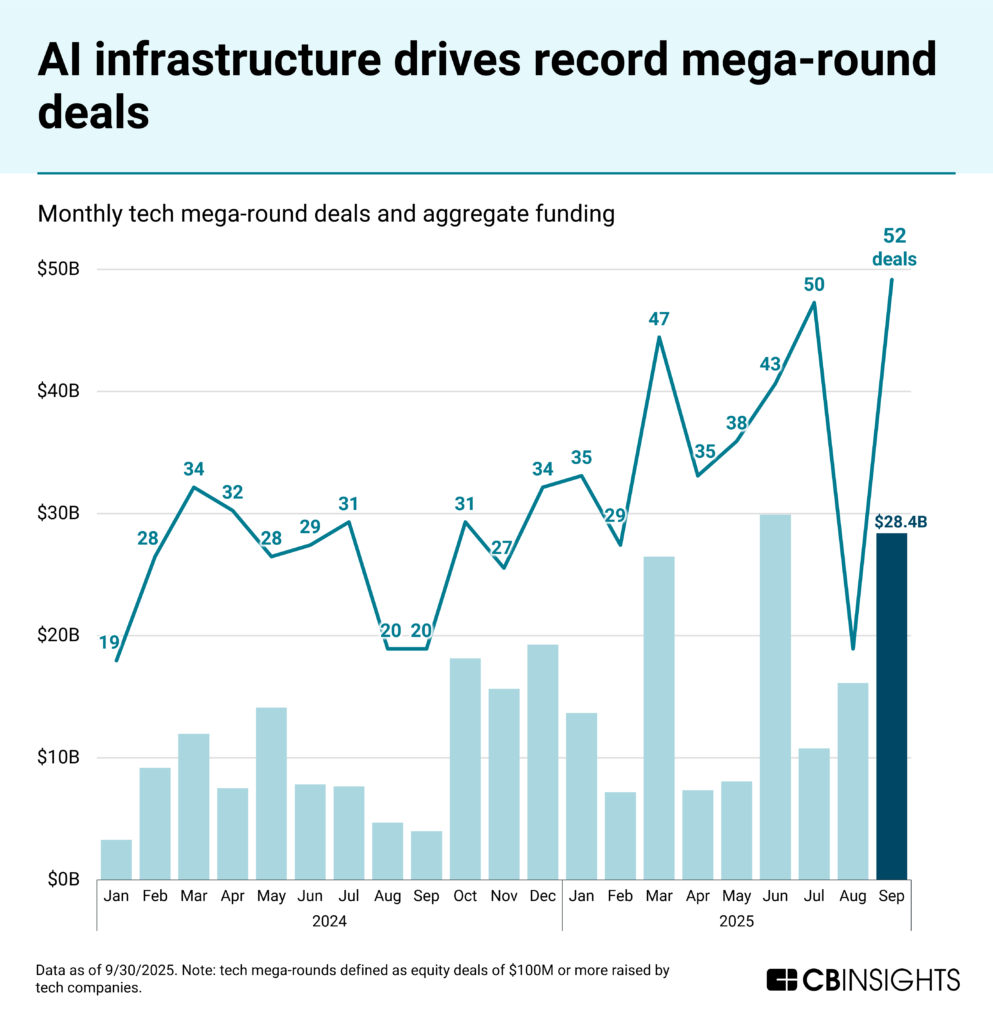

September saw the most mega-round deals in 2 years, with AI infrastructure as the clear driver, capturing 78% of all dollars raised to scale AI models and making them more efficient.

Training LLMs at scale is capital-intensive, and large funding rounds create a moat that shields model developers from new entrants.

Yet raw compute is a bottleneck, prompting bets on next-generation inference architecture — specialized chips and model fine-tuning — to bypass spiraling AI costs.

This investment pattern shows that scaling models alone is no longer sufficient. In the next phase of AI growth, performance, efficiency, and accessibility will determine which models and platforms emerge as winners.

Using CB Insights’ Business Graph, our monthly Book of Scouting Reports offers an in-depth analysis of every private tech company that has raised a funding round of $100M or more. It spotlights where private capital is concentrating, startups gaining momentum, and which companies are becoming tomorrow’s AI disruptors.

Download the book to see all 50 scouting reports.

KEY TAKEAWAYS

Companies helping control AI costs are gaining momentum: 7 AI inference/performance optimization companies received mega-round funding in September, with over 80% already generating revenue. Baseten achieved 10x revenue growth in 12 months, Rebellions projects $68M for 2025, and Invisible generated $134M in 2024. Their client rosters include LLM and genAI developers like Cohere, Writer, and OpenEvidence), signaling strong demand and proven value.

Cryptocurrency companies zero in on regulation and banking partnerships, boosting credibility and reach: 3 cryptocurrency companies received mega-round funding this month, and all either facilitate payments or offer digital currencies. 2 boast major banking relationships that validate institutional trust — Kraken partnered with PayPal, Circle, and Mastercard, and Fnality‘s Series C saw participation from 8 major banks, including Barclays, Bank of America, and Citibank. Fnality also received regulatory approval from the Bank of England, and Kraken acquired regulatory licenses in the United States and Europe, signaling that these companies are clearing compliance hurdles that have historically limited crypto’s reach.

Investors continue to place big bets on specialized, purpose-built AI ahead of commercial validation: Building on August’s momentum, early-stage bets are flowing to specialized AI companies built for specific industries and domains like robotics, manufacturing, materials science, healthcare, and pharmaceuticals. This month, 60% of verticalized AI mega-rounds occurred at Series A, and over 80% of these companies have Commercial Maturity Scores of 2, meaning their solutions are still being validated. Only robotics developer Auterion has live clients, while Lila Sciences and CuspAI have a single commercial partnership each. The rest — Periodic Labs, DYNA, and UltraGreen — feature strong founding teams or novel tech, suggesting investors are prioritizing talent and product over traction. As falling training costs fuel more vertical AI startups, team quality and product potential will remain critical funding criteria.

Want to submit your company’s funding data? Please reach out to researchanalyst@cbinsights.com.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.