Shares of Confluent Inc. closed 7.5% higher today following a report that it’s exploring a sale.

Three sources told Reuters that the company, which commercializes Apache Kafka, has drawn takeover interest from both tech firms and private equity funds. Confluent is reportedly working with an investment bank to review the offers.

Kafka is an open-source platform that organizations use to sync data between their applications. The software is widely used because it moves information in near real-time, which is important for many use cases. A breach detection tool, for example, requires the ability to analyze malware alerts immediately after they’re generated.

Kafka also has other selling points. The platform is horizontally scalable, which allows it to process millions of data points per second, and offers a reliability feature called exactly-once schematics. The latter capability prevents Kafka from accidentally sending multiple copies of the same data point to an application.

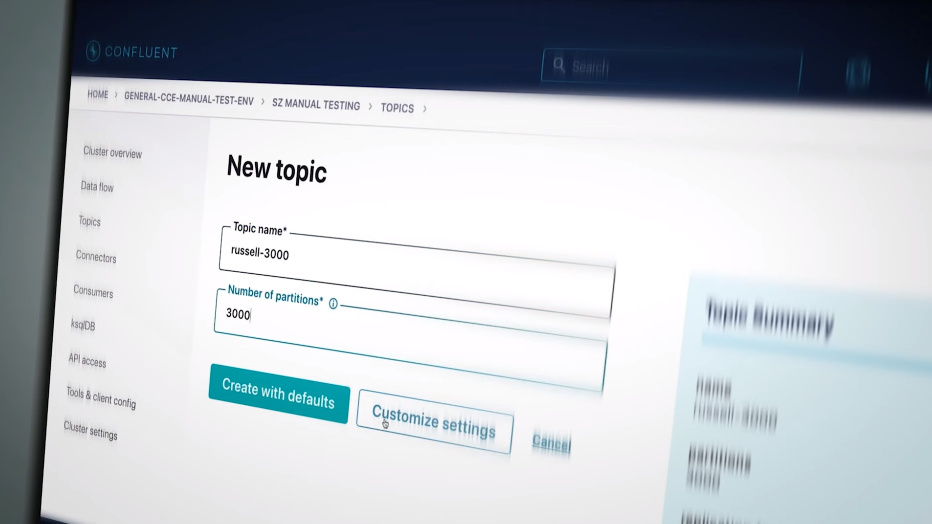

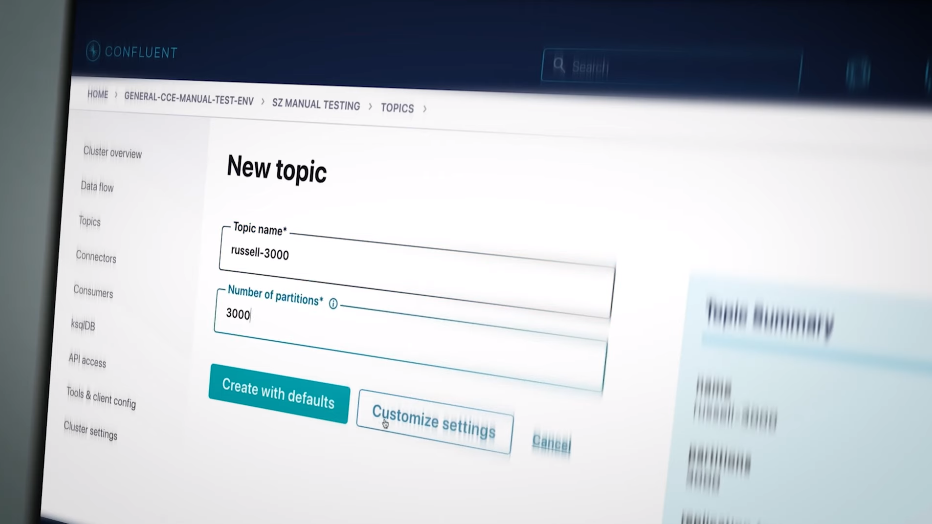

Confluent’s flagship offering is Confluent Cloud, a commercial managed version of Kafka. It extends the open-source platform’s feature set with capabilities that make it easier to use.

The company provides an autoscaling engine that automatically adds or removes infrastructure as usage changes, which saves time for administrations. There are also cybersecurity features that aren’t included in Kafka out of the box. One of them is an end-to-end encryption tool for protecting data from eavesdropping attempts.

Confluent Cloud enables companies to not only move data but also process it. Developers can use SQL to combine data points from different sources, remove unnecessary items and fix formatting issues. The platform can also cache the results of frequently recurring queries, which avoids the computing overhead associated with generating results from scratch every time.

Cloud accounts for more than half of Confluent’s revenue. Most of the the rest comes from Confluent Platform, a self-managed version of the platform.

The company reportedly started drawing takeover interest after its second quarter earnings report in late July. It announced a 25% year-over-year increase in Confluent Cloud revenue, but disclosed that a major “AI native customer” had decided to replace the platform with in-house software. Shares of the company dropped more than 20% the following day, which made it a more affordable acquisition target.

Despite the recent stock selloff, Confluent would likely fetch a significant sum if a sale materializes. The company had a market valuation of more than $7 billion before word emerged of the acquisition talks. Reuters’ sources cautioned that the discussions are in an early stage and may not lead to a sale.

Image: Confluent

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About SiliconANGLE Media

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.