In 2024, banking crossed a critical threshold. No longer satisfied with being simply digital and inspired by interactions with Chat GPT, customers began demanding something deeper—experiences that understand them. Banks turned to a powerful

ally: artificial intelligence. The result? A seismic shift from transactional to transformational. AI didn’t just automate services—it began shaping

intimate, context-aware journeys that feel less like banking and more like a personal concierge for your financial life. From predictive insights to adaptive interfaces, the age of

“one-size-fits-one” in banking CX has arrived—and it’s only getting started.

Banking, Tailored: Personalized Banking Experiences

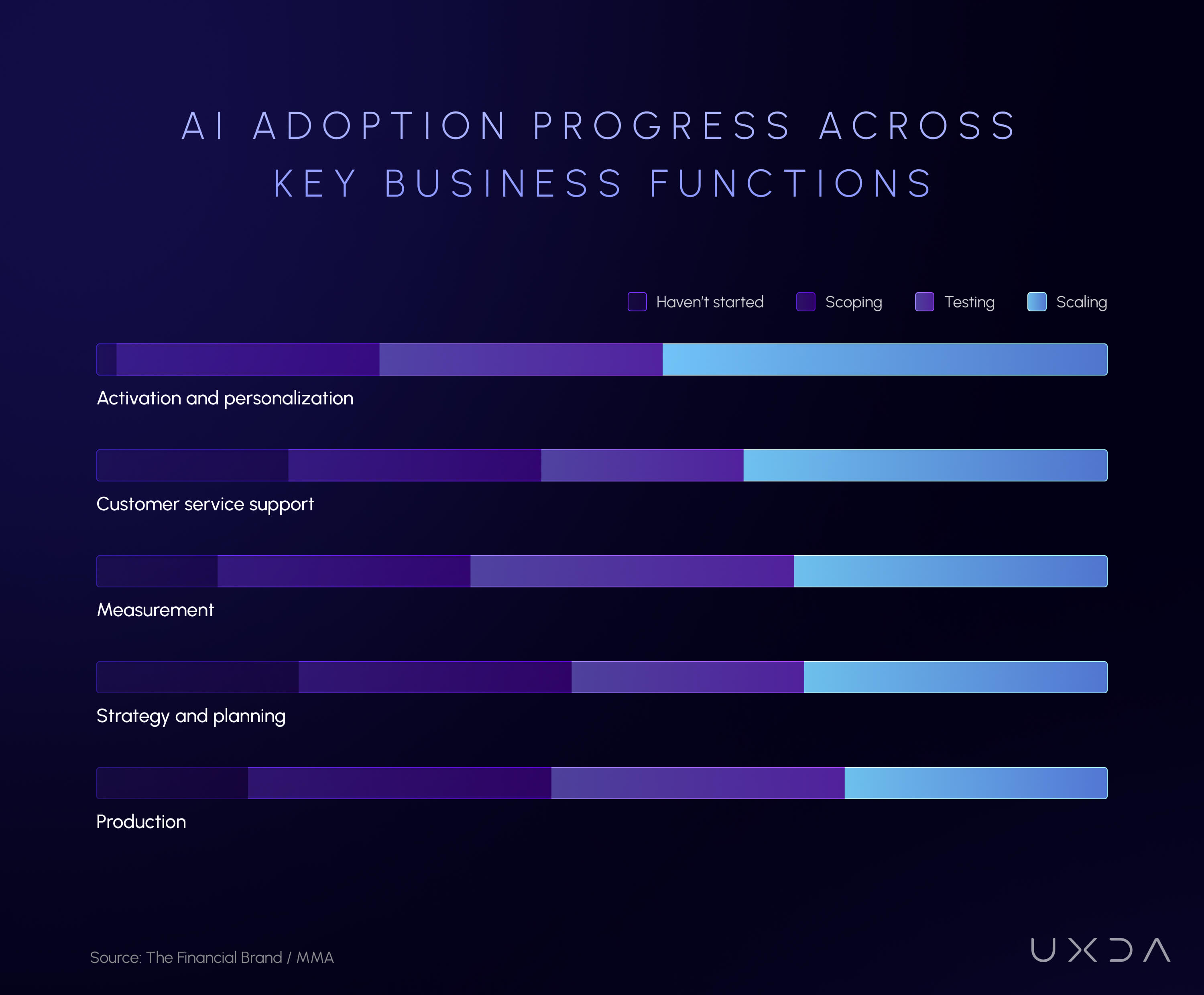

AI turns one-size-fits-all into one-size-fits-one, driving double-digit revenue and CSAT jumps. Personalization emerged as a top priority for banks’ AI initiatives in 2024, driven by customer expectations for services tailored to their needs. According

to a McKinsey study, 71% of consumers now expect personalized experiences from their banks, and 76% feel upset when personalization is lacking.

Banks responded by leveraging AI (including machine learning and predictive analytics) to analyze vast troves of customer data—from transaction histories to digital behavior—and deliver more individualized experiences.

In fact, a global marketing survey found personalization is the predominant use case for AI in finance, with 44% of organizations scaling AI to tailor customer experiences, anticipate needs and boost loyalty. This shift toward hyper-personalization

is yielding tangible results: one analysis reported that using AI-driven insights for customer experience led to “double-digit boosts in revenue, customer satisfaction and campaign conversions” for financial institutions. In other words, AI isn’t just a gimmick;

it’s translating into happier customers and improved business outcomes.

Banks around the world rolled out AI-powered personalization features in 2024. Many mobile banking apps started offering AI-generated insights and advice customized to each user’s financial situation. For example, some banks use AI to automatically notify

customers of unusual spending, predict upcoming bills or suggest budget adjustments—all tailored to the individual. In the US, Wells Fargo began leveraging predictive analytics and generative AI for dynamic content creation, aiming to deliver “hyper-personalized

interactions that drive engagement and revenue.”

Regional banks also saw success: First Horizon Bank’s marketing team integrated AI to predict client needs and personalize messages, reporting “promising results” in deepening customer relationships. Meanwhile, in the UK, both incumbents and digital challengers

invested in personalization. Digital-only banks like Starling Bank and Revolut (which reached 52.5 million customers in 2024) built their growth in part on personalized financial tools, prompting incumbents to follow suit.

The demand is high: a large majority of banking customers (in all age groups) want more personalized experiences, and almost half are willing to let banks use their data for this purpose. This pushed banks in 2024 to use AI not only for targeted product

offers, but also to tailor content, notifications and even the user interface to each customer’s profile.

Beyond marketing, AI-driven personalization extended to financial advice and planning. Some banks piloted virtual financial advisors that analyze a customer’s goals and spending patterns to offer bespoke advice—for example, suggesting how to save

for a house or which debt to pay down first. While these AI advisors gained some traction, trust remained a hurdle for sensitive advice: a survey found only 27% of consumers fully trust AI for financial guidance. To address this, banks paired AI insights with

human validation or made AI recommendations fully transparent.

The overall trajectory is clear: personalization became a must-have aspect of digital banking, and AI provided the engine to deliver it at scale. Banks that executed well saw improvements in customer loyalty, whereas those with generic one-size-fits-all

digital experiences risked falling behind.

As Capgemini’s global head of data for financial services noted, “AI and generative AI are rapidly transforming how we view personalized banking experiences… enabling analysis of vast data to generate tailored content, recommendations and interactions,” which

is proving “transformational” for customer engagement.

DIY Banking Takes Over: Rise of Self-Service

AI adoption in 2024 also turbocharged self-service capabilities in banking. Customers increasingly prefer to handle their banking needs digitally, without having to visit a branch or call a helpline for routine tasks. Banks used AI to make these

self-service options smarter, more intuitive and more comprehensive than ever. The result was a continued climb in digital banking usage across markets.

A Cornerstone Advisors study showed digital banking users reached 77% of checking account customers in 2024, reflecting that digital adoption is at near-saturation among many demographics.

Even in markets with traditionally high branch usage, the trend is similar. In the UK, for instance, 87% of adults use online banking, and 60% use mobile banking as of 2024, according to UK Finance, and 40% of Brits in 2025 have an account with

a digital-only bank—a number that has risen sharply in recent years. This mass migration to digital channels has been facilitated and accelerated by AI-driven enhancements to self-service.

One of the clearest impacts of AI is the proliferation of virtual assistants and chat interfaces that empower customers to get things done on their own. From simple tasks, like checking a balance or paying a bill, to more complex actions like applying

for a loan, AI has made self-service more convenient. A survey by Zendesk noted that self-service adoption in financial services has grown 5.4× in recent times, as banks provide more useful tools like searchable knowledge bases and intelligent chatbots.

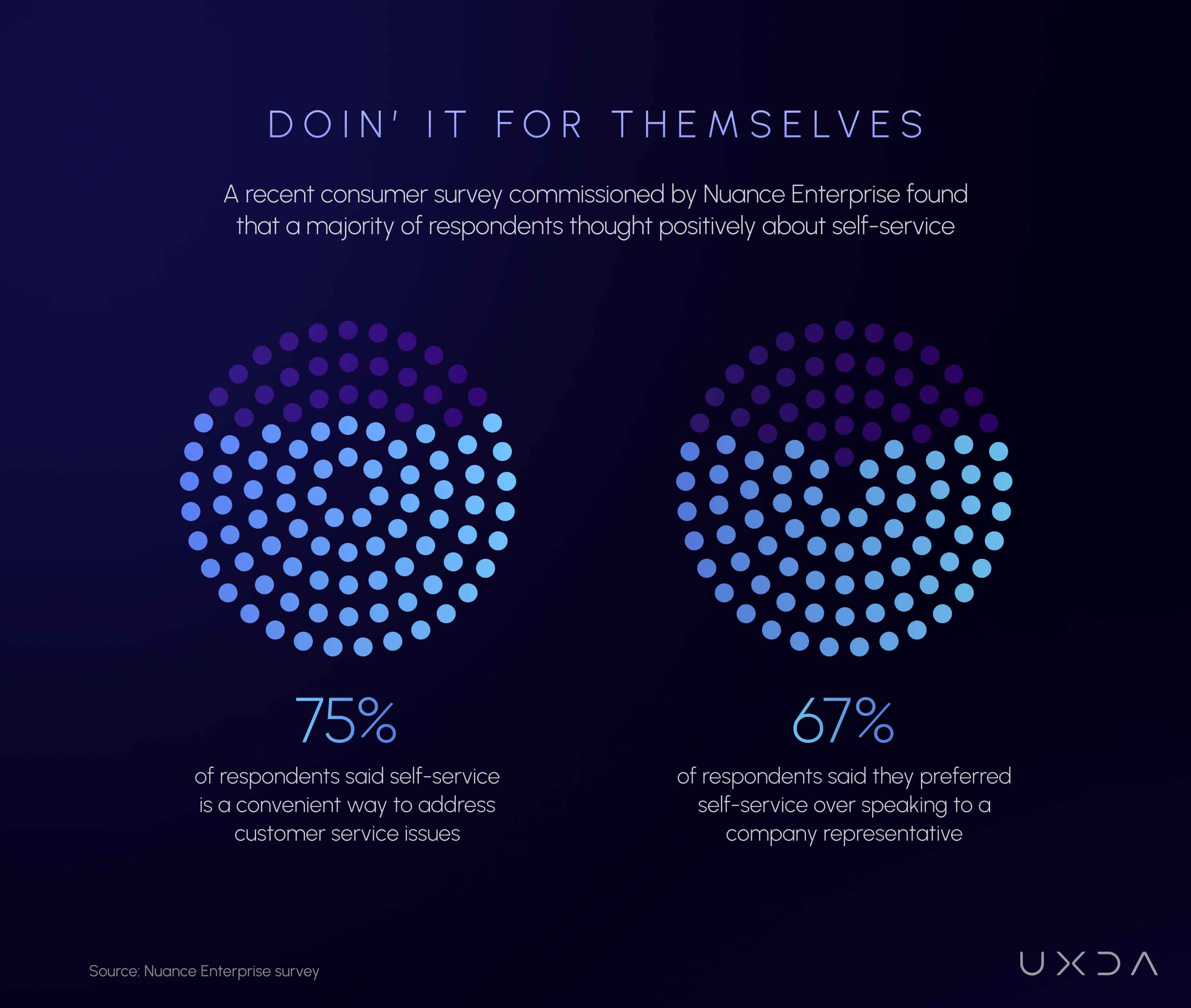

Customers appreciate these improvements: about 75% say self-service is a convenient way to address issues, and 67% actually prefer self-service over speaking to a human rep.

Especially for tech-savvy segments (millennials and Gen Z), digital banking is the default – 60% of millennials primarily use mobile banking apps as their main way to bank. In 2024, banks responded to this demand by expanding what customers can

do without human intervention.

AI-powered chatbots and voice assistants played a dual role in boosting self-service. First, they act as 24/7 guides: an AI bot can understand a customer’s query in natural language and either provide the answer or walk the user through the steps

to complete a task. Second, these bots leverage AI to handle multi-step requests that previously might have required an employee.

For example, Brazil’s Nubank (one of the largest digital banks) offers a self-service model in which customers can do “everything from paying a bill or raising their credit limit to setting travel notices” via the app. Over 80% of Nubank’s customers

handle their needs through these digital self-service features without the need for additional support.

This kind of comprehensive self-service became a benchmark in 2024. In the US, Bank of America (BofA) expanded the capabilities of its virtual assistant, “Erica,” to allow in-app money transfers and more complex queries, further reducing the need

to visit a branch or ATM. And at Wells Fargo, the new AI assistant, “Fargo,” was introduced to simplify everyday banking tasks in the mobile app, contributing to a staggering 245.4 million customer interactions via the assistant in its first year.

The convenience of AI-driven self-service translated into higher digital engagement and cost savings. Automated self-service options deflect routine inquiries that would otherwise flood call centers, freeing human staff to focus on high-value or

complex cases.

Industry analysis estimated that bank chatbots will save around $7.3 billion globally in customer service costs, roughly $0.70 per interaction handled by AI instead of a human. Moreover, customers who get quick, effective answers on their own tend

to be more satisfied. A survey by Zendesk in 2024 found 77% of consumers say AI is helpful for simple issues, indicating that when AI works, it meets customer expectations. However, it’s worth noting that AI self-service is not yet perfect.

The J.D. Power 2024 banking satisfaction study found that while overall satisfaction with big banks rose, the one area that saw a dip was when customers tried to contact the bank through self-service digital channels for help. This suggests that

some banks’ self-service tools in 2024 still left a gap when customers had more detailed questions or problems. Banks are learning from this, enhancing their knowledge bases and making AI bots more context-aware so they can handle nuanced inquiries.

In summary, 2024 cemented self-service as an essential component of banking CX—largely enabled by AI—with customers embracing the flexibility to “do it yourself” and banks enjoying higher digital adoption rates as a result.

Next-Gen CX in Banking: Proactive Customer Engagement

Beyond enabling transactions, AI has transformed how banks engage and build relationships with customers through digital channels. In 2024, banks used AI to become more proactive, conversational and timely in customer interactions, rather than

just reactive. This led to higher customer engagement, measured by increased logins, more frequent interactions and deeper usage of digital services.

A striking example comes from Bank of America, which reported that its clients logged into digital banking 14.3 billion times in 2024, and nearly 38 million customers subscribed to proactive digital alerts (up 7% from the prior year). Those alerts,

powered by AI analysis of account activity, delivered nearly 12 billion personalized notifications in 2024, giving customers real-time insights into things like low balances or unusual charges.

This kind of AI-driven engagement keeps customers continuously connected with their finances and with the bank’s app. As a result, BofA saw users logging in on average more than once per day, and digital interactions overall jumped by double digits

year-over-year.

A Forrester analyst noted that BofA’s mobile app “at least meets and often exceeds customers’ expectations” in most categories, thanks in part to useful features like these AI-powered alerts. The lesson echoed globally: when digital banking is

helpful and personalized, customers engage with it frequently, creating a virtuous cycle of value for both the user and the bank.

AI also enabled conversational engagement through chat and messaging interfaces. In 2024, many banks rolled out or upgraded chat services (e.g., in-app chat, WhatsApp banking, etc.) in which AI would be the first to respond. This effectively turned

customer service into a continuous, two-way dialogue.

For instance, NatWest (UK) saw its chatbot, Cora, manage millions of conversations that not only answered questions but also guided customers to relevant services. With the launch of Cora+ (a generative AI-enhanced version), NatWest’s assistant

became even more engaging—able to converse more naturally about products and financial guidance, almost like a human agent. Early pilots suggest that these AI chats can handle complex queries with a more conversational tone, making customers feel heard and

supported.

Similarly, banks in the US like Capital One expanded their AI chat capabilities. For example, Capital One’s Eno can proactively warn customers about suspected fraud or duplicate charges, engaging them in real-time via text message.

By analyzing customer data and context, AI allows banks to initiate contact at the right moment: sending a helpful tip, a security alert or a personalized offer exactly when it’s relevant. 70% of consumers value a consistent experience across channels,

and AI helps achieve this by maintaining context across mobile apps, web and chat. A customer might start a task in a chatbot and finish in the app, or vice versa, with AI ensuring a seamless handoff. This omnichannel fluidity was a key engagement theme in

2024.

Major markets demonstrated the impact of AI on engagement through concrete metrics. In the U.S., banks that invested heavily in AI-driven CX saw higher Net Promoter Scores (NPS) and loyalty drivers. While overall NPS can depend on many factors,

leading banks like Chase and Capital One (both noted for their advanced digital experiences) continued to rank at the top of customer satisfaction surveys. In the U.K., digital challengers dominated customer advocacy: Forrester’s 2024 survey of European banks

found that app-centric banks, such as Starling Bank, earned the highest NPS in the UK market (beating even other fintechs by a few points).

From a qualitative standpoint, AI-powered engagement in 2024 meant banks could anticipate customer needs instead of waiting for customers to reach out. Predictive models identified which customers might be shopping for a home, need a savings boost

or be at risk of overdraft—and then proactively offered assistance or deals. This not only drives sales; it also improves the customer’s financial health, thus building goodwill.

One survey noted that 62% of consumers would immediately try AI-driven personalized alerts to help avoid fees, showing that engagement efforts that clearly benefit the customer are warmly welcomed.

In summary, AI made digital banking more engaging in 2024 by turning it into an ongoing conversation—through alerts, chats and personalized content—rather than a static utility. Banks in the U.S. and UK that mastered this saw stronger customer

loyalty and higher usage of their digital platforms, while globally the norm shifted toward AI-enabled “smart” engagement as a key to CX success.

AI Takes Care: Support at the Speed of Thought

Perhaps the most visible impact of AI in banking has been in customer support automation. In 2024, nearly every major bank either launched or upgraded an AI-driven virtual assistant to handle customer inquiries, marking a significant shift in how

service is delivered. These AI assistants (e.g., text-based chatbots and increasingly voice bots) became front-line support, capable of resolving many issues that used to require a phone call or branch visit.

The volume of inquiries handled by AI is staggering: by late 2024, it’s estimated that more than 987 million people worldwide use AI chatbots for various services, and banking is a leading sector in this trend. Banks like Bank of America reported

that since launching the “Erica” chatbot a few years ago, it had facilitated over 2.5 billion interactions in total, with hundreds of millions in 2024 alone.

In the UK, NatWest’s Cora not only answered routine questions but also helped perform transactions, effectively handling workload equivalent to thousands of support agents. Cora handled 11.2 million retail banking conversations in 2024, matching

the scale of their human-assisted contacts.

These examples underscore how AI automation scaled customer support to new levels, improving response times and availability. Customers can get help 24/7, in seconds, which is reflected in high satisfaction with these tools: a Capgemini study found

89% of customers were satisfied with generative AI virtual assistants, and 73% trust content written by AI, indicating growing confidence in automated support.

NatWest’s Cora+ was trained with safeguards (in partnership with IBM) to avoid the pitfalls of open AI models (like inaccurate “hallucinations” or bias), emphasizing trust and reliability in its answers. In the U.S., banks were more cautious but

still active in exploring generative AI for support.

JPMorgan Chase, for example, invested in developing AI models (sometimes dubbed “IndexGPT”) for both customer service and investment advice, while Wells Fargo’s Fargo assistant used Google’s Dialogflow AI for robust understanding of customer requests.

Even regional banks and credit unions began deploying AI chatbots through cloud providers or fintech partners, recognizing that automated support is becoming an expected part of digital banking.

The quantitative benefits of support automation are significant. AI assistants resolve a large portion of common inquiries—balance requests, card activation, password resets, loan rate questions, etc.—in a self-service manner. This has led to shorter

wait times and faster issue resolution for customers. For example, one report highlighted that customer service teams using AI can scale productivity without adding headcount, deflecting repetitive inquiries and freeing human agents for more complex issues.

This improved first-contact resolution rates and reduced call center volumes.

A Gartner study noted that 61% of banking executives planned to increase AI investments specifically to enhance areas like customer service in the coming year. In 2024’s AI strategy, leading banks integrated a seamless escalation to human agents

when needed, often with AI assisting in the background by summarizing the issue for the agent. This human-in-the-loop approach ensured that while AI handles the heavy load, the human touch remains essential for sensitive matters.

Both the U.S. and UK saw case studies of improved support due to AI. BofA’s Erica not only answered questions but could perform actions (like bill pay or Zelle transfers via voice commands), and the bank attributed part of its high digital engagement

to Erica’s success.

20 million BofA clients used Erica in 2024, and feedback has been positive enough that Erica’s capabilities keep expanding. In the UK, Lloyds Bank and HSBC also enhanced their AI chat assistants in 2024, with HSBC launching an AI-powered customer

support chat on its mobile app to complement phone service (especially valuable as branch networks contract).

As a broader trend, a PYMNTS report noted only 12% of banks provided AI-powered customer service as of early 2024, but about half plan to implement it in the next months—signaling that support automation was a major focus industry-wide. Consumers

increasingly embraced these AI helpers when well-implemented: one survey found 72% of retail banking customers actually prefer an “intelligent virtual assistant” over a standard chatbot, likely because the former provides a more accurate and conversational

experience.

Further AI-driven support in banking will evolve from simple chatbots to more advanced virtual agents. This evolution will improve the speed, availability and consistency of customer service, thereby lifting overall customer satisfaction despite

initial skepticism.

Inclusive by Design: Enhancing Accessibility

An often underappreciated aspect of AI in banking is how it can improve accessibility and inclusivity of digital services. In 2024, banks began applying AI to ensure that digital banking works better for all customers, including those with disabilities

or special needs.

Traditionally, accessibility in finance focused on accommodating visual or hearing impairments (e.g., screen reader compatibility or text-to-speech for phone banking). But 2024 brought a broader vision: banks started to tailor digital experiences

for people with cognitive differences, mental health challenges, language barriers and more—areas in which AI’s adaptability is key. Accessibility and inclusivity are finally receiving greater attention across the banking sector, with advances in AI helping

to drive this progress.

For instance, AI can detect when a customer is having difficulty navigating an app (through behavior patterns) and proactively offer simplified explanations or switch to a voice-assisted mode. AI-driven personalization also means interfaces can

adjust to a user’s needs in real time.

Financial products should be designed for users with anxiety, depression or other mental health conditions in mind, not just physical disabilities, and AI can stitch together behavioral data across touchpoints to help banks understand and support

each customer holistically. This represents a more compassionate use of AI: using data to identify when a customer might be financially stressed or confused and responding with empathy through the digital channel.

In practical terms, 2024 saw banks introduce features like AI-powered voice assistants for those who prefer speaking to navigating a screen. These go beyond basic IVR systems; they use natural language processing to carry out banking tasks via

voice (useful for visually impaired customers or the elderly who find apps challenging).

Some banking apps added real-time transcription and translation services (AI translating speech or text on the fly), making services accessible to non-native speakers or customers with hearing impairments. For example, a customer could speak in

one language and have the chatbot respond in another, bridging communication gaps.

Another development was AI-driven image recognition for bill payment or check depositing, simplifying processes for those who struggle with manual input, just snapping a photo and letting AI do the work. These kinds of features improved the overall

usability of digital banking for a wider audience.

In the U.S., where regulatory focus on accessibility is growing, large banks worked to ensure their websites and apps meet ADA standards and WCAG guidelines, often using AI tools to test and fix accessibility issues (like adjusting color contrast

or adding AI-generated descriptions for images). In the UK, banks collaborated with fintechs specializing in inclusive design—for instance, leveraging AI fintech solutions that help dyslexic users by changing fonts or reading out text.

The benefits of AI-driven accessibility enhancements are both social and commercial. They empower more customers to confidently use digital banking, which in turn increases digital adoption among groups that might have been left behind. A more

accessible app can turn reluctant users into active digital customers, raising adoption rates. It also strengthens trust and loyalty: customers feel the bank cares about their individual needs. While quantitative metrics here are harder to measure, one can

look at engagement from traditionally underserved segments.

Banks reported, for example, increased usage of mobile apps among senior customers after adding voice-command features and larger, adaptive text, indicating that AI features can bring in demographics that previously stuck to branches. Moreover,

designing for extreme use cases often improves the experience for everyone (the curb-cut effect).

A Forrester study on CX drivers noted that feeling “valued” is a key loyalty driver, and providing accessible, inclusive digital services is a concrete way to show every customer they are valued.

In summary, 2024’s AI push in banking was not only about efficiency and personalization, but also about humanizing digital experiences and leaving no customer behind. From adjusting to a user’s pace (as simple as noticing if someone is scrolling

slowly and might need extra help) to providing emotionally intelligent responses via chat, AI made digital banking more accommodating.

Both the U.S. and UK saw forward movement: U.S. banks like Citi invested in AI-driven document readers for visually impaired users, while UK banks such as Lloyds emphasized mental health–friendly banking apps with calming designs guided by AI feedback.

These efforts, while still emerging, set the stage for a more inclusive digital banking landscape.

Conclusion:

As AI continues to infuse every corner of banking, the ultimate question is no longer whether machines can think, but whether banks can feel.

Can they recognize struggle? Anticipate need? Offer not just efficiency, but empathy? The winners of the next era in banking won’t be the ones with the most features—but the ones that can

form the strongest emotional connection through digital channels. CX isn’t just a battleground for loyalty; it’s where trust is earned or lost in milliseconds. In the race toward hyper-personalization,

AI is the engine—but humanity is the destination.