of a better business mix, improving operating leverage through productivity gains and increased investment in growth opportunities will likely drive profitability.

With a surge in traditional cloud-native workloads and associated applications, and a rise in generative AI deployment, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which, in turn, have led firms to undertake a cloud-agnostic and interoperable approach to highly secure multi-cloud management. IBM’s acquisition of HashiCorp is a probable ploy to address these issues. The integration of HashiCorp’s cloud software capabilities has strengthened IBM’s hybrid multi-cloud approach. IBM completed the acquisitions of StreamSets and webMethods from Software AG to augment its AI platform and automation capabilities. The buyouts bring together leading capabilities in integration, API management and data ingestion.

Despite solid hybrid cloud and AI traction, IBM is facing stiff competition from Amazon Web Services and Microsoft Corporation’s (MSFT Quick QuoteMSFT – Free Report) Azure. Increasing pricing pressure is eroding margins, and profitability has trended down over the years, barring occasional spikes. The company’s ongoing, heavily time-consuming business model transition to the cloud is a challenging task. Weakness in its traditional business and foreign exchange volatility remain significant concerns.

The Case for Oracle

Oracle’s cloud infrastructure business has witnessed healthy demand trends in fiscal 2025 with Infrastructure-as-a-Service revenue surging 51% to $10.2 billion and total cloud services increasing 24% year over year to $24.5 billion. The company’s differentiated cloud architecture, designed specifically for enterprise workloads, continues to attract customers seeking superior performance and capabilities. Management expects cloud infrastructure revenues to grow more than 70% in fiscal 2026. This, in turn, is likely to help Oracle capture a greater pie of the rapidly expanding cloud infrastructure market, particularly as enterprises migrate mission-critical workloads to the cloud, seeking better performance and cost economics.

The company’s Oracle 23 AI database represents a transformative AI data platform, uniquely positioned to make enterprise data immediately available to popular large language models while maintaining complete data privacy. This AI-centric approach addresses the critical enterprise need to leverage AI with proprietary data, creating a powerful growth driver that management describes as foundational to the company’s expanding market opportunity and competitive differentiation.

However, Oracle’s multi-cloud approach offers significant technical complexity and operational risks that could undermine service reliability and customer satisfaction. Managing Oracle database services across Amazon Web Services, Microsoft Azure and Google Cloud Platform creates multiple points of failure and increases support complexity exponentially. The company’s expansion to several multi-cloud data centers amplifies these integration challenges while dividing management attention across competing platforms. Oracle’s cloud infrastructure business also faces overwhelming competition from Amazon Web Services, Microsoft Azure and Google Cloud Platform. The company’s multi-cloud strategy inadvertently validates competitors’ platforms, potentially cannibalizing its own Oracle Cloud Infrastructure adoption and undermining long-term competitive positioning.

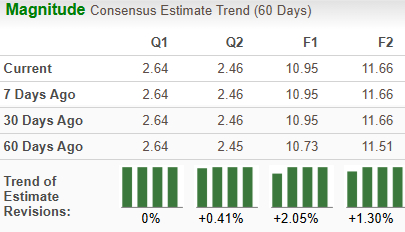

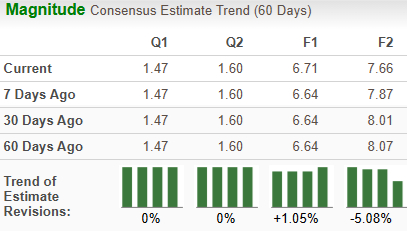

How Do Zacks Estimates Compare for IBM & ORCL?

The Zacks Consensus Estimate for IBM’s 2025 sales and EPS implies year-over-year growth of 5.5% and 6%, respectively. The EPS estimates have been trending northward over the past 60 days.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Oracle’s 2025 sales and EPS implies year-over-year growth of 16.1% and 11.3%, respectively. The EPS estimates have been trending northward over the past 60 days.

Image Source: Zacks Investment Research

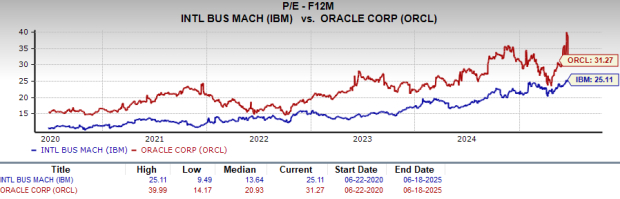

Price Performance & Valuation of IBM & ORCL

Over the past year, IBM has gained 62.9% compared with the industry’s growth of 4%. Oracle has jumped 47.5% over the same period.

Image Source: Zacks Investment Research

IBM looks more attractive than Oracle from a valuation standpoint. Going by the price/earnings ratio, IBM’s shares currently trade at 25.11 forward earnings, significantly lower than 31.27 for Oracle.

Image Source: Zacks Investment Research

IBM or ORCL: Which is a Better Pick?

IBM and Oracle carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies expect their sales and profits to improve in 2025. Oracle has shown steady revenue and EPS growth over the past few years, while IBM has been facing a bumpy road. However, with a better price performance and attractive valuation metrics, IBM is relatively better placed than Oracle, although both appear to be on a level playing field in terms of Zacks Rank. Consequently, IBM seems to be a better investment option at the moment.