While pure-play quantum stocks offer explosive upside, IBM’s roadmap to fault-tolerant computing by 2029 makes it the safest way to own the quantum revolution.

Quantum computing could revolutionize everything from drug discovery to cryptography, with the global market expected to reach $7.3 billion by 2030. Most of today’s headlines focus on pure plays like IonQ and Rigetti Computing, whose prototypes and partnerships generate attention but little revenue and whose stock prices often swing wildly on technical updates.

Meanwhile, International Business Machines (IBM 0.52%) has taken a quieter path, booking $1 billion in cumulative quantum business since 2017 and publishing a clear roadmap to fault-tolerant systems by 2029. The company already operates multiple large-scale quantum systems worldwide and anchors a network of nearly 300 organizations using its cloud-access platform.

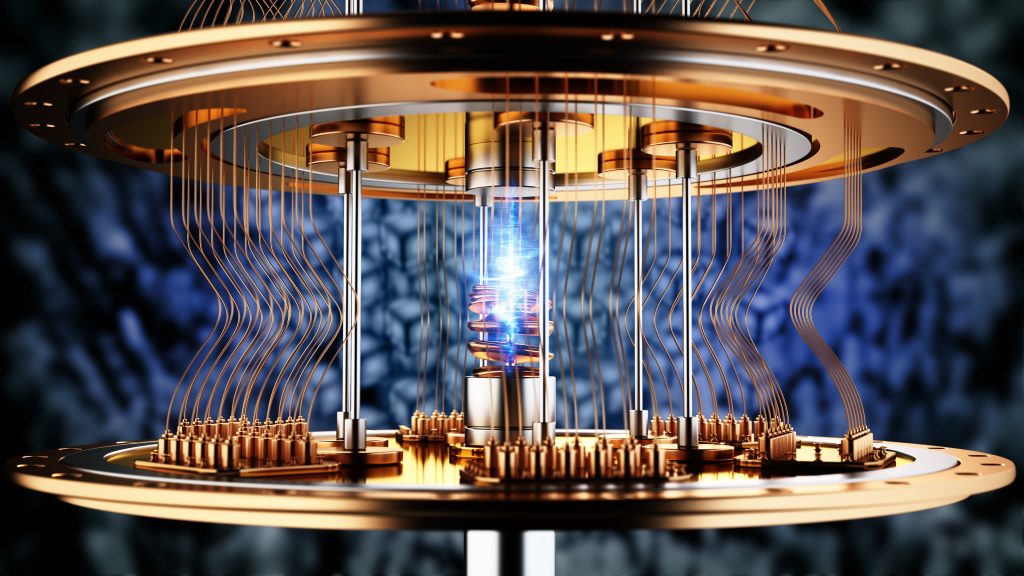

Image source: Getty Images.

Is the century-old tech giant the smartest way to own the quantum future? Let’s break down the company’s quantum computing platform and business model to find out.

The roadmap nobody’s talking about

IBM’s quantum strategy reads like a military campaign plan, with specific milestones and deadlines that pure plays can only dream about. The company targets utility today, quantum advantage by 2026, and its Starling system — planned for 2029 with 200 logical qubits and 100 million quantum gates — represents the holy grail of fault-tolerant quantum computing.

The company already operates multiple System Two deployments globally, including at Japan’s RIKEN Center and upcoming in Europe’s Basque Country. Its Quantum Network includes nearly 300 organizations — a mix of Fortune 500 companies, academia, and national labs — with over 600,000 active users accessing systems through cloud platforms.

In April, IBM announced a $150 billion investment in America over five years, including more than $30 billion specifically for quantum and mainframe research and development. That’s a tremendous amount of spending power for innovation — a key feature most rivals can’t match.

What’s the bottom line? Quantum is presently a small slice of IBM’s overall revenue. But that’s precisely the point — you’re getting quantum optionality without the binary risk associated with the pure-play options.

The pure-play moonshots

The alternative to IBM’s measured approach is the pure-play quantum space, where hope trades at rich multiples relative to revenue. IonQ generates modest revenue while sporting a $17.5 billion market cap. The company’s trapped-ion technology shows promise, with partnerships at Microsoft and Amazon, but profitability remains years away, according to analyst estimates.

Rigetti Computing tells a similar story: minimal revenue supporting a massive valuation (over 600 times trailing sales). Its 84-qubit Ankaa-3 system achieved a 99.5% median two-qubit gate fidelity; this is impressive for research but still far from full error correction.

D-Wave Quantum, another key name in the field, uses a quantum annealing approach that works primarily for optimization problems. However, the company’s stock is also richly valued at over 700 times trailing sales.

The bottom line is that all three pure-play quantum stocks remain years from consistent profitability. IBM, by contrast, is already a cash-generating enterprise with quantum as optionality layered on top.

The stability premium

IBM’s quantum program offers what pure plays can’t: diversification, resources, and patience. The company’s hybrid cloud and AI businesses provide steady cash flow while quantum develops. Its Q2 2025 results showed $17 billion in revenue and more than $13.5 billion in expected free cash flow for the year, underscoring the financial strength behind its long-term bets.

When IBM says it will achieve fault tolerance by 2029, it has the engineers, patents, and capital to deliver. If quantum computing takes longer than expected, IBM shareholders still own a profitable enterprise technology company with strong dividends (current yield is 2.65%), steady services contracts, and exposure to AI growth.

For investors seeking maximum quantum exposure, the pure-plays like IonQ, D-Wave, and Rigetti offer higher beta — both up and down. But for those who want credible quantum progress without existential risk, IBM provides the safest path, arguably the best choice in this emerging space.

George Budwell has positions in D-Wave Quantum, IonQ, Microsoft, and Rigetti Computing. The Motley Fool has positions in and recommends Amazon, International Business Machines, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.