The top 3 global cloud providers are racing to monetize the AI boom. Drawing on CB Insights’ Business Graph — which links data across private investments, acquisitions, business relationships, and public company disclosures — we surface key signals on how each cloud player is capitalizing on this technological revolution to expand their market shares.

The AI boom is creating massive cloud computing needs that the top 3 global cloud providers — Amazon, Microsoft, and Alphabet (Google) — are racing to address and monetize.

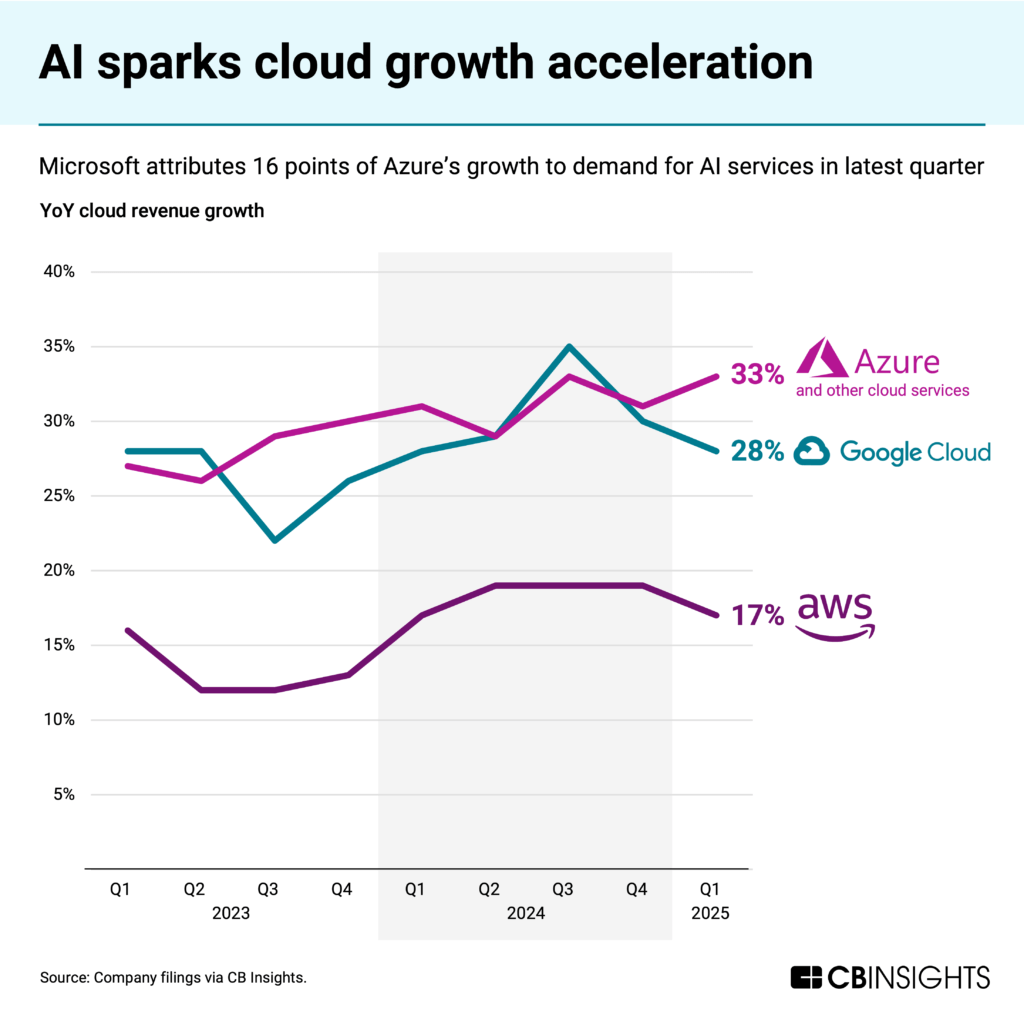

AI is already fueling revenue growth for these cloud giants.

First, AI workloads require more computing resources than traditional workloads, thus increasing per-customer spending. Second, AI companies (with their own computing needs) are proliferating rapidly, now capturing 20% of all venture deals globally. Together, these trends create both enormous revenue opportunities and unprecedented infrastructure challenges.

At the same time, new competitors are emerging to serve this insatiable demand. The OpenAI-led Stargate Project, with its planned $500B investment, threatens to reshuffle the cards in the cloud computing space that AWS has led for over a decade in terms of market share.

In response, cloud providers are spending tens of billions to capture their share of AI computing spend.

In the 19-page report, we cover 3 strategic pillars that emerged from our analysis:

Cloud providers are investing heavily in compute infrastructure to meet explosive AI demand. Amazon, Alphabet, and Microsoft are planning a combined $250B+ in capex spend, primarily for AI data centers, in 2025 in addition to vertically integrating into energy production with 6 nuclear partnerships and creating custom AI chips to control costs and gain competitive advantages.

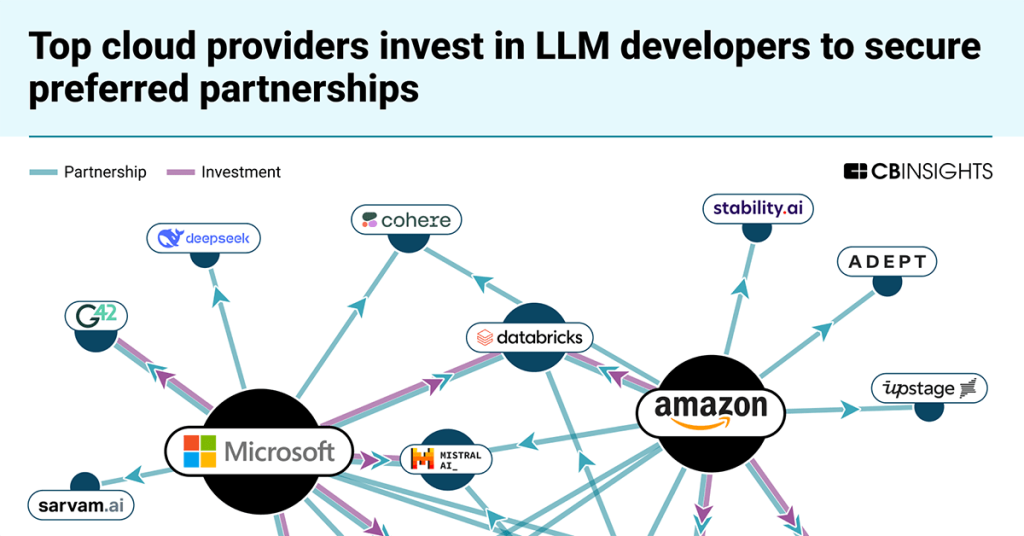

Strategic partnerships and ecosystem development are key to cloud dominance, as providers lock in strategic partnerships with leading model developers (such as Microsoft’s $13B investment in OpenAI), develop proprietary foundation models, and build out accelerator programs to seed AI ecosystems. For example, Amazon expanded its genAI-focused accelerator from 21 to 80 startups between 2023 and 2024 while more than tripling the value of the cloud credits offered.

Cloud providers are expanding their AI service portfolios into agentic AI and security to drive adoption and consumption. Alphabet recently made its largest acquisition ever to expand into the cloud security space, spending $32B to buy Wiz, while all 3 players are racing to expand their agentic AI offerings, including developer tools, dedicated marketplaces, and customizable agents.

Additional resources:

If you aren’t already a client, sign

up for a free trial to learn more about our platform.