Five-star Bank of America analyst Wamsi Mohan kept a Buy rating on IBM (IBM) and set a price target of $270 after saying that the tech company is a safe investment with expected growth ahead. Indeed, he believes that IBM will grow its revenue and cash flow, which could help fund more mergers and acquisitions in the future. In his note, Mohan focused on transaction processing (TP) software, a key part of IBM’s mainframe systems, which has not only stabilized but is now growing again, even in today’s cloud-focused tech world.

Confident Investing Starts Here:

Mohan explained that TP software makes up about one-third of IBM’s total software revenue, earning between $5 billion and $7 billion per year, with most of this coming from IBM Z mainframe systems. In addition, growth in this area is being driven by new pricing models, technological improvements, and high demand for reliable systems that are used in critical business operations. Mohan also pointed out that many IBM Z customers are increasing their usage in order to handle more digital transactions, which has boosted IBM’s recurring software revenue.

Interestingly, while Red Hat has been a major driver of growth for IBM, TP software is also becoming more important. In fact, IBM expects this part of the business to grow by mid-single digits, while the total software segment is expected to grow by about 10%. It is worth noting that IBM has added features like WatsonX AI and switched to more flexible subscription pricing, which has helped more customers sign on and stay longer. As a result, these strategies are helping IBM grow both usage and revenue by making the software a deeper part of customers’ businesses, according to Mohan.

What Is the Target Price for IBM?

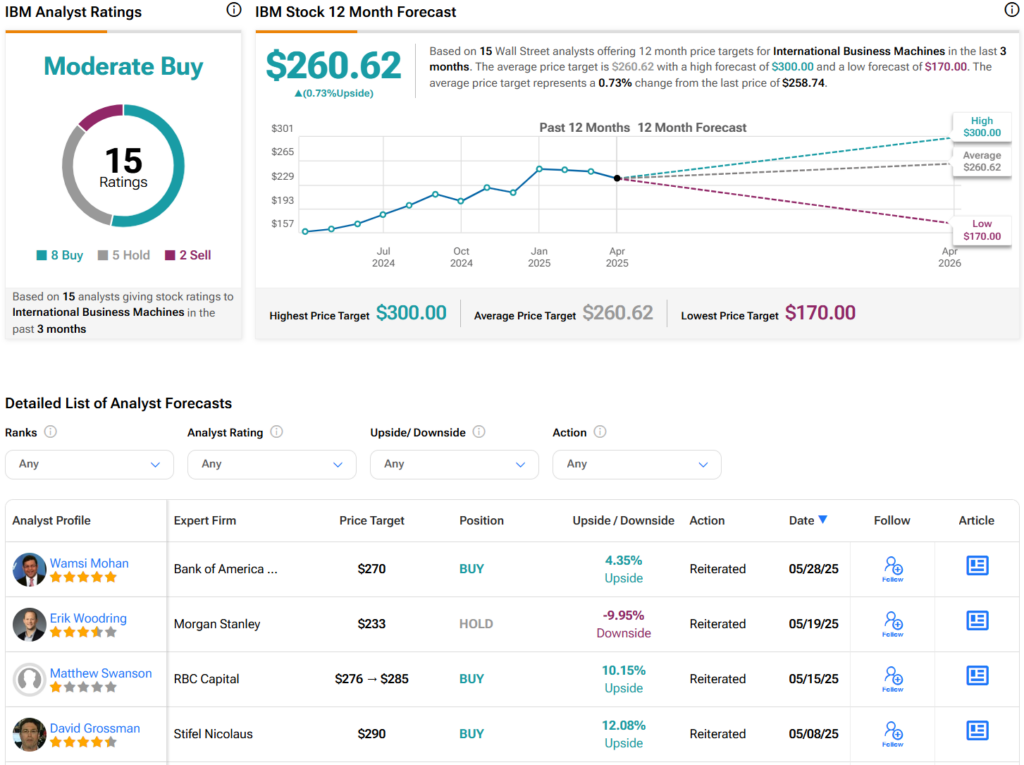

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on eight Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $260.62 per share implies 0.7% upside potential.

See more IBM analyst ratings

Disclaimer & Disclosure

Looking for a trading platform? Check out TipRanks’

Best Online Brokers

, and find the ideal broker for your trades.

Report an Issue