The coding AI agent & copilot space has quickly become one of the fastest-growing enterprise use cases for LLMs. Startups like Anysphere (maker of Cursor), Replit, and Lovable have all crossed $100M in ARR — a milestone reached in record time.

The market is already worth more than $2B, and appetite for these tools continues to accelerate. New players are flooding in: IDE startups are launching their own agents, 12 brand-new coding AI agent companies have been founded since 2024, and every major cloud provider and LLM developer has been rolling out offerings.

So who’s leading today, and who’s gaining ground fastest?

Using CB Insights’ revenue data, we measured the current size of the market and estimated market shares for players in the space. Download our book of scouting reports for an in-depth analysis of every private player with disclosed revenue in the market.

If you are active in the coding AI agent & copilots market and want to submit your company’s revenue data, please reach out to researchanalyst@cbinsights.com.

![]() See all coding AI agent & copilot companies ranked by revenue

See all coding AI agent & copilot companies ranked by revenue

Key takeaways

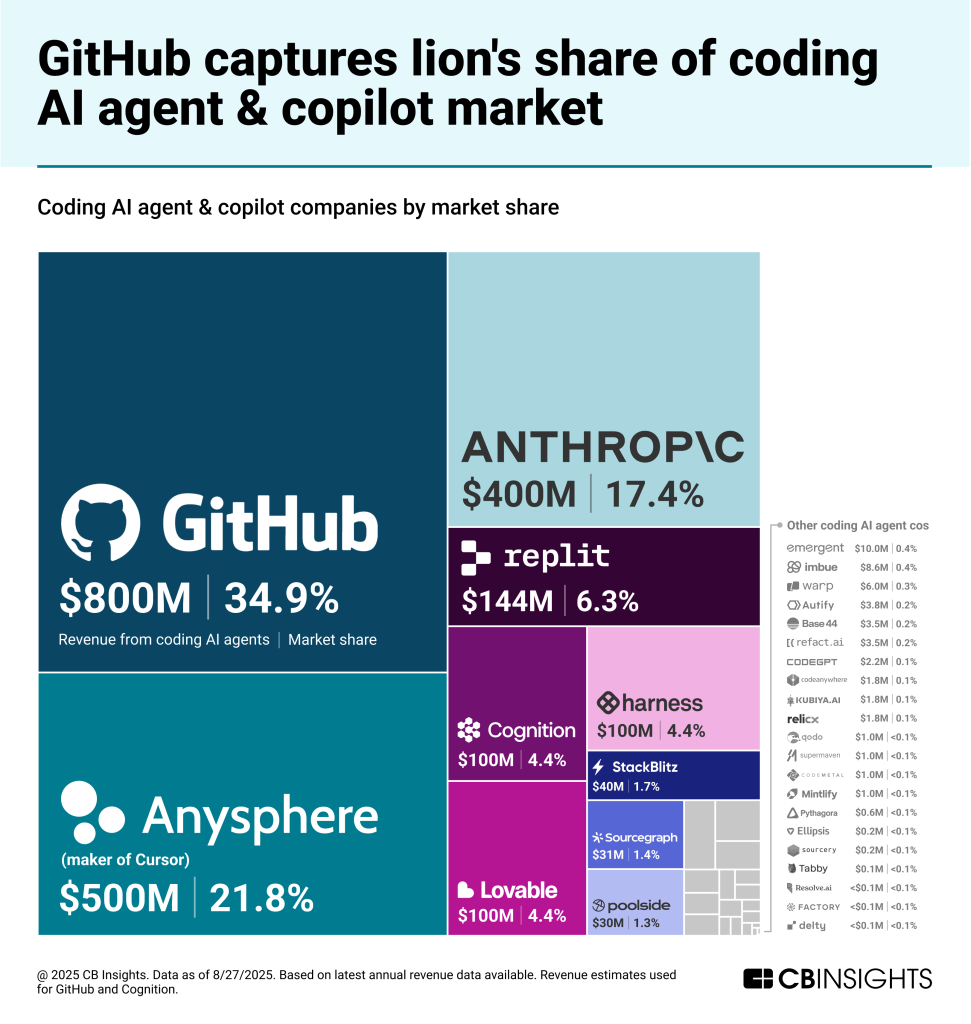

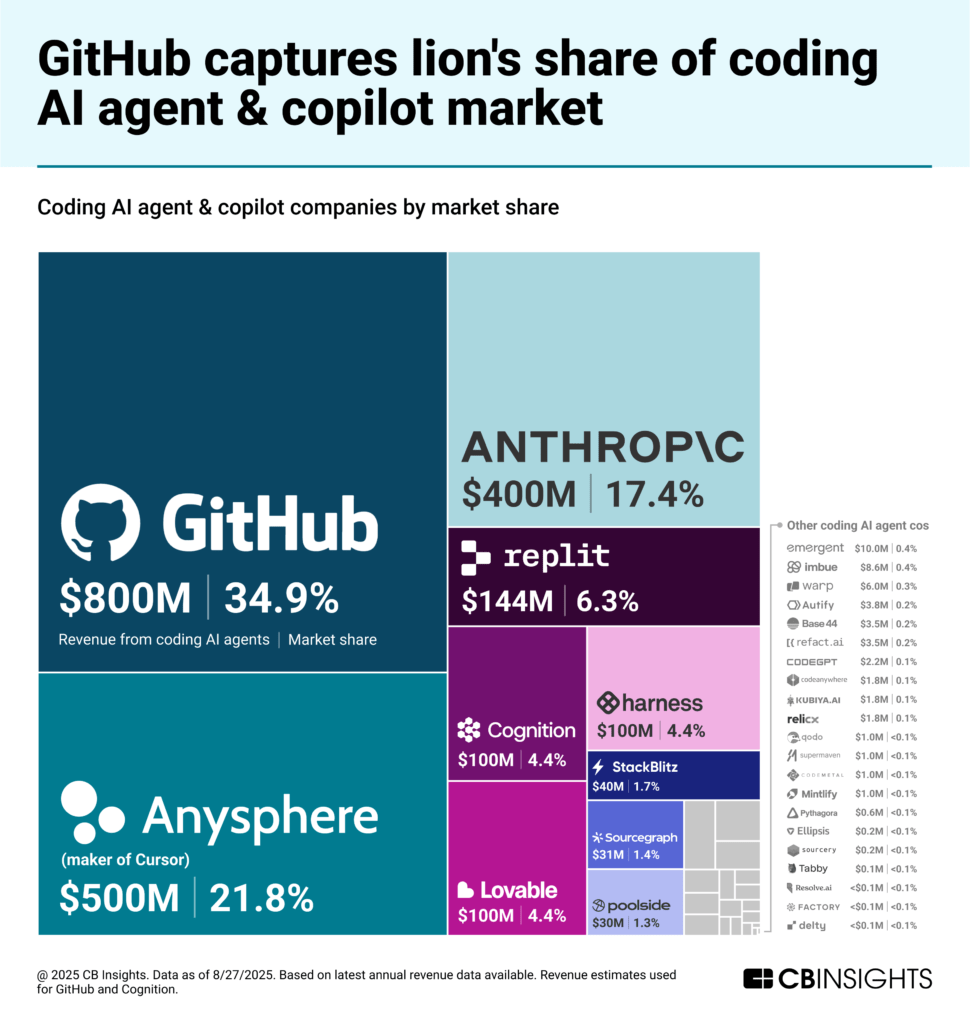

Coding AI agent & copilot is a highly concentrated market, with the top 3 players currently holding just over 70% of the market. GitHub (owned by Microsoft) leads with an estimated $800M in ARR generated from its AI-powered coding offerings, demonstrating the power of superior distribution in the agentic AI space. With close to 40% of players showing low commercial maturity scores (emerging or validating), we expect leaders to be challenged and risk losing market share unless they turn to M&A to maintain their position — and technological edge.

Explosive growth creates a dynamic leaderboard, with companies reaching and surpassing $100M in ARR at record pace. For example, Anysphere was generating $500M in ARR by June this year, up from $100M as of December 2024, a level it reached just 12 months after launching its product. Similarly, Anthropic scaled its AI coding solution (Claude Code) from 0 to $400M in ARR in just 5 months. This is adding more pressure on leaders as it highlights the low barriers to scale in this market, with new entrants able to win material share very quickly.

The pie keeps getting bigger, with companies projecting top-line growth of 12x on average this year. Lovable recently said it expects to reach $250M in ARR by year-end, up from $10M at the start of 2025, and projects $1B by mid-2026 — a 100x increase in just 18 months. However, higher costs and reluctance from enterprises to adopt usage-based pricing could slow growth in the space or require significantly more funding to stay in the race.

Market overview

The coding AI agents & copilots market consists of AI-powered solutions that help software developers write, fix, test, and maintain code. These tools offer features like intelligent code completion, natural language code generation, automated testing, code review, debugging assistance, and technical debt management. Many solutions integrate directly with popular IDEs and development environments, while others operate as standalone agents or chat interfaces. The market includes both general-purpose coding assistants and specialized tools for specific programming languages, frameworks, or development workflows.

We count close to 100 players in this market, with a mix of early-commercial-maturity pure players (~40%), recently minted unicorns such as Anysphere and Lovable, leading LLM developers, and most big tech companies.

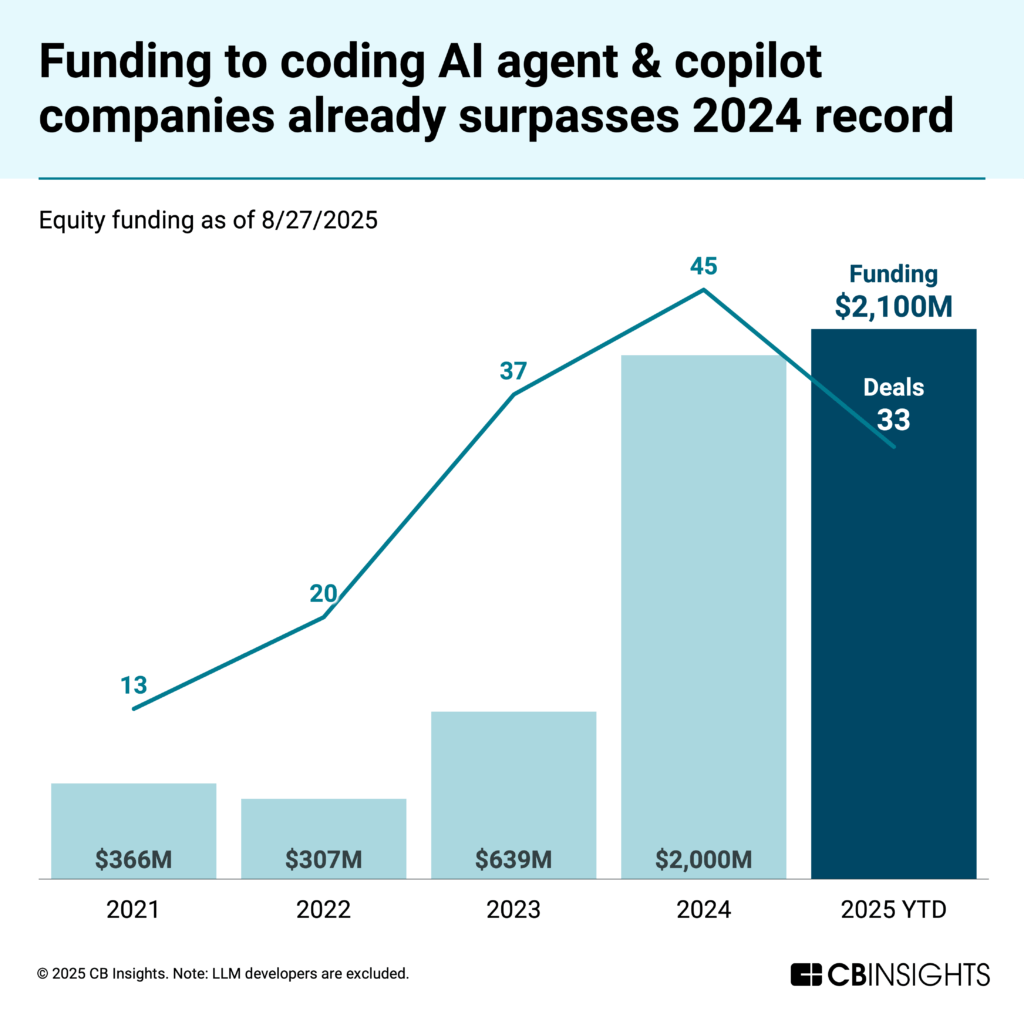

They have raised a combined $2.1B in equity funding so far this year, already surpassing the $2B raised last year. Traction in the market is also reflected in its average Mosaic score (a measure of company health) of 633, well above the 370 average across all private companies.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.