The top 3 cloud providers globally are racing to support AI agents and the companies enabling them. This report analyzes their strategies — based on partnerships, startup investments, and internal projects — to see how they’re capitalizing on this next wave of monetization in AI.

As the AI boom accelerates, the top 3 global cloud providers — Amazon, Microsoft, and Google — are racing to capture a larger share of enterprise AI spend. Central to this shift is the rise of AI agents: intelligent systems capable of performing multi-step tasks, interacting autonomously with tools and data, and automating business workflows.

Drawing on CB Insights’ Business Graph, which links data across private investments, business relationships, and public company disclosures, we surface key signals on how each cloud player is positioning itself in the agentic AI space and what their next move could be.

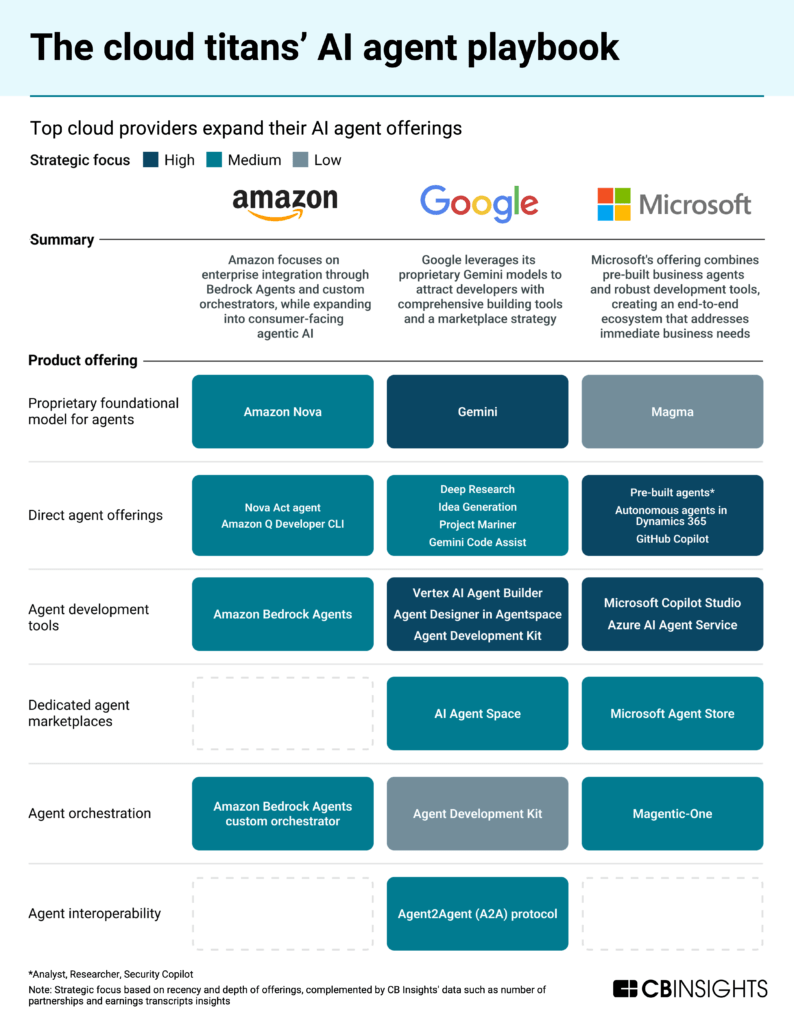

While all 3 providers are investing heavily in infrastructure to support agentic AI, they are taking distinct paths to monetization and market control — from proprietary models and low-code build tools to strategic partnerships and go-to-market accelerators.

Understanding these differences will prove critical in evaluating cloud alignment, competitive positioning, and agent-enabled product strategy.

Key takeaways

Amazon positions itself as a neutral infrastructure layer for the agentic ecosystem, betting on in-house chips and seeding its ecosystem with 16 total investments in agent startups. These investments, which primarily take the form of cloud credits rather than equity, form a low-risk, high-volume strategy to lowering the barriers to building on AWS. Amazon’s approach combines enterprise enablement with strategic consumer-facing investments, signaling potential integration with its broader ecosystem.

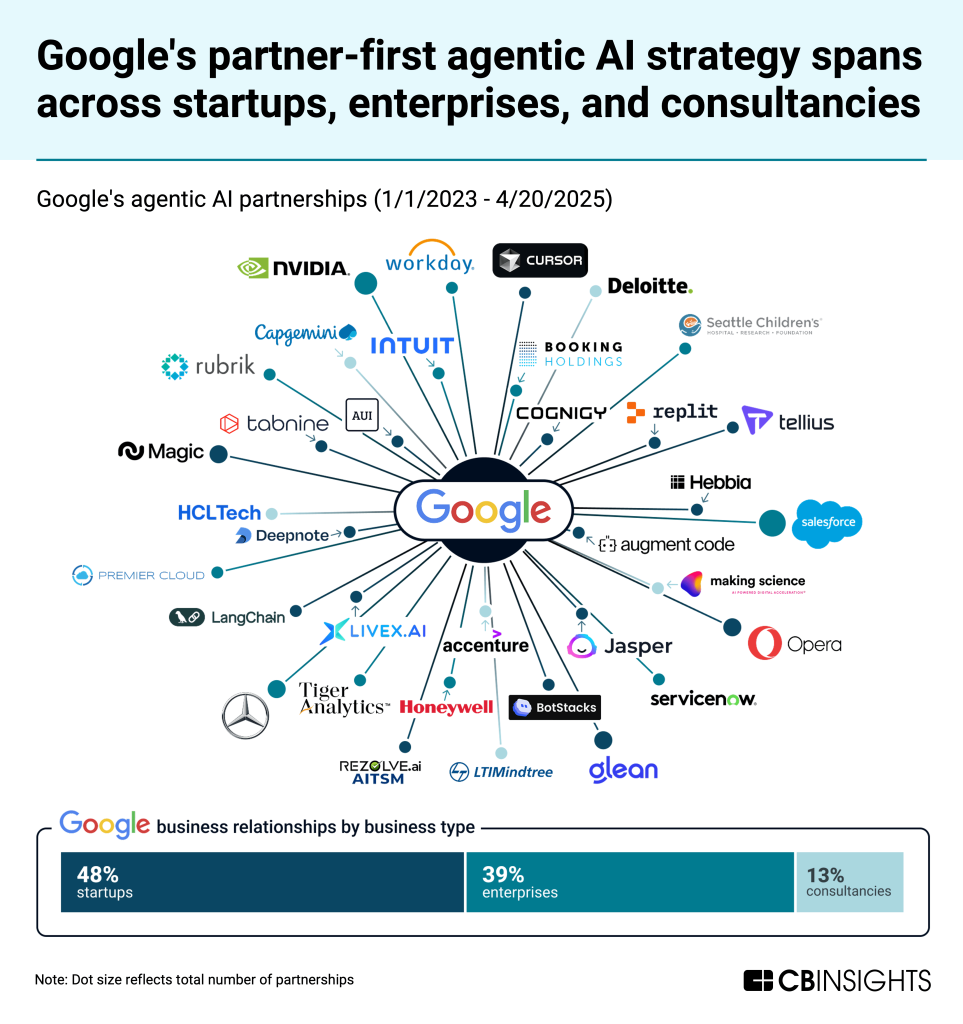

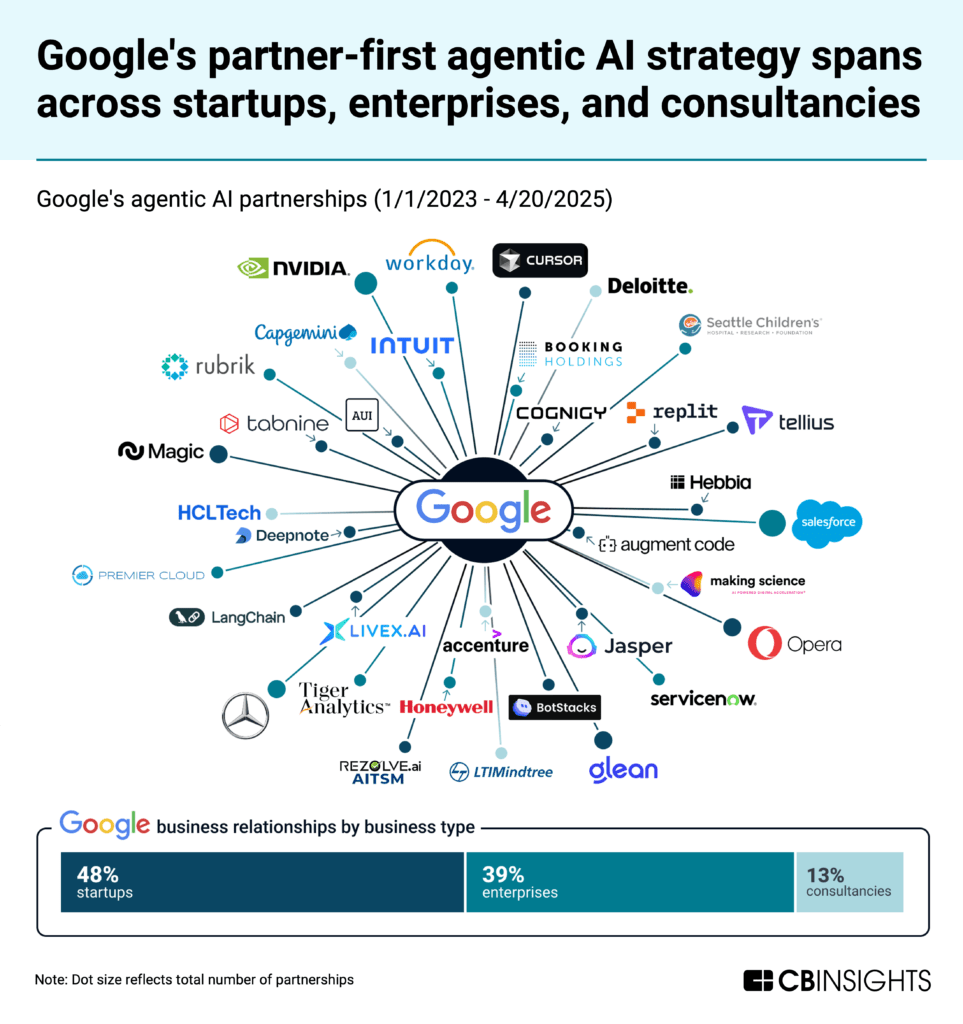

Google’s agentic offering centers around its Gemini foundational models, creating an open marketplace for partner-built agents leveraging its technological leadership — supported by 46 total partnerships and its Agent2Agent protocol. This partner-centric approach means Google can quickly populate its marketplace with specialized agents while maintaining Gemini as the differentiating foundation technology.

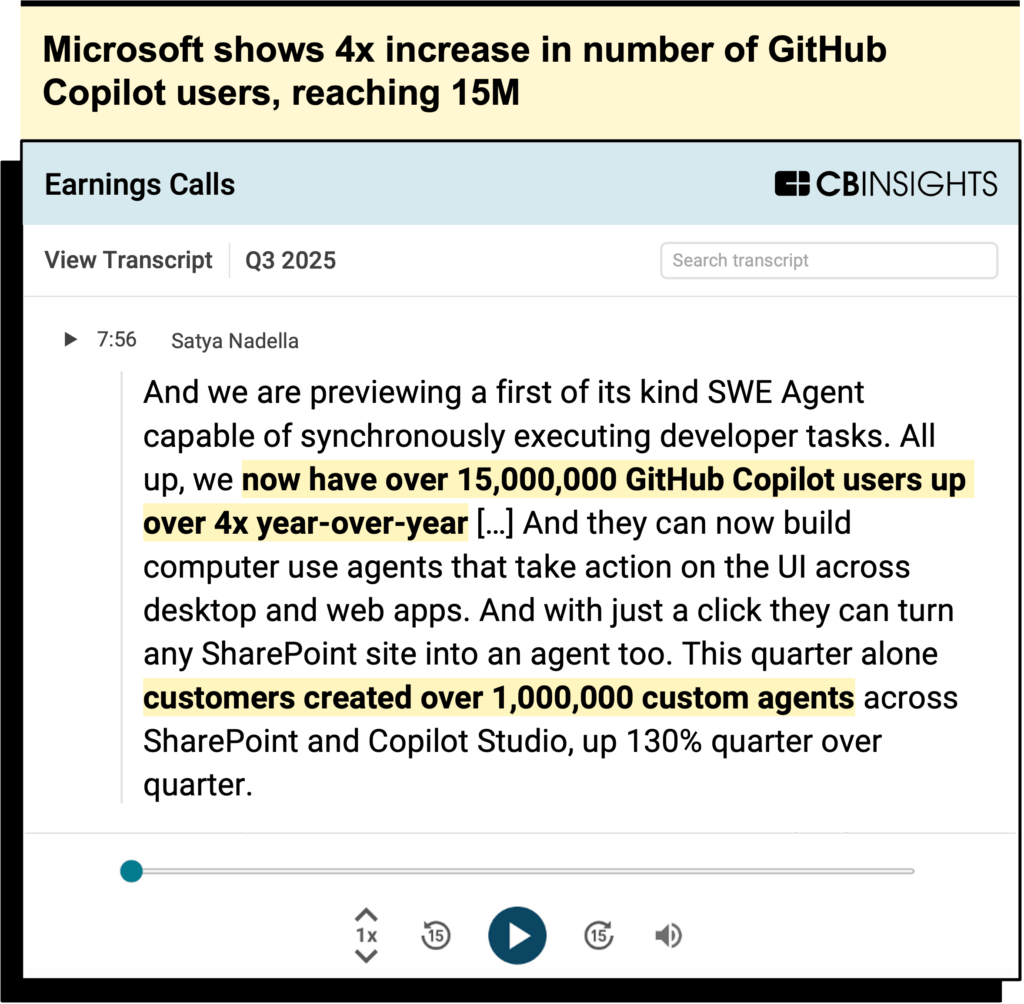

Microsoft emphasizes a pre-built suite of agentic solutions to drive enterprise adoption, embedding Copilot agents throughout its productivity ecosystem. The company recently achieved 15M GitHub Copilot users, up 4x YoY, and recorded 1M custom agents created on its SharePoint and Copilot Studio platforms. Microsoft’s expansive enterprise client base gives it an in-built audience for new agent products.

Amazon positions itself as the neutral infrastructure layer for the agentic ecosystem

Amazon is approaching the agentic AI landscape as a pragmatic infrastructure provider, with a strategic bias toward enabling partners rather than competing with its own agent suite. This partner-first approach comes at a critical time, as Amazon has been playing catch-up in the agentic race — although recent moves, including forming a dedicated agentic AI group in March 2025 and unveiling its Nova foundational models in December 2024, signal a growing focus.

Amazon is betting on its in-house chips, Trainium and Inferentia2, to attract agentic AI workflows, as these chips can help reduce the cost and energy consumption associated with AI model training and inference. Amazon has already formed several partnerships with agentic AI startups such as Poolside and NinjaTech for them to train and run their AI agents on its in-house chips.

This approach — of providing robust infrastructure and letting specialized partners build solutions on top — is also reflected in its agent development tool offerings. While developers can build agents using Amazon Bedrock Agents, Amazon (unlike Google or Microsoft) doesn’t directly emphasize low-code/no-code solutions, instead enabling partners like SnapLogic to build such tools on its platform.

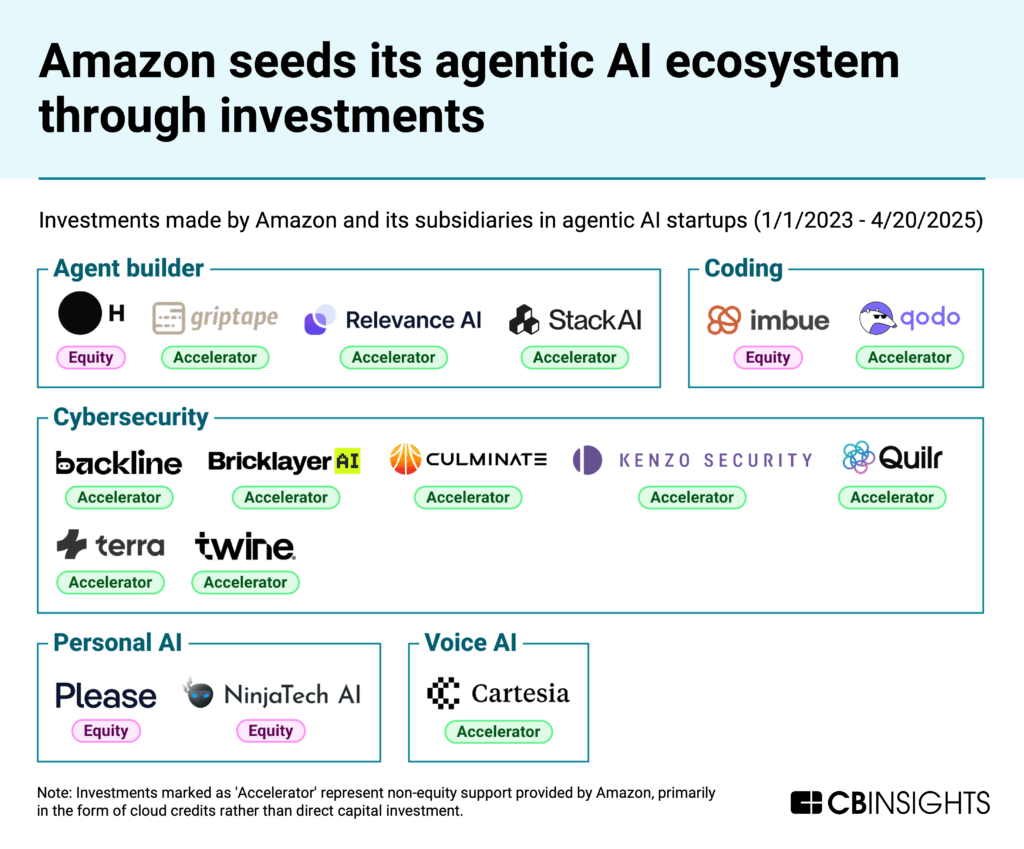

The company has also been investing heavily in agentic AI startups, with 16 unique investments since 2023 — more than both Google and Microsoft combined. However, 12 of these were made through non-equity accelerator programs that provide cloud credits and technical enablement rather than capital.

This low-risk, high-volume approach lowers the barriers to building on AWS while seeding future clients at minimal cost. It also embeds AWS infrastructure into early-stage agent development, capturing mindshare before competitors can gain traction. Amazon’s investments reveal a strategic interest in consumer-facing AI applications that complement its existing business. Three of its four equity investments are in consumer-focused companies — Please and NinjaTech (personal AI agents) and Cartesia (voice AI) — aligning with Amazon’s consumer strategy and the recent launch of Nova Act, its web-browsing agentic AI targeting developers.

Amazon’s investments reveal a strategic interest in consumer-facing AI applications that complement its existing business. Three of its four equity investments are in consumer-focused companies — Please and NinjaTech (personal AI agents) and Cartesia (voice AI) — aligning with Amazon’s consumer strategy and the recent launch of Nova Act, its web-browsing agentic AI targeting developers.

These investments suggest AWS is taking a dual strategy: framing itself as an enterprise infrastructure provider for partners while developing consumer-facing capabilities that could enhance Amazon’s broader ecosystem, including potentially a revamped Alexa.

This could lead Amazon to make an acquisition that accelerates monetization of consumer-facing agents. Acquiring a startup developing agent payment infrastructure, for instance, would support efforts to enable autonomous transactions.

![]() See 4 agent payment infrastructure startups Amazon could acquire

See 4 agent payment infrastructure startups Amazon could acquire

Google’s agentic offering centers around its Gemini foundational models

Google has positioned itself as the central platform provider in the agentic AI landscape, building a comprehensive ecosystem centered around its proprietary Gemini foundation models. Unlike Amazon’s infrastructure-focused approach or Microsoft’s enterprise application strategy, Google is creating an open marketplace for partner-built agents that leverage its technological leadership.

To boost adoption of its Gemini models for agentic AI, Google unveiled its AI Agent Space last year, a dedicated marketplace exclusively for partners’ agents. This is complemented by Google’s agent interoperability initiative, the Agent2Agent (A2A) protocol, which enables AI agents to communicate effectively regardless of their underlying frameworks or vendors.

Google leads in agent-related partnerships with 46 collaborations — 2x as many as Microsoft and Amazon. Almost half of these are with agentic AI startups, including AI coding agents like Cursor, Augment Code, and Replit. This partner-centric approach means Google can quickly populate its marketplace with specialized agents while maintaining Gemini as the differentiating foundation technology.

Source: CB Insights — Google’s business relationships. Note: includes business relationships for Google Cloud.

Enterprise partnerships also demonstrate Google’s strategy in action. Its recent Salesforce collaboration will empower Salesforce customers to build Agentforce agents using Gemini, while Deloitte has launched over 100 ready-to-deploy AI agents powered by Google’s models. According to Google Cloud, more than 60% of generative AI startups are now building on its platform.

Google has also been partnering with leading venture capital firms and accelerators, like Sequoia, Lightspeed, and Y Combinator, to promote the use of its technology (such as TPUs and Gemini models) to fast-growing startups that are building with AI.

Google’s development toolkits — Vertex AI Agent Builder, Agent Designer in Agentspace, and Agent Development Kit — offer solutions for both technical developers and non-technical users, reflecting Google’s goal of becoming the complete platform for agent creators and consumers alike.

Rather than building a comprehensive first-party agent suite, Google is embedding itself into the tech stack of emerging agentic players, making Gemini the platform of choice for agent innovation.

To maintain its edge in safe scaling and cross-agent coordination, Google may look to acquire companies focused on monitoring, governance, and lifecycle tooling, such as Galileo — a leader in AI evaluation backed by Databricks and ServiceNow.

![]() See 20+ AI observability & evaluation startups Google could acquire

See 20+ AI observability & evaluation startups Google could acquire

Microsoft emphasizes a pre-built suite of agentic solutions to drive enterprise adoption

Microsoft’s offerings center around a comprehensive suite of pre-built agents deeply integrated into its productivity ecosystem. While Amazon focuses on infrastructure and Google on promoting its foundational models, Microsoft aims to deliver immediate business value through turnkey solutions.

The company leads the market in pre-built agent offerings, with its Copilot suite including Analyst, Researcher, Security, and Dynamics 365 autonomous agents — all powered by its exclusive access to OpenAI’s models.

This strategy has driven strong adoption: Microsoft’s Q3 FY’25 earnings call revealed that GitHub Copilot’s developer base has surpassed 15M users (up 4x YoY), while 1M custom agents were created during that quarter through Copilot Studio and SharePoint.

Source: CB Insights — Microsoft Earnings Insights

Microsoft’s development tools (Copilot Studio, Azure AI Agent Service) cater to both technical and non-technical users, but the company’s primary advantage comes from embedding agentic capabilities throughout its productivity ecosystem. The November 2024 launch of Magentic-One, a multi-agent system for enterprise deployment, further enhances Microsoft’s position in business workflows.

Unlike Amazon’s broad ecosystem-seeding or Google’s push to embed Gemini models into any agentic workflow, Microsoft concentrates on initiatives that complement its in-house agentic tools. Its partnership with Moveworks exemplifies this strategy, allowing employees to access Moveworks’ specialized agents directly within Microsoft 365 Copilot and Teams.

Microsoft’s approach demonstrates the power of integration over technological differentiation in driving enterprise adoption. By leveraging its existing relationships and software suite, Microsoft has established dominance in high-value business workflows where agentic AI delivers immediate productivity gains — and where competitors must overcome Microsoft’s entrenched position.

To round out its Copilot suite and reinforce its workflow ownership strategy, Microsoft may seek acquisitions in sectors where it lacks native agent offerings, like recruiting, healthcare administration, or logistics.

![]() Identify which vertical AI agent startups Microsoft could acquire

Identify which vertical AI agent startups Microsoft could acquire

Related research on AI agents and big tech:

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.