AI agent startups are rewriting the VC funding playbook by compressing traditional timelines — racing through consecutive funding rounds with skyrocketing valuations while rapidly reaching commercial maturity.

Based on CB Insights Commercial Maturity data, 42% of these companies are already deploying or commercializing their solutions (deploying, scaling, established), with a few leaders already crossing $100M in ARR. This includes Anysphere ($500M in ARR) as well as Windsurf and Moveworks, both of which reached $100M ARR shortly before being acquired.

This commercial traction signals the rapid adoption of specific types of AI agents by enterprises and who the early market winners are. The companies generating the most revenue often target workflow-heavy sectors where AI delivers immediate ROI — primarily coding and enterprise workflows.

We expect these categories to continue driving adoption (and revenue), and predict the enterprise AI agents & copilots space will generate close to $13B in annual revenue by the end of 2025, up from $5B in 2024.

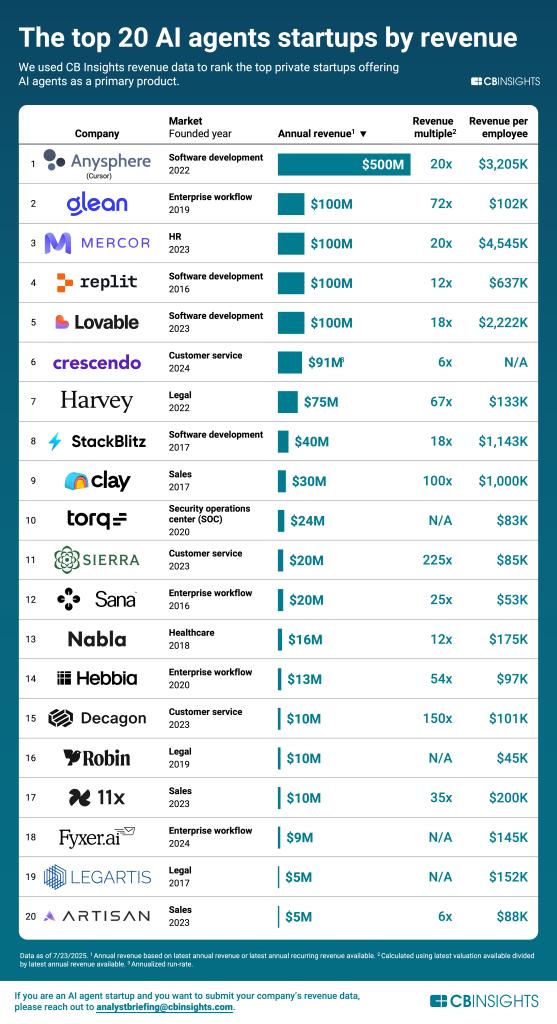

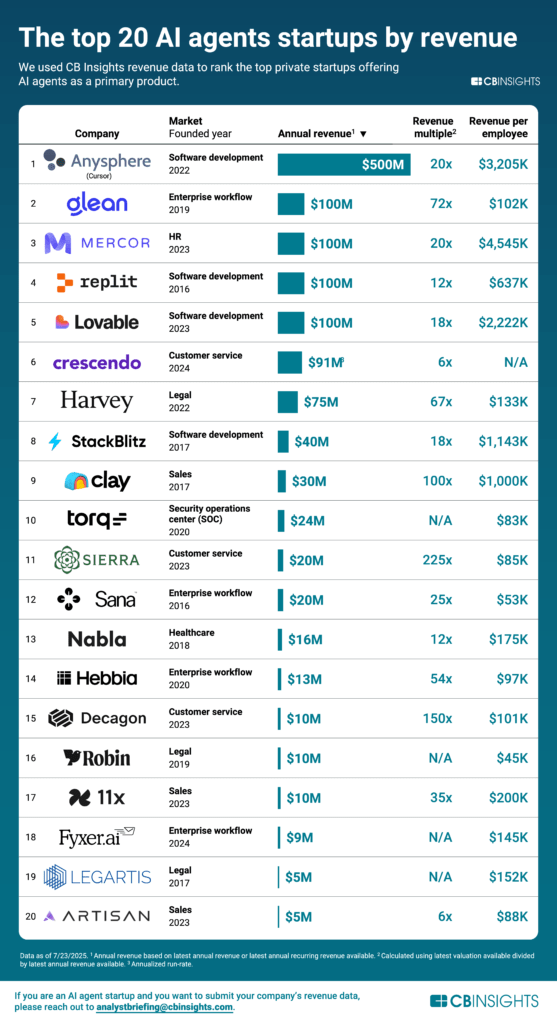

Using CB Insights revenue data, we identified the top 20 private startups offering AI agents as their primary offering and analyzed how they are rewriting the VC funding playbook (see below graphic).

If you are an AI agent startup and want to submit your company’s revenue data, please reach out to analystbriefing@cbinsights.com.

![]() See the top AI agent startups ranked by revenue here

See the top AI agent startups ranked by revenue here

Key takeaways

Top revenue-generating AI agent startups are just under 5 years old on average, with 50% of them having been founded in the last 3 years. This signals how quickly these AI-native companies are scaling and monetizing their products with recent breakouts including Anysphere ($500M revenue, founded 2022), Mercor ($100M, founded 2023), and Lovable ($100M, founded 2023).

Customer service AI agents command the highest valuation premiums, with an average revenue multiple of 127x compared to 52x on average across all top 20 AI agents by revenue. This valuation gap signals that investors are betting on aggressive revenue acceleration in customer service AI, driven by the sector’s universal market applicability and the expectation that businesses will rapidly replace human support teams with AI agents.

Some AI agent startups are already as capital-efficient as big tech companies. Mercor ($4.5M per employee) and Anysphere ($3.2M per employee) already surpass the likes of Microsoft ($1.8M per employee, FY 2024) and Meta ($2.2M per employee, FY 2024), and rivaling Nvidia‘s efficiency levels ($3.6M per employee, FY 2025).

However, as new entrants enter the AI agent market at a record pace — both startups and tech giants pivoting into AI agents — the question becomes whether these early revenue wins can translate into defensible market positions.

We expect competitive moats to emerge through proprietary data advantages, deep vertical specialization, and the creation of switching costs through deep integration into customers’ critical business workflows.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.