Key Takeaways

QBTS fell 0.9% in 30 days despite a 509% Q1 revenue surge driven by Advantage2 system sales. IBM’s Starling roadmap and Google’s Willow chip aim to outscale D-Wave’s annealing approach. QBTS trades at 144.4X forward sales, well above its median, as investor caution around scalability grows.

D-Wave Quantum (QBTS Quick QuoteQBTS – Free Report) shares have slipped 0.9% over the past 30 days, a slight pullback that masks intensifying headwinds from tech titans International Business Machines (IBM Quick QuoteIBM – Free Report) and Alphabet (GOOGL Quick QuoteGOOGL – Free Report) , both aggressively scaling up their gate-based quantum computing roadmaps.

While D-Wave made headlines with a 509% year-over-year revenue surge in the first quarter of 2025, fueled by its first full-system Advantage2 sale and real-world production use cases, the stock is currently trading more than 20% below its all-time high reached on May 23, 2025.

Investor caution is growing as IBM unveiled its “Starling” roadmap toward fault-tolerant systems by 2029 and Google showcased its “Willow” chip’s error-reducing breakthroughs. In contrast, D-Wave’s annealing-based architecture, while effective for optimization tasks, may face long-term limitations in market scope versus gate-based rivals that are targeting cryptography, quantum chemistry and advanced machine learning.

Despite a robust cash position of more than $300 million and strong early adoption via programs like the Leap Launchpad, analysts are signaling caution. Forbes’ Peter Cohan highlights that while D-Wave’s niche use cases are growing, its ability to scale may fall short as IBM and Google push deeper into enterprise markets. As fault tolerance and broad algorithmic reach become key differentiators, investors are questioning whether D-Wave’s annealing approach can stay relevant, or if it’s on track to become a niche player in a quantum landscape dominated by tech giants.

One-Month Price Performance

Image Source: Zacks Investment Research

IBM and Google Accelerate Quantum Ambitions, Dent D-Wave’s Niche Advantage

IBM’s June 2025 unveiling of its “Starling” roadmap marks a major leap in the quantum race. The company aims to build the world’s first fault-tolerant quantum supercomputer by 2029, with over 200 logical qubits deployed at its new Quantum Data Center in Poughkeepsie, NY. Building on the success of its Heron and Condor chips, IBM is shifting focus from physical qubit counts to scalable, error-corrected systems, positioning itself for real-world applications in cryptography, materials science and AI. This evolution could challenge annealing-based players like D-Wave, which lack fault-tolerance capabilities.

Google is also advancing rapidly, showcasing its new “Willow” chip, which significantly reduces error rates. It ran a key quantum benchmark in under five minutes. With a long-term vision to reach 1 million qubits using surface code error correction, Google is integrating quantum into its broader AI and cloud ecosystem. As IBM and Google push gate-based quantum platforms toward commercial viability, D-Wave risks being edged into a narrower niche, especially as universal algorithms and fault-tolerant designs gain traction.

QBTS Valuation Getting Expensive

Image Source: Zacks Investment Research

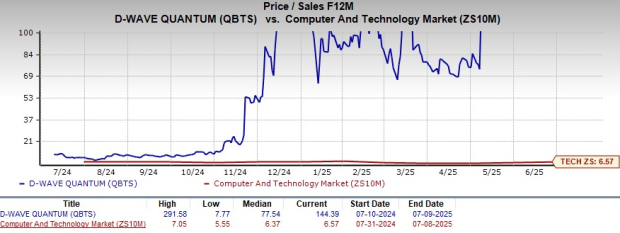

D-Wave is presently trading at a forward 12-month price-to-sales of 144.4X, which is way ahead of its 1-year median of 77.54X. It also remained overvalued compared to the sector.

QBTS currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.