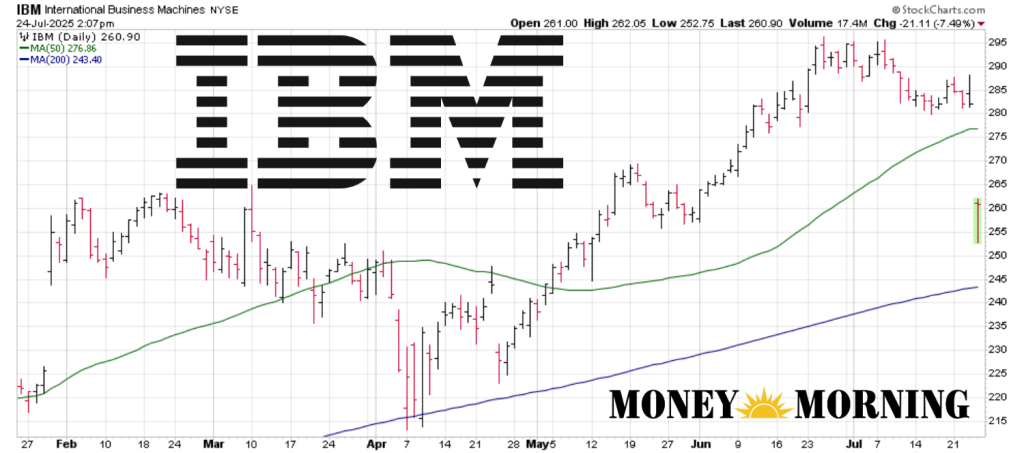

IBM (IBM) is down 7.6% today despite reporting some solid headline numbers. Revenue of $16.98 billion beat the $16.59 billion consensus, adjusted EPS of $2.8 cleared the $2.65 estimate, and full-year free-cash-flow guidance was nudged north of $13.5 billion.

Despite that, IBM stock still fell.

This is mainly due to IBM’s software segment, where sales of $7.39 billion came in about $40 million lower vs. expectations. It also showed that organic software revenue growth has decelerated to 5% from 8% in Q4. The market’s reaction feels harsh until you remember that IBM stock was up over 53% in one year before Q2 earnings sent it down.

The AI, software, and quantum computing narratives pushed this rally, and a slowdown here is causing it to cool off.

Time to buy or sell IBM stock?

The setback is unlikely to lead to a sustained decline unless the broader market also turns bearish. Bank of America trimmed its price target to $310 but kept a buy rating. That’s because the trajectory remains intact even if software has become a “show me” story.

Wedbush’s Dan Ives reiterated his outperform rating with a $325 price target on IBM. He believes it is “well-positioned to capitalize on the current demand shift for hybrid and AI applications with more enterprises looking to implement AI for productivity gains and drive long-term profitable growth”.

JPMorgan also increased its price target to $290 due to the margins here. UBS is the odd one out, as it raised its target to just $200.

IBM’s Q2 was a classic high-wire act: the numbers were good, the optics were bad, and the fundamentals are better than the stock’s reaction implies. Unless software growth collapses outright, the rally seems to have caught its breath rather than broken its leg. The quantum computing narrative alone could take IBM higher than $300 if the broader market cooperates.

More Trending Stories from Money Morning