AI grabs 1 in 5 venture deals. Early-stage deal sizes balloon. Billion-dollar M&A deals sweep the tech landscape. Here’s everything you need to know about VC.

Venture capital funding reached the highest level in nearly 3 years in Q1’25 — led by OpenAI’s mammoth $40B round — as AI continues to reshape the venture ecosystem.

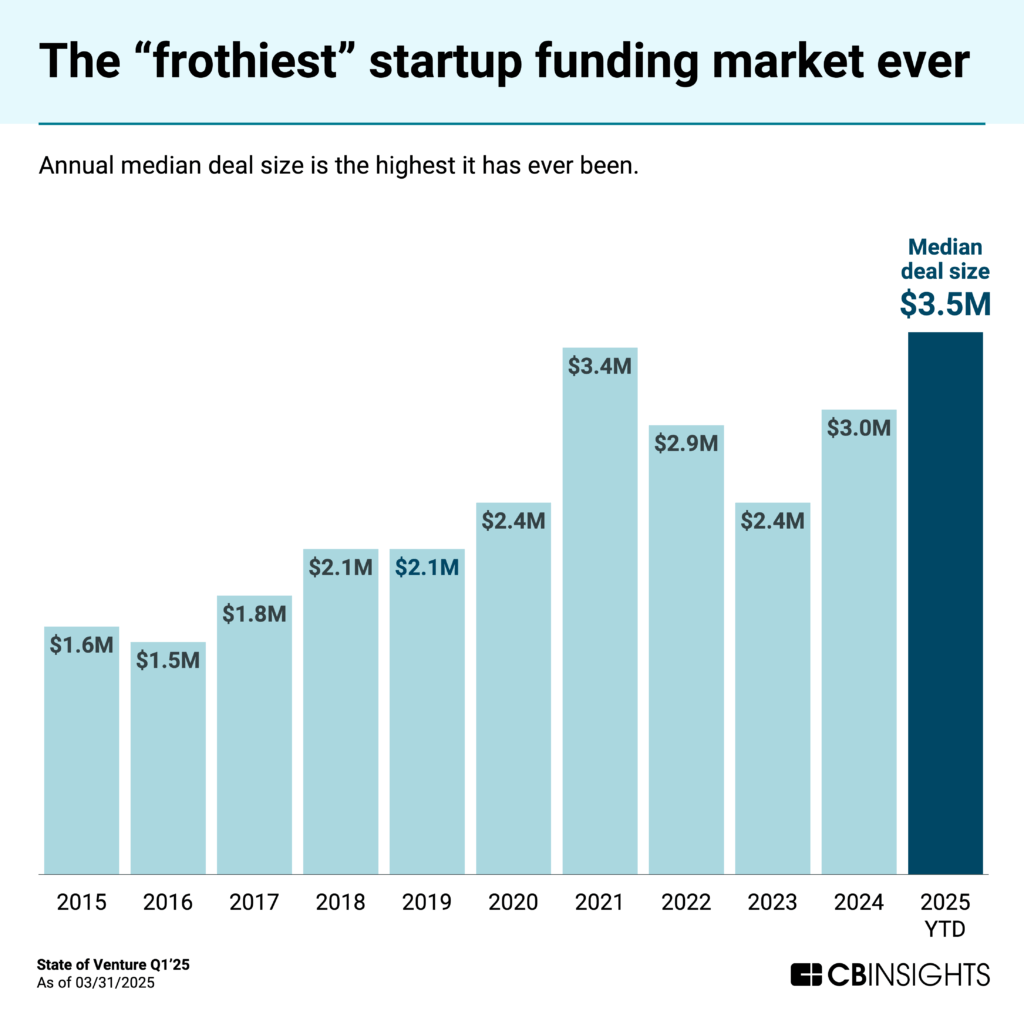

Opportunities across stages and geographies have fueled growth in deal sizes globally. So far in 2025, the median deal size sits at a record $3.5M.

While AI continues to dominate headlines and venture activity, sectors like fintech, digital health, and retail tech all recorded quarterly funding increases as investors diversify beyond core AI infrastructure plays.

Download the full report to access comprehensive data and charts on the evolving state of venture across sectors, geographies, and more.

Below, we break down the top stories from this quarter’s report, including:

Quarterly funding jumps to $121B, even as deal count keeps falling

AI now drives 1 in 5 global venture deals

Eight early-stage AI companies raise $100M+ mega-rounds

Early-stage deal sizes pace at an all-time high

Billion-dollar M&A exits hit a new quarterly record

We also outline the key trends shaping venture dealmaking for the rest of 2025 — from AI agent specialization and the voice AI boom to crypto’s rebound.

Let’s dive in.

Top stories in Q1’25

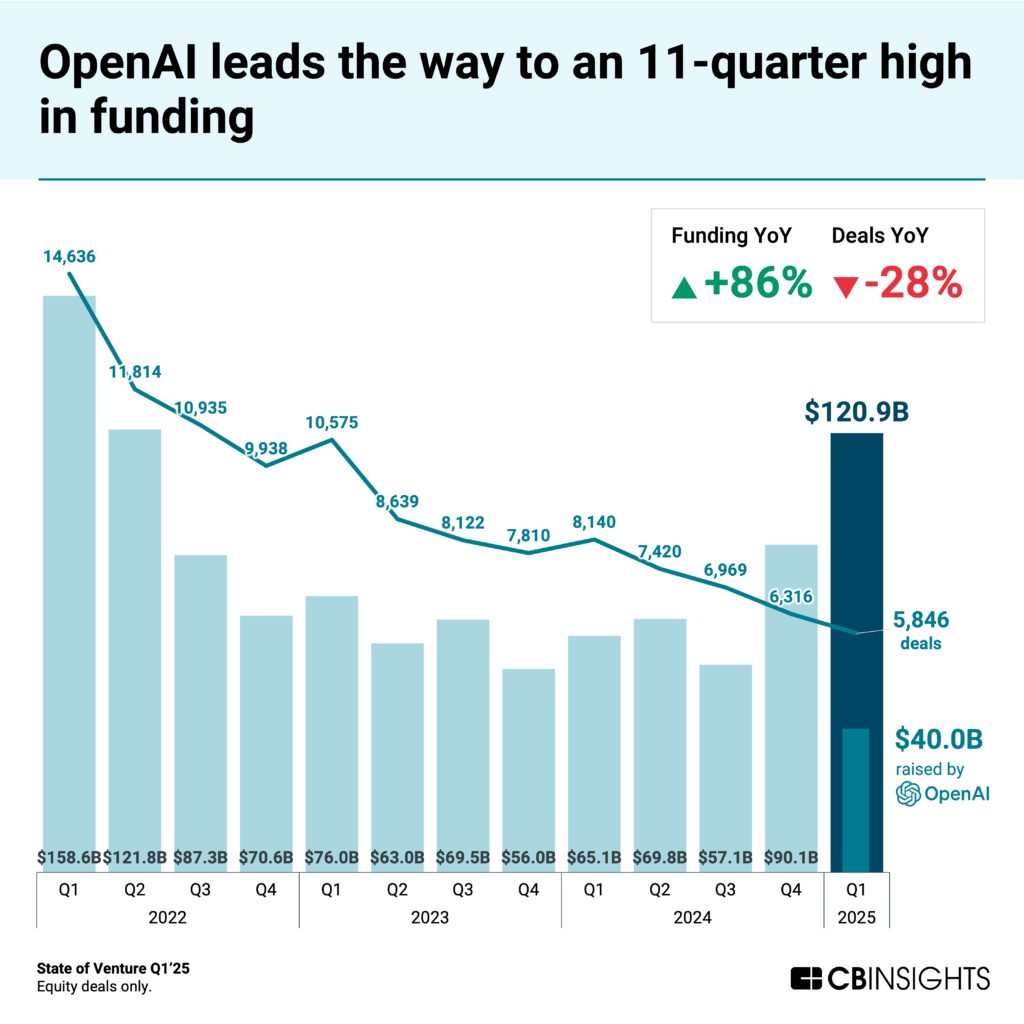

1. Quarterly funding jumps to $121B, even as deal count keeps falling

Q1’25 saw global venture funding rise to $121B — the highest quarterly total since Q2’22 — driven by OpenAI’s $40B raise, which values the company at $300B. This ties OpenAI with ByteDance as the second-highest-valued private company globally (behind SpaceX at $350B).

The OpenAI funding round — led by SoftBank and backed by Microsoft, Thrive Capital, and others — marks the largest private funding round in history. Even excluding this deal, total funding in Q1’25 would have reached $81B, still the second-highest quarterly figure since Q3’22.

However, global deal count slid for a fourth straight quarter, to 5,846 deals, down 7% QoQ and 28% YoY.

The stark contrast between soaring funding and declining deal count highlights growing capital concentration.

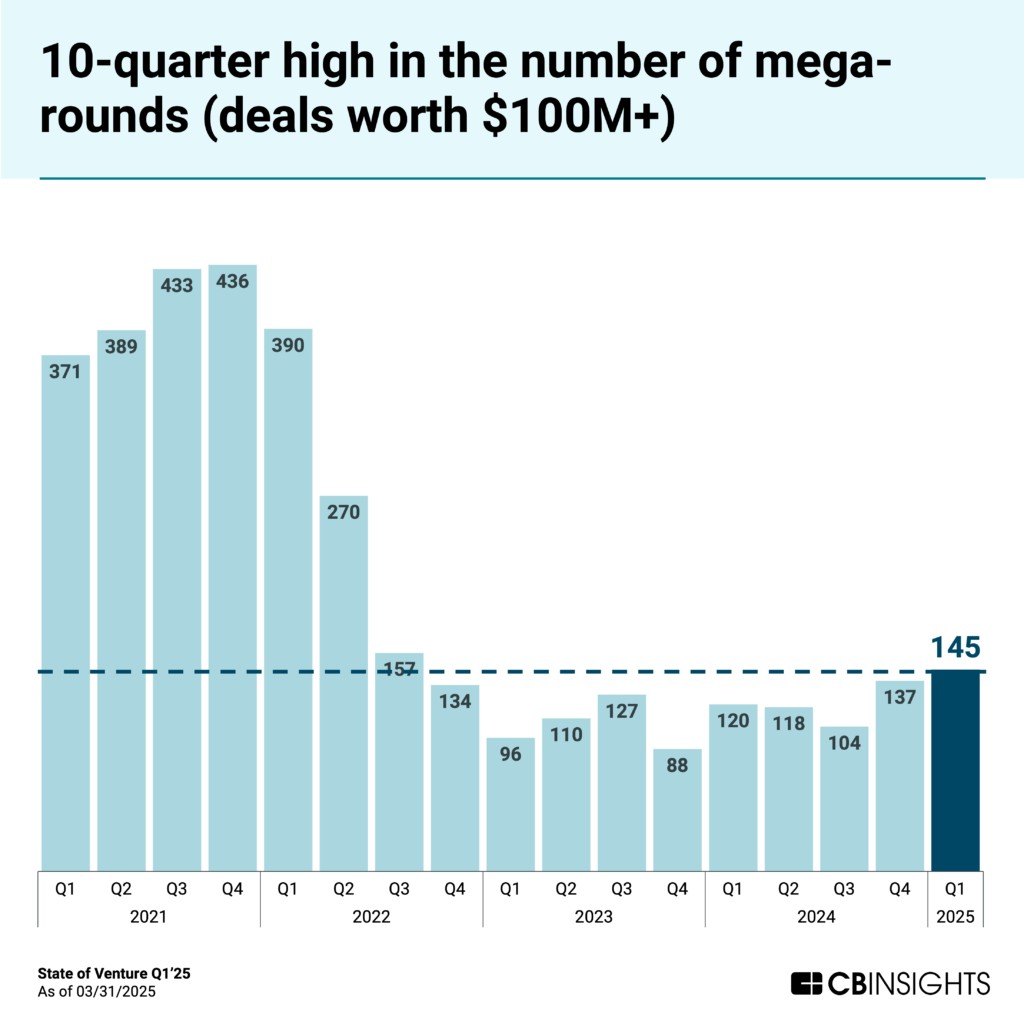

Mega-rounds (deals worth $100M+) accounted for 70% of all funding this quarter, up from 60% in Q4’24. A total of 145 mega-rounds closed in Q1’25 — the highest quarterly total since Q3’22, which saw 157.

While AI startups remain the primary beneficiaries of this capital concentration — grabbing more than half of the quarter’s funding — other sectors are showing resilience. Fintech funding increased 18% quarter-over-quarter to $10.3B, retail tech rose 18% to $6.5B, and digital health grew 47% to $5.3B.

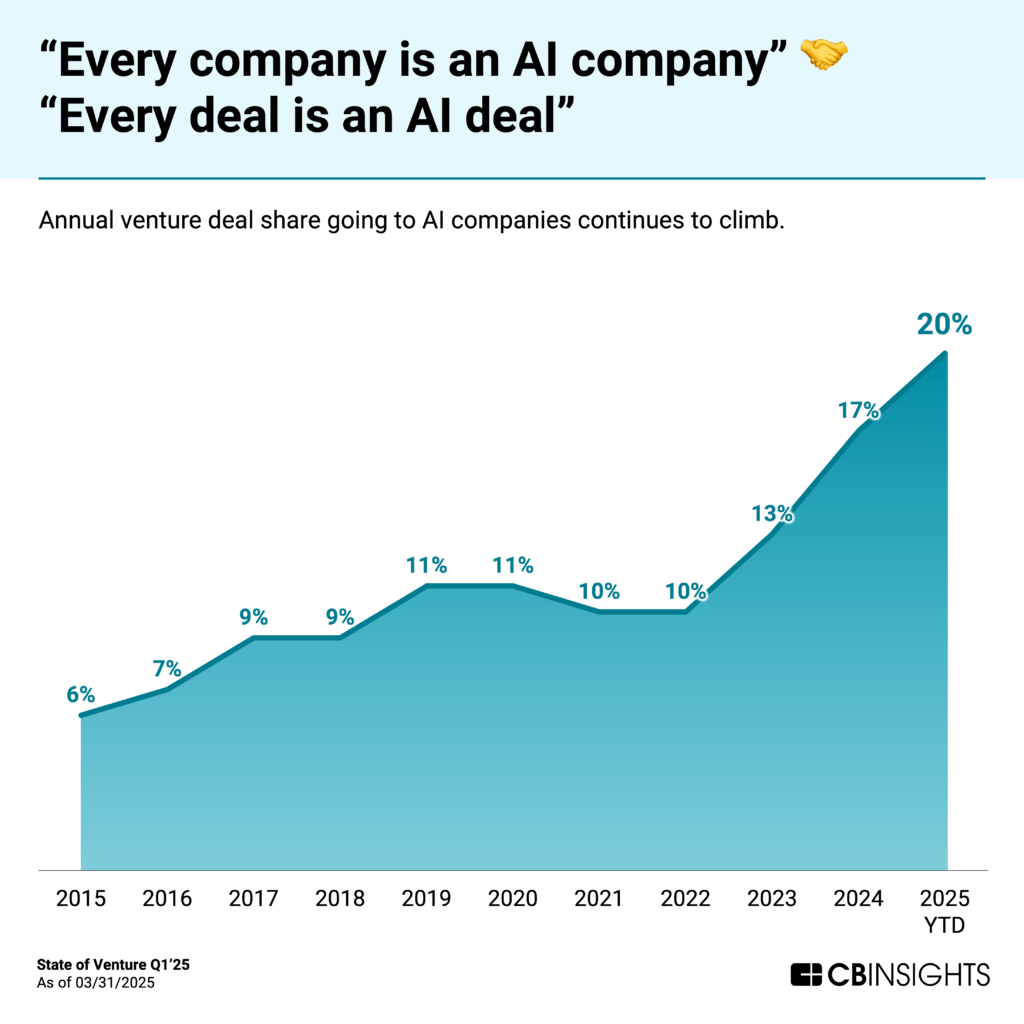

2. AI now drives 1 in 5 venture deals

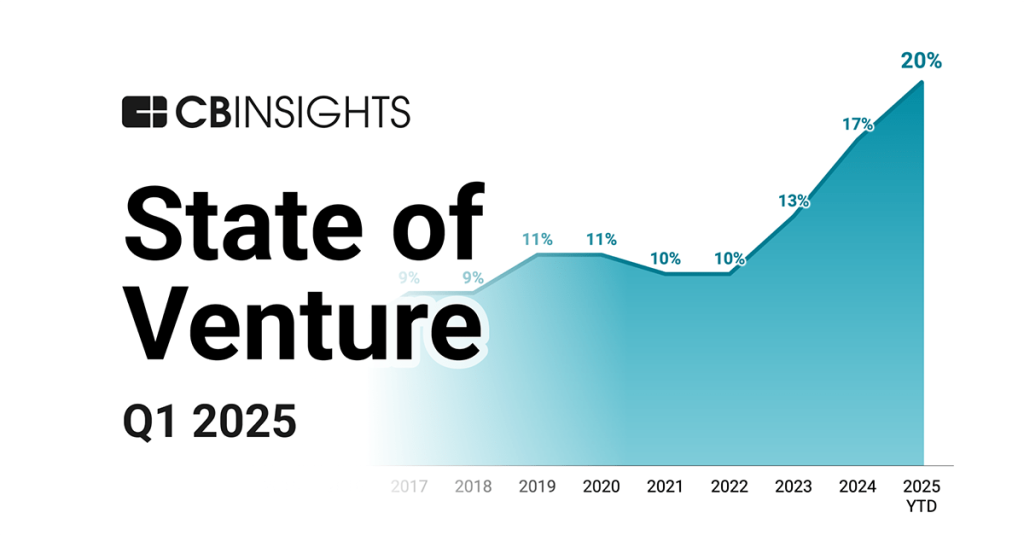

The influence of AI on venture capital continues to grow, with AI companies now capturing 20% of all venture deals globally — a new high, and up 2x since OpenAI’s launch of ChatGPT in 2022.

In absolute numbers, AI companies secured 1,134 deals in Q1’25 — a 7% decline from the previous quarter but still the fourth straight quarter with over 1,100 AI deals.

The composition of AI dealmaking is evolving. Early-stage deals (seed and Series A) made up 70% of all AI deals in Q1’25, down from 75% in full-year 2024. Correspondingly, late-stage deal share has increased from 6% to 9%, indicating market maturation as more AI companies progress to advanced funding stages.

The focus of AI dealmaking has also evolved. While infrastructure investments dominated the early AI boom, we’re now seeing greater emphasis on vertical solutions and application-layer platforms that address specific industry challenges. Notable exceptions exist in emerging categories like voice AI, where infrastructure still attracts significant investment.

Geographically, US-based AI companies secured 52% of global AI deals in Q1’25, while Asia and Europe grabbed 21% a piece.

![]() Explore 15,000+ AI companies in the Expert Collection

Explore 15,000+ AI companies in the Expert Collection

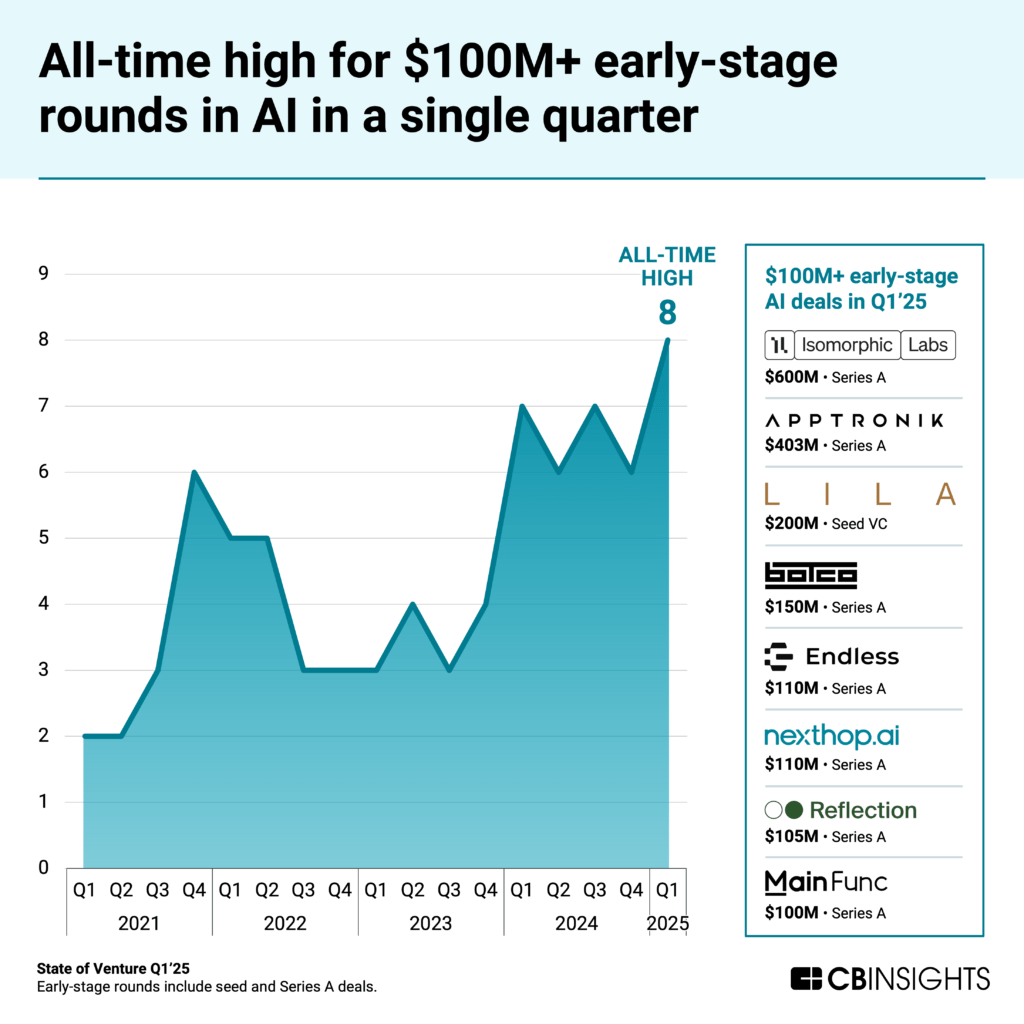

3. Eight early-stage AI companies raise $100M+ mega-rounds

Q1’25 set a new record with 8 early-stage AI companies raising rounds of $100M or more. These 8 companies raised a combined $1.8B — with an average round size of $222M — highlighting investors’ willingness to place substantial bets on AI startups earlier than ever.

The companies represent a diverse range of AI applications:

What unites these companies is their focus on specific industry or technical challenges — not general-purpose AI models. This same trend appears among late-stage players that raised deals in Q1’25, with companies emphasizing enterprise applications, vertical use cases, and infrastructure optimization.

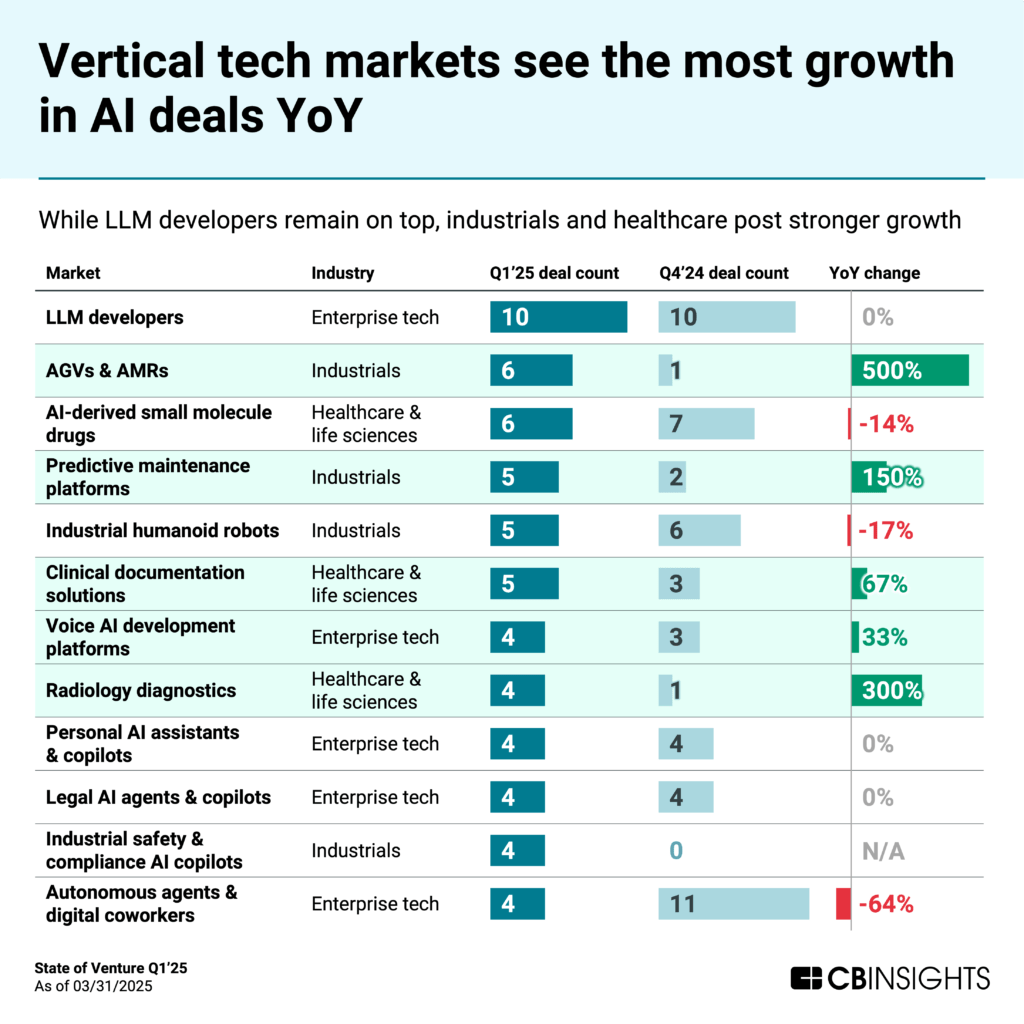

The shift from infrastructure to applications also plays out at the tech market level. Among the 1,400+ tech markets that CB Insights tracks, those in the below chart saw the greatest number of AI deals in Q1’25.

While LLM developers remain the top target for deals, they saw no growth in Q1’25 vs. Q1’24. On the other hand, vertical applications in industrials and healthcare — where AI is measurably improving automation — led in terms of YoY growth.

The top three vertical markets for AI deal growth in Q1’25 were automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), radiology diagnostics — particularly those focused on multiple imaging modalities — and clinical documentation solutions.

![]() See how markets stack up in the CBI Market Index

See how markets stack up in the CBI Market Index

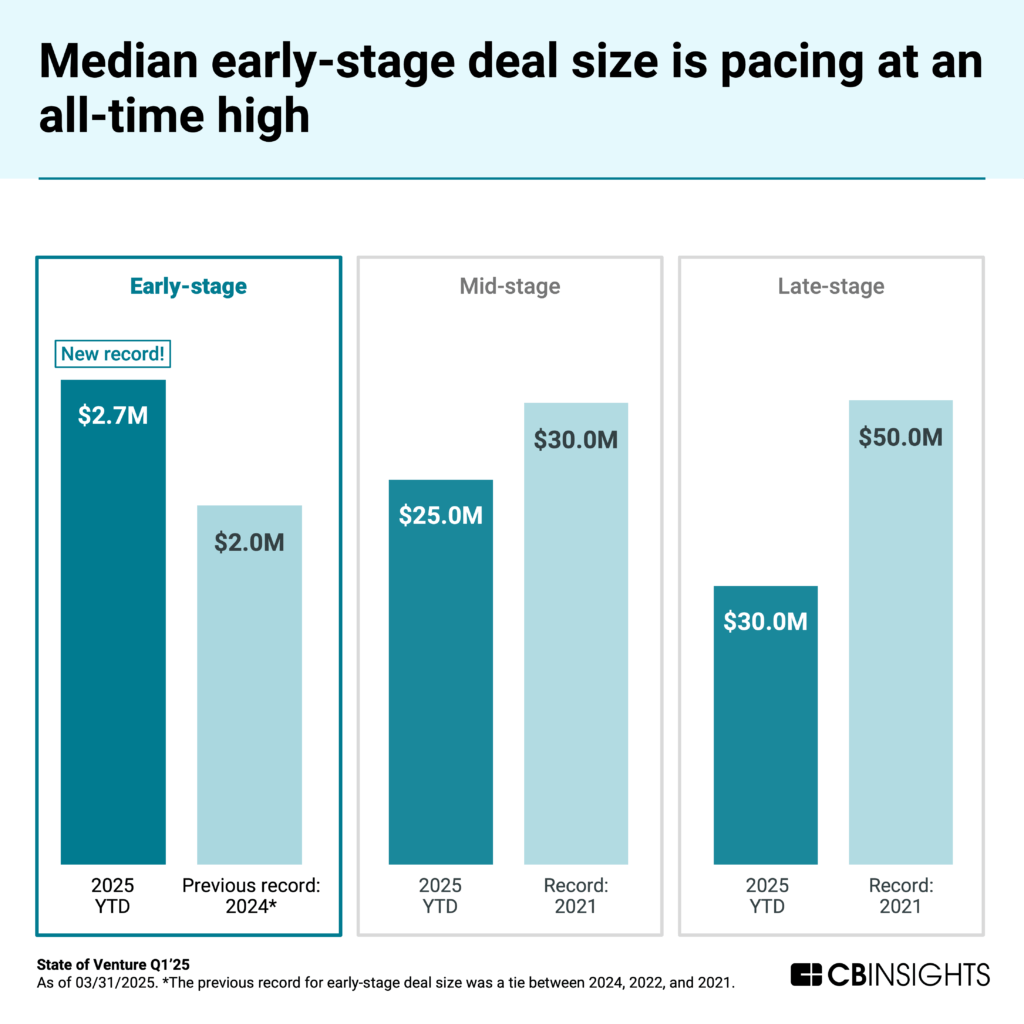

4. Early-stage deal sizes pace at an all-time high

The median early-stage deal size reached $2.7M in Q1’25, up from $2M in full-year 2024 — a 35% increase. This jump reflects both investors’ willingness to place larger bets on promising teams and the increased capital requirements for competitive AI development.

The increase is particularly notable against a backdrop of declining deal volume — investors are concentrating resources on fewer, more promising opportunities rather than spreading capital across a wide range of startups.

This environment creates both opportunities and challenges for founders. Well-positioned early-stage companies can secure larger initial rounds, but expectations for progress and growth are similarly elevated. The bar for follow-on funding will be higher for mid-stage rounds.

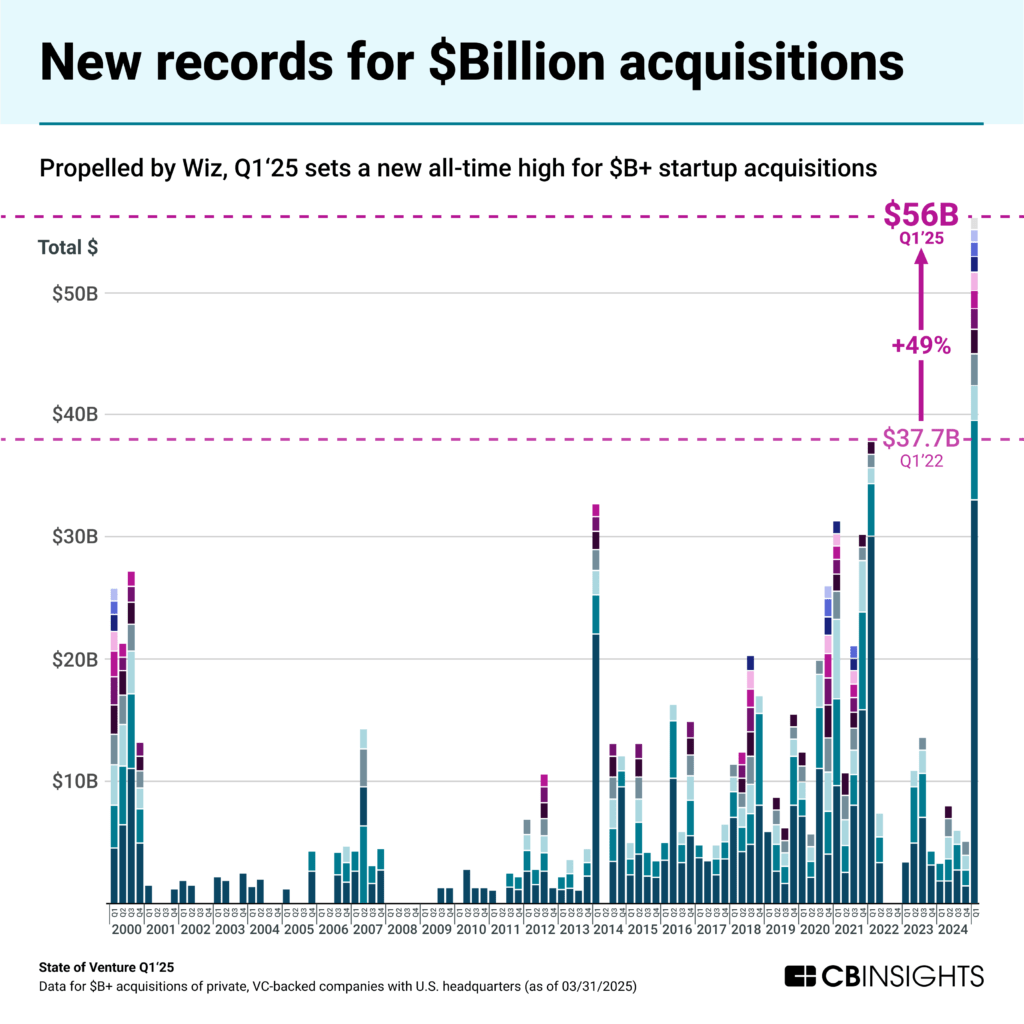

5. Billion-dollar M&A exits hit a new quarterly record

Q1’25 set a new record for billion-dollar M&A activity, with 12 VC-backed exits exceeding $1B in value, surpassing the previous high of 11 seen in both Q1’00 (dot-com bubble) and Q4’20 (peak ZIRP era). These 12 transactions had a combined value of $56B, driven primarily by Google‘s landmark acquisition of cloud security company Wiz.

The Wiz deal now stands as the most valuable M&A deal ever for a VC-backed private company, exceeding Meta‘s WhatsApp acquisition by more than $10B. It also marks Google’s largest acquisition to date — more than double the size of its Motorola Mobility purchase in 2012 — and sets a new record for cybersecurity exits, eclipsing Salesforce’s $28B acquisition of Splunk.

The Wiz deal highlights the growing focus among big tech companies on AI-driven cloud security as enterprises prioritize securing their expanding digital footprints.

It’s also part of a broader trend of high-profile unicorn exits that includes both IPOs (CoreWeave) and M&A transactions (Moveworks, Weights & Biases).

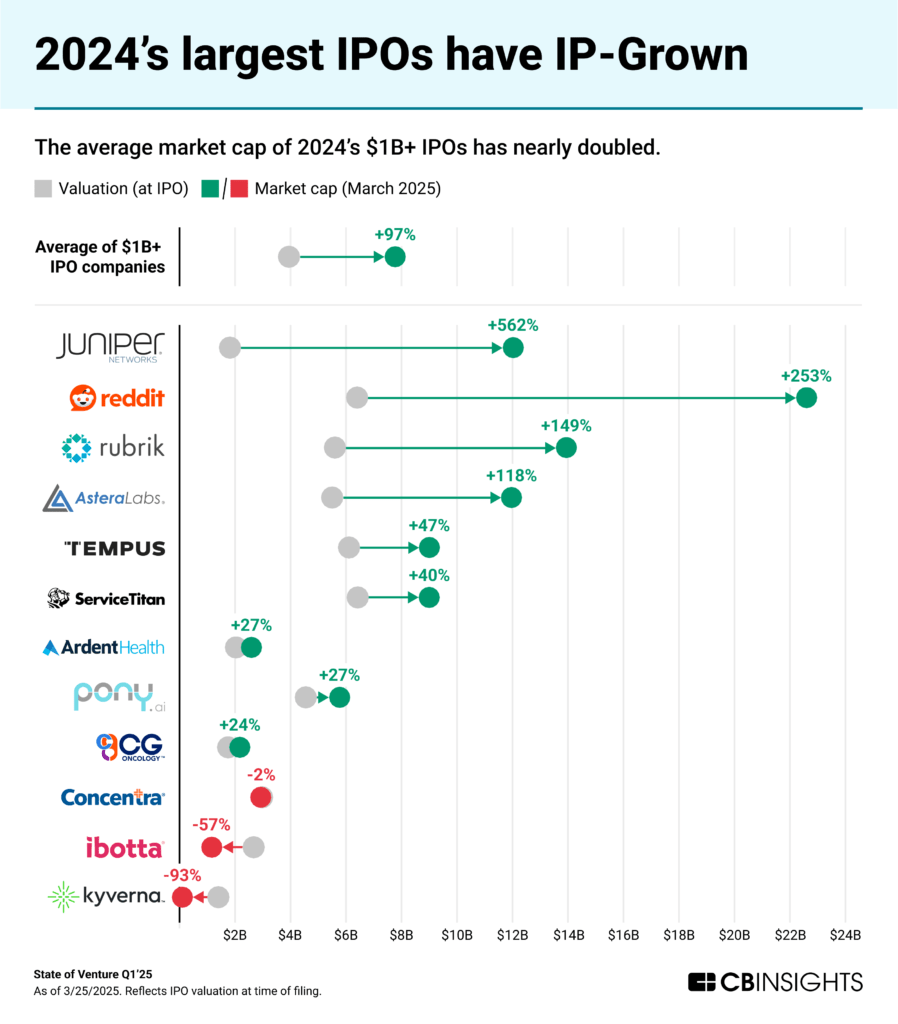

In fact, looking back to 2024, billion-dollar IPOs delivered strong returns — averaging a 97% increase in market cap post-listing. This bodes well for other IPO hopefuls looking to brave the public markets in the coming months.

Predictions for venture dealmaking in 2025

Below, we use signals from public-company earnings calls, startup financing trends, and business relationships to predict which trends will dominate venture activity through the rest of 2025.

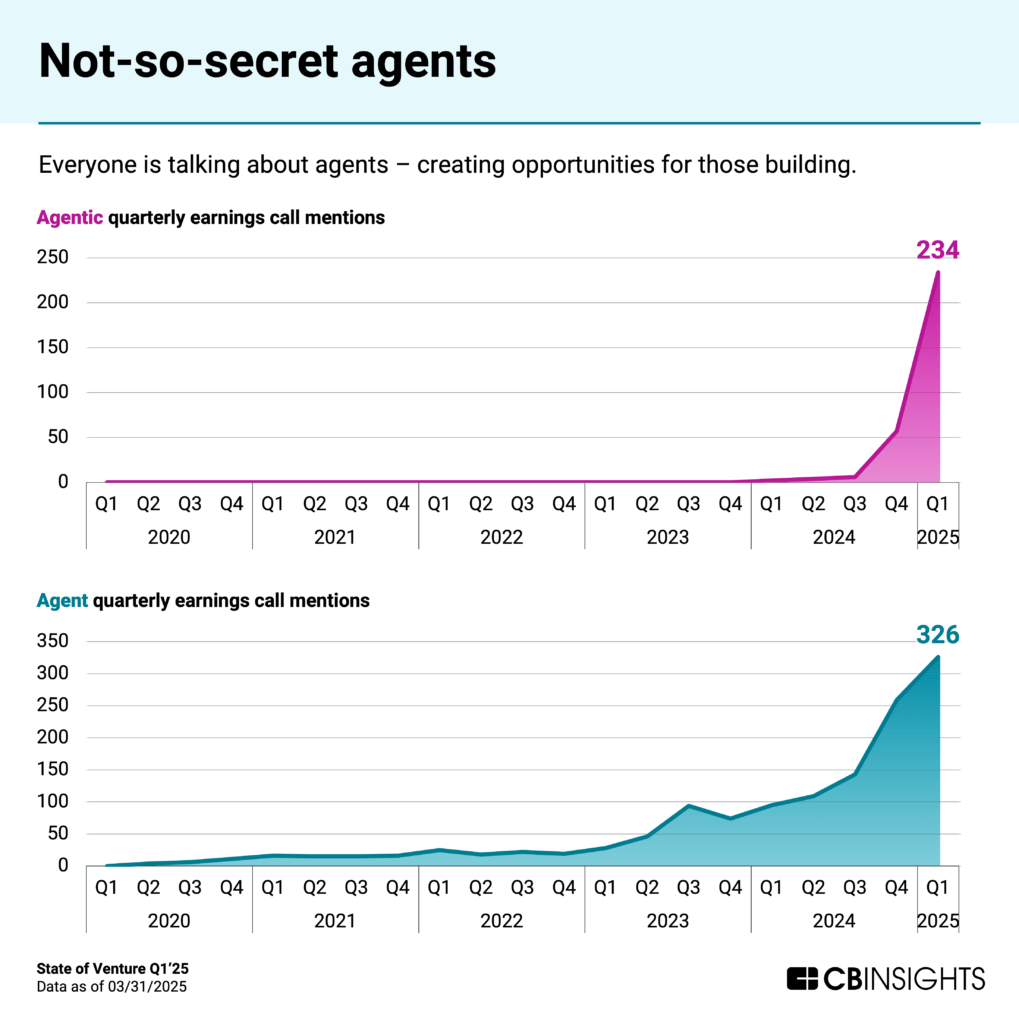

AI agents “niche down” and gain enterprise buy-in

AI agents are transitioning from concept to commercial application. They’ve become a frequent topic on corporate earnings calls, and according to a December 2024 CB Insights survey, 63% of organizations said they are placing significant importance on AI agents over the next 12 months. All respondents reported at least experimenting with agents.

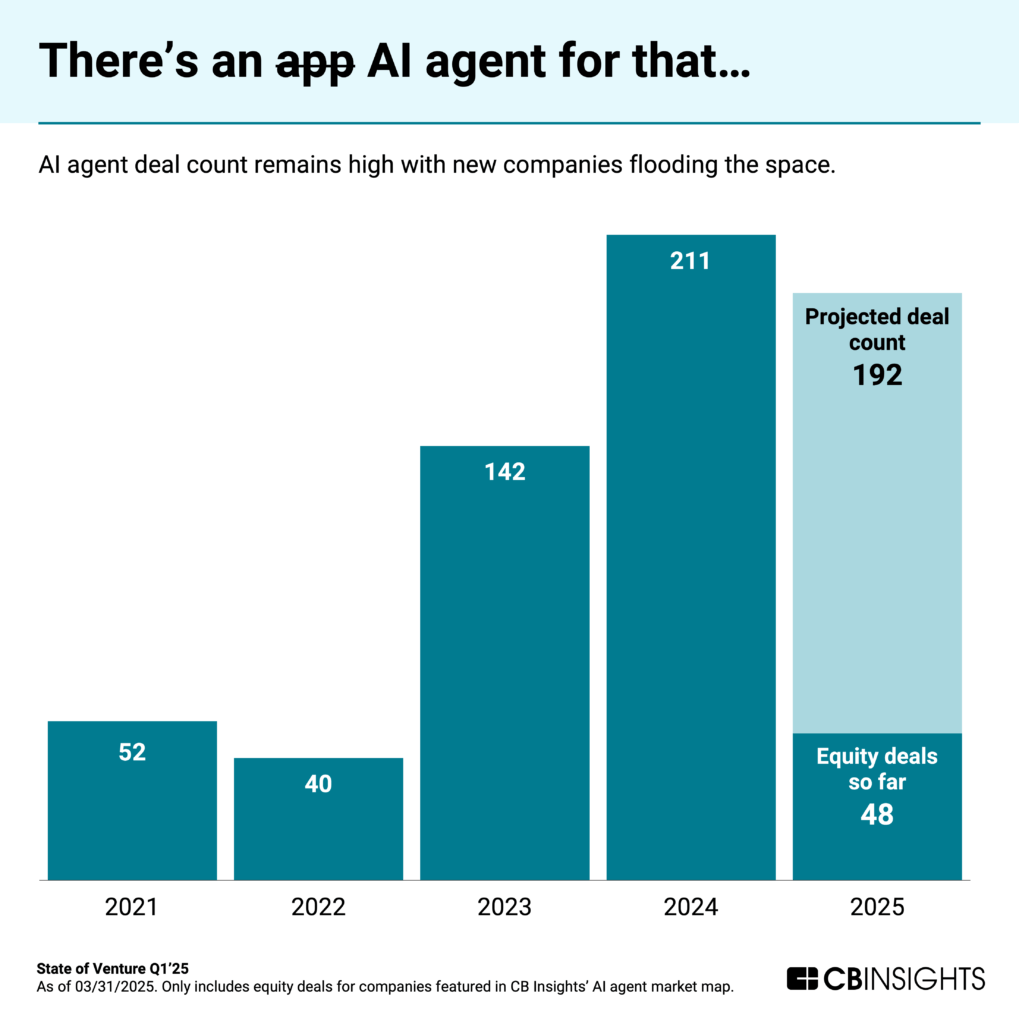

These LLM-based systems represent an evolution beyond copilots. They can autonomously handle complex tasks — from sales prospecting to compliance decision-making — with limited human input. The market is expanding rapidly, with CB Insights data showing that over half of companies in the space were founded since 2023.

Investor interest is surging in parallel. AI agent startups saw more than 200 equity deals in 2024 — and activity is pacing toward similar levels this year.

Key investment themes emerging in the space include:

Specialized agents for specific business functions (sales, legal, finance)

Agent orchestration platforms that manage multiple agentic systems

Safety and alignment tools for ensuring agent behaviors match human intentions

Enterprise-grade agents with robust permissions and security frameworks

As agents become more capable and trustworthy, adoption will accelerate across industries.

Read more from our AI agent coverage:

![]() CBI customers: Track 250+ AI agent companies

CBI customers: Track 250+ AI agent companies

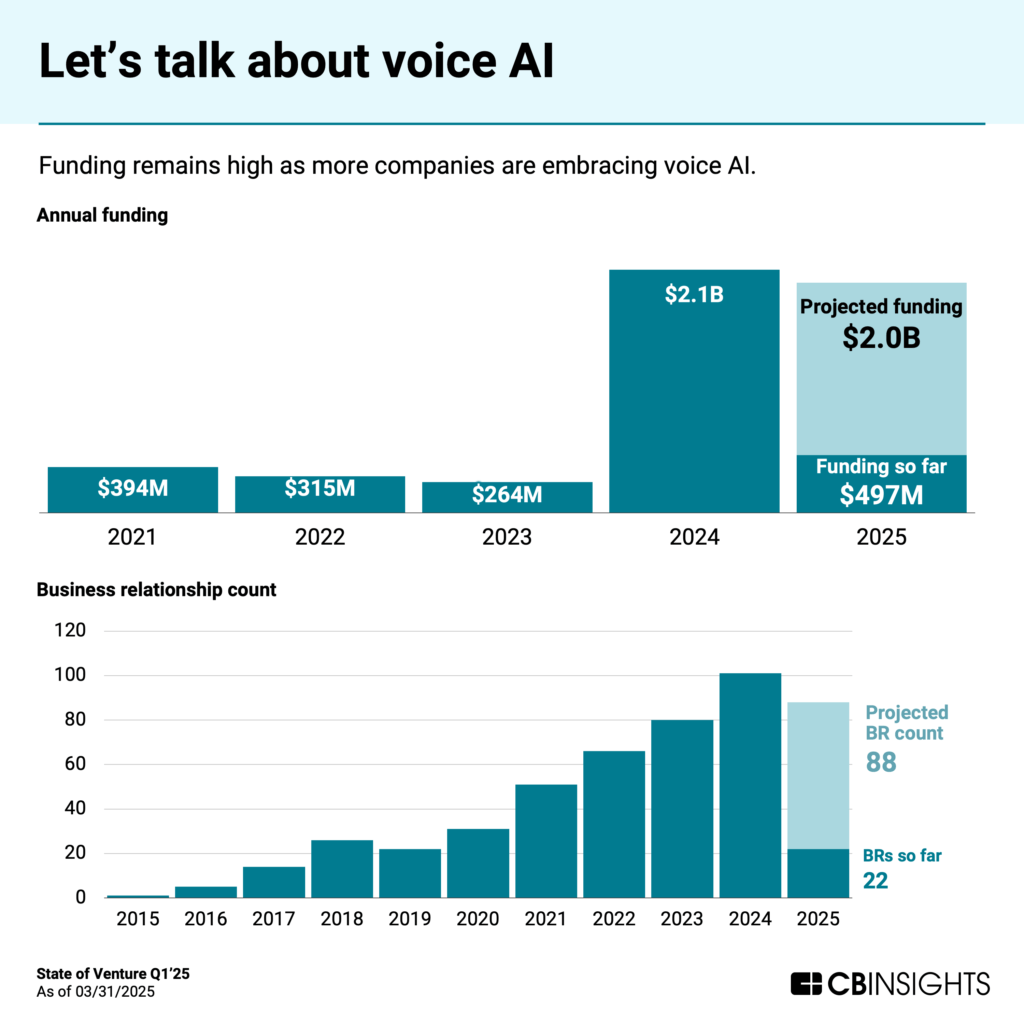

Voice AI takes off amid technical advances

Voice AI is undergoing a technical transformation as models shift toward processing audio directly — bypassing the text intermediation stage — and approaching human-like conversation latency of under 300ms.

This technical progress has fueled substantial investment, with voice AI solutions raising $2.1B in 2024 and nearly $500M in Q1’25.

One standout is ElevenLabs, which reached $100M in ARR just 3 years after its founding and raised a $180M round in January from investors including a16z, Salesforce Ventures, and Sequoia Capital.

Despite these promising signals, the voice AI market remains in early development. CB Insights data shows approximately 85% of companies in the space are at levels 1-3 on the Commercial Maturity scale. Nearly half are developing or validating their products, while 39% have just begun commercial distribution.

As voice interfaces become more natural and capable, we expect to see investment opportunities emerge in several areas:

Domain-specific voice applications for industries like healthcare and legal

Voice AI trained on local languages not typically covered by general-purpose AI systems

Voice-first UI/UX for both consumer and enterprise applications

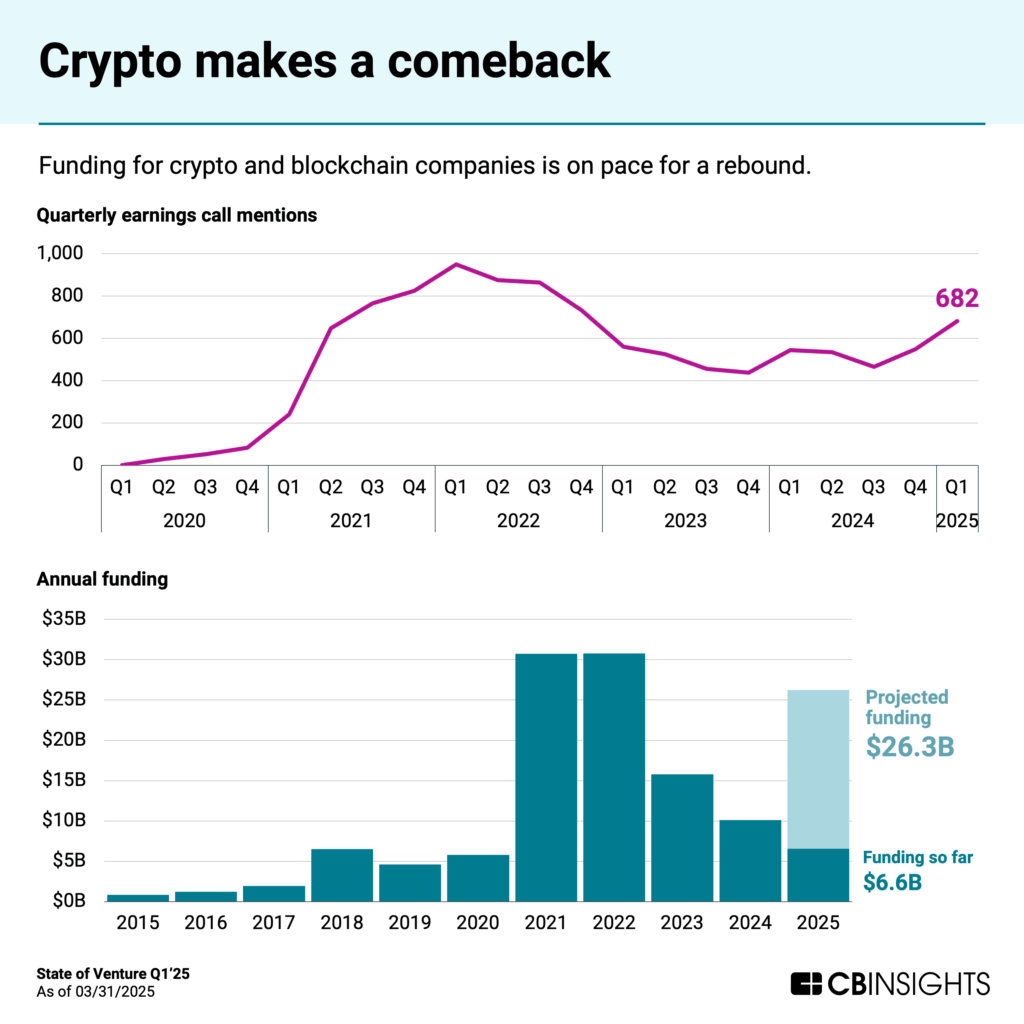

Crypto & blockchain rebound

After weathering a prolonged crypto winter, blockchain technologies are experiencing renewed institutional interest. Funding to crypto/blockchain companies reached $6.6B in Q1’25, putting the space on track to surpass $20B in annual funding. Earnings call mentions have climbed accordingly.

Several crypto companies now rank among the most likely IPO candidates, with platforms like Blockchain.com and Kraken showing IPO probabilities 64x higher than the average company tracked by CB Insights — a notable shift in public-market viability for the sector.

Another trend to watch is the growing institutional and government focus on stablecoins, as regulators develop frameworks to incorporate these digital assets into the traditional financial system.

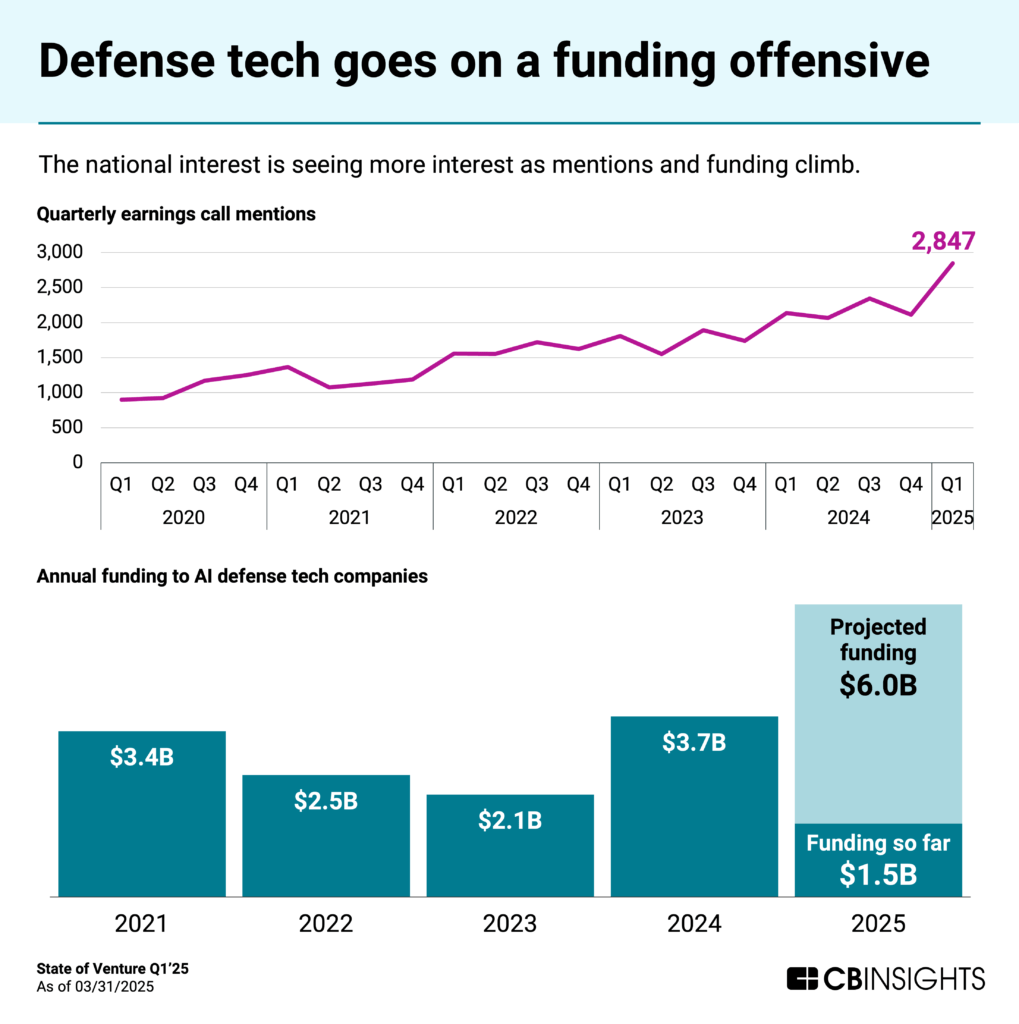

Defense tech comes into focus

Military technology is entering a new era as investment shifts toward autonomous systems and AI-driven capabilities.

According to formerJoint Chiefs of Staff Chairman General Mark Milley, smart machines and robotics could account for one-third of the US military presence within the next 15 years.

Funding to AI defense tech startups has already reached $1.5B this year — leading to a projected $6B by year-end. Last quarter saw earnings call discussion of defense reach an all-time high.

Much of this activity centers on multidomain operations (MDO) technologies — integrating systems across land, sea, air, space, and cyber — where AI is accelerating mission planning, threat detection, and battlefield connectivity. Major defense contractors are forming partnerships with AI startups to enhance battlefield management systems, mission planning capabilities, and integrated defense connectivity platforms.

As geopolitical tensions persist, defense tech investment is likely to continue growing, with particular focus on autonomous systems, AI-enhanced battlefield analytics, and advanced cybersecurity solutions for critical infrastructure.

![]() See 240+ AI defense companies in this market map

See 240+ AI defense companies in this market map

Conclusion

The venture capital landscape in Q1’25 reflects key contrasts: record funding alongside declining deal count, significant early-stage deals vs. heightened expectations for follow-on capital, and a resurgence in billion-dollar exits despite broader market caution.

AI continues to influence capital allocation decisions across the venture ecosystem, but we’re seeing a shift from general infrastructure investments to specialized vertical applications and industry-specific solutions. Meanwhile, sectors beyond AI are showing resilience, with fintech, digital health, and retail tech all posting quarterly funding increases.

For investors, the data suggests maintaining a disciplined approach to AI investments while remaining alert to opportunities in adjacent sectors. The companies that successfully blend AI capabilities with sustainable business models will emerge as the defining ventures of this era.

For more insights on venture trends and emerging technologies, explore our related resources:

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.