Early-stage deals serve as leading indicators of where capital, talent, and innovation are concentrating.

In August, private companies globally raised 1,140+ early-stage rounds (noting this total will rise as more deals are published retroactively). Investors are backing startups targeting applications from AI agents to aerospace manufacturing.

Download the full report to access comprehensive CB Insights data on early-stage activity, including top investors & deals, valuation data, and our predictive signals.

Leading industries & tech areas

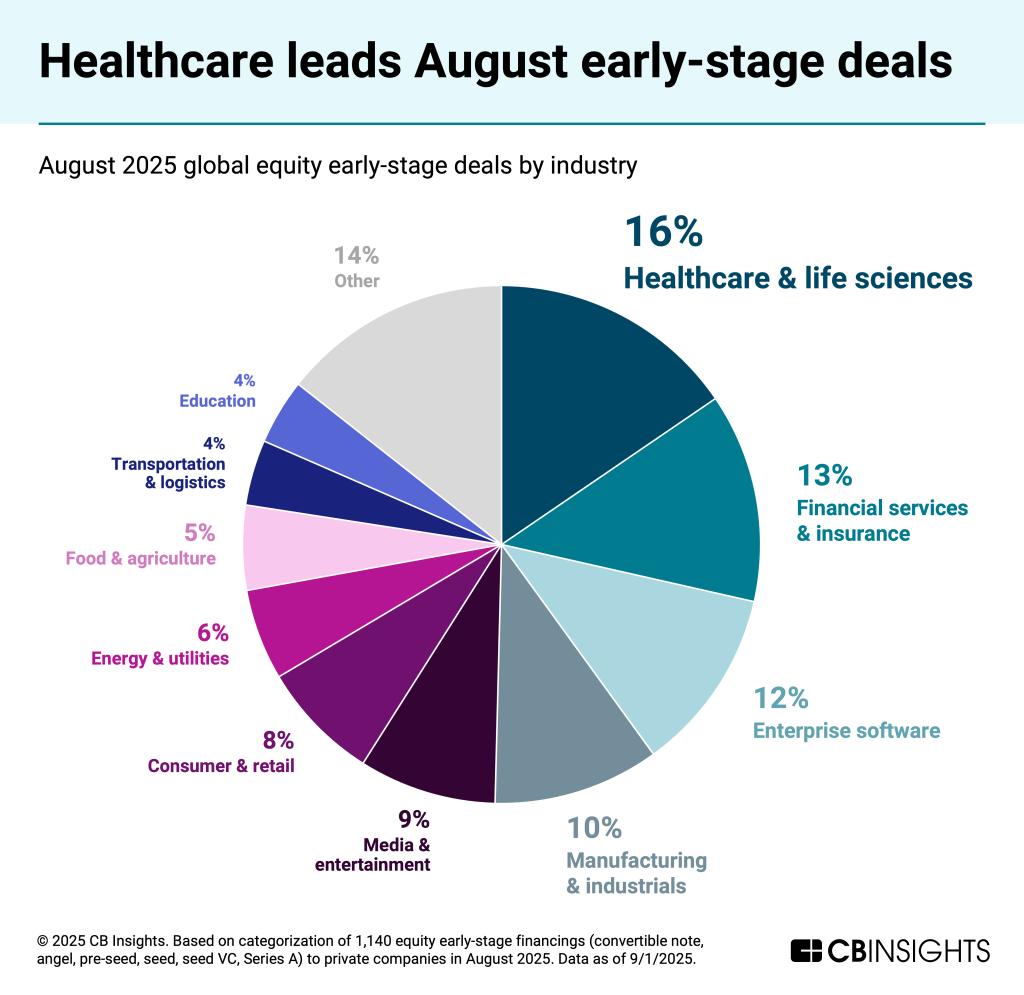

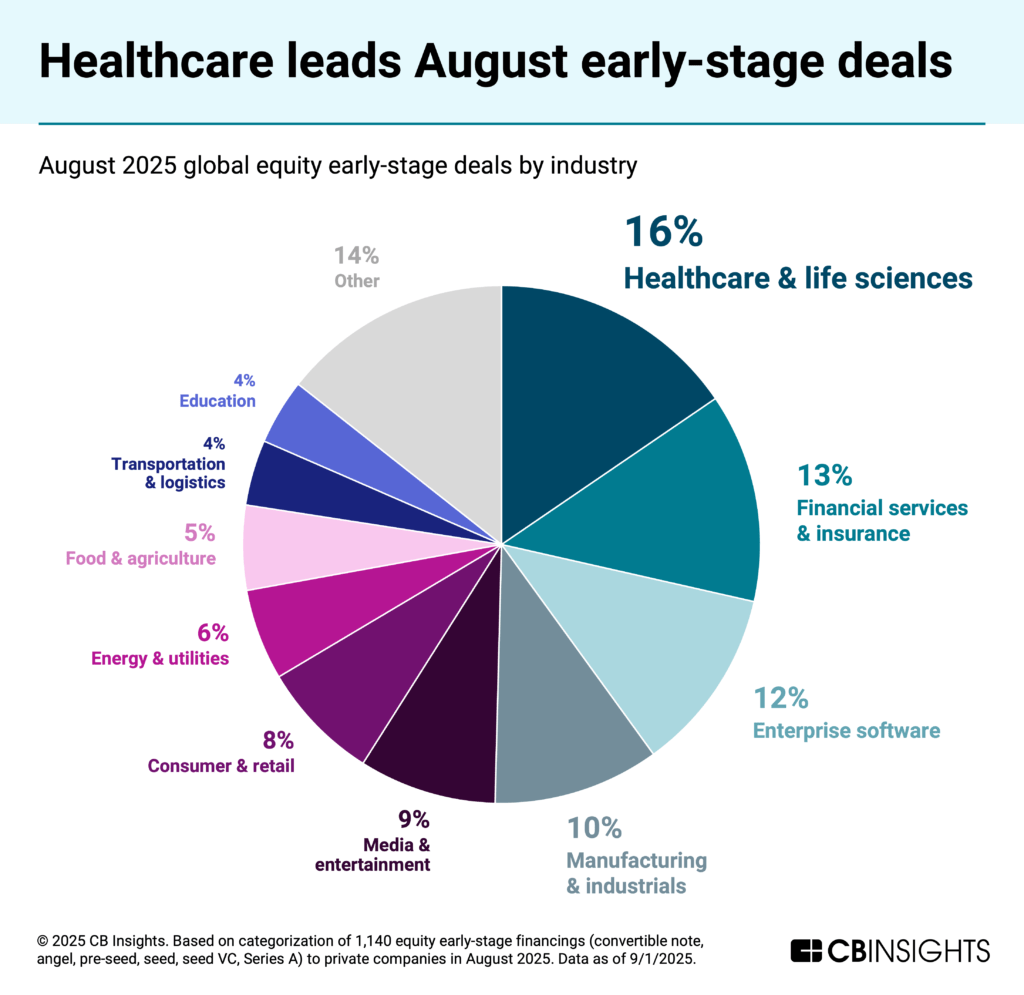

Startups targeting healthcare & life science, financial services, and enterprise software led early-stage funding activity in August.

AI is ubiquitous across the landscape. Over 30% of startups that raised rounds are building AI-enabled products and services. Companies targeting AI agent applications in particular raised over 50 deals.

Other focuses include blockchain/crypto (50+ deals) and robotics (50+ deals). FieldAI, which is developing foundation models for robots, raised a $314M Series A at a $2B valuation — the largest early-stage round of the month.

![]() CBI Customers: Review the full deal dataset

CBI Customers: Review the full deal dataset

Emerging & frontier tech categories to watch

More niche categories (those with fewer than 20 deals in the month) show a clear focus on “hard tech” across areas like space, quantum computing, and fusion energy.

Click the links to see underlying deal activity. Categories are not mutually exclusive.

Satellite technology (13 deals): The commercialization of low Earth orbit is accelerating with decreasing launch costs and miniaturization enabling new satellite constellations for communications, Earth observation, and more. SpaceX’s success has opened the door for specialized players, like earth observation platform SkyFi. 12 out of the 13 companies that raised early-stage deals in this category in August are based outside of the US in countries like China and India.

Space services & manufacturing (9 deals): The emerging space economy is driving activity across areas like transportation & logistics from space to earth (Orbital Paradigm) and in space (Orbital Operations). Companies such as Orbital Matter and Catalyx Space are leveraging microgravity to manufacture materials, components, and pharmaceuticals in space.

Quantum computing & secure communications (7 deals): Startups are developing quantum hardware, software, and infrastructure to tackle complex problems and keep data safe in the era of quantum technology. Examples include superconducting processors (QuamCore), quantum-inspired software for industries like finance and logistics (QMill), and quantum-secure satellite networks (olee).

Fusion (4 deals): The AI boom has created a $500B power infrastructure gap for data centers, triggering a race to secure nuclear technology. Fusion represents a longer-term breakthrough that could revolutionize power generation. Startups like Canada-based Fusion Fuel Cycles and Japan-based MiRESSO are focused on producing enabling materials and tech.

Top companies by Management strength score

Especially at the earliest stages of the startup lifecycle, the strength of the management team serves as a key signal of potential.

Using CB Insights’ Management strength score — which scores the founding and management team’s prior achievements and likelihood of achieving future success, like a high-value exit — these are the top 3 startups in this month’s cohort:

Perle (976 out of 1,000) — Founder Ahmed Rashman was previously Head of Supply and Growth at Scale, and has experience across a range of large tech companies including Amazon and Oracle.

Lettuce (973) — Founder Ran Harpaz was founding CTO of Globality (valued at $1B in 2019) and former CTO at Hippo Insurance (went public in 2021).

Lorikeet (858) — Co-founder Steve Hind previously worked in product at Stripe for 3 years, while co-founder Jamie Hall was a software engineer at Google for nearly 7 years.

See the rest of the top 10 by Management strength in the full report.

Methodology

This report includes equity early-stage financings (convertible note, angel, pre-seed, seed, Series A) to private companies in August 2025. We excluded companies that are later-stage that raised an angel round or convertible note in the month. Categorization based on company descriptions.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.