While the hyperscalers and clouds and their AI model builder customers are setting the pace in compute, networking, and storage during the GenAI revolution, that does not mean that they will necessarily provide the only systems that will be used by the largest enterprises in the world.

In many cases, it will be IBM and its peers in systems and applications, such as Microsoft and Oracle, who make a fair bit of change from the GenAI boom even as they upgrade the existing back office transaction processing and analytics systems that feed into AI models. The evidence from IBM’s latest financial results certainly indicates that Big Blue is benefiting from GenAI as well as from the Linux systems software stacks that it has gotten its hands on through the acquisitions of Red Hat and HashiCorp.

In the second quarter ended in June, IBM’s revenues rose by 7.8 percent to just a tad under $17 billion, with gross profits up 11.5 percent to $9.98 billion and net income up 19.6 percent to $2.19 billion. The new “Telum II” mainframe processors and their System z17 servers had a 67 percent revenue spike in the quarter as they started shipping in June, and that was a big part of the revenue and profit boost in Q2.

We also think that IBM’s internal use of AI in its supply chain, back office, and sales operations is helping it to cut costs (meaning people) and boost profits, although Big Blue has not said anything specific about this in a while, but Jim Kavanaugh, IBM’s chief financial officer, dropped this hint:

“We have been accelerating our productivity initiatives, which is fueling our flywheel for growth and margin expansion. We are early in this Client Zero journey on scaling AI internally to reinvent the way we work and are excited about the significant opportunities ahead of us. We exited 2024 at $3.5 billion of annual run rate savings achieved. And we now believe we can achieve approximately $4.5 billion in annual run rate savings by the end of 2025.”

Client Zero is, of course, IBM itself. IBM was a textbook case in adopting sophisticated SAP software to run its manufacturing, distribution, and back office operations nearly three decades ago and used itself as an example of how to modernize. And here in the GenAI revolution, IBM is deploying AI internally to show how enterprises can build AI models (or buy them from Big Blue) and use them in their workflows and processes to cut costs. Talking about its own successes – and those of early adopters in the enterprise that are IBM’s top customers – with AI models is the sales technique the company is applying in every deal is does right now.

When it was announced in 2023, the Client Zero effort was projected to deliver $2 billion in cost reductions in 2024, but this April, IBM looked back and said that it has actually delivered $3.5 billion in annualized savings as it exited last year. IBM is running its own watsonx platform and Granite models atop Red Hat OpenShift on its System z mainframes, and is using AI in workflows spanning IT modernization, digital labor, human resource transformation, enterprise performance management, client support, and supply chain management. IBM’s watsonx Orchestrate, which allows customers to build AI agents, now has 150 pre-built custom AI agents that cover human resources, sales, procurement, and IT operations.

It would be interesting to know how much of this $3.5 billion run rate in savings from the Client Zero effort is actually trickling down to the bottom line. How much does IBM’s AI training and inference cost? We need to know that to do the math. Inquiring minds want to know. . . .

What seems obvious right now is that IBM’s bottom line is being helped by AI more than its top line, but that will eventually shift, we think. We do not think that AI represents a very large portion of its $70 billion or so in revenues for 2025, but a $3.5 billion run rate at the end of 2024 in savings from AI initiatives against $5.8 billion in pre-tax income for the 2024 year is a huge impact. Imagine if IBM didn’t have AI to drive automation and therefore savings?

Anyway, Big Blue was firing on its server, software, and services cylinders in the quarter. Sales of infrastructure hardware and operating systems related to server and storage platforms rose by 13.6 percent to $4.14 billion, and gross profits were $2.55 billion, representing 61.5 percent of revenues and increasing 23.7 percent year on year. (A new mainframe cycle is clearly a good thing for IBM’s books, and the Power11 server cycle in the RISC systems market, which gets started with initial shipments this week, will help IBM in the coming quarters, too.

Within the Infrastructure group, sales of servers and storage – what IBM calls hybrid infrastructure – rose by 21.5 percent year on year to $2.85 billion. Infrastructure support continues its downward slide, off a half point to just under $1.3 billion in the quarter. Add it all up and subtract out the costs and IBM’s pre-tax income for the Infrastructure group rose by 47.6 percent to $965 million.

IBM’s Software group did well in the quarter, with Red Hat Enterprise Linux, OpenShift, and HashiCorp Terraform doing particularly well. Software revenues rose by 9.6 percent to $7.39 billion, but pre-tax income was flat at $2.11 billion even if gross profits for software were up 10 percent to $6.2 billion. The Red Hat business was up 14 percent to just a hair under $2 billion in the quarter.

IBM’s Consulting group with Intelligent Operations (what used to be called Application Operations, up 5 percent as reported to $1.97 billion and Strategy and Technology (what used to be separated out as the Technology Consulting division and the Business Transformation division) up 1.2 percent as reported to $3.34 billion.

IBM Financing is still tiny by comparison to the other divisions, with $166 million in sales, down 1.8 percent, but an unexplained $179 million in pre-tax income. (Perhaps from the sale of assets? Who knows?)

Our best guess is that the core, real systems business – servers, storage, switching, operating systems, tech support, and financing of IBM’s own gear – brought in $7.66 billion in sales, up 9.2 percent, with a pre-tax income of $4.27 billion in our model. If you add in the systems-level stuff from Red Hat – Enterprise Linux, OpenStack, OpenShift, HCI, maybe Ansible – that was about $1.39 billion more in “real” systems revenues added to the mix, up 9.9 percent compared to Q2 2024. So the “real” IBM systems business, with Red Hat drove a little more than $9 billion in revenues and around half of that dropped down to the pre-tax income level in the books for Q2 2025.

This is a very healthy business. It may not be taking the world by storm, but it is no joke.

And as the chart above shows, Red Hat really has saved the IBM’s systems business and reinvigorated it. It was rebounding a bit on its own, but Red Hat really got it growing again.

That leaves us with the GenAI book of business. Arvind Krishna, IBM;s chief executive officer, said on the call with Wall Street analysts going over the Q2 2025 numbers that the cumulative AI book of business for Big Blue was $7.5 billion as the quarter ended. Krishna did not elaborate on how much of this was driven by hardware, software, or consulting. And frankly, IBM has never given any impression about how its z16 or Power10 system sales have been driven by AI in any fashion. But, we suspect it will try to characterize this during the z17 and Power11 generations that are just getting going now.

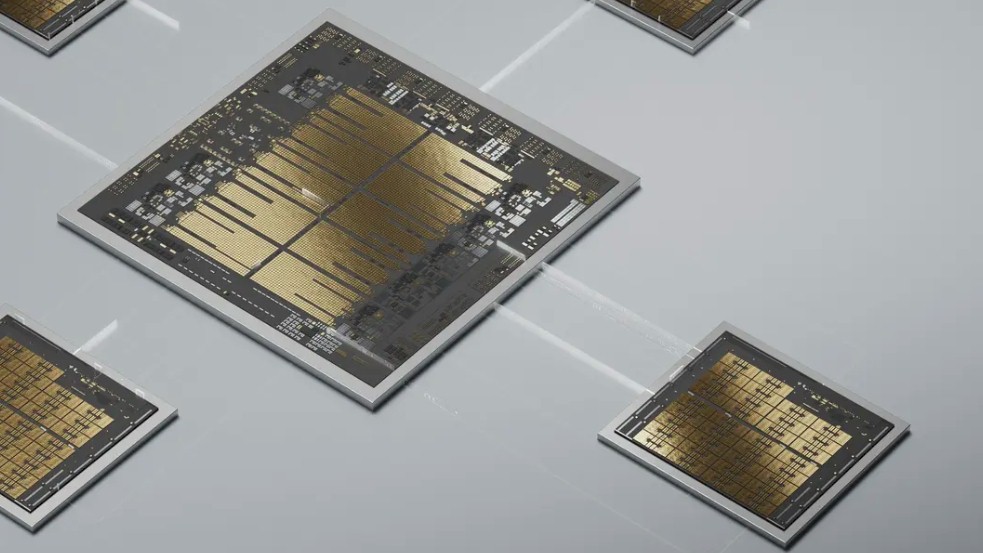

We took our best shot at figuring out the breakdown of how much GenAI bookings came from software and how much from consulting. And hopefully, IBM will start talking about how its z17 and Power11 chips as well as its “Spyre” AI accelerators are driving its Infrastructure group when the revenues become material. If IBM doesn’t do that, then we can be pretty sure that they were never material, which would be unfortunate for Big Blue.

We think that AI accelerators, both on IBM’s CPUs and on Spyre clusters, has the potential to double IBM’s hardware sales because many of IBM’s customers will want to do AI natively on their z and Power iron. If IBM makes AI easy and integrated and fairly cheap, there is no reason to believe this cannot happen.