Our data-driven analysis reveals how major pharma companies stack up across key AI readiness metrics, from technical partnerships to organizational culture.

AI is projected to generate over $350B in annual value for the pharmaceutical sector, as mounting cost pressures and looming revenue losses (pharma companies face a $236B revenue cliff through 2030 from expiring patents) are creating urgent demand for accelerated development timelines at a lower cost.

In response, pharma companies are investing heavily in AI to discover drugs faster and navigate industry challenges more effectively through AI implementation. Those that aren’t investing risk falling behind competitors.

We analyzed the activity of the top 50 global pharma companies by market cap, together with their subsidiaries. Using CB Insights data on investments, acquisitions, partnerships, and earnings transcripts, we examined each entity’s AI activity and then ranked them based on their preparedness to evolve with the rapidly changing AI landscape.

Please click to enlarge.

Key takeaways

This year’s pharmaceutical AI readiness rankings show tight competition as supply chain concerns drive companies to build domestic AI-integrated facilities. Just 3.9 points separate second-place Merck KGaA (70.7) from fifth-place Roche (66.8), compared to an 11-point gap in 2023. These new domestic facilities will serve as testing grounds for large-scale AI deployment in the coming years, determining which companies gain lasting competitive advantages.

The pharma AI leaders are playing a dual-pronged game, cracking the AI-readiness code through complementary strategies of capital deployment and strategic alliances. Lilly and Merck KGaA lead on investments (13 and 10, respectively, since August 2023), while Roche and Bayer dominate business relationships (22 and 21, respectively). External collaboration drives top rankings as breakthrough innovations increasingly emerge from partnerships rather than internal development alone.

Oncology has established itself as the top priority for pharma AI partnerships. This field captures one-third of all partnerships, with top startups collaborating with major pharma across the entire care continuum, from tumor profiling (Caris Life Sciences) to patient monitoring (Huma).

Pharma AI arms race intensifies as supply chain fears drive domestic facility buildout

The pharmaceutical AI landscape was particularly competitive this year, with just 3.9 points separating second place from fifth place, compared to an 11-point difference in 2023’s list. This tight clustering signals AI readiness has evolved from a competitive advantage for select leaders into a strategic imperative across the entire industry. Strong execution scores throughout the industry drive this competition, stemming from three common internal AI initiatives among top performers: new AI-integrated facilities, internal LLMs, and drug discovery platforms.

AI-integrated facilities

Supply chain disruptions from tariffs and geopolitical tensions have catalyzed massive investments in domestic facilities, with nearly every major pharma company committing billions to new US and EU manufacturing and research centers. The biggest pledges have come from J&J at $55B, Roche at $50B, and Eli Lilly at $27B.

Beyond just replacing capacity, these proposed facilities present the opportunity to execute comprehensive digital transformation strategies, incorporating automation, IoT sensors, and AI into their core workflows. Planned AI integration spans from predictive maintenance to operational optimization. These new facilities will serve as testing grounds for the large-scale deployment of AI and automation over the next several years, with companies that execute integrations most effectively gaining competitive advantages in efficiency and innovation.

Internal LLMs

Internal LLMs have become the second pillar of pharma AI deployment, with companies either developing proprietary systems or partnering with big tech to enable the automation of data querying and document processing. For example, Pfizer‘s Amazon-powered Vox platform demonstrates how companies are deploying these tools for internal researchers’ use, while companies like Merck & Co and Bayer have implemented comprehensive LLM systems across business units.

Drug discovery platforms

Drug discovery platforms constitute the third common deployment area, with virtually every top-10 company building internal AI systems to analyze data, predict drug-target interactions, and guide experimental design. Examples include Sanofi’s CodonBERT platform to aid in mRNA design and AbbVie’s ARCH platform for consolidating data and aiding in target discovery.

These trends illustrate that AI readiness has shifted from preparedness for emerging technology to effective implementation and agility, enabling organizations to stay at the cutting edge. The scramble among major pharma companies reflects this new reality: it’s no longer about getting ready for AI but about not being left behind in its application.

External activity drives top rankings

All AI-readiness leaders invested strongly in internal initiatives; what differentiated those at the top was their external activity, both partnerships and deal-making.

Eli Lilly, this year’s top performer, made the most dramatic leap in the rankings, jumping from #14 in 2023 to #1 this year. The company’s record-breaking GLP-1 profits powered increased investment activity, including substantial AI investments. With this financial windfall, Lilly doubled its total direct investment spending from 2022 ($0.7B) to 2024 ($1.5B), which translated directly into AI leadership. Lilly’s 13 AI investments this year outpaced every other pharmaceutical company.

Lilly’s investment strategy reveals 3 key areas where the company sees AI’s greatest potential in pharmaceuticals: drug discovery (Insilico Medicine), medical devices (RetiSpec), and regulatory solutions (Yseop). Drug discovery represents the most significant focus, accounting for half of Lilly’s AI investments. Lilly’s impressive track record in this area includes 2 portfolio companies that successfully IPO’d last year — BioAge and Alto Neuroscience — suggesting strong prospects for current investments like Insilico Medicine, which boasts a 29% IPO probability score compared to the platform average of just 1%.

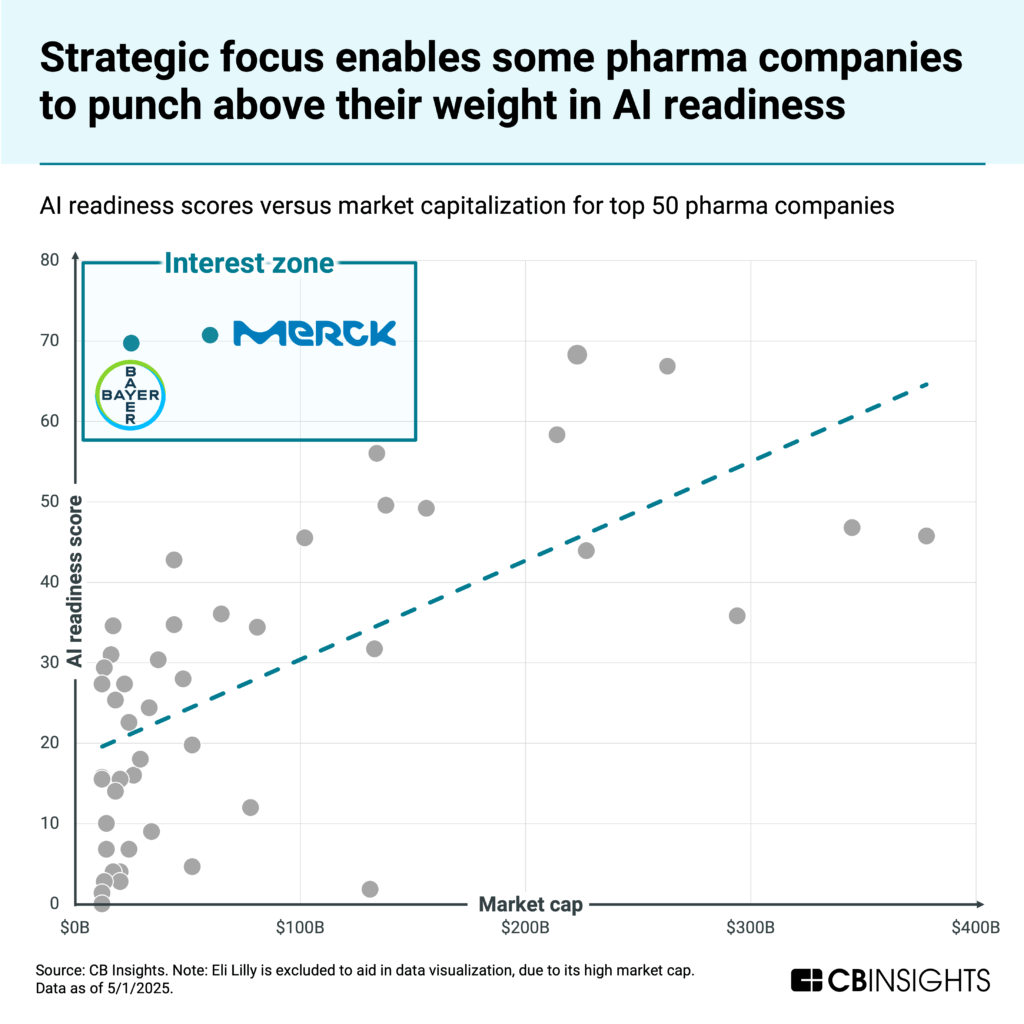

Since this year’s AI readiness rankings hinged largely on external investment and partnership activity, one might expect the list to correlate with market cap. While this is generally true, 2 companies stand out as high performers with AI readiness scores that significantly exceed what their market cap would suggest: Merck KGaA and Bayer. Ranking second and third, respectively, these companies demonstrate that strategic focus can be as important as financial resources.

Both companies achieved their high rankings through significant external engagement strategies. While matching competitors on internal AI initiatives, Merck KGaA recorded the second-highest number of AI investments (10), trailing only Lilly’s 13. Bayer secured the second-highest number of business relationships with 21 AI partnerships, just behind Roche’s 22.

Strategic partnership approaches can elevate AI readiness regardless of market cap, as these examples illustrate. Breakthrough innovations often emerge from partnerships and acquisitions rather than purely internal development, with over 70% of new molecular entity revenues since 2018 coming from externally sourced products, demonstrating the importance of external collaboration.

Oncology dominates pharma AI partnerships

Oncology has emerged as the clear focus for pharma AI partnerships, capturing 1 in 3 pharma business relationships among the 50 companies analyzed — far more than any other therapeutic area. This concentration stems from both market dynamics and cancer’s data complexity. Cancer rates continue rising worldwide while the field shifts toward precision oncology, creating opportunities for pharmaceutical companies to apply AI across multiple aspects of cancer care. Furthermore, cancer drug revenues have increased 70% over the past decade, creating substantial commercial opportunity for AI-enabled drug development.

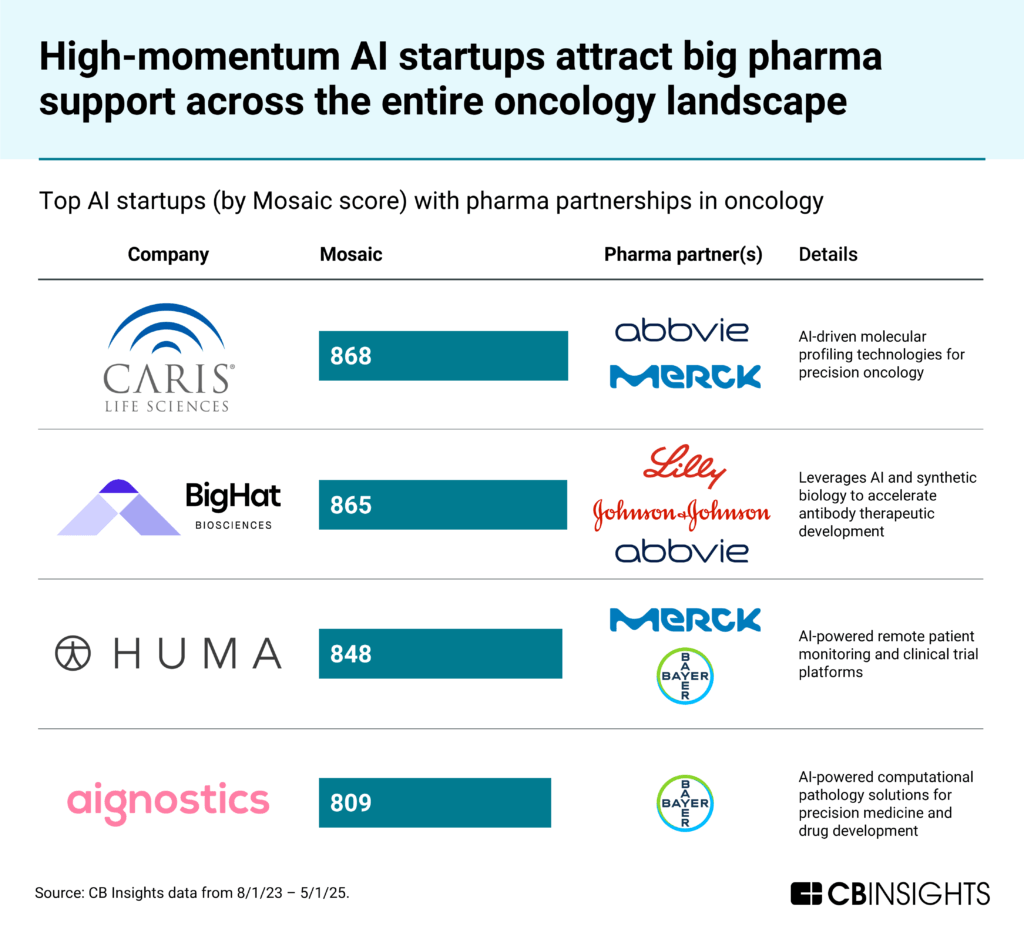

The AI startups with the highest Mosaic scores that partner with big pharma in oncology each tackle completely different pieces of the cancer puzzle. These partnerships span the entire care continuum, from liquid biopsy screening (Caris Life Sciences) and antibody therapeutics (BigHat Biosciences) to patient monitoring (Huma) and diagnostic pathology (Aignostics).

While these companies all work in oncology, they demonstrate how AI addresses fundamentally different challenges across cancer care. Cancer’s data-rich environment and biological complexity make it a natural testing ground for AI innovation, suggesting that oncology will continue to drive the most cutting-edge applications in pharmaceutical AI.

RELATED RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.