Nvidia’s shares slid after the AI semiconductor giant reported its latest quarterly profit and gave a revenue forecast that was slightly below expectations in its latest earnings report.

Demand for the company’s chips, an essential part of AI data centres, wasn’t quite feverish enough to ease recent worries that the AI craze may be fading.

The results announced on Wednesday were hotly anticipated because Nvidia has emerged as a key barometer of a two-year-old AI boom that has been propelling the stock market to new heights.

The Silicon Valley chipmaker also became the first publicly traded company to achieve a $4tr (€3.44tr) market capitalisation, surpassing the value of the German stock market.

In recent weeks, though, research reports and comments by prominent tech executives have raised investor fears that the AI mania has been overblown.

In the May-July period, Nvidia’s data centre division posted revenue of $41.1bn (€35.3bn), a 56% increase on the same time last year, but below analysts’ forecast of $41.3bn (€35.48bn), according to FactSet Research.

Even so, Nvidia’s profit of $26.4bn (€22.68bn), or $1.08 per share, was higher than analysts predicted, as was its total revenue of $46.7bn (€40.1bn) — also a 56% increase on the previous year.

Nvidia signalled it believes more good things are still to come by forecasting revenue of $54bn (€46.4bn) for the August-October period, slightly above what analysts had been envisioning for the quarter.

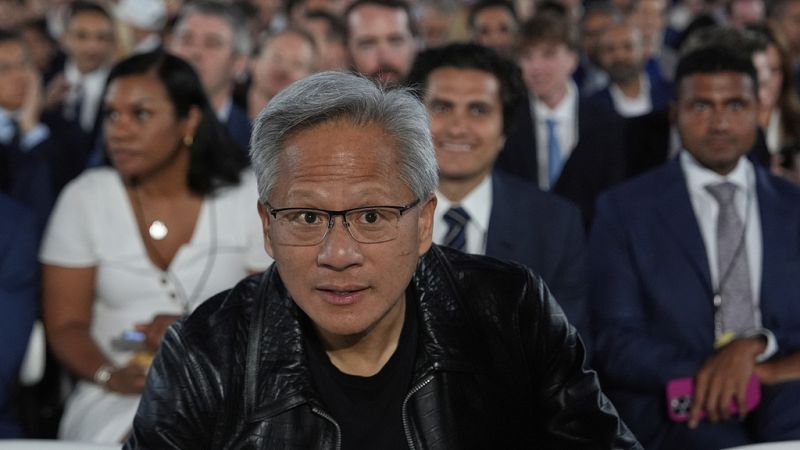

“We are in the beginning of the buildout,” Nvidia CEO Jensen Huang told analysts during a Wednesday conference call where the company predicted another $3tr to $4tr will be spent on AI initiatives by the end of this decade.

But Nvidia’s stock still slipped 3% in extended trading after the fiscal second quarter report came out, indicating the performance wasn’t enough to allay investors’ fears. A letdown was almost inevitable, given that the stock price has increased by more than tenfold during the past two and a half years.

“Saying the stock was priced for perfection would be an enormous understatement,” said Investing.com analyst Thomas Monteiro.

Delivering the kind of growth to push Nvidia toward a $5tr (€4.3tr) market value has become more daunting as Nvidia’s annual sales have ballooned from $44bn (€37.8bn) in its fiscal 2024 to a projected $204bn in the company’s current fiscal year that ends in January.

That has translated into progressively slower rates of year-over-year revenue growth. After Nvidia’s revenue at least doubled or tripled from the previous year in five consecutive quarters during 2023 and 2024, the growth has been tapering off over the past four quarters.

Story Continues