We use CB Insights data and on-the-ground analysis from the InsurTech NY Spring Conference to provide innovation imperatives for insurance executives.

The bar for insurance innovation is getting higher.

GenAI adoption is changing how insurance companies operate, incumbents are meeting new competitors, and startups face a more selective dealmaking environment focused on profitability.

Industry leaders echo this reality: commentary from the InsurTech NY 2025 Spring Conference emphasized an increasingly fast-paced — and fast-changing — insurance industry.

Below, we highlight 3 innovation imperatives for insurance leaders in 2025 and beyond. We base these on CB Insights’ datasets like Business Relationships, Instant Insights, and Public Company Financials, along with executive commentary from panel presentations at the InsurTech NY 2025 Spring Conference.

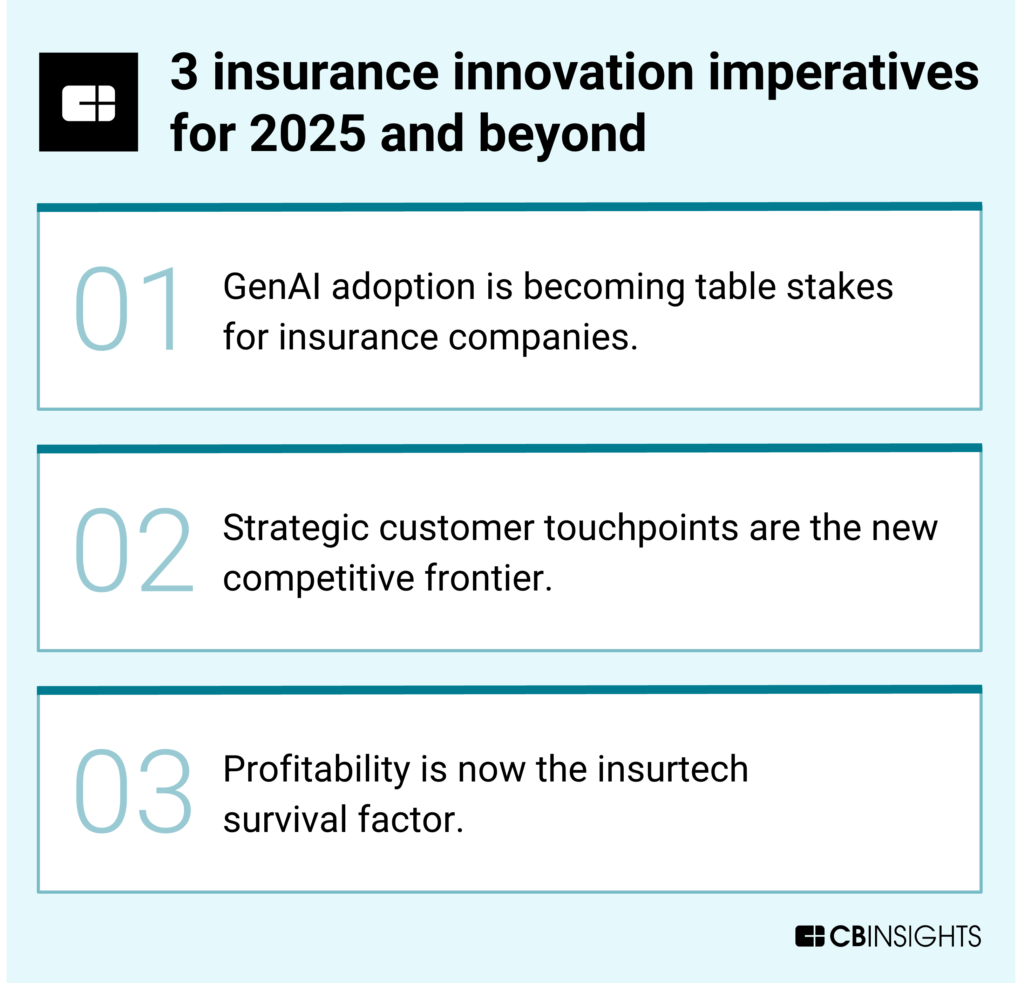

Here are the 3 imperatives:

GenAI adoption is becoming table stakes for insurance companies.

Strategic customer touchpoints are the new competitive frontier.

Profitability is now the insurtech survival factor.

1. GenAI adoption is becoming table stakes for insurance companies

Insurance companies are no longer just discussing using genAI to build their future — they’re actively pursuing it.

GenAI is enabling insurance leaders to build — rather than exclusively buy — future operating systems, as Tokio Marine North America EVP and CIO Robert Pick noted on an InsurTech NY 2025 panel titled “The New AI Tech Stack.”

Insurance companies that do not invest in genAI capabilities risk losing a competitive advantage. Industry leaders from AIG to Marsh McLennan have invested in such capabilities for years, with Marsh McLennan CEO John Doyle mentioning the company’s internal generative AI platform (“LenAI”) as early as its Q3’23 earnings call.

Human talent will distinguish future genAI-powered operating environments. For example, insurtech managing general underwriter Counterpart — one of 2024’s Insurtech 50 winners — prioritizes a hiring strategy focused on aggressive AI integration across core operations. Counterpart CEO Tanner Hackett mentioned the need for “human-in-the-loop” genAI operations on a panel at the conference.

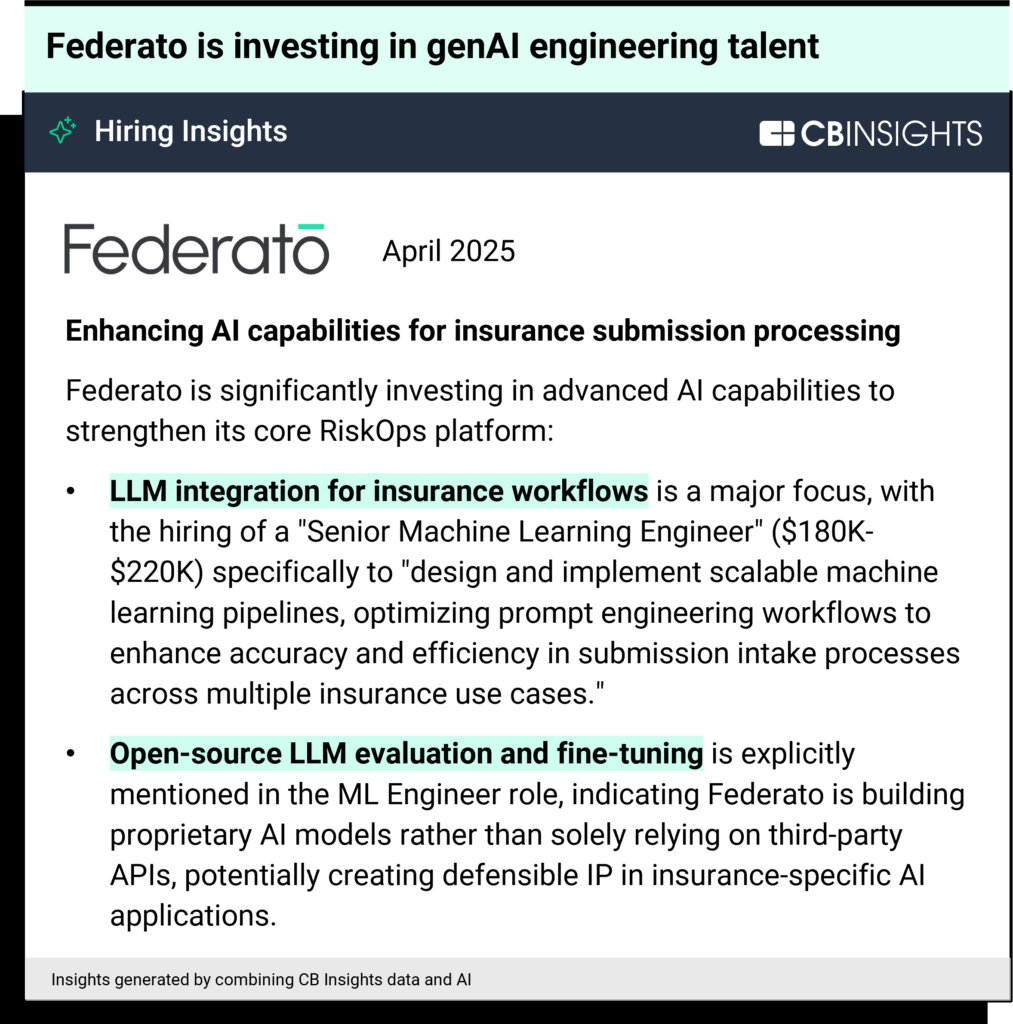

Tech vendors are betting on specialized talent to build genAI products to sell to insurance companies. For instance, AI underwriting platform Federato has a hiring approach that prioritizes genAI-focused talent and product development. The company has more than doubled its headcount over the past year and raised $40M in a November 2024 Series C round.

![]() Explore Federato’s Hiring Insights

Explore Federato’s Hiring Insights

At the conference, Will Ross, Federato’s CEO and co-founder, pointed to the industry’s widespread genAI adoption by highlighting the rapid development of concepts such as foundation models, agentic workflows, and the model context protocol (MCP), an Anthropic-developed standard for AI agents and copilots to connect to data systems.

As major tech companies adopt the MCP, it’s driving widespread interest in the standard and triggering the emergence of new startups like Smithery, a registry of MCP servers founded in 2025. Dnotitia, a winner of CB Insights’ 2025 AI 100, also recently launched an MCP-based vector database.

Skyward Specialty Insurance Chief Information and Technology Officer Daniel Bodnar highlighted MCP on a conference panel, further signaling the standard’s role in genAI interoperability.

Looking forward, insurance executives should expect the MCP to accelerate genAI-powered insurance operations as the standard enables greater interoperability between data sources and agentic applications.