US tech giants continue to post double-digit revenue growth. Here’s how big tech is positioning itself for the future through AI investments, M&A, humanoid robotics development, and more.

Big tech companies — Alphabet (Google), Amazon, Apple, Meta, Microsoft, and Nvidia — earned nearly $2T in aggregate revenue in 2024, up 15% from 2023.

They already dwarf the private tech sector — surpassing the combined value of all 1,200+ unicorns by a factor of 3 — and after a period of layoffs, they’re back to hiring, with 2024 headcount growing an average of 7% YoY.

Now, they’re betting big on AI to power their next phase of growth.

Spending on AI infrastructure (including data centers) has sent their capital expenditures to unprecedented levels. The venture arms of Nvidia, Google, and Amazon all backed a record number of AI deals last year. And after a years-long slump in big tech M&A, AI acquisitions will likely drive a rebound in 2025.

Below, we dive into how AI is reshaping dynamics among big tech players — including deep dives into fast-emerging markets like humanoids and AI agents — across 7 charts.

Note: We include US-based big tech companies based on market cap ($1T+) as of 04/11/2025.

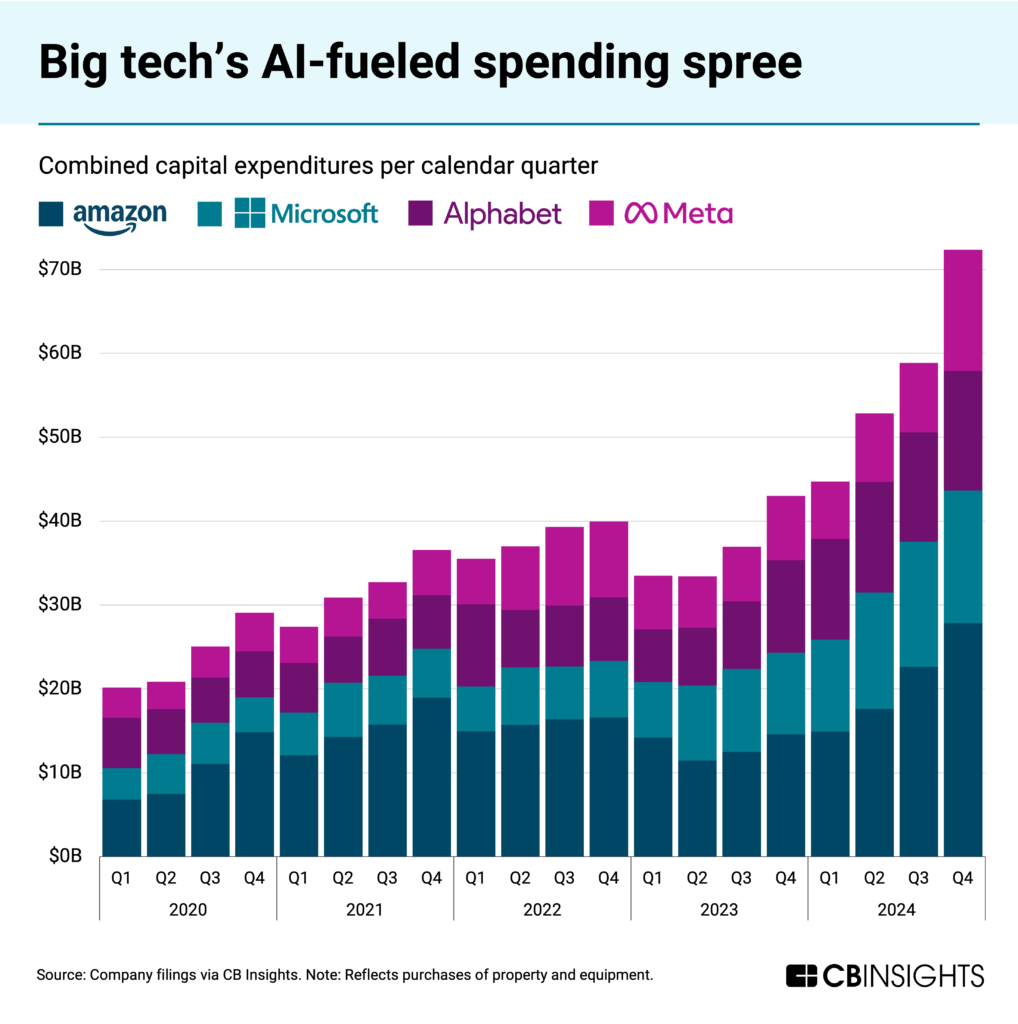

Big tech heads toward $300B+ in 2025 capex

Increased spend on AI infrastructure like high-powered data centers has driven Amazon, Microsoft, Alphabet, and Meta’s combined capex past $50B in recent quarters.

Meta CEO Mark Zuckerberg framed Meta’s capex spend as a “strategic advantage” on its Q4’24 earnings call as the company scales AI usage across its products. Meta plans to spend $60-65B in capex in 2025.

As AI model costs drop, cloud providers in particular expect they will benefit from the expanding market.

Microsoft CEO Satya Nadella emphasized this potential on the company’s recent earnings call: “We ourselves have been seeing significant efficiency gains in both training and inference…as AI becomes more efficient and accessible, we will see exponentially more demand.”

To capture the demand, the big 3 are planning major infrastructure investments:

Amazon projects $100B in capex in 2025, up from $83B in 2024

Microsoft has committed $80B in 2025 to build out AI data centers

Google expects $75B in capex in 2025

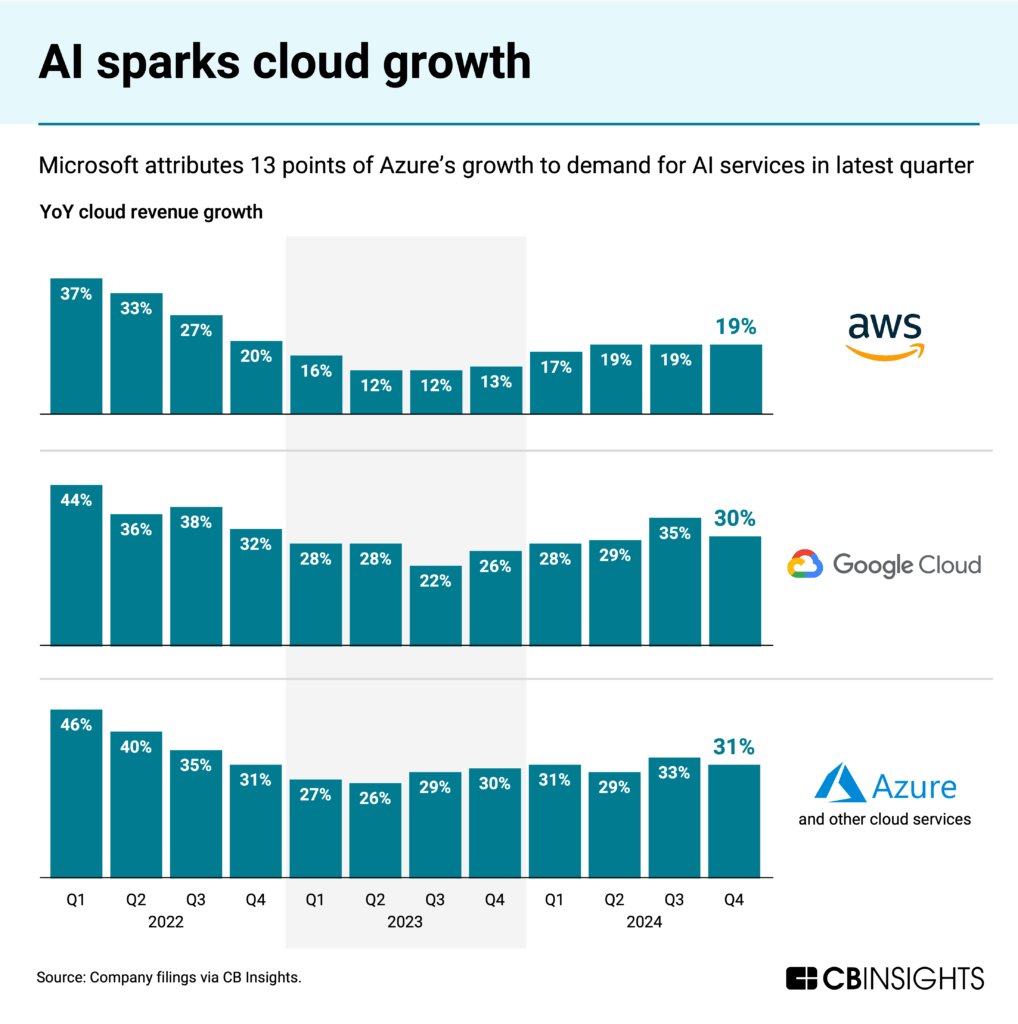

Cloud competition hinges on AI demand

AI demand is turning into cloud revenue for Amazon, Google, and Microsoft.

AI sales have helped boost revenue growth for Microsoft’s Azure and cloud services arm, which averaged 31% quarterly growth in 2024, up from 28% in 2023.

Google Cloud’s more muted growth in Q4’24 (down 5 percentage points quarter-over-quarter) sent Alphabet’s shares down in February. Both Microsoft and Alphabet cited compute capacity constraints as reasons for the more limited growth in their latest quarters.

Expect close investor attention in 2025 to cloud revenue growth, especially as these players accelerate their infrastructure spend. AWS’ $28.8B in Q4’24 revenue was nearly on par with Amazon’s capex spend overall ($27.8B).

Meanwhile, as cloud competition intensifies, providers are strengthening their security offerings to capture enterprise clients with stringent compliance requirements.

Google Cloud has made notable investments in cloud security through strategic acquisitions including Wiz, Siemplify, and Mandiant. In contrast, AWS primarily leverages its partner network for security solutions, collaborating with companies like Bitdefender for endpoint security and CrowdStrike for incident response.

Their divergent approaches represent another dimension where cloud giants are competing for enterprise wallet share, beyond just AI compute capacity.

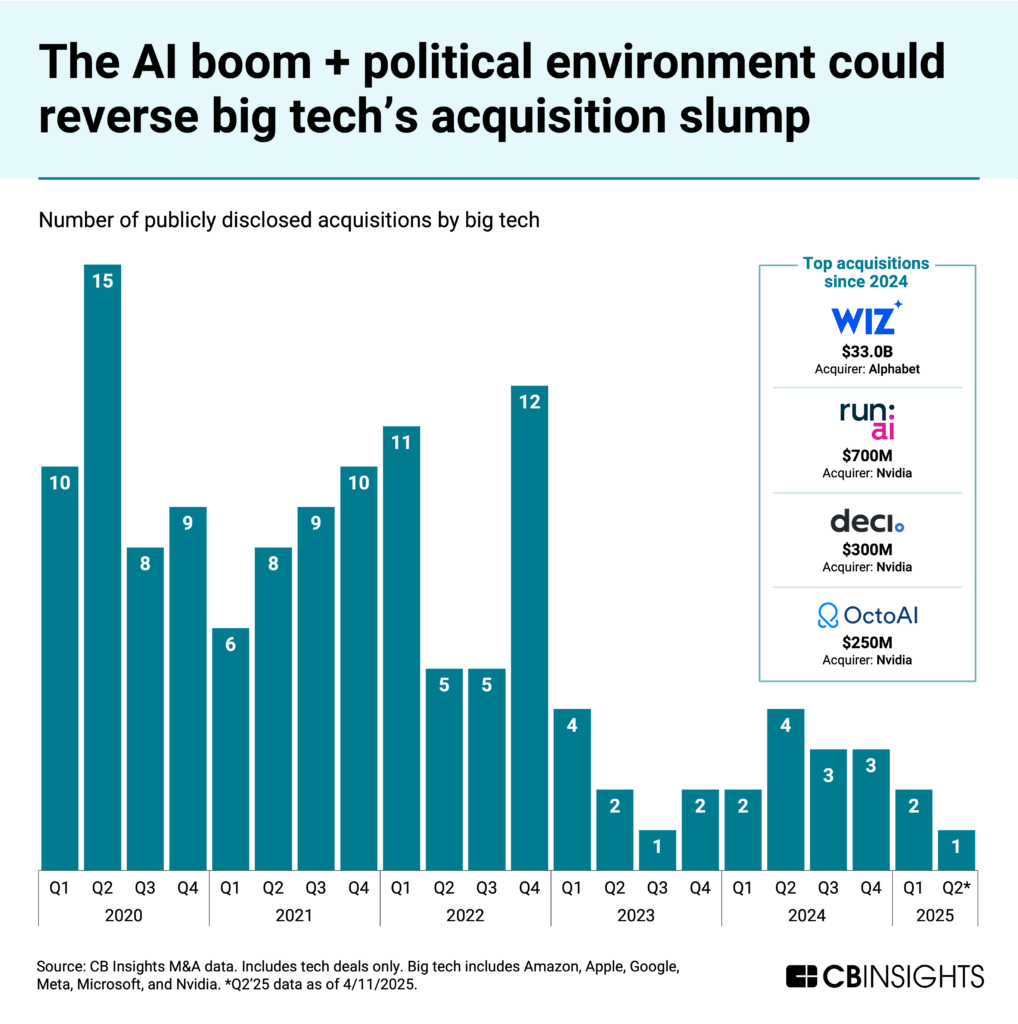

2025 likely to bring a rebound in M&A

Tech giants have pulled back dramatically on M&A in the last few years amid the antitrust climate. But with a new US administration in office, tech giants are betting on a friendlier dealmaking environment.

Notably, Google parent Alphabet announced a $33B acquisition of cloud security firm Wiz in March — the biggest VC-backed M&A exit ever. It’s also the first billion-dollar big tech acquisition since 2023, when Microsoft’s Activision deal closed.

In 2024, Nvidia led acquisition activity, with a focus on companies optimizing AI workloads (Run:AI, Deci, Octo AI). It’s already made 2 more acquisitions in 2025 so far: synthetic data generation startup Gretel in March; and server-renting service Lepton AI in April.

While tech giants test the M&A waters, we also expect to see more “quasi-acquisitions” — for instance, hiring away the teams and licensing the tech of promising startups to avoid antitrust scrutiny. For example, Amazon hired robotic startup Covariant’s founders and a quarter of its staff, while licensing the company’s models, in August 2024.

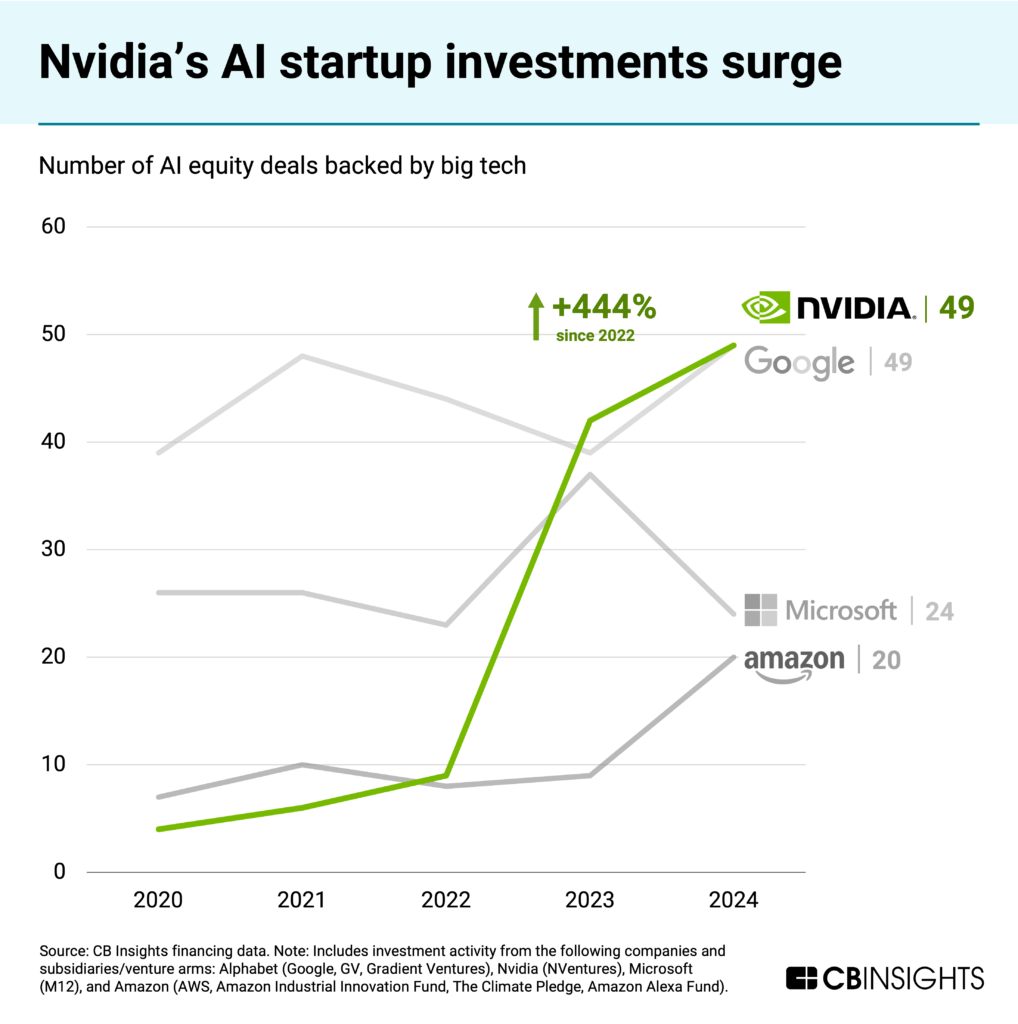

Nvidia accelerates AI startup investments

Nvidia has leapfrogged other big tech companies like Microsoft and Amazon in AI dealmaking.

The chip leader’s AI startup investments nearly 5x’d between 2022 and 2023. Of course, many of its investments — like Perplexity and xAI — are in turn using its chips.

The upswing indicates the strategic importance it’s placing on being a player in the AI startup landscape.

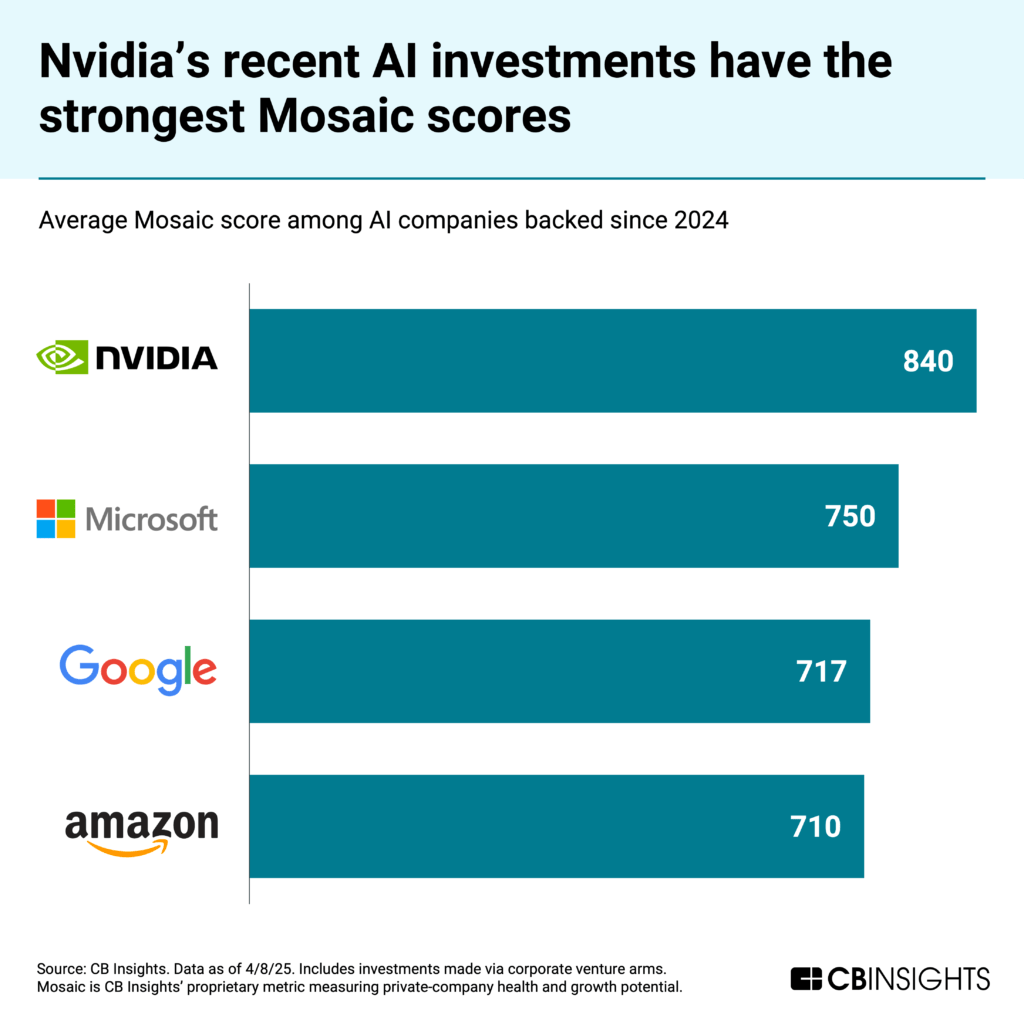

Nvidia also takes the lead when it comes to the strength of its AI startup portfolio. According to CB Insights’ Mosaic scores — which measure private-company health and growth potential, on a scale of 0-1,000 — Nvidia’s AI investments since 2024 come out on top with an average score of 840.

Nvidia is followed by Microsoft, with an average Mosaic score of 750 among its AI investments since 2024.

![]() See every big tech-backed, private AI company ranked by Mosaic

See every big tech-backed, private AI company ranked by Mosaic

Physical AI in focus

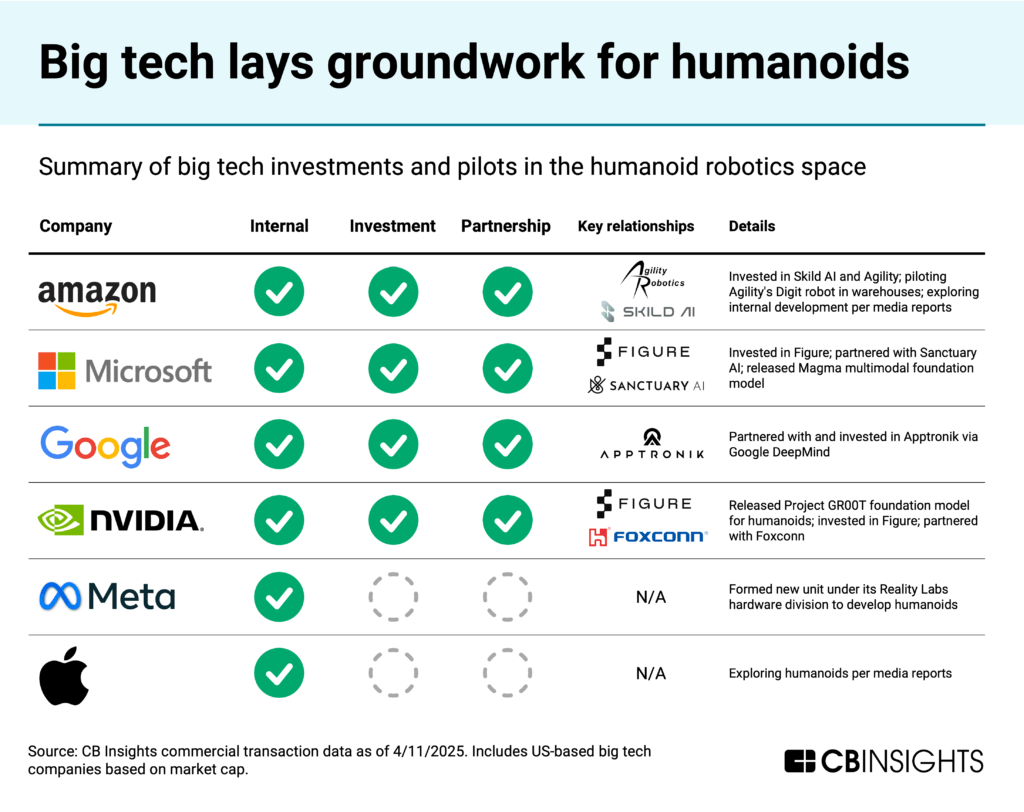

Big tech is aggressively pursuing the humanoid robotics space.

In February 2025, for example, Google joined Apptronik’s $403M Series A funding round while Meta formed a new unit under its Reality Labs hardware division to develop humanoids.

Humanoids are complicated to build and deploy, requiring substantial sensor processing, advanced control, and more.

Tech giants see this as an opportunity to flex their software muscle and deep pockets. AI breakthroughs are unlocking new robotic capabilities, allowing humanoids to complete more complex tasks in a shorter training window, with applications from industrials to healthcare.

![]() CBI customers: Map the industrial humanoid robotics market

CBI customers: Map the industrial humanoid robotics market

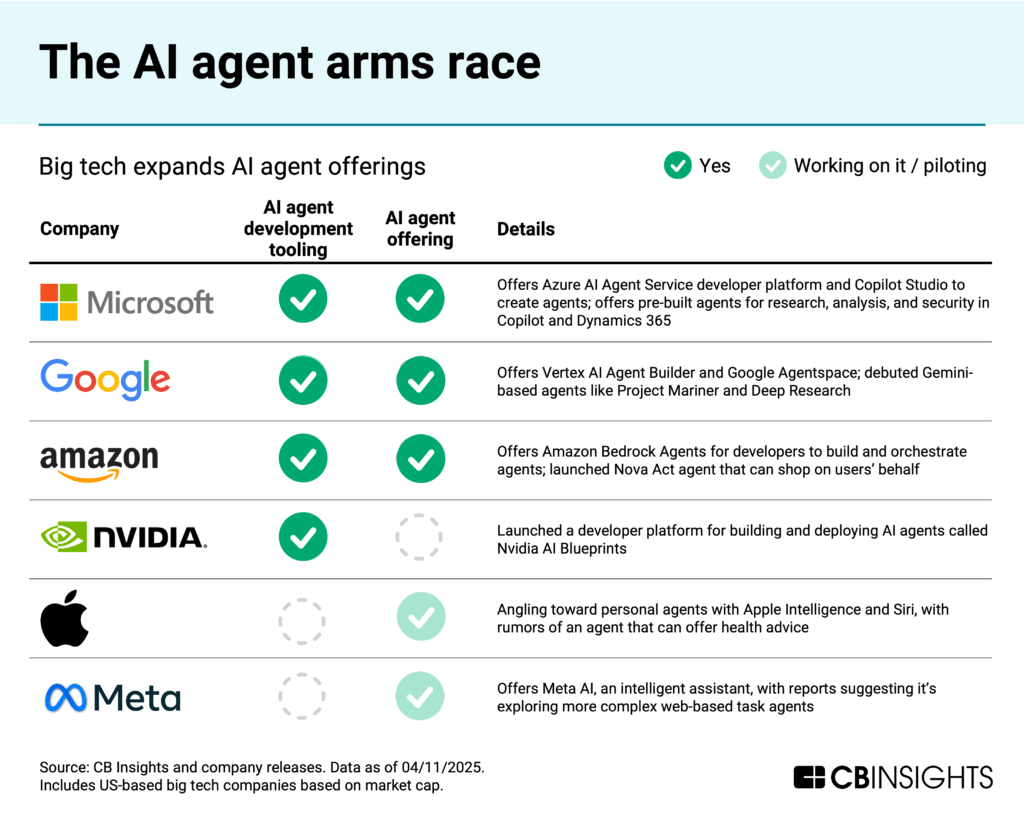

Race to own AI agents

Increasingly capable AI agents will reshape industries as we know them.

Big tech is getting in on the ground floor — each company is developing agents or building the tooling for them.

We expect big tech players (alongside LLM developers) to dominate general-purpose agent use cases, such as in commerce, given their distribution and infrastructure edge. Read more in our report on AI agent trends to watch.

RELATED RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.