This year has seen quantum computing being pushed from lab interests toward practical deployments. Vendors and tech giants published official updates showing progress on error correction, larger qubit systems, hybrid quantum-classical stacks and new research centers aimed at real-world use.

Google reiterated its Willow roadmap and published research on error correction and scalable chips and NVIDIA NVDA launched a dedicated “Quantum Day” and announced an Accelerated Quantum Research Center to couple AI supercomputing with quantum research. Pure plays like Rigetti highlighted multi-chip systems and new commercial availability in their quarterly results. Together, these companies have sketched a year of measurable engineering advances and growing commercialization pathways.

Below are four stocks expected to gain from quantum computing in 2025.

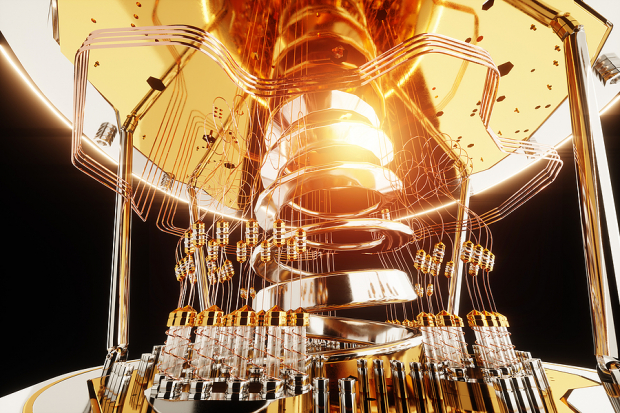

Microsoft’s first-half 2025 quantum computing-based developments center on Majorana 1 and on partnerships to scale quantum hardware and control. Earlier this year, the company unveiled Majorana 1 as a breakthrough topological-qubit processor and a measurement/control approach intended to simplify qubit control and make very large qubit counts practical, positioning Microsoft to pursue a distinct, potentially more scalable hardware path than superconducting or trapped-ion approaches. Microsoft’s focus on developer toolchains and collaborations to accelerate scalable systems suggests the company is pushing both hardware differentiation and cloud integration as its path to commercial quantum advantage. For investors who prefer a diversified tech heavyweight’s exposure to quantum instead of startups, Microsoft’s official roadmap points to multi-front engagement.

IBM in 2025 is pursuing a stepwise engineering route to fault-tolerant quantum computing that includes building a new IBM Quantum Data Center and an explicit roadmap toward large-scale, fault-tolerant machines. IBM also highlighted international System Two deployments, including a collaboration with RIKEN, along with continued Nighthawk-family hardware and software releases to expand circuit complexity, all signaling IBM’s investment in data-center-scale infrastructure, strategic partnerships and software stacks to support near-term commercial users and research collaborators.

As IBM has outlined, its current focus is on building industrial-scale, co-located classical–quantum platforms and ecosystems that enterprises and governments are likely to adopt first. The company’s 2025 outlook emphasizes steady platform expansion and strategic deployments rather than relying on a single near-term “killer app.”