C3.ai shares are down more than 30% Monday morning after the company issued sharply lower Q1 revenue guidance. The company also announced a completed restructuring of its global sales and services organization.

C3.ai now expects Q1 (July) revenue of $70.2–$70.4 million, well below the $103.98 million FactSet consensus. Non-GAAP loss from operations was ($57.7) million, essentially unchanged from the prior period.

The restructuring included the appointment of Rob Schilling as EVP and Chief Commercial Officer, responsible for all sales, customer-facing teams, and alliances, effective June 16, 2025.

Management cited two key factors behind the weak quarter, a disruption from the leadership transition and the CEO’s reduced participation in the sales process due to recent health issues.

While the company expressed confidence in its market opportunity, product offering, and customer satisfaction, the near-term outlook remains pressured.

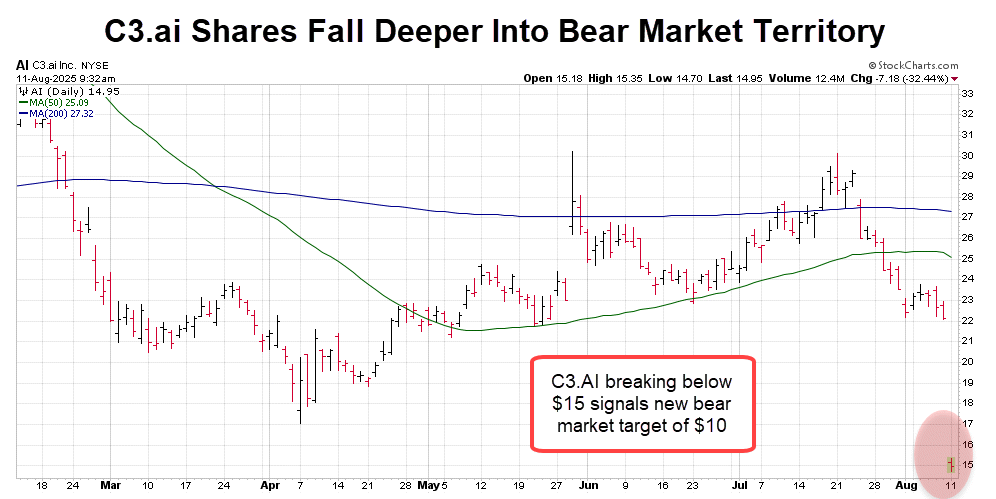

Technically, the stock had already rolled over from a neutral trend last week after failing at resistance near $30.

Shares dropped back below the 50-day moving average on July 29, a critical level that has acted as a trend gauge for much of 2025.

Earlier this year, C3.ai spent 73 consecutive days below the 50-day, losing over 45% of its value during that period.

Today’s sell-off confirms a return to the stock’s bearish trend, with the 50-day moving average now turning lower again.

The breakdown is significant.

This morning’s open below $15 marks the lowest price for AI shares since January 2023. The loss of this price level removes a key support area that had held for more than 18 months.

From a longer-term perspective, the stock has been in a bear market trend since February 2025, when it dropped below its 20-month moving average.

The prior rally to $50 earlier this year has fully reversed into a sequence of lower highs and lower lows, signaling sustained distribution.

Given the lowered guidance, completed restructuring, and renewed downside momentum, the next technical target sits near $10, an area of prior price memory that could attract buyers, but only if the company begins to show signs of a fundamental bottom.

Until then, both investors and short-term traders should expect continued volatility, with the potential for further capitulation if broader market conditions weaken.

The combination of fundamental disappointment and technical breakdown puts C3.ai back in an extremely high-risk category, with any near-term rallies likely to face selling into resistance.

]]>

More Trending Stories from Money Morning