Investors and corporates are swarming the defense tech industry. We look at how AI is fueling the market’s rise, as well as the top deals and most active investors of 2025.

This research comes from the April 8 edition of the CB Insights newsletter. You can see past newsletters and sign up for future ones here.

Military technology is entering its AI era.

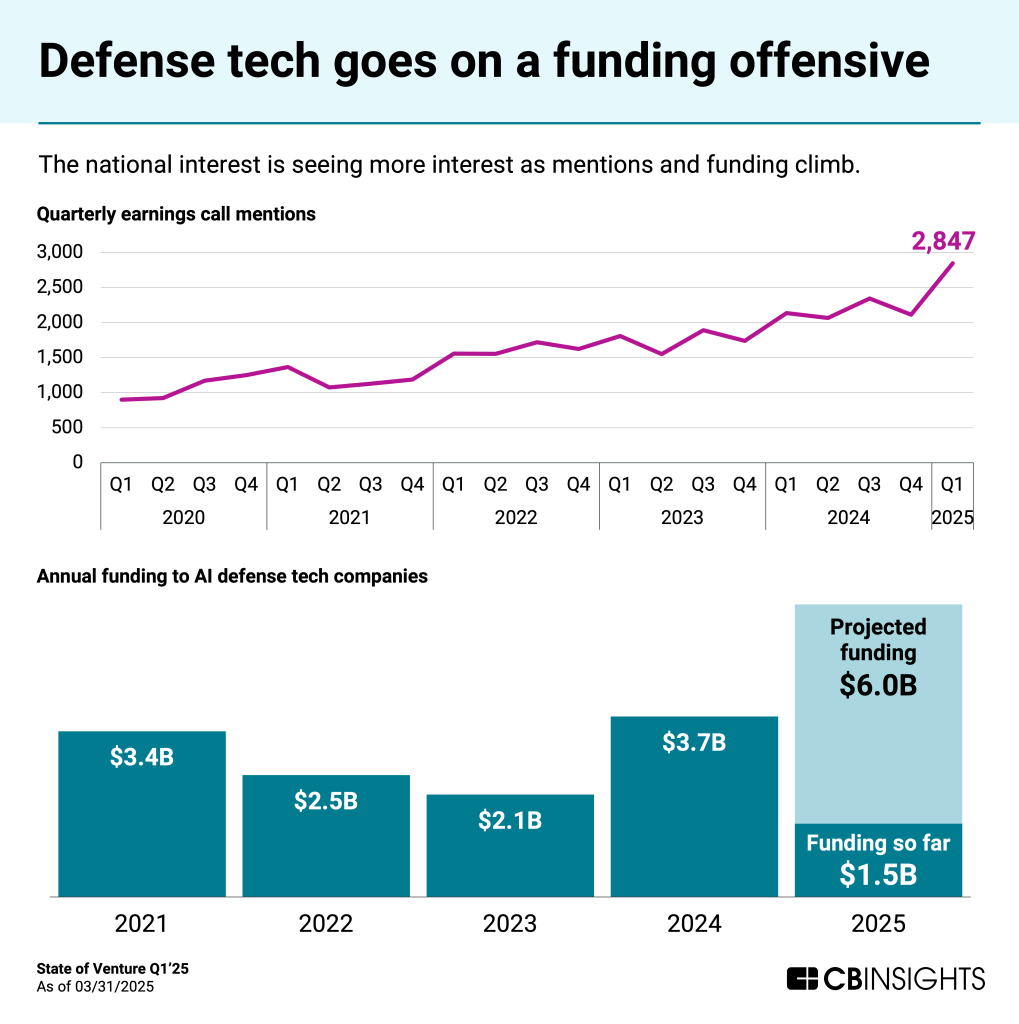

Funding to AI companies targeting defense applications has reached $1.5B this year. At the current rate, this year will set a new record for the sector.

Public-company execs also have defense on the brain.

Last quarter saw earnings call mentions of “defense” reach an all-time high, according to CB Insights’ Earnings Transcript Analytics.

Growing geopolitical tensions combined with AI advances are fueling the investment surge.

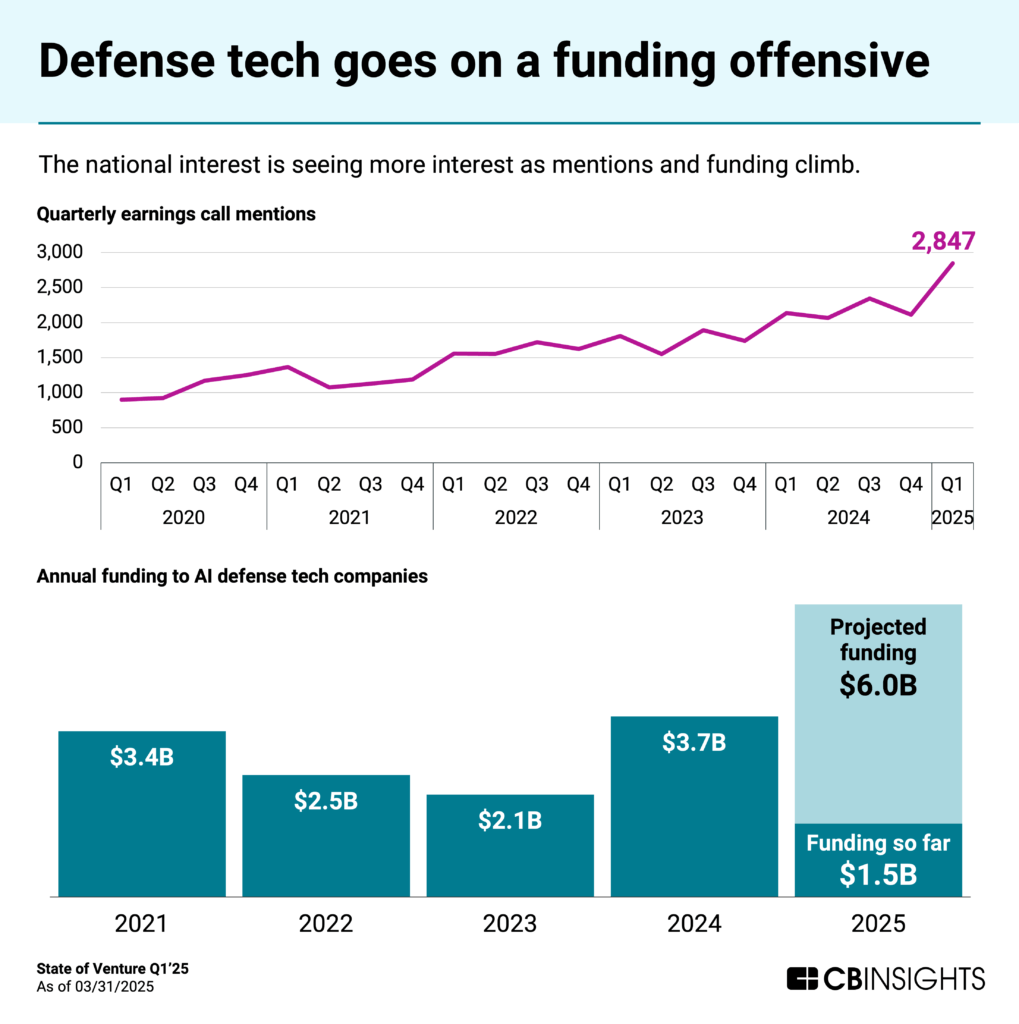

Much of the activity centers on multidomain operations (MDO) technologies — integrating systems across land, sea, air, space, and cyber — where AI is accelerating mission planning, threat detection, and battlefield connectivity.

Below, we look at:

Recent partnerships and the year’s biggest deals

Anduril’s UUV announcement

Top investors in 2025

1. Recent partnerships and the year’s biggest deals

Major defense contractors are forming partnerships with AI startups to pilot more autonomous capabilities.

For instance, defense contractor L3Harris partnered with Shield AI in February to combine L3Harris’ electronic warfare capabilities with Shield AI’s autonomous flight tech.

The next month, L3Harris invested in Shield AI’s $240M Series F alongside a16z, Booz Allen Hamilton, and others.

That round is the 3rd-largest AI defense deal we’ve seen in 2025 so far, surpassed only by:

Saronic’s $600M Series C. Saronic develops autonomous surface vessels for naval defense.

Epirus’ $250M Series D. Epirus creates high-power microwave systems for counter-drone and electronic warfare applications.

Meanwhile, last week, SandboxAQ (an Alphabet spinout) raised a $150M extension to its $300M Series E from December. Its AQNav product is a real-time navigation system that combines AI and quantum sensing, with the aim of operating in areas where GPS is jammed or otherwise unavailable.

SandboxAQ is a leader in the quantum sensing market, alongside players like Q-Ctrl and Aosense — both of which partnered with Lockheed Martin last month on quantum-led navigation for GPS-denied environments.

2. Anduril’s UUV announcement

AI defense leaders are also making gains in commercializing more advanced autonomous systems.

This week, Anduril unveiled an unmanned underwater drone equipped with torpedo-like capabilities. Anduril was last valued at $14B in August, making it the most highly valued private AI defense firm.

We featured Anduril in several areas of our recent AI in defense tech market map. Customers can use the below links to see how Anduril stacks up against competitors in these markets:

CBI customers can unlock the full map here.

3. Top investors in AI defense tech in 2025

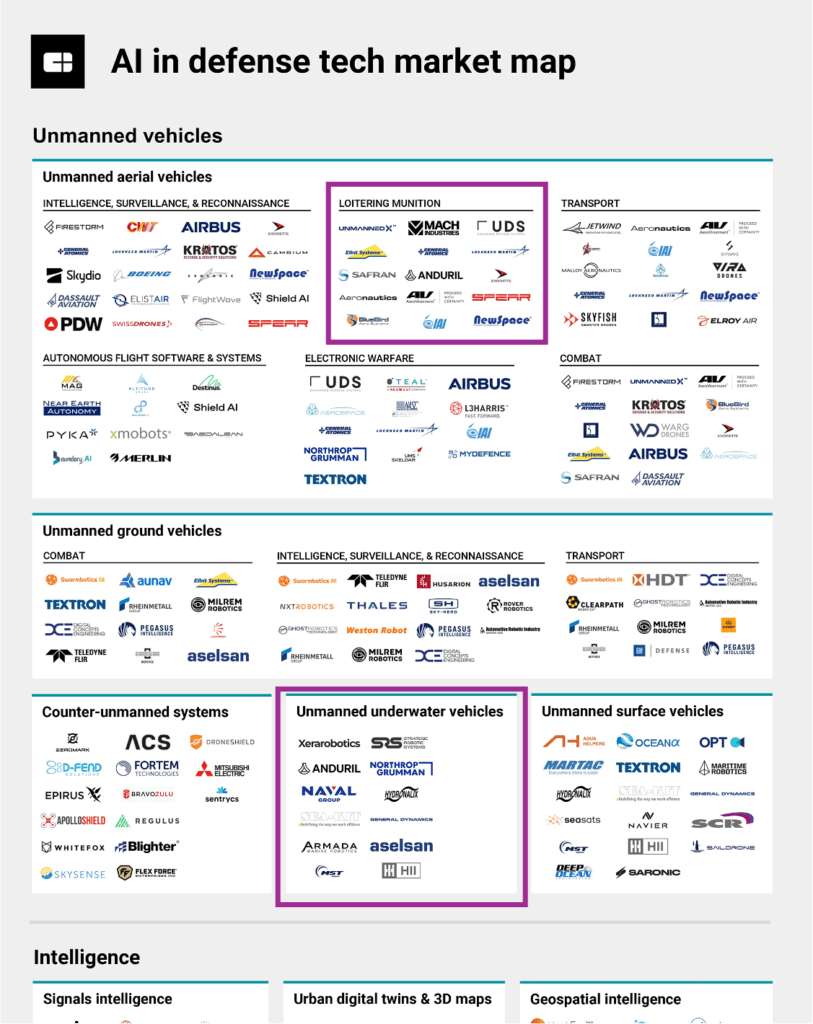

8VC and a16z rank among the top investors in AI defense tech this year — but they’re outpaced by one peer who has already backed 4 AI defense tech companies in 2025.

CB Insights customers can see who it is using this platform search.

Related CB Insights research:

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.