We analyzed Anduril’s acquisitions, partnerships, and product development since Q1’23 to surface the company’s strategic priorities.

Founded just 7 years ago, Anduril has rapidly emerged as a force in the defense industry.

Its Lattice operating system serves as a digital backbone for autonomous capabilities across land, sea, air, and space domains. Meanwhile, its Arsenal factory platform aims to modernize the defense manufacturing playbook by producing different autonomous systems on demand, potentially slashing production cycles from years to months while reducing costs.

Together, these strategies bring a startup mentality to defense and have helped Anduril reach a potential $28B valuation and $1B in revenue in 2024 — clear signals of traction among investors, government agencies, and global defense firms.

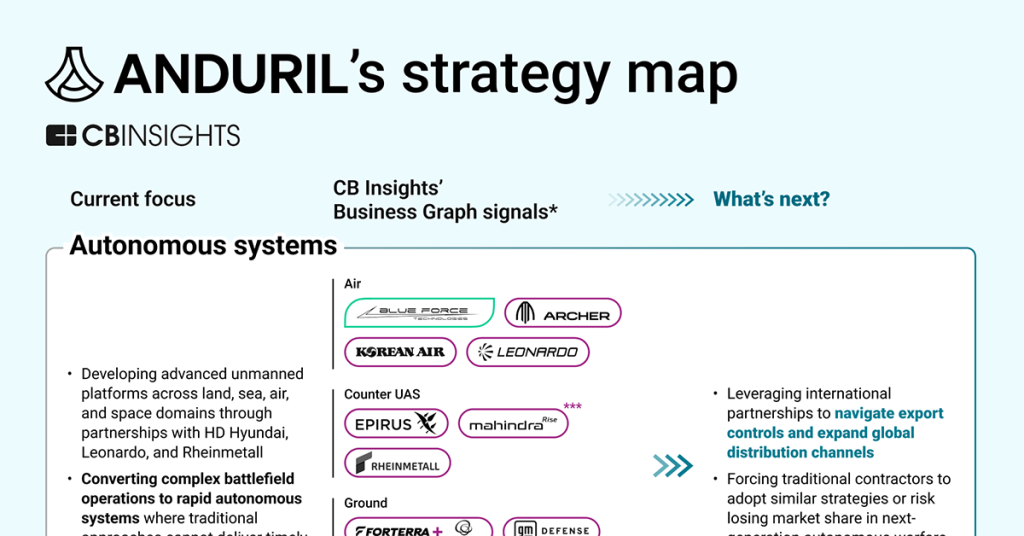

Using CB Insights data, we analyzed Anduril’s acquisitions, partnerships, and product moves since Q1’23 to identify the 4 key areas driving its next chapter of growth — and the companies it’s aligning with to get there.

Here are 3 key takeaways from our analysis:

Anduril is prioritizing software to build an open, networked defense ecosystem. Its Lattice AI platform enables interoperability across previously siloed defense systems by connecting commercial AI companies, cloud providers, and defense contractors across land, sea, air, and space domains, positioning Anduril as essential middleware for next-generation military capabilities.

Anduril is using vertical integration and flexible manufacturing to outpace legacy defense firms. Its Arsenal manufacturing platform replaces complex industry processes with simplified, modular designs and standardized supply chains. This lets Anduril scale output rapidly and address the vulnerability of quickly exhaustible US weapon stockpiles in a major conflict.

Anduril is leveraging international partnerships to build a global defense ecosystem, helping the company navigate export controls, expand distribution channels, and develop new technologies. These alliances may also accelerate the global shift to autonomous warfare, forcing legacy defense firms to adapt or risk losing market share.