With M&A on the rise, we break down how Nvidia is using acquisitions — including purchasing synthetic data startup Gretel last week — to strengthen its positioning in the next wave of AI development.

This research comes from the March 25 edition of the CB Insights newsletter. You can see past newsletters and sign up for future ones here.

M&A is back.

Below, we break down what’s driving the surge in deals, then zoom in on Nvidia’s latest purchase.

Buyers on the prowl

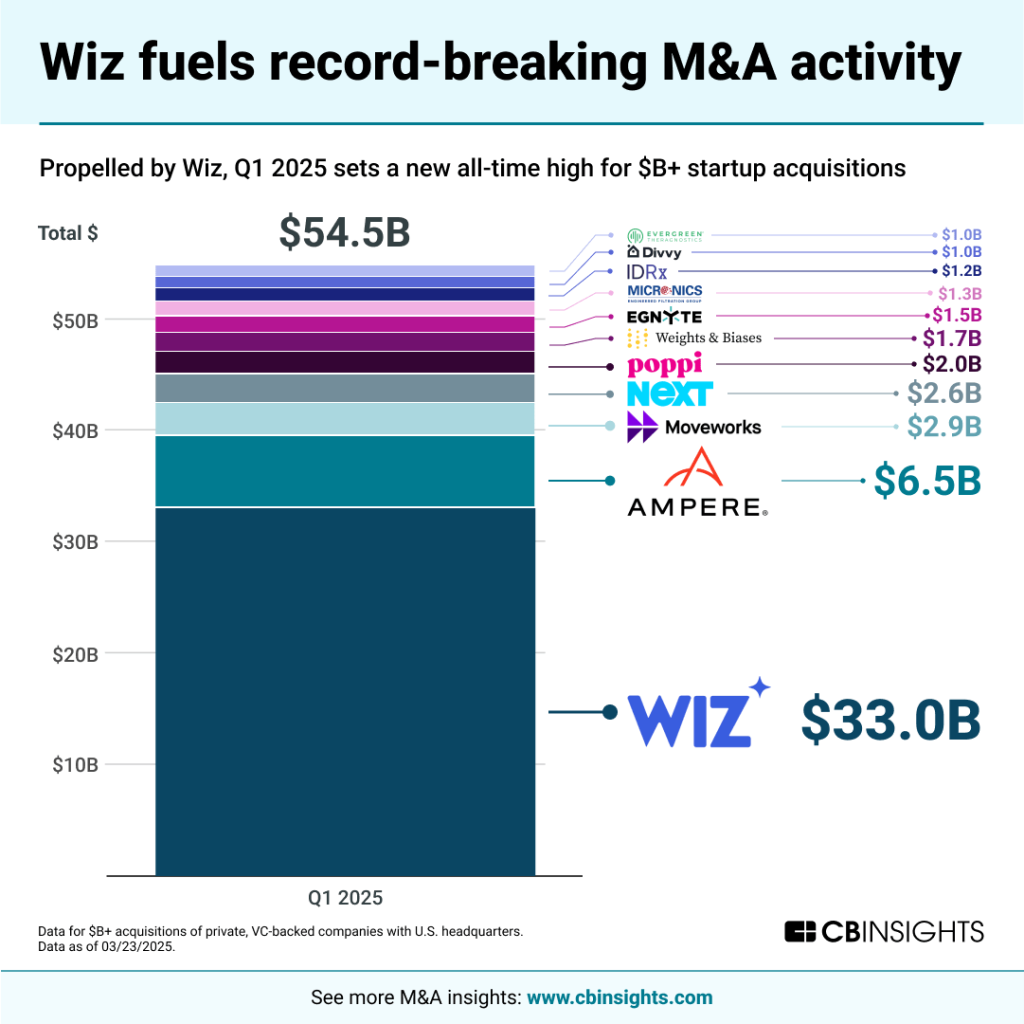

Q1’25 has already seen 11 $1B+ deals for VC-backed companies worth a combined $54.5B — blowing past quarters out of the water.

More than half of that value comes from Google’s $33B purchase of Wiz, the biggest VC-backed M&A exit of all time.

It’s not just tech startups — consumer & retail brands are getting snapped up too, like Pepsi’s $2B acquisition of Poppi.

But tech is leading the charge.

M&A activity in the sector rebounded 5% in 2024 and we expect it to gain more steam this year thanks to several factors:

Less regulatory pressure: Big tech players like Google are betting on a friendlier dealmaking climate with Lina Khan out as head of the FTC.

AI boom: Incumbents are anxious to get their hands on AI assets and infrastructure (see ServiceNow’s acquisition of MoveWorks and SoftBank’s acquisition of Ampere).

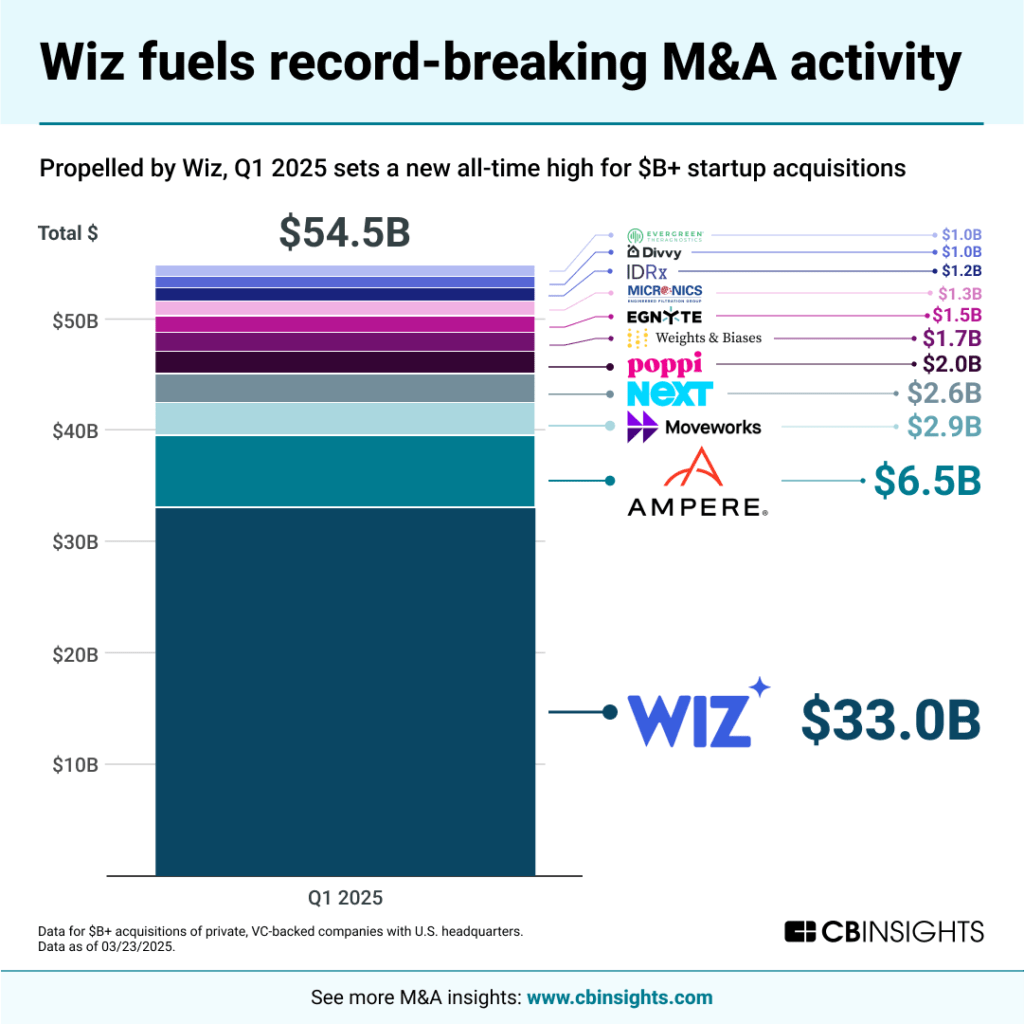

Cheaper prices: Tech M&A valuations keep falling, encouraging strategic and financial buyers to get off the sidelines.

Nvidia’s M&A playbook

Among the Mag 7, Nvidia stands out for its aggressive acquisition strategy.

All told, Nvidia has snapped up 7 AI startups since 2021, with 4 of these in just the last year.

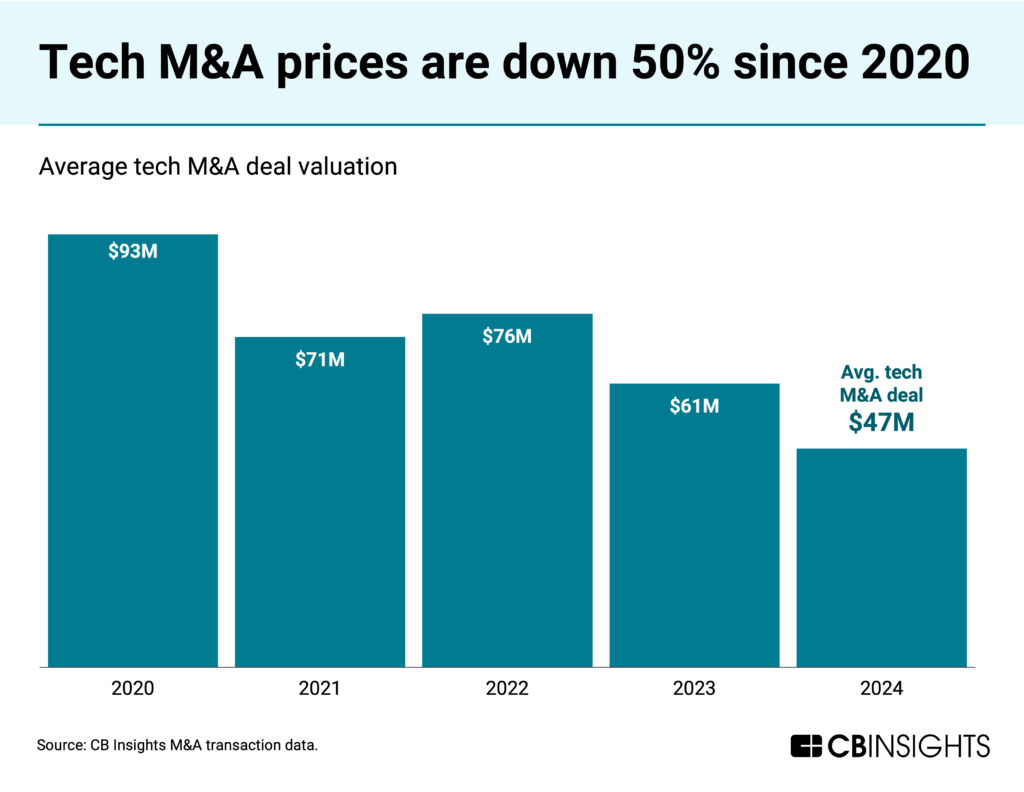

Last week it bought Gretel — reports place the exit valuation north of $320M (Gretel’s last disclosed valuation) but less than $1B.

Per CB Insights’ ESP ranking, Gretel is a leader in the synthetic training data market.

Source: CB Insights — ESP ranking of players in tabular and text-based synthetic training data

Synthetic data offers a potential solve to 3 issues in AI development:

A diminishing pool of high-quality text data to train more advanced LLMs.

The need to preserve privacy by using anonymized data, critical to AI adoption in industries like healthcare and finance.

The absence of real-world data to train physical AI models on tasks like driving cars or piloting humanoid robots.

CBI customers can see our analysis of 50 synthetic data providers here.

By acquiring Gretel, Nvidia positions itself at the forefront of the synthetic data market and strengthens its position in emerging areas like physical AI.

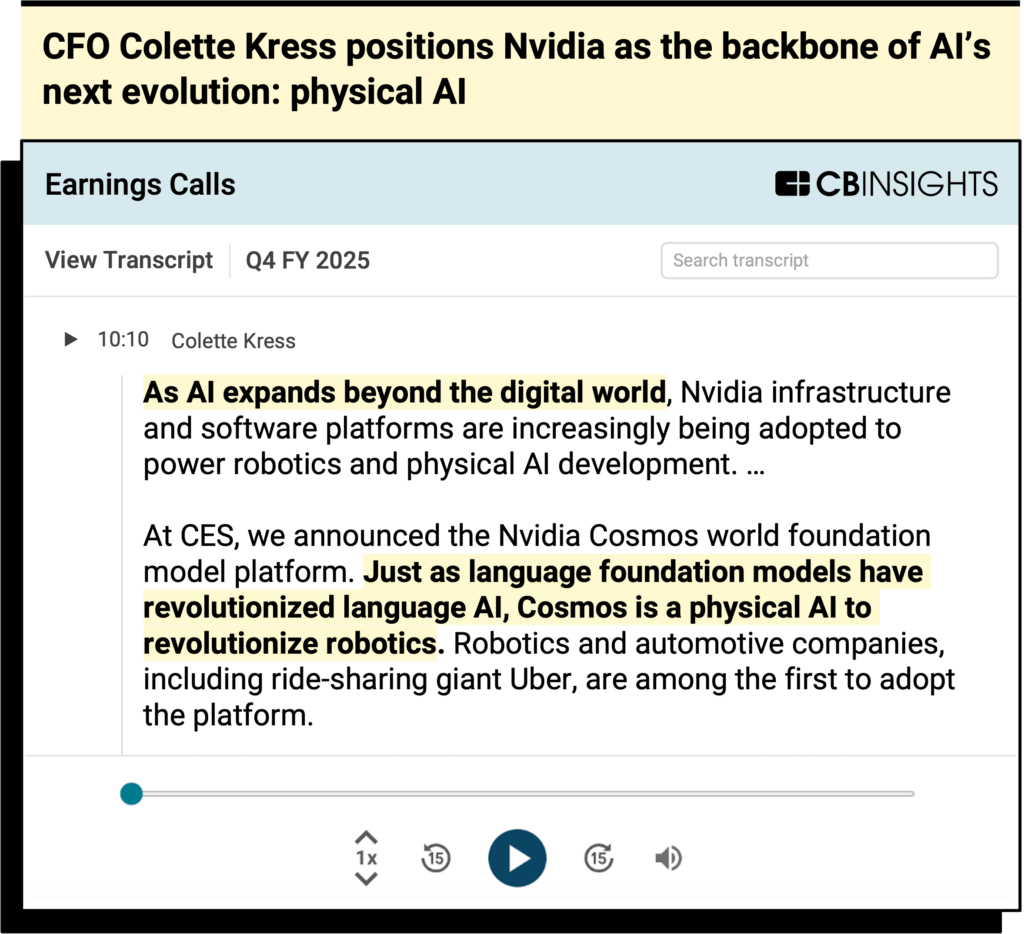

Nvidia sees the physical domain as the next evolution of AI, according to CB Insights’ earnings call transcripts.

Source: CB Insights — Nvidia Q4 FY 2025 earnings transcript

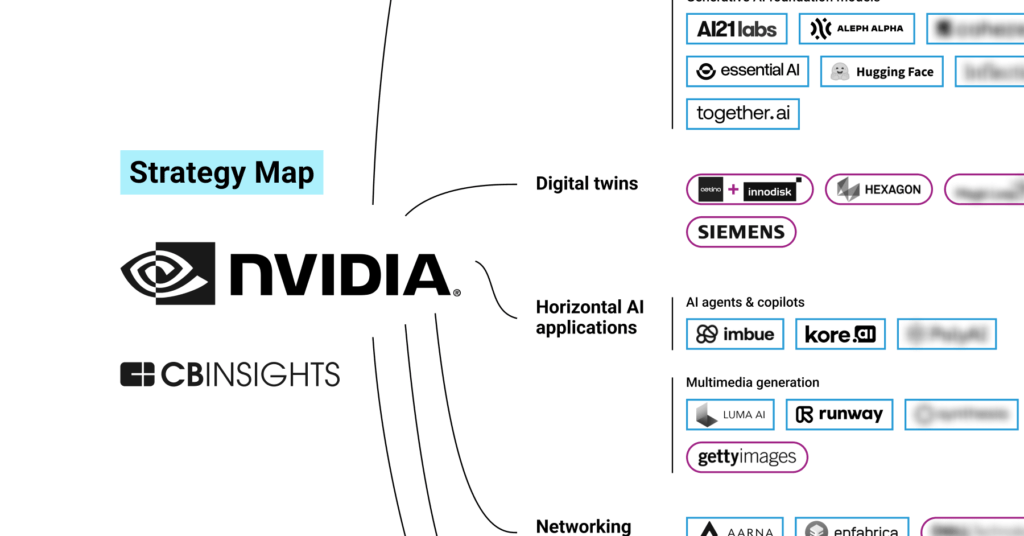

Back in June 2024, we wrote about how Nvidia is investing in and partnering with companies focused on industrial applications, like digital twins and robotics, which can rely on AI for simulation and training.

See where else the $3T company is targeting growth in our Nvidia strategy map.

Related research from CB Insights:

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.