Deutsche Bank (DB) and tech company IBM (IBM) have expanded their long-term partnership with a new agreement that gives Deutsche Bank more access to IBM’s wide range of software tools. This includes IBM’s automation software, hybrid cloud services, and its watsonx artificial intelligence (AI) platform. Deutsche Bank will also get the latest version of IBM Storage Protect, which will improve how the bank protects and manages its data.

Confident Investing Starts Here:

With these tools, Deutsche Bank plans to upgrade its technology, replace outdated systems, and make its operations more efficient. The goal is to save money, improve returns, and offer better services to customers. This deal continues the strong partnership between the two companies and supports Deutsche Bank’s attempt to modernize and simplify its entire tech setup.

Tony Kerrison, who oversees Deutsche Bank’s technology infrastructure, said that IBM is a natural fit for their digital upgrade plans. Dominic Schulz, IBM’s Global Managing Director for Deutsche Bank, added that the expanded deal will help the bank better analyze data, simplify complex tasks, and use automation to improve its IT systems. This partnership is just one of many that IBM has been working on. In fact, it recently teamed up with Ferrari (RACE) in order to launch an app for its fans.

What Is the Target Price for IBM?

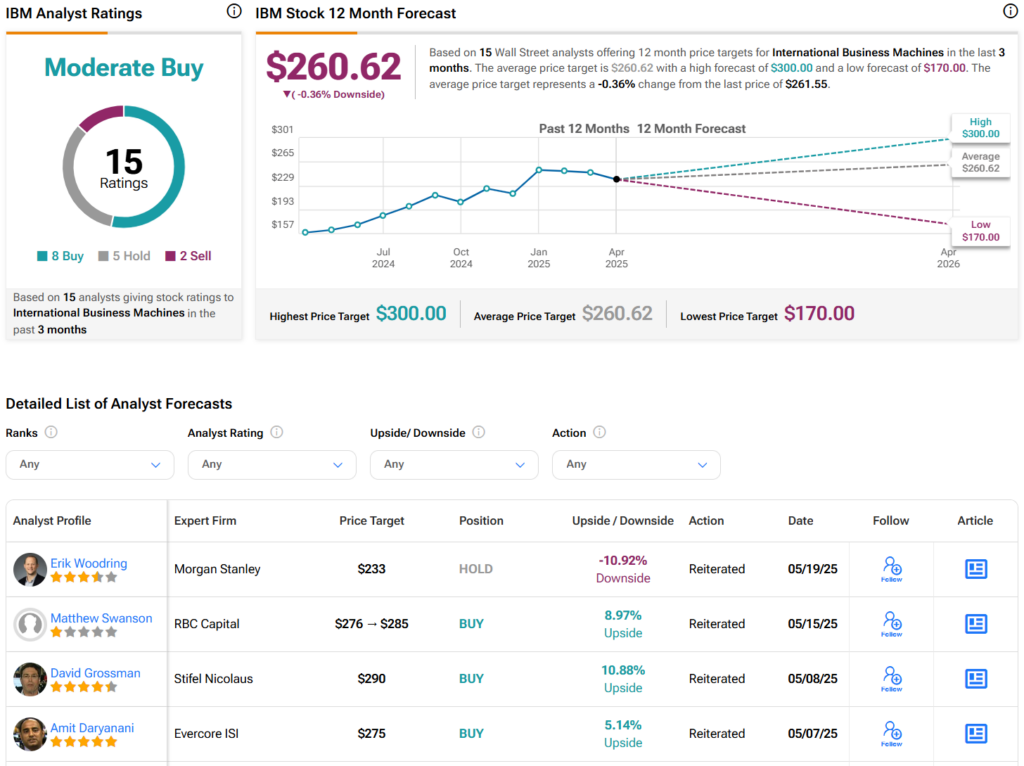

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on eight Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $260.62 per share implies that shares are fairly valued.

See more IBM analyst ratings

Disclaimer & Disclosure

Looking for a trading platform? Check out TipRanks’

Best Online Brokers

, and find the ideal broker for your trades.

Report an Issue