New data from Raymond James suggests that despite some very chunky investment rounds recently, e.g. Harvey, the legal tech funding market as a whole is not really in a bubble scenario…yet, or at least that’s this site’s view after considering the data.

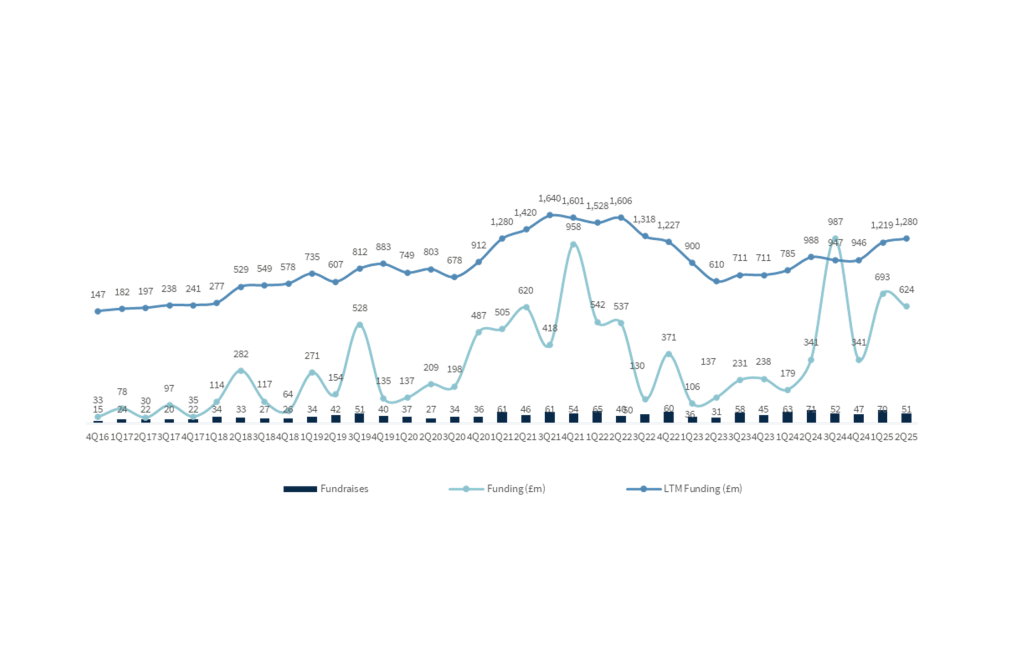

If you look at H1 2025 in both the short-term and long-term charts below, you can see that first the total number of rounds is not the highest ever, nor is the total value of VC funds invested the highest ever.

That doesn’t mean this has not been a great year for legal tech funding so far – it has – and there have been plenty of major rounds (see list below) – but if you take out the two (yes, two) $300m raises in H1 by Harvey then the picture changes a lot. In fact, the combined $600m of Harvey so far this year, is over 40% of the total invested in H1.

And we have also seen $100m go into Laurel, albeit for a company that has been around for some time. Probably the other truly unusual ones – i.e. in terms of being unusual for the age of the legal tech startup – are Legora ($80m) and Eudia ($105m), both of which, like Harvey, are very young companies.

But…..and this is the billion dollar question: is this a bubble?

If you look at the longer-term picture, yes the total amount going into legal tech has risen steadily since 2016 (see second chart), but it’s actually lower today than that strange period during Covid when tech stocks went wild (see the spike in 2021). (Note: the spike in 2024 is driven mainly by the $900m Clio raise, which skewed the data.)

The number of rounds is also high, but again it’s not wildly higher or totally out of predictable patterns based on previous growth trajectories. E.g. H1 2024 saw 134 rounds, in H1 2025 (i.e. the last 6 months) we saw 121 rounds.

So, what’s making the market think there is a bubble? It’s likely the valuations – which have risen considerably and the values paid in M&A deals, e.g. the $1 billion in stock and cash paid by Clio for vLex.

Plus, if you look really long-term, back to 2017, then clearly something massive has happened to legal tech. In H1 of 2017 there were 46 funding rounds for a total of $108m – and 2017 was a generally strong year in the global economy.

So, what does it all mean?

First, as noted above, the money now going into legal tech has risen to incredible levels compared to the days of that first wave of early AI companies back in 2016/17. But, we would expect companies to get more as they mature, e.g. Clio’s massive funding round of $900m in 2024 – a company that started back in 2008. Also, genAI has changed the game. It’s easy to use, provides value very quickly, and lawyers like to use it. So, we should expect more money generally now to go into legal tech.

What stands out is that ‘new’ companies, which in some cases didn’t really hit the market for real until 2023, are already at very large funding rounds, (relative to the legal tech market’s past levels). E.g. Harvey, Legora, and Eudia. But, that is because investors believe genAI will make a difference and those startups have the faith of backers who see very large companies of the future taking shape.

The big deals, such as Clio/vLex further make it feel like the world has gone a bit wild. But….consider this:

Many other investment rounds are actually quite proportionate, given the potential for genAI to help expand the legal tech market and the genuine interest now from law firms and inhouse teams to bring in this tech.

That the legal tech startup market cannot and could not stay as it was. All markets mature and as new tech arrives, new growth opportunities arrive as well. It you consider the millions of lawyers globally – even if there are only about 400 major law firms worldwide – there is still a lot of growth in the market, not to mention the 1,000s of corporates with legal teams large enough to merit investment into new legal AI tools.

In short, there are what we might call ‘ambitious’ moves that look a bit ‘frothy’, but the broader trend is simply that of a market that is expanding and maturing, so larger rounds are expected.

Final point, with the Lexis and Harvey alliance many companies and their investors can see that the market is open to a great reshaping and that’s triggering all kinds of new moves, from Clio/vLex and Eudia / Johnson Hana…with more to come.

When a market grows, matures and you see big strategic plays then more money flows into it. Now, is that ‘a bubble’, i.e. an unsustainable increase that is not connected to the real word…? AL would argue that while some deals may be over-priced, the general trajectory is a logical one.

–

And many thanks to Raymond James for the data. Junya Iwamoto, Managing Director, Investment Banking, added: ‘Why the surge in investment generally? Legal tech has always been a category that investors have wanted to invest in, to get exposure to the digitalisation of legal work, but it’s historically been difficult as there haven’t been that many successful, higher growth startsup / scaleups.’

I.e. that is now changing – and that’s a good thing.

—

Legal Innovators Conferences in New York and London – Both In November ’25

If you’d like to stay ahead of the legal AI curve….then come along to Legal Innovators New York, Nov 19 + 20, where the brightest minds will be sharing their insights on where we are now and where we are heading.

And also, Legal Innovators UK – Nov 4 + 5 + 6

Both events, as always, are organised by the awesome Cosmonauts team!

Please get in contact with them if you’d like to take part.

Discover more from Artificial Lawyer

Subscribe to get the latest posts sent to your email.