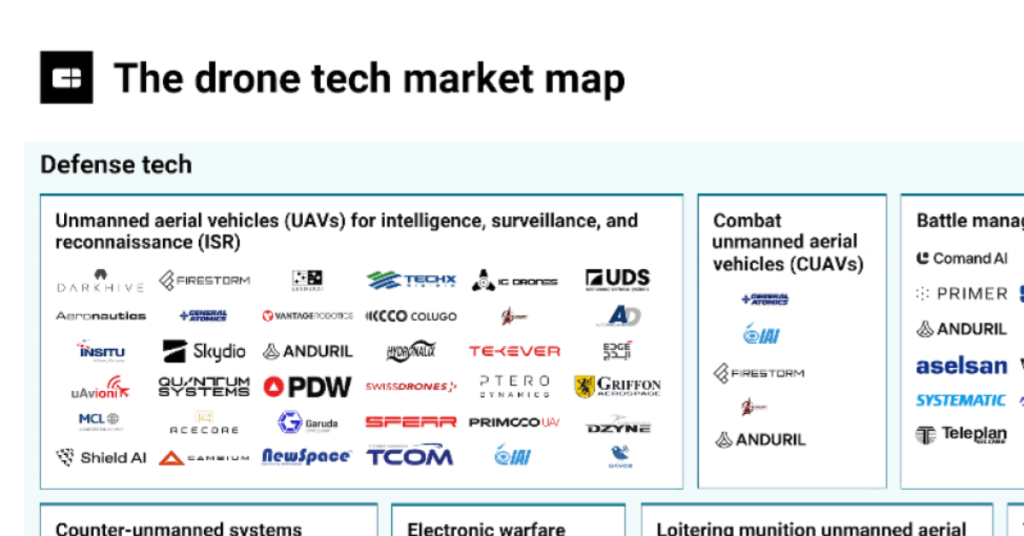

The drone industry is taking off.

Equity funding to drone developers has reached a record $5.5B already this year. More broadly, the drone market is projected to grow from $73.1B in 2024 to $163.6B by 2030, driven by defense spending, more permissive regulations, and AI advances that enable autonomous navigation, real-time object detection, and mission planning without human intervention.

Defense spending is leading the drive. The US Department of Defense is redirecting approximately $50B from legacy programs to new priorities, including drones and counter-drone systems. On the industrial front, adoption is already proving the technology’s value. Companies report 30-50% more efficient inspections, with one industrial player seeing millions in monthly cost savings.

The recent acquisition of Alteia by GE Vernova — bringing AI-powered visual intelligence to grid inspection — exemplifies established players’ aggressive moves to integrate drone capabilities into their operations. This push comes as Chinese manufacturer DJI holds nearly 70% of the global drone market, prompting the US government to accelerate domestic alternatives via procurement restrictions and DoD programs like Blue UAS and Replicator amid supply chain and security concerns.