The CB Insights Smart Money list identifies the world’s 25 best-performing VC investors over the past decade. These firms consistently back breakout startups before they hit escape velocity, making their portfolios a powerful signal for where the future is headed.

To create the 2025 list, we analyzed 10 years of CB Insights’ Business Graph data, evaluating 12,000+ venture firms on portfolio outcomes (unicorns and exits), share of rounds led, portfolio quality via Mosaic Score, capital efficiency, and entry discipline. Smart Money VC portfolios offer a front-row view of where the sharpest investors are placing their bets. Use the list as an early indicator to spot emerging markets and promising founders.

Which VC firms are on the Smart Money list?

Firms are presented in alphabetical order.

Accel

Andreessen Horowitz

Bain Capital Ventures

Battery Ventures

Bessemer Venture Partners

Felicis

First Round Capital

Founders Fund

General Catalyst

Google Ventures

Greylock Partners

Index Ventures

Institutional Venture Partners

Kleiner Perkins

Lightspeed Venture Partners

Meritech Capital Partners

New Enterprise Associates

Norwest Venture Partners

Notable Capital

Redpoint Ventures

Salesforce Ventures

Sapphire Ventures

Sequoia Capital

Spark Capital

Thrive Capital

![]() CBI customers: See Smart Money’s latest bets

CBI customers: See Smart Money’s latest bets

How Smart Money VCs are outperforming the market

Our 2025 edition of Smart Money VCs:

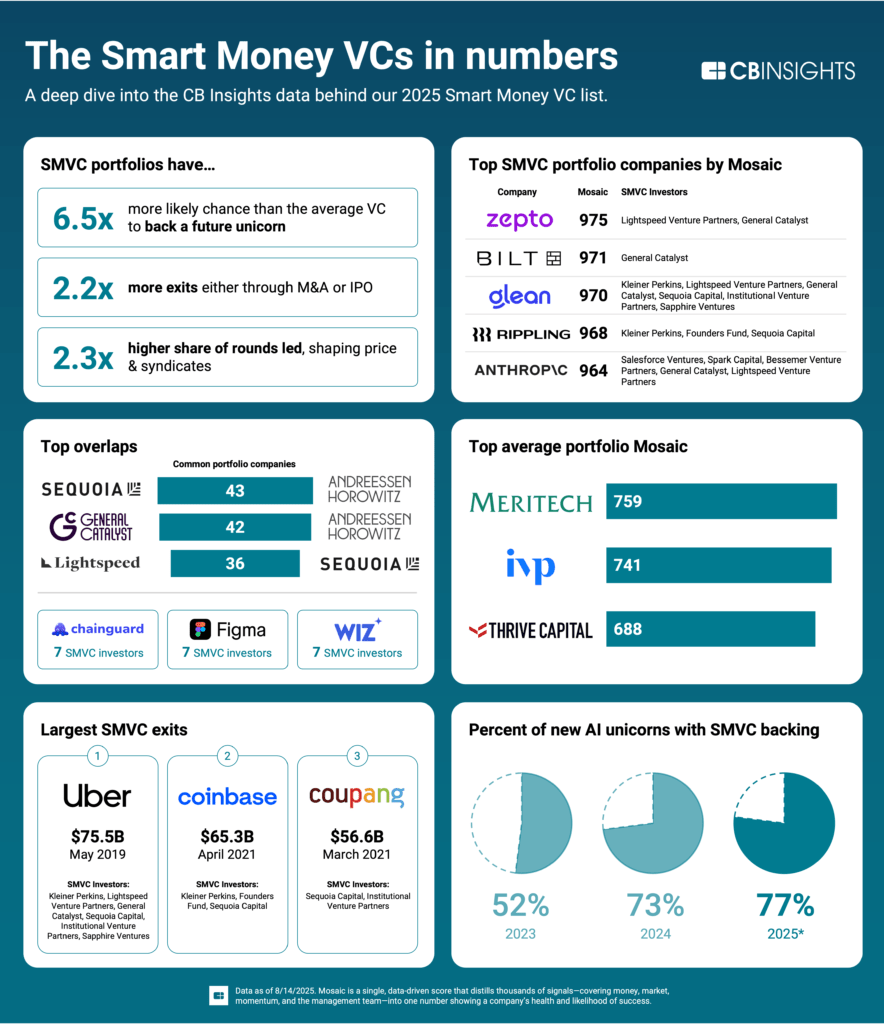

6.5x more likely than the average VC to back a future unicorn

2.2x more exits per firm, either through M&A or IPO

2.3x higher share of rounds led, shaping pricing and syndicates

Smart Money syndicates amplify signal. The top pairs share dozens of portfolio companies — Sequoia & Andreessen Horowitz (43), General Catalyst & Andreessen Horowitz (42), and Sequoia & Lightspeed (36). Most widely backed across the cohort: Chainguard, Figma, and Wiz (each with 7 Smart Money backers).

Smart Money firms have also been the dominant backers of the AI wave — they backed 52% of new AI unicorns in 2023, 73% in 2024, and 77% in 2025 YTD — and that exposure is translating into outlier outcomes.

Since 2015, Smart Money VCs have backed 80 companies that exited at $10B+ — roughly 100x the $100M median exit. The largest Smart Money exits include Uber ($75.5B, 2019), Coinbase ($65.3B, 2021), and Coupang ($56.6B, 2021).

Mosaic shows where they’re headed next. Smart Money portfolios skew to higher Mosaic Scores — CB Insights’ 0–1,000 predictive rating of private-company health. The average portfolio Mosaic is 628 — about 2.6x the VC norm.

And the edge is most visible at the very top of the distribution: more than 65% of companies in the top 1% of Mosaic Scores are backed by a Smart Money VC. Top firms by average portfolio Mosaic include Meritech (759), IVP (741), and Thrive Capital (688). Standout companies in 2025 include Zepto, Bilt, Glean, Rippling, and Anthropic.

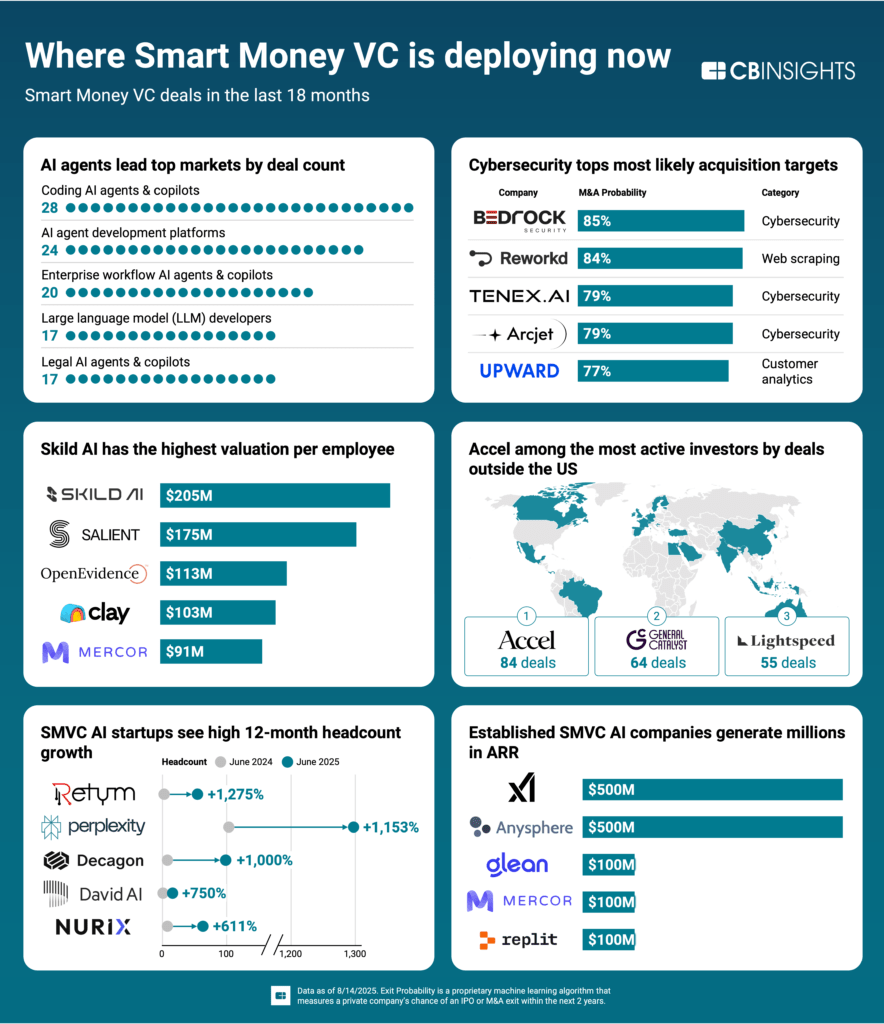

Where Smart Money is deploying now

Smart Money is still leaning into AI — especially agentic applications.

Over the last 18 months, agent-related categories led by deal count: coding agents and copilots (28 deals), agent development platforms (24), enterprise workflow agents and copilots (20), and legal agents and copilots (17). Infrastructure remained active as well, with 17 deals into LLM developers. Top recent AI deals by Mosaic include Glean (enterprise AI agents), Augment Code (coding AI agents), and ElevenLabs (voice AI).

Our M&A probability model points to cybersecurity as the most likely near‑term exit pool among Smart Money portfolios, with companies like Tenex.ai ranking highest. Activity is accelerating — highlighted by Google’s $32B acquisition of Smart Money–backed Wiz in March 2025. For acquirers, targeting Smart Money portfolio or syndicate companies can streamline diligence and post‑deal integration.

Outside the US, cybersecurity is also drawing Smart Money. Since Jan’24, Accel (84 deals), General Catalyst (64), and Lightspeed (55) are the most active by ex‑US deal count; their portfolios include companies like Tines, Cato Networks, and Torq.

Methodology

What is the CB Insights Smart Money list?

The Smart Money list is an unranked collection of the top 25 venture capital firms worldwide. We analyzed 12,000+ venture investors with 10+ unique portfolio companies using 10 years of CB Insights’ Business Graph data (2015–2025) to surface the highest performers via our Smart Money Index.

What makes a VC “smart”?

Comparable lists in other asset classes rank firms based on investment performance, but returns data is hard to come by in the VC world, and rates of return can be easily manipulated.

Our methodology factors:

Portfolio outcomes — unicorn count/share and exit count/share

Deal leadership — share of rounds led

Portfolio quality — average CB Insights Mosaic Score

Capital efficiency — portfolio value created per dollar raised

Entry discipline — median stage at first check

Inputs were normalized and combined into the Smart Money Index. The top 25 became the 2025 Smart Money cohort.

What can I do with this collection?

Explore the Smart Money Expert Collection on the CB Insights platform to filter deals, build screens, and make faster decisions.

If you are a venture investor and want to submit data on your portfolio companies to allow us to better score you in the future, please reach out to researchanalyst@cbinsights.com.

RELATED RESOURCES FROM CB INSIGHTS:

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.