Autonomous vehicles are booming again, led by robotaxi pioneers like Waymo.

Their commercial breakthroughs are sparking an industry-wide race, with Tesla and Uber scrambling to catch up — Uber recently partnered with Lucid and Nuro to launch its own robotaxi fleet.

This revival is creating massive demand for simulation and training solutions — essential components of AV development that generative AI has made faster and more cost-effective.

AV simulation and training market leader Applied Intuition exemplifies this opportunity, having just raised $600M at a $15B valuation and counting 18 of the top 20 automotive OEMs as clients — a strong signal of surging demand.

The appeal is obvious: external simulation offers a cost-effective alternative to in-house development for major OEMs like GM and Hyundai, which have struggled with safety issues and commercialization delays in their self-driving units.

As AVs accelerate their shift from experimentation to deployment, simulation providers are expanding beyond passenger vehicles into high-value sectors like defense and industrials.

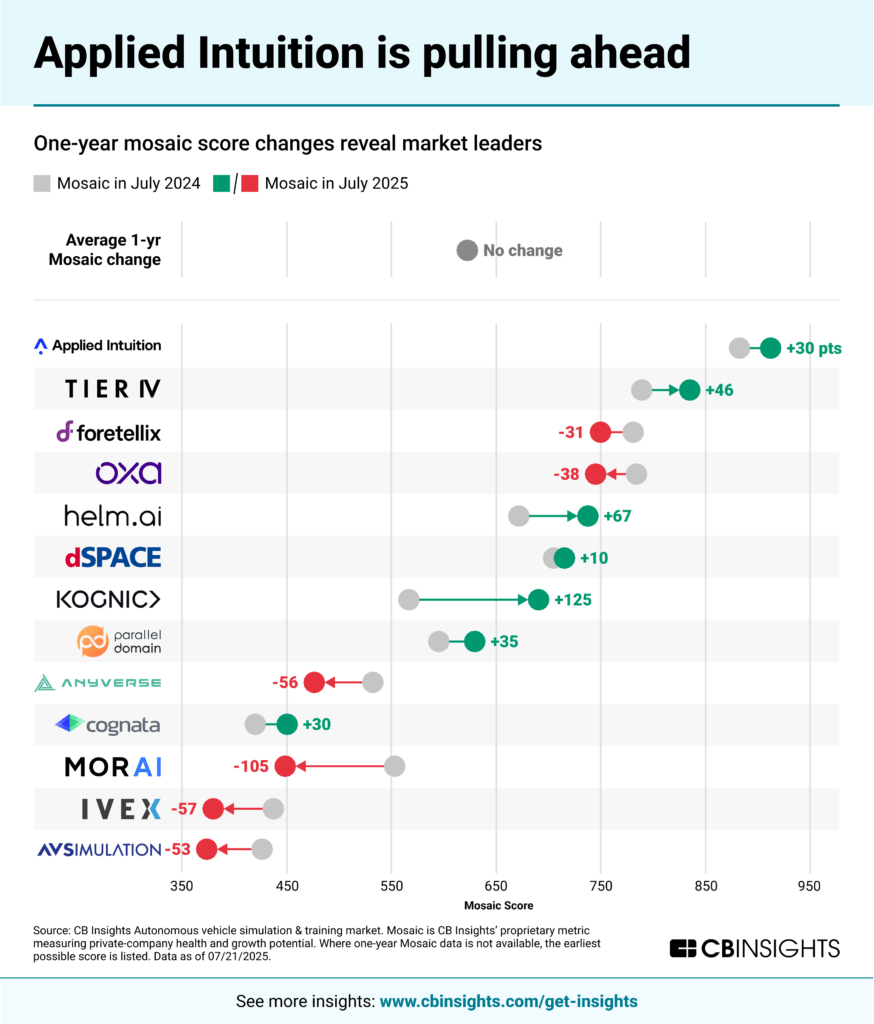

Using CB Insights’ Mosaic score, which measures a company’s health, we identified the most promising autonomous driving training and simulation providers, revealing critical signals for the industry’s expansion into new AV use cases (see graphic below).

If you are an autonomous vehicle simulation and training startup and want to be featured in our research, please reach out to analystbriefing@cbinsights.com to submit your data.

![]() See the full list of autonomous vehicle simulation & testing companies

See the full list of autonomous vehicle simulation & testing companies

Industrials and defense are the new battlegrounds. Top Mosaic score movers target AV applications beyond the already competitive passenger vehicles market. Both Cognata and Applied Intuition offer defense-specific autonomous vehicle solutions, with the latter recently strengthening its position in this space by acquiring EpiSci, a company specializing in national security autonomy. Others like Kognic and Parallel Domain focus on industrial applications, including robotics and drones.

OEM relationships create strategic moats. The top 5 market leaders all have relationships with OEMs and hardware manufacturers. Since 2022, 74% of OEM relationships have gone to the top 5 players in the space. The bottom 5 players account for just 12% of these partnerships, and most have decreased Mosaic scores over the past year.

NVIDIA emerges as a key enabler. Oxa and Foretellix are using NVIDIA’s large world models to strengthen AI training. The tech giant has partnerships with 3 of the top 5 market players, positioning NVIDIA is a likely winner of growth in this space.

As the autonomous vehicle arms race continues, momentum will favor the companies diversifying beyond passenger vehicles. Established passenger vehicle players already leverage proprietary AI simulation tools, pushing new entrants to other applications such as defense and aerospace — with growing demand for autonomous guidance simulation in robotics and drones. Monitor strategic partnership activity to identify the likely winners in each AV application.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.