The generative artificial intelligence boom has been driving the Nasdaq to all-time highs, but not every company in the space is a success story. Analysts at Wedbush are calling C3 AI , an enterprise AI provider, a “sinking ship” after disappointing earnings and changes in the executive suite.

C3 had warned investors that its numbers were going to be rough before Wednesday’s earnings announcement – and the revenue figure of $70.3 million was in line with that lowered guidance. But the company closed just 46 agreements last quarter, compared to 69 in the prior quarter. It also has withdrawn its guidance for the just-started fiscal year.

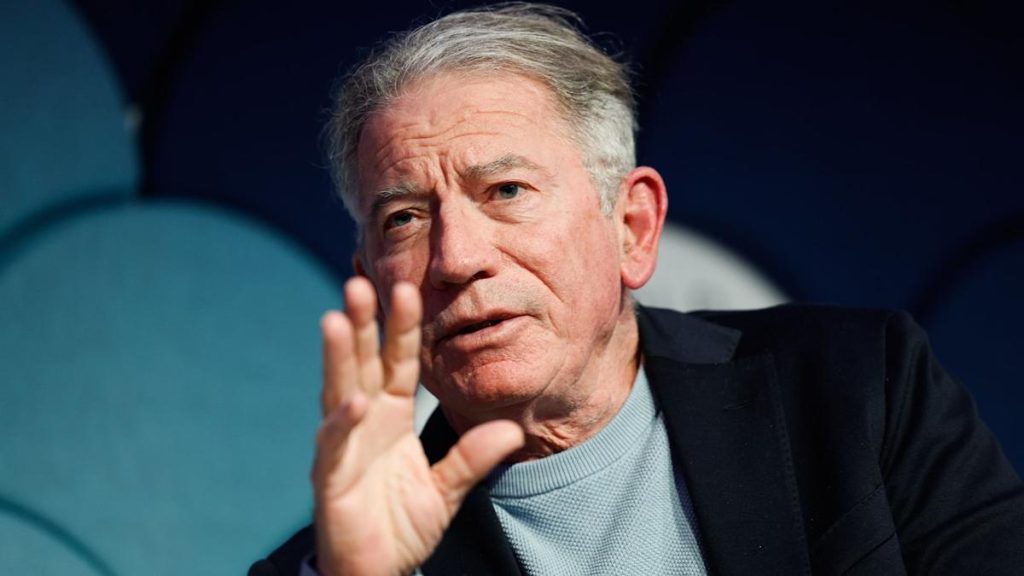

The company also announced that Stephen Ehikian would take over as C3’s CEO, replacing Tom Siebel, who earlier this year revealed that he was diagnosed with an autoimmune disease that resulted in “significant visual impairment.” Siebel will remain at the company as executive chairman.

Ehikian has previously served as Acting Administrator of the General Services Administration (GSA), as well as CEO and co-founder of Airkit, an AI company for customer service teams, and as vice president of product at Salesforce.

Wedbush analyst Dan Ives wrote in a note to investors that the hire of Ehikian was “solid,” given Ehikian’s experience in scaling AI companies. But he said it wasn’t enough to erase investor concerns.

“Regardless of this new hire, the company still has significant hurdles to overcome to regain the Street’s confidence given the weakness in its operational performance following the sales restructuring,” Ives wrote.

C3 was one of the beneficiaries of the hot IPO market during the pandemic . The stock launched at more than $119 per share, eventually moving as high as $161. That’s well above the current share price of $16. Life to date, the company’s stock has lost almost 87% of its value. It was down about 3% on Thursday.

Government contracts are a significant part of C3’s business. In May, it landed a $450 million deal with the Air Force for a predictive analytics program.